Outlook for the Permanent Magnet Synchronous Motors Market in Electric Vehicles by 2032

The global market for electric vehicle permanent magnet synchronous motors (PMSMs) was valued at USD 12.53 billion in 2023 and is projected to reach USD 30.0 billion by 2032, growing at a CAGR of 10.19% from 2024 to 2032. This growth is primarily driven by advancements in motor design and materials.

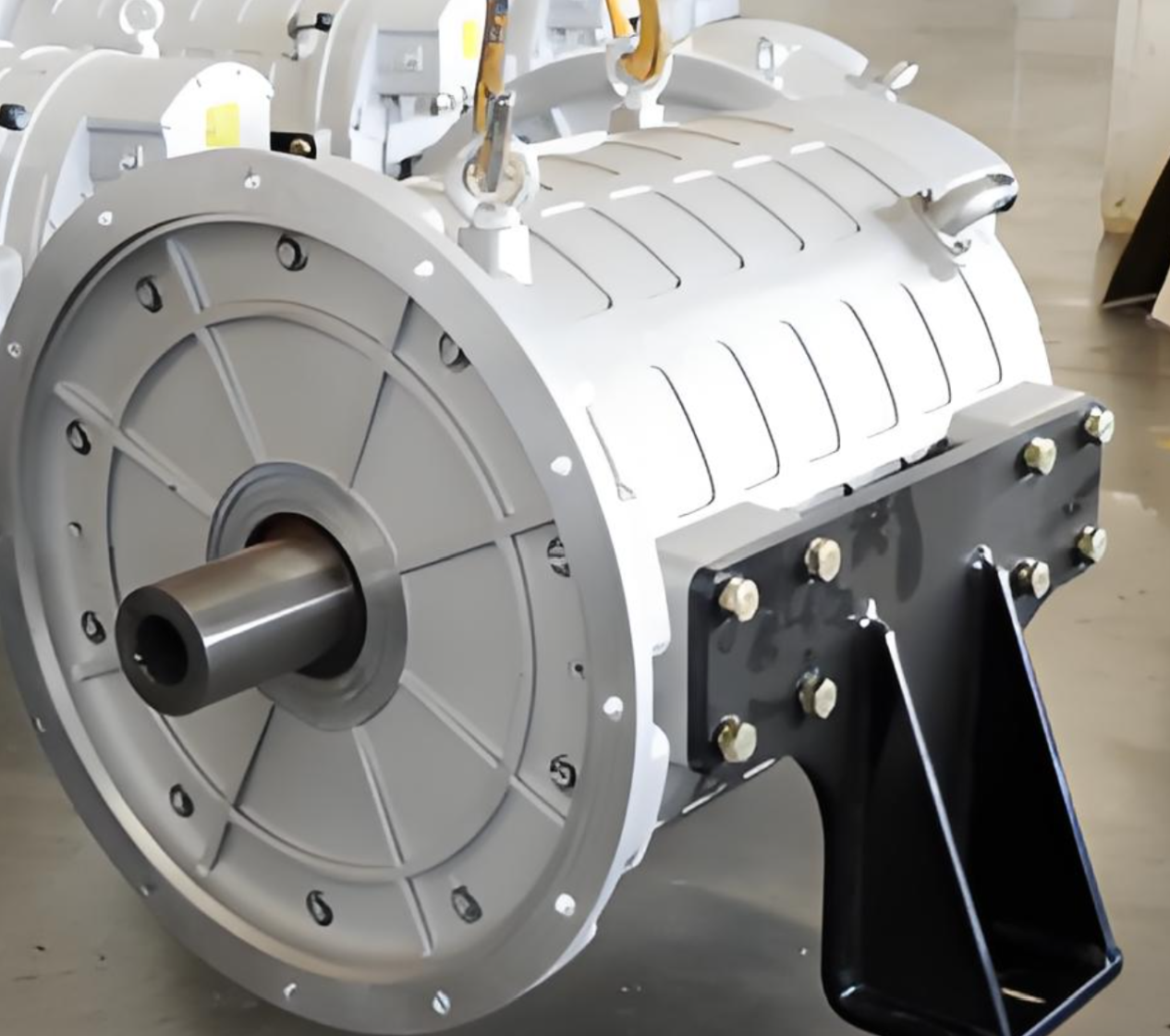

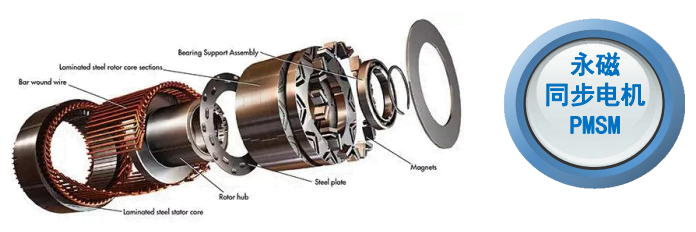

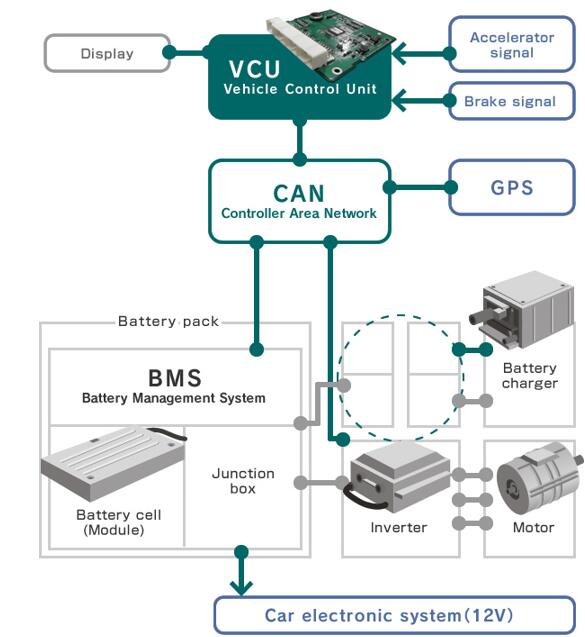

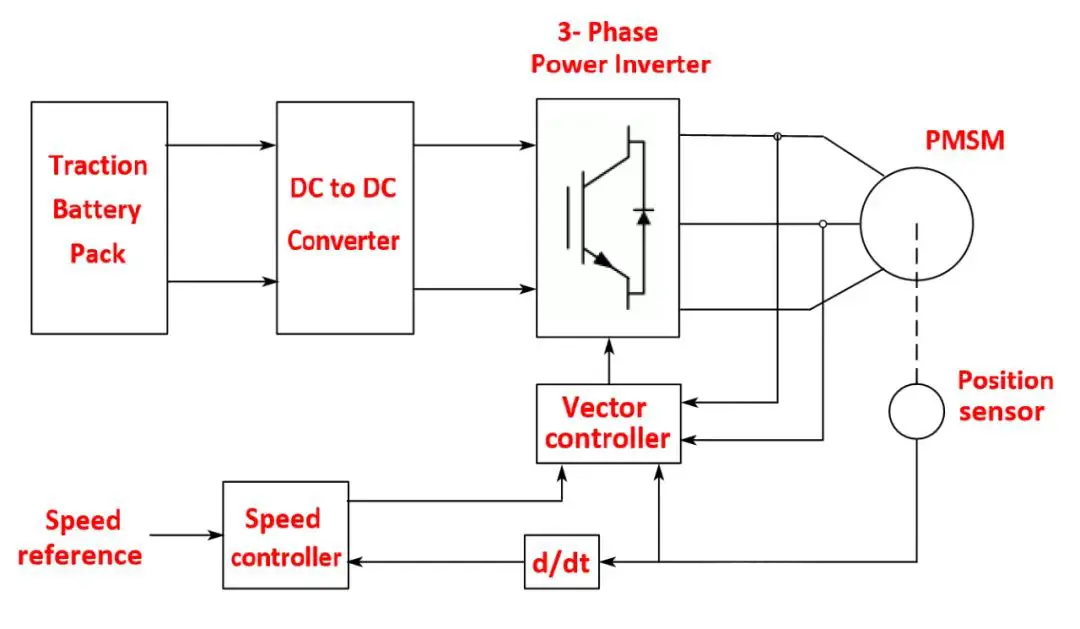

The electric vehicle PMSM market is experiencing rapid expansion, fueled by the increasing adoption of electric vehicles (EVs). These motors are preferred over other motor types, such as induction motors, due to their superior efficiency and performance characteristics. PMSMs utilize permanent magnets within the rotor and maintain synchronous speed regardless of the load, delivering precise torque and speed control — a vital feature for EV applications.

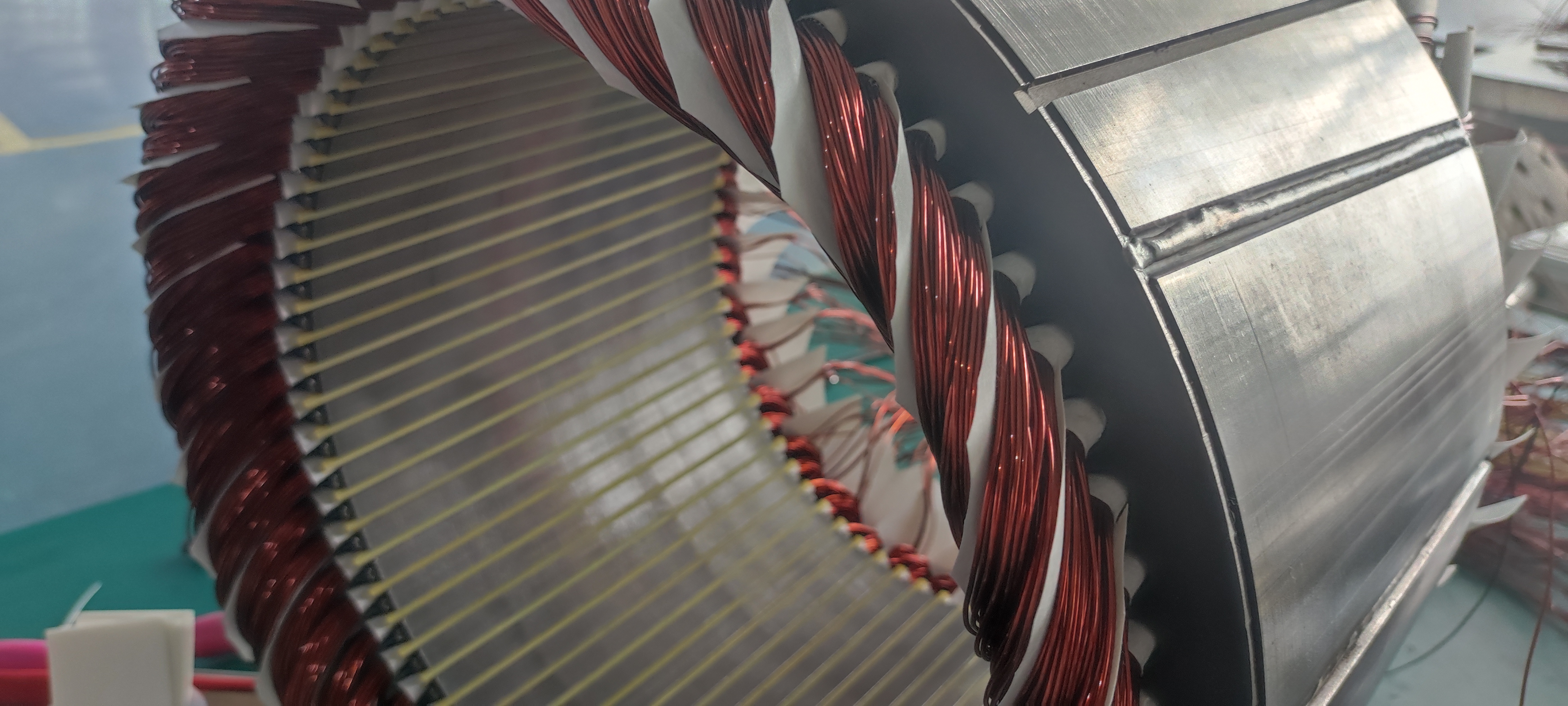

Technological advancements in motor design and materials are significantly improving the performance and efficiency of PMSMs in electric vehicles. Innovations like the incorporation of high-grade magnetic materials with superior magnetic properties are enhancing motor efficiency, thereby extending EV driving ranges.

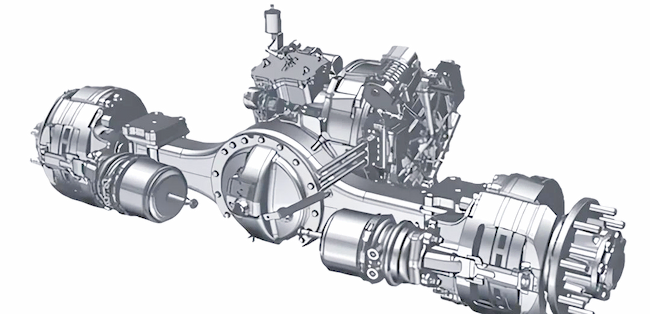

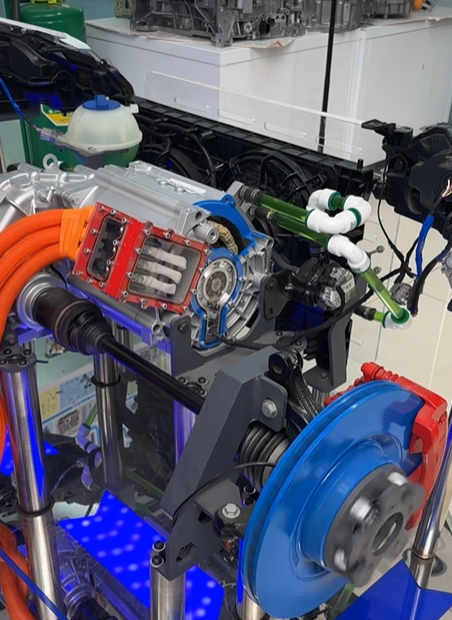

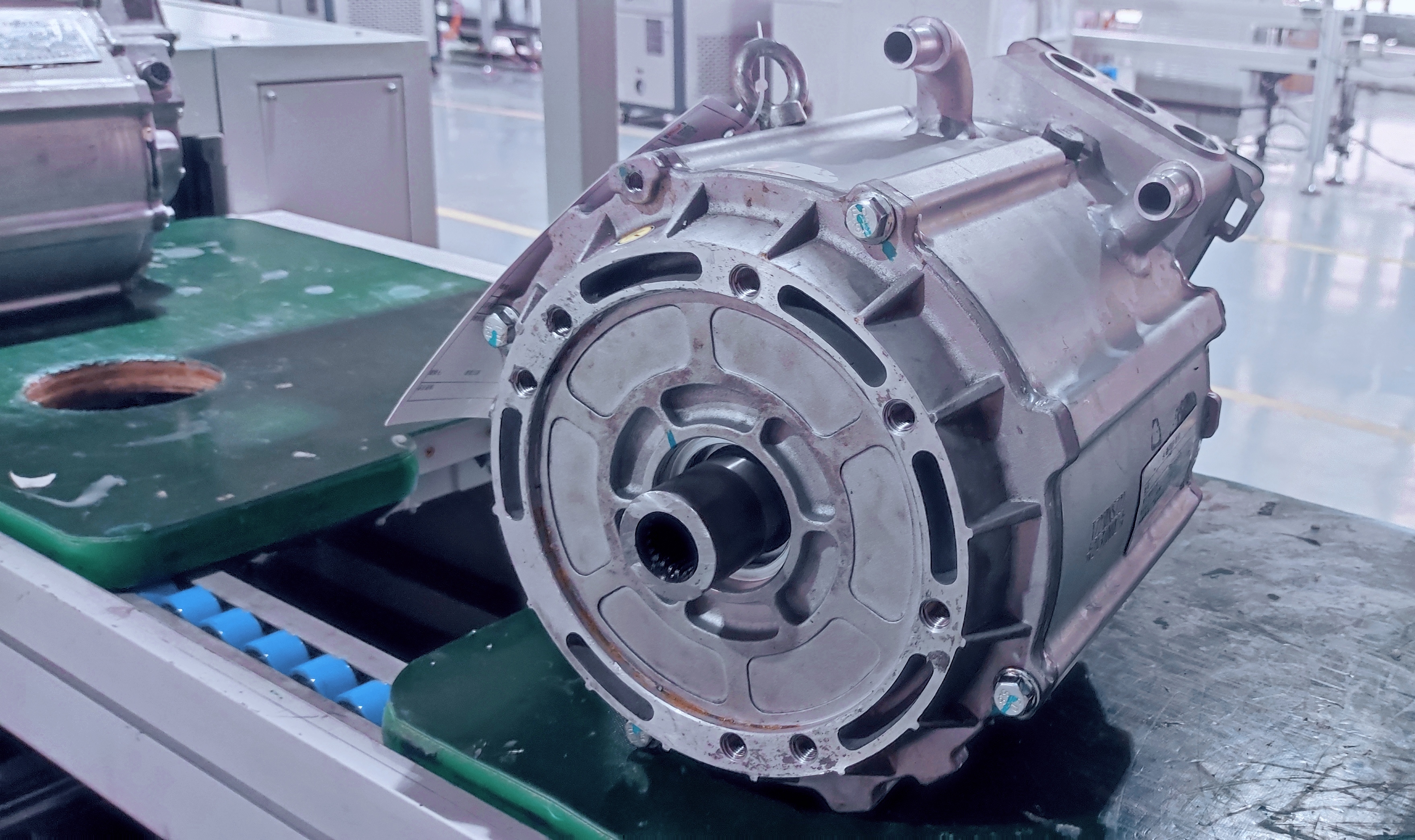

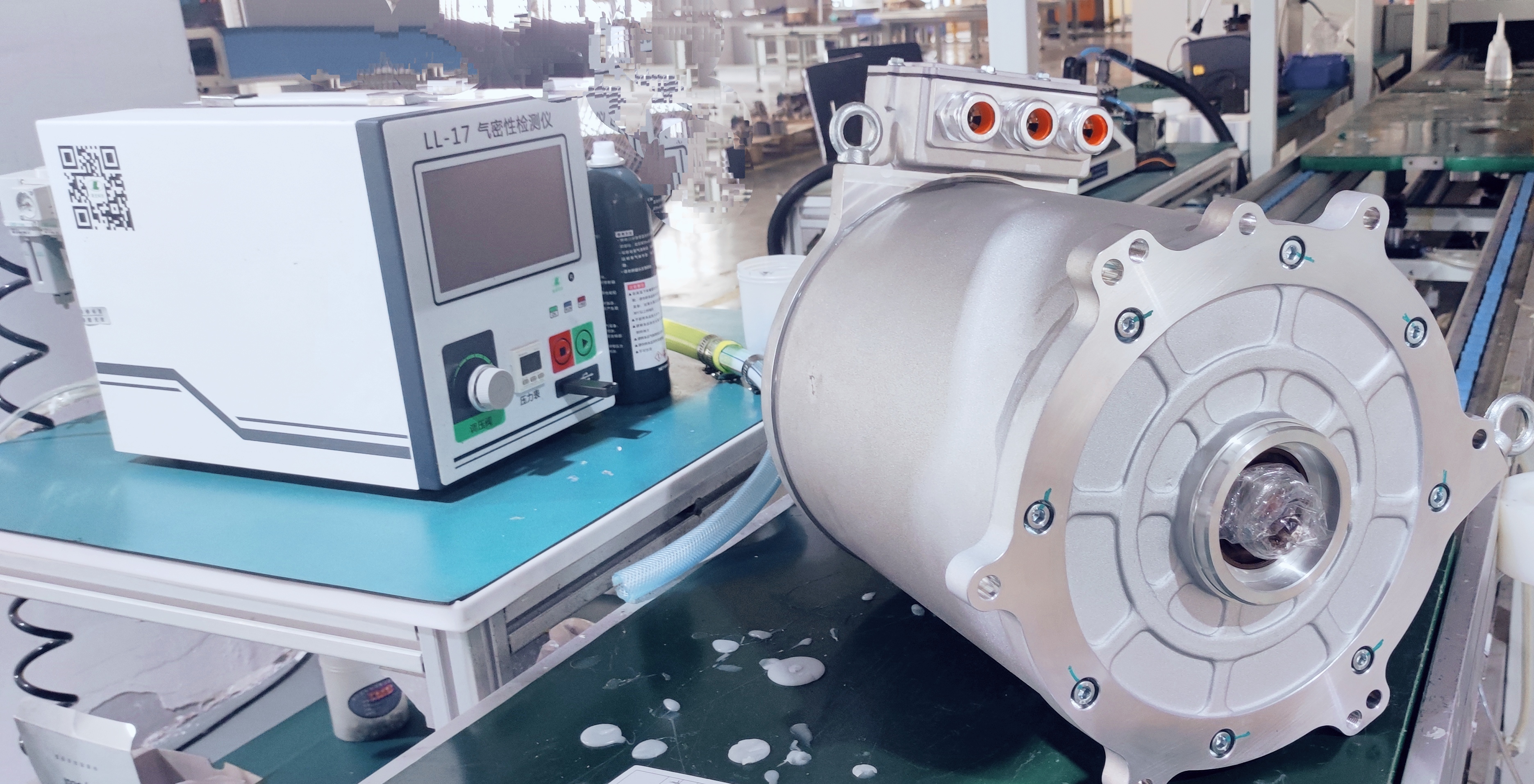

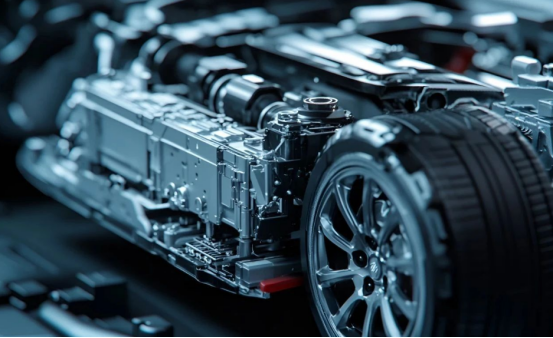

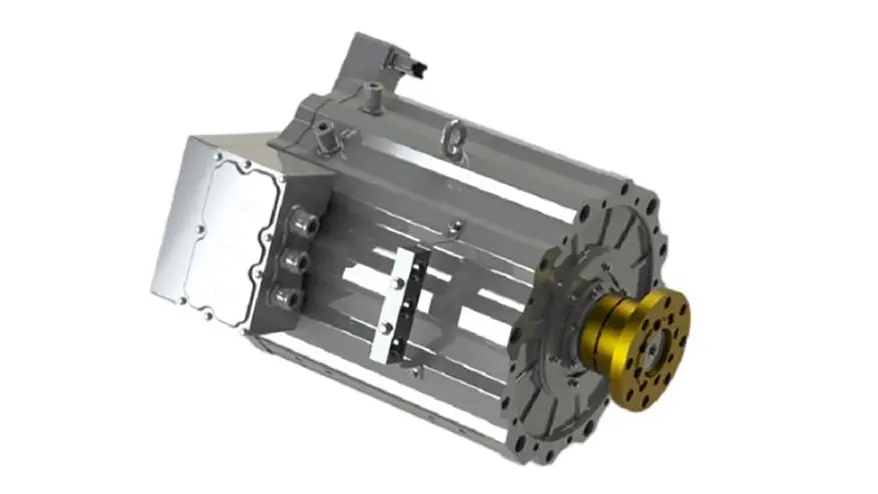

Furthermore, developments in motor topology and design, such as advanced cooling systems and optimized motor geometries, are leading to more compact, lightweight, and energy-efficient motors. These advancements not only enhance vehicle performance but also contribute to cost reduction and material efficiency, making electric vehicles more sustainable and widely accessible.

Electric Vehicle Permanent Magnet Synchronous Motors Market Dynamics:

Major Drivers

The global shift toward electric vehicles (EVs) is a key factor driving the growth of the electric vehicle permanent magnet synchronous motors (PMSM) market. As environmental concerns rise and awareness of the detrimental effects of fossil fuels on climate change grows, both consumers and businesses are increasingly adopting sustainable transportation solutions. Electric vehicles, known for their energy efficiency and lower emissions, are becoming more popular across various regions.

This transition is not limited to passenger cars but extends to commercial vehicles, buses, and two-wheelers, broadening the market's scope. As EV sales rise, the demand for high-efficiency motors like permanent magnet synchronous motors, which are essential for improving vehicle performance and range, also grows. With automotive manufacturers investing in electrifying their fleets, the need for these motors is expected to continue expanding.

Government policies, incentives, and stricter emission regulations are playing a significant role in boosting the market. Many governments have introduced supportive measures such as subsidies, tax rebates, and grants to promote the purchase of electric vehicles. In addition, regulations targeting significant reductions in greenhouse gas emissions are driving automotive manufacturers to accelerate the development and production of EVs.

Regions like the European Union, China, and California in the United States have set stringent deadlines for reducing vehicle emissions and, in some cases, have proposed banning the sale of new internal combustion engine vehicles in the coming decades. These regulatory frameworks are prompting manufacturers to innovate and invest in electric mobility solutions, including advanced motor technologies like permanent magnet synchronous motors, to comply with regulations and take advantage of government incentives.

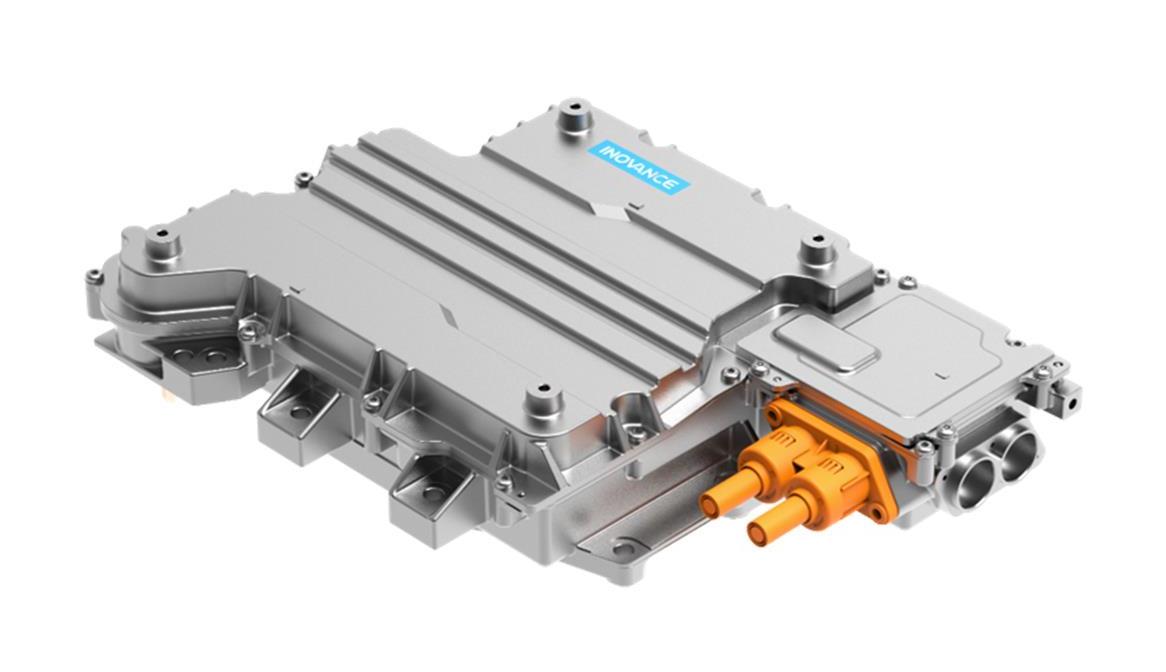

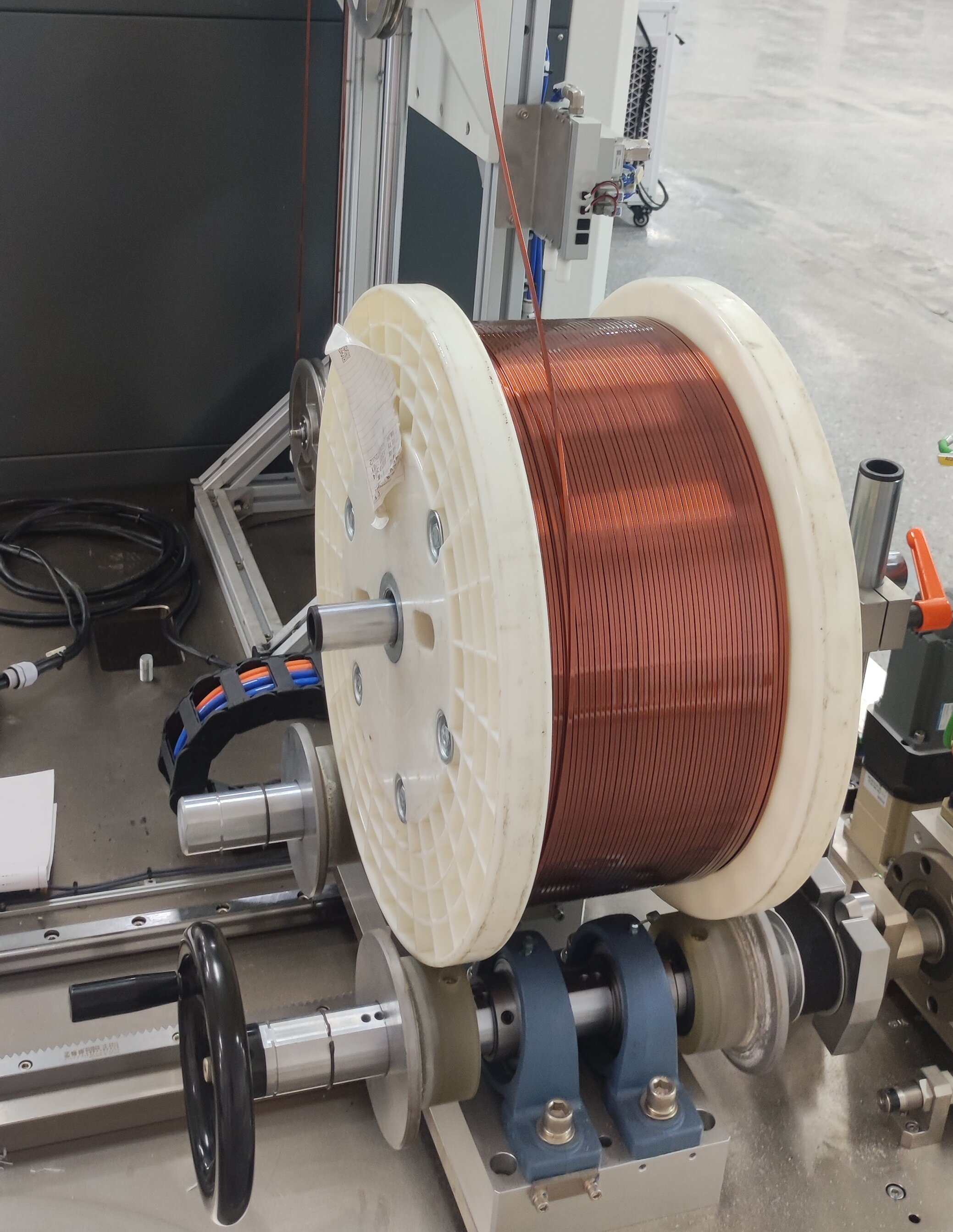

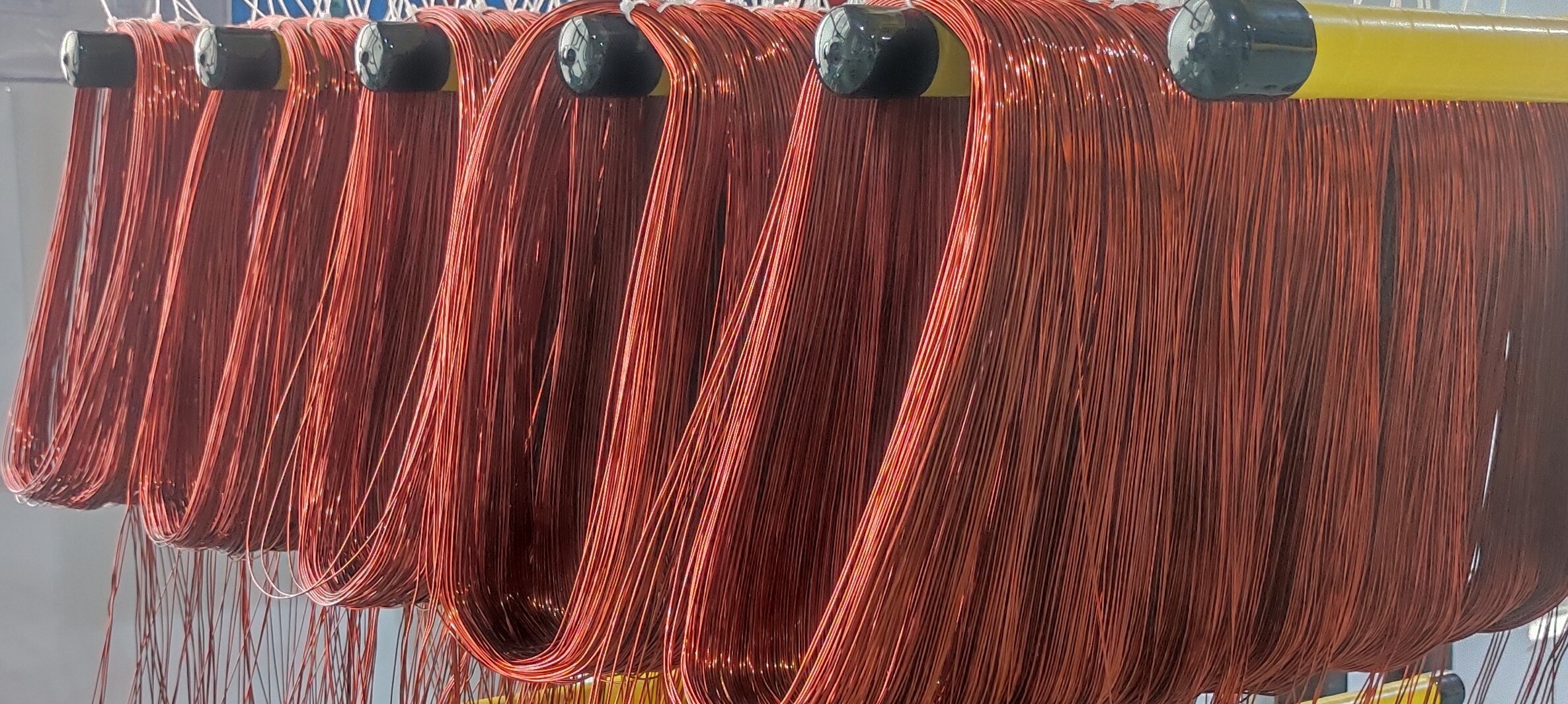

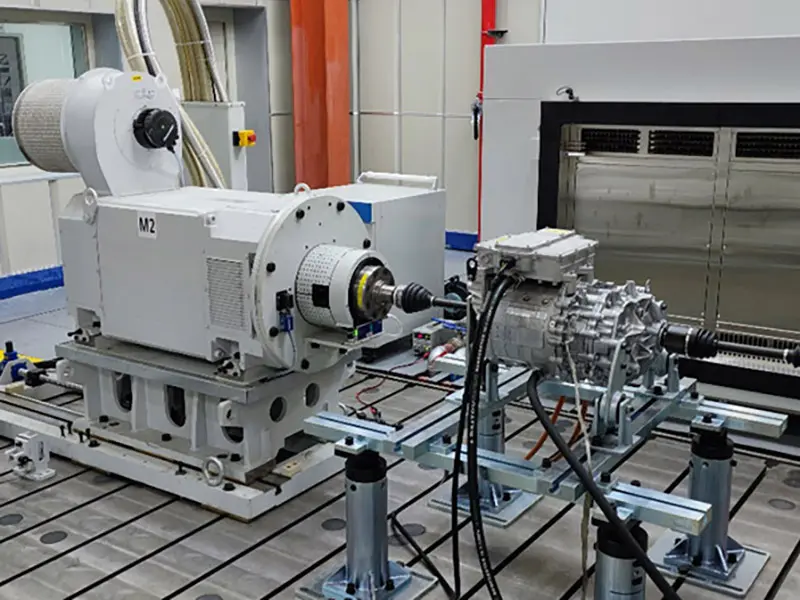

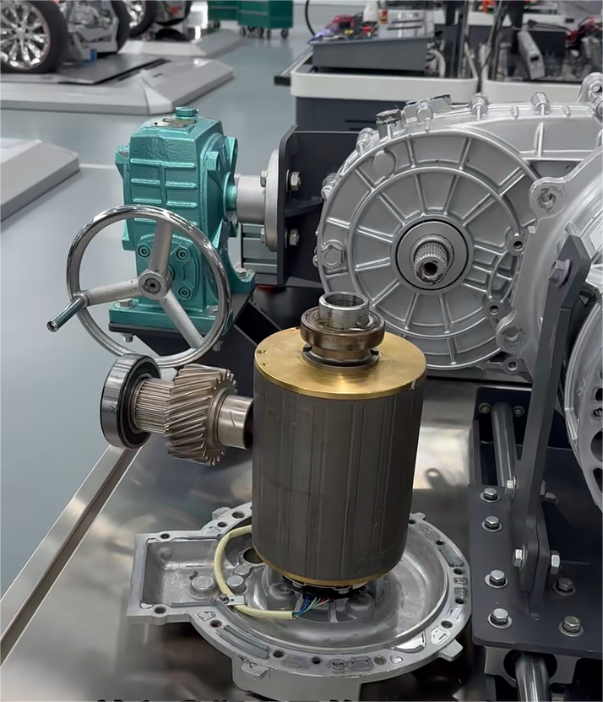

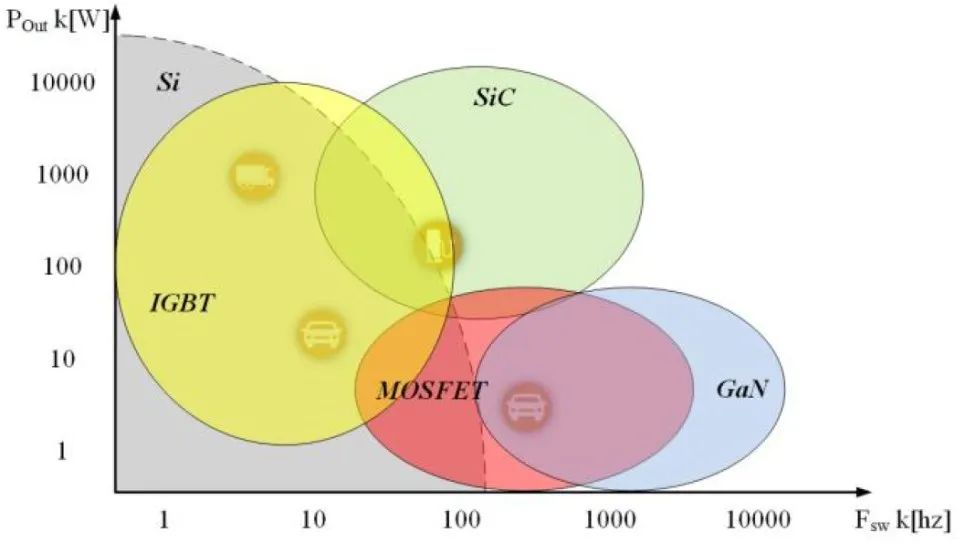

Technological advancements in motor efficiency are also crucial in fueling the growth of the electric vehicle PMSM market. Ongoing improvements in motor design, materials, and manufacturing processes have resulted in more compact, powerful, and efficient motors. Developments in magnet technology, such as the use of rare-earth materials, have significantly enhanced the performance of synchronous motors, making them increasingly attractive for use in electric vehicles.

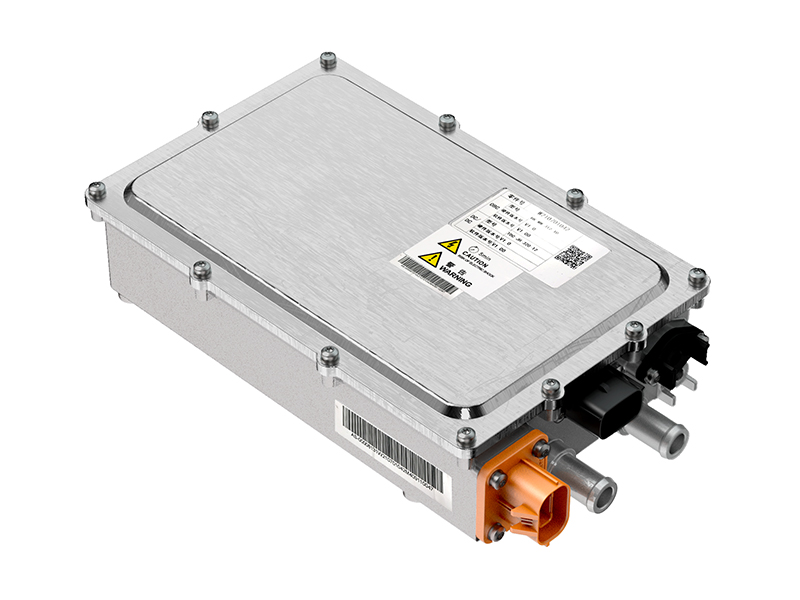

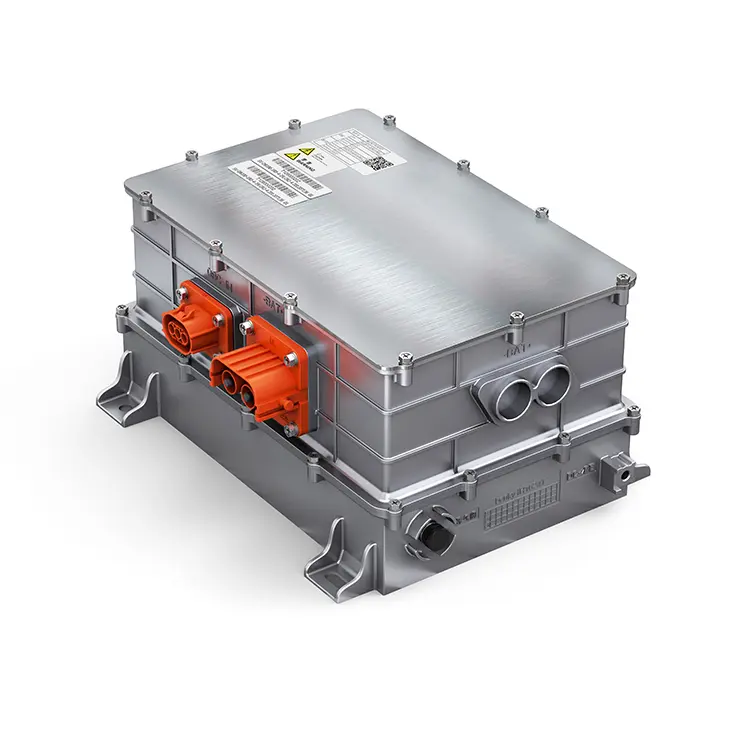

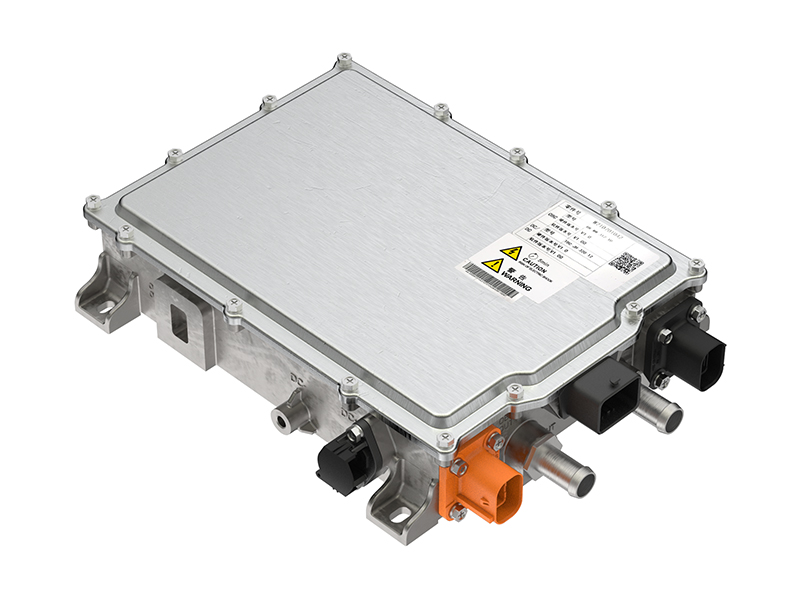

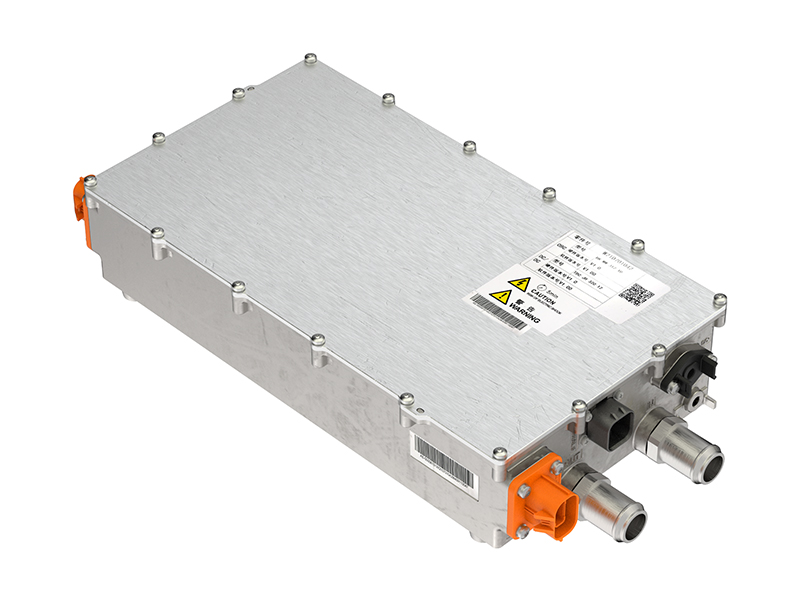

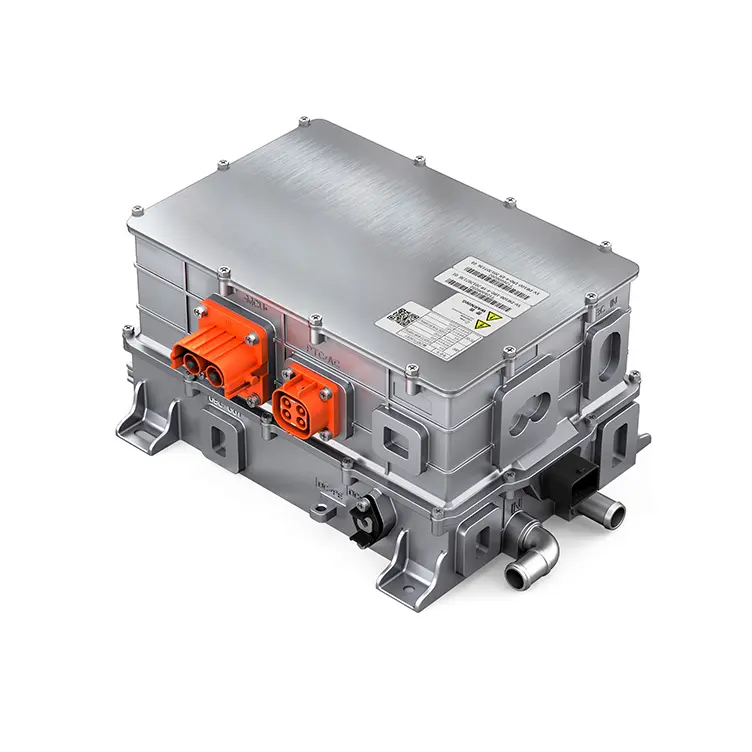

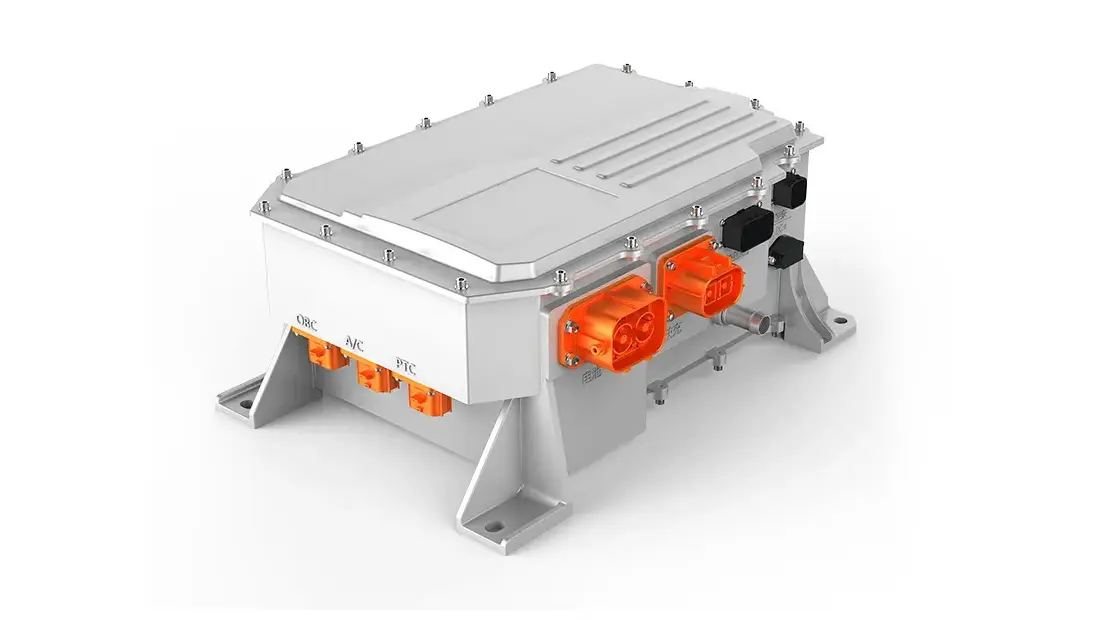

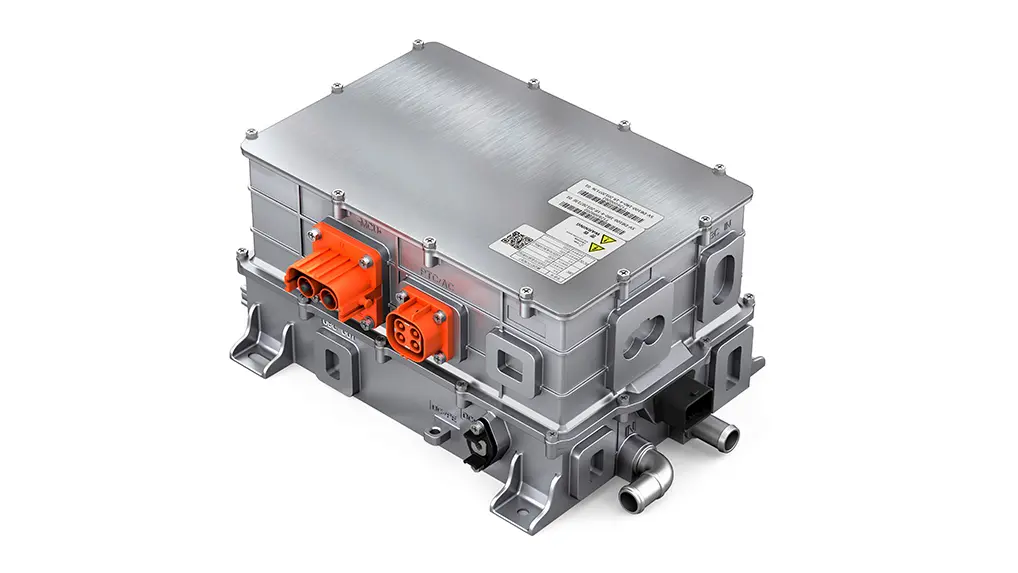

Innovations like advanced cooling systems and integrated power electronics are further boosting motor efficiency and reliability. These technological improvements not only enhance electric vehicle performance but also help reduce costs, making EVs more accessible to a wider consumer base. As technology continues to evolve, the capabilities of permanent magnet synchronous motors are expected to grow, further driving the market's expansion.

Existing Restraints

The high cost of rare earth magnets, which are vital for the production of electric vehicle permanent magnet synchronous motors (PMSMs), presents a significant restraint on the market. Rare earth elements like neodymium and dysprosium are valued for their exceptional magnetic properties, essential for achieving the high efficiency and performance of PMSMs. However, these materials are relatively scarce and primarily sourced from a limited number of countries, with China being the dominant supplier.

This concentration of supply leads to price volatility and rising costs for motor manufacturers. Furthermore, the extraction and processing of rare earth materials are environmentally challenging and politically sensitive, which further complicates supply dynamics and increases costs. These factors make managing the cost of rare earth magnets a major obstacle to the widespread adoption and profitability of PMSMs in electric vehicles.

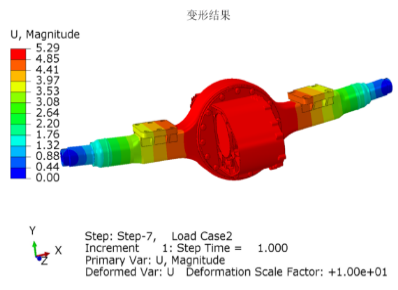

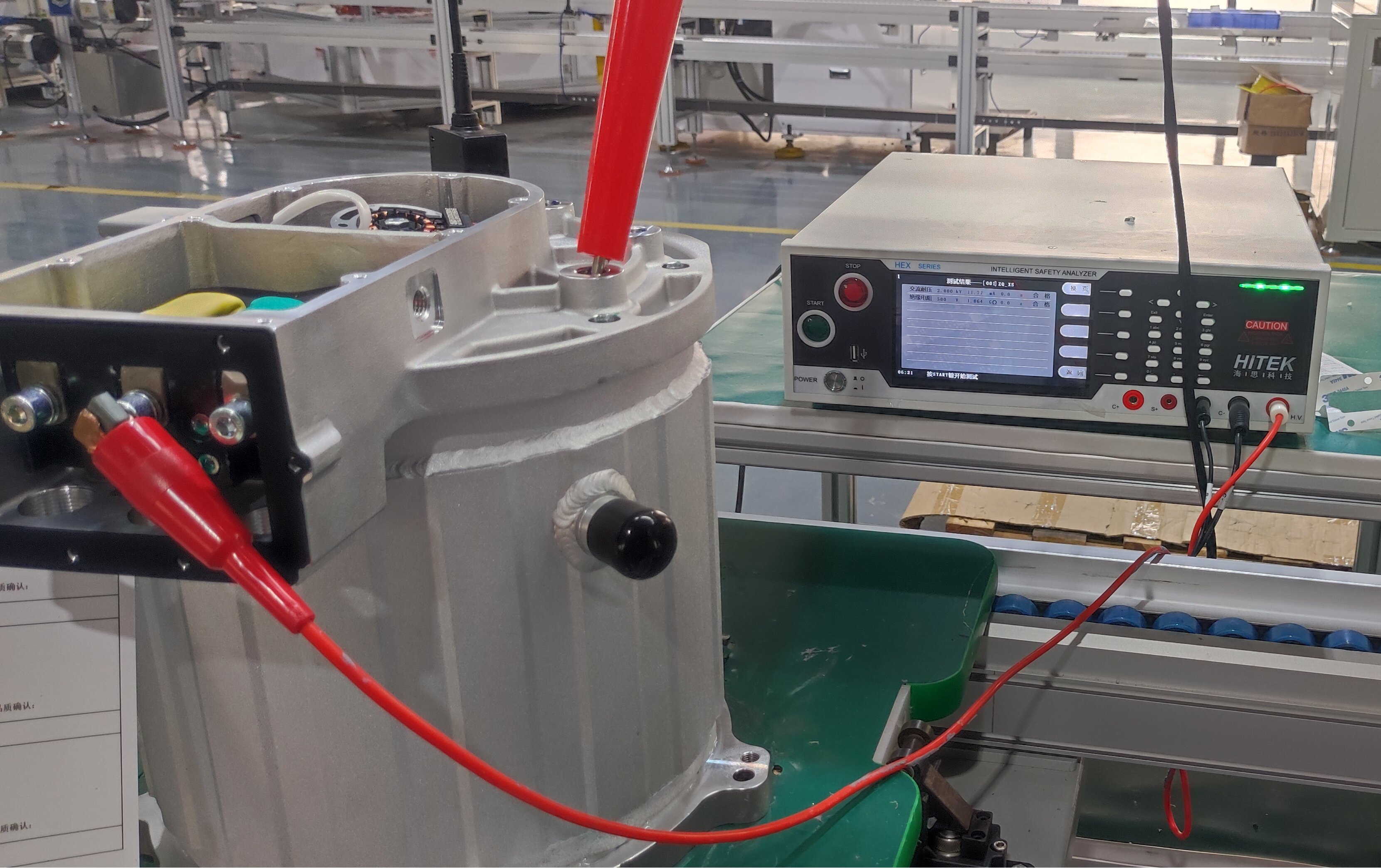

Technical challenges in the design and manufacturing of PMSMs for electric vehicles also impede market growth. These motors must be optimized to deliver peak performance, efficiency, and reliability under diverse operational conditions. Achieving this requires advanced design techniques to manage magnetic flux, reduce energy losses, and improve thermal management.

Moreover, integrating these motors into vehicle systems demands precise engineering to ensure compatibility with other components and the overall vehicle design. Manufacturing difficulties arise from the need for high precision in component fabrication and assembly to ensure motor performance and durability. Overcoming these technical hurdles requires continuous research and development, skilled labor, and significant investment in manufacturing technologies, all of which slow the pace of market expansion.

Supply chain disruptions also pose a considerable challenge to the electric vehicle PMSM market. The production of PMSMs relies on a complex, multi-country supply chain, from sourcing raw materials like rare earth elements to manufacturing electronic and structural components.

Disruptions caused by geopolitical tensions, trade disputes, or global events like pandemics can lead to shortages of critical materials and components, production delays, and increased costs. The COVID-19 pandemic, for example, highlighted vulnerabilities in global supply chains as lockdowns and restrictions disrupted the availability of supplies and halted manufacturing activities.

These disruptions hinder the ability of motor manufacturers to meet the growing demand for electric vehicles, affecting both market growth and competitiveness. To mitigate these challenges, companies must implement robust supply chain management strategies, diversify sourcing, and enhance resilience to external shocks.

Emerging Opportunities

Innovations in motor technology that drive cost reductions present a significant growth opportunity for the electric vehicle permanent magnet synchronous motors (PMSM) market. Advances in materials science, such as the development of new magnet materials and more efficient manufacturing processes for rare earth elements, help lower the cost of the magnets that are crucial for PMSMs.

Additionally, improvements in motor design and manufacturing techniques boost production efficiency and reduce waste, further decreasing costs. As the cost of producing PMSMs falls, electric vehicles equipped with these motors become more competitively priced, potentially increasing their market share over traditional internal combustion engine vehicles and expanding the consumer base for EVs.

The ongoing shift of traditional automotive manufacturers into the electric mobility space is another key opportunity for market growth. Many well-established automakers are dedicating substantial resources to developing electric vehicles as part of their future product lines, responding to changing consumer preferences and regulatory requirements. This transition involves creating entirely new electric models as well as adapting existing vehicle platforms to incorporate electric powertrains.

By leveraging their vast production capabilities, distribution networks, and customer bases, these manufacturers are significantly accelerating the adoption of electric vehicles. This expansion is a major boost for the PMSM market, as these motors play a vital role in electric vehicle performance. The increased volume of EV production driven by traditional automakers results in greater economies of scale, further stimulating the demand for permanent magnet synchronous motors.

The integration of digital technologies and the Internet of Things (IoT) into electric vehicle motors, particularly PMSMs, is revolutionizing the monitoring and maintenance of these motors. IoT-enabled devices gather real-time data on motor performance, such as speed, temperature, and efficiency. This data enables predictive maintenance, allowing potential issues to be identified and resolved before they cause motor failure, thus minimizing downtime and maintenance costs.

Moreover, digitalization supports remote monitoring and management of motors, enhancing the convenience and effectiveness of fleet operations, especially for commercial electric vehicles. These technological advancements improve the reliability and lifespan of PMSMs, further enhancing the overall operational efficiency of electric vehicles.

Electric Vehicle Permanent Magnet Synchronous Motors Market Segment Insights:

Motor Type Segment Analysis

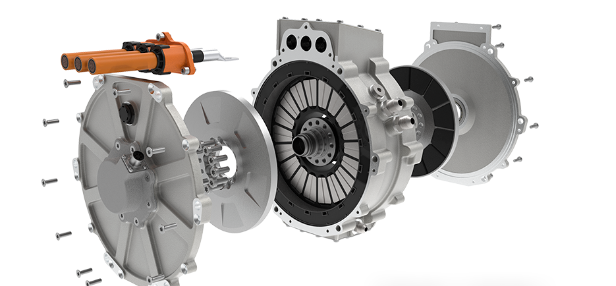

Interior permanent magnet synchronous motors (IPMSMs) are currently one of the leading types of motors in the electric vehicle market. These motors feature permanent magnets embedded within the rotor, often placed beneath the surface or within laminations. This configuration enhances magnetic performance and operational efficiency, which are essential for electric vehicles where energy conservation and management are critical.

The internal placement of the magnets improves thermal management, which is vital for maintaining motor efficiency and extending its lifespan under varying operating conditions. Due to these benefits, IPMSMs are widely used in high-performance electric vehicles that demand strong power outputs and longer driving ranges. The growing preference for IPMSMs is further fueled by their ability to provide high torque at low speeds and maintain consistent efficiency across a wide range of speeds and loads, making them well-suited for automotive applications.

On the other hand, surface permanent magnet synchronous motors (SPMSMs), where magnets are mounted directly on the rotor's surface, form another important segment in the electric vehicle market. While SPMSMs are slightly less efficient than IPMSMs in terms of thermal management and torque delivery, their simpler design and lower manufacturing costs make them appealing for cost-conscious applications.

SPMSMs are particularly popular in electric vehicles that don’t require the high torque and power density offered by IPMSMs, such as smaller passenger cars or light commercial vehicles. The straightforward design of SPMSMs also facilitates easier maintenance and repair, which is a key consideration for automotive manufacturers aiming to reduce after-sales service complexities and costs.

Despite their lower performance capabilities compared to IPMSMs, the demand for SPMSMs remains strong, driven by their affordability and the ability to meet the performance needs of a significant segment of the electric vehicle market.

Vehicle Type Segment Analysis

Battery electric vehicles (BEVs) are a leading segment in the electric vehicle permanent magnet synchronous motors market. These fully electric vehicles rely entirely on electric motors for propulsion, powered by energy stored in rechargeable batteries. The motor's efficiency and performance are crucial for BEVs, as they directly influence the vehicle's range and overall functionality.

Permanent magnet synchronous motors are particularly favored in this segment due to their high efficiency, excellent torque delivery, and superior power density when compared to other motor types. These attributes are essential for BEVs, as they directly impact the vehicle's range and performance—two key selling points for consumers.

The growth of the BEV segment is largely driven by increasing environmental awareness, government incentives for zero-emission vehicles, and advancements in battery technology, which have enhanced BEV range and reduced costs. As the global electric vehicle market continues to expand, the demand for high-performance permanent magnet synchronous motors in the BEV sector is expected to rise.

Plug-in hybrid electric vehicles (PHEVs) also represent a significant segment in the market. These vehicles combine an internal combustion engine with an electric propulsion system, which includes a permanent magnet synchronous motor. PHEVs can be recharged from an external power source and operate solely on electric power for a limited range before switching to hybrid mode.

PHEVs offer flexibility, making them an appealing choice for consumers not yet ready to fully transition to BEVs. This drives demand for efficient and reliable electric motors, such as permanent magnet synchronous motors. In PHEVs, these motors are vital for delivering initial torque and power for all-electric driving, improving the vehicle's overall fuel efficiency, and reducing emissions during short trips.

The market for PHEVs, and consequently for permanent magnet synchronous motors used in these vehicles, is supported by consumers who want the benefits of electrification without concerns about battery range, as well as ongoing regulatory incentives for low-emission vehicles.

Power Rating Segment Analysis

The 51 kW to 150 kW power segment plays a key role in the electric vehicle permanent magnet synchronous motors market. Motors in this range are widely used in passenger electric vehicles that require moderate to high power for optimal performance and efficiency. This segment mainly serves mainstream electric cars and small commercial vehicles, where achieving a balance between power output and energy efficiency is essential.

The popularity of this power range is driven by consumer demand for electric vehicles that offer sufficient speed, acceleration, and towing capacity without sacrificing range. As the global shift toward electrification accelerates and automotive manufacturers continue to innovate and enhance electric vehicle efficiency, the demand for permanent magnet synchronous motors in this power range is anticipated to rise.

Technological advancements that improve motor performance and reduce costs further support the growth of this segment, making electric vehicles more accessible and appealing to a larger consumer audience.

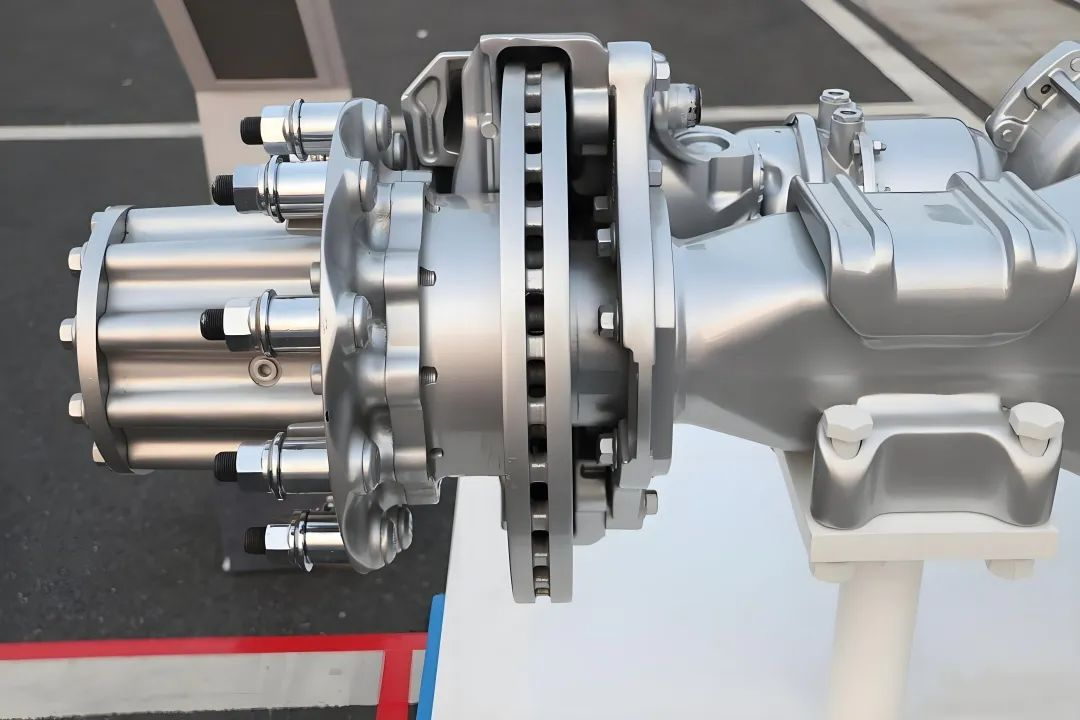

The segment above 150 kW targets high-performance and luxury electric vehicles that demand high power outputs for superior acceleration and speed. Motors in this range are crucial for sports cars, high-end sedans, and larger commercial vehicles, where strong power is required to meet performance expectations.

The growing market for premium electric vehicles, which often emphasize performance capabilities comparable to or exceeding those of traditional internal combustion engine vehicles, drives the demand for permanent magnet synchronous motors with power ratings above 150 kW. Moreover, advancements in electric powertrain technology and the expanding availability of charging infrastructure have made high-power electric vehicles both feasible and desirable. This segment is expected to experience significant growth as consumer preferences shift toward high-performance electric vehicles, and manufacturers explore new applications for high-power motors across various vehicle types.

Cooling Type Segment Analysis

The air-cooled segment holds a substantial share of the market, primarily due to its simplicity and affordability. Air-cooled motors rely on ambient air to dissipate heat, utilizing fans or the natural airflow generated by the vehicle’s movement. This cooling method is more straightforward and cost-effective compared to liquid cooling systems, as it doesn’t require additional components like pumps, radiators, or coolant fluids.

Air-cooled motors are typically used in lower-power applications and in electric vehicles where cost reduction is a key focus. The demand for air-cooled motors is particularly strong in markets where the economic aspect of electric vehicle production and ownership is prioritized. Although air-cooled systems are less efficient in terms of cooling compared to liquid-cooled systems, they remain popular in the electric vehicle industry, especially in regions with cooler climates or in vehicles that don’t require extreme performance.

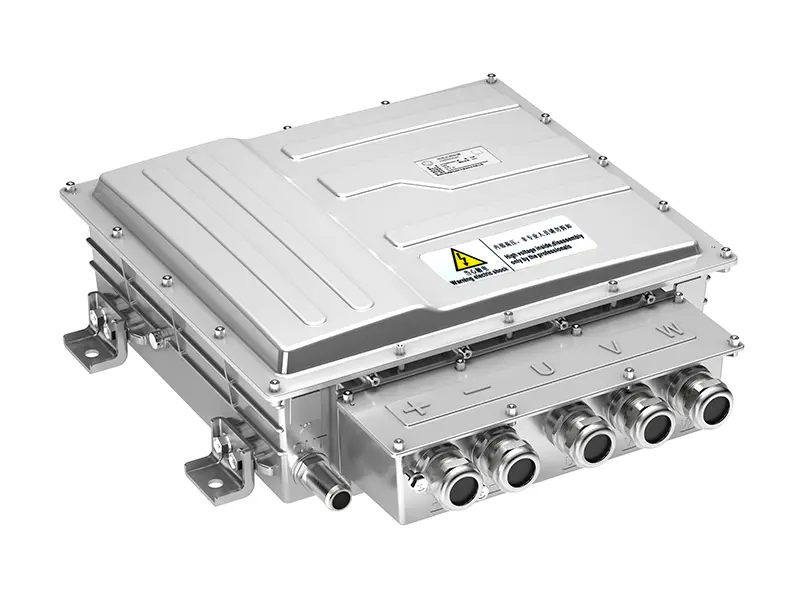

Liquid-cooled motors are gaining prominence in higher-performance electric vehicles. These motors use a coolant fluid to absorb and dissipate heat, providing effective temperature control even under heavy load conditions. Liquid cooling is particularly beneficial in high-power and high-speed electric vehicles, where motors experience significant heat generation due to intense operational stresses.

The superior cooling efficiency of liquid-cooled systems helps maintain optimal motor performance, increase durability, and prevent overheating, which can lead to reduced efficiency and potential motor damage. The rising demand for high-performance electric vehicles, such as luxury sedans, sports cars, and heavy-duty commercial vehicles, is driving the market for liquid-cooled motors.

Furthermore, as electric vehicle technology advances, with a continued focus on longer ranges and faster charging times, the need for efficient thermal management through liquid cooling systems is expected to grow, further boosting the expansion of this segment.

Application Segment Analysis

The passenger car segment is a key driver in the electric vehicle permanent magnet synchronous motors market. This category includes a broad spectrum of vehicles, from compact cars to luxury sedans, all of which are progressively adopting electric powertrains. Permanent magnet synchronous motors are preferred for this application due to their high efficiency, excellent torque characteristics, and compact size, all of which are crucial for optimizing interior space and extending vehicle range.

As consumer demand for electric passenger cars continues to rise, driven by concerns over the environment, increasing fuel prices, and supportive government policies, the need for efficient and dependable electric motors grows. Manufacturers are constantly innovating motor technology to enhance performance, reduce costs, and make electric passenger cars more attractive. This ongoing innovation is expected to support the continued growth of the market in this segment, as consumers shift from traditional internal combustion engines to electric alternatives.

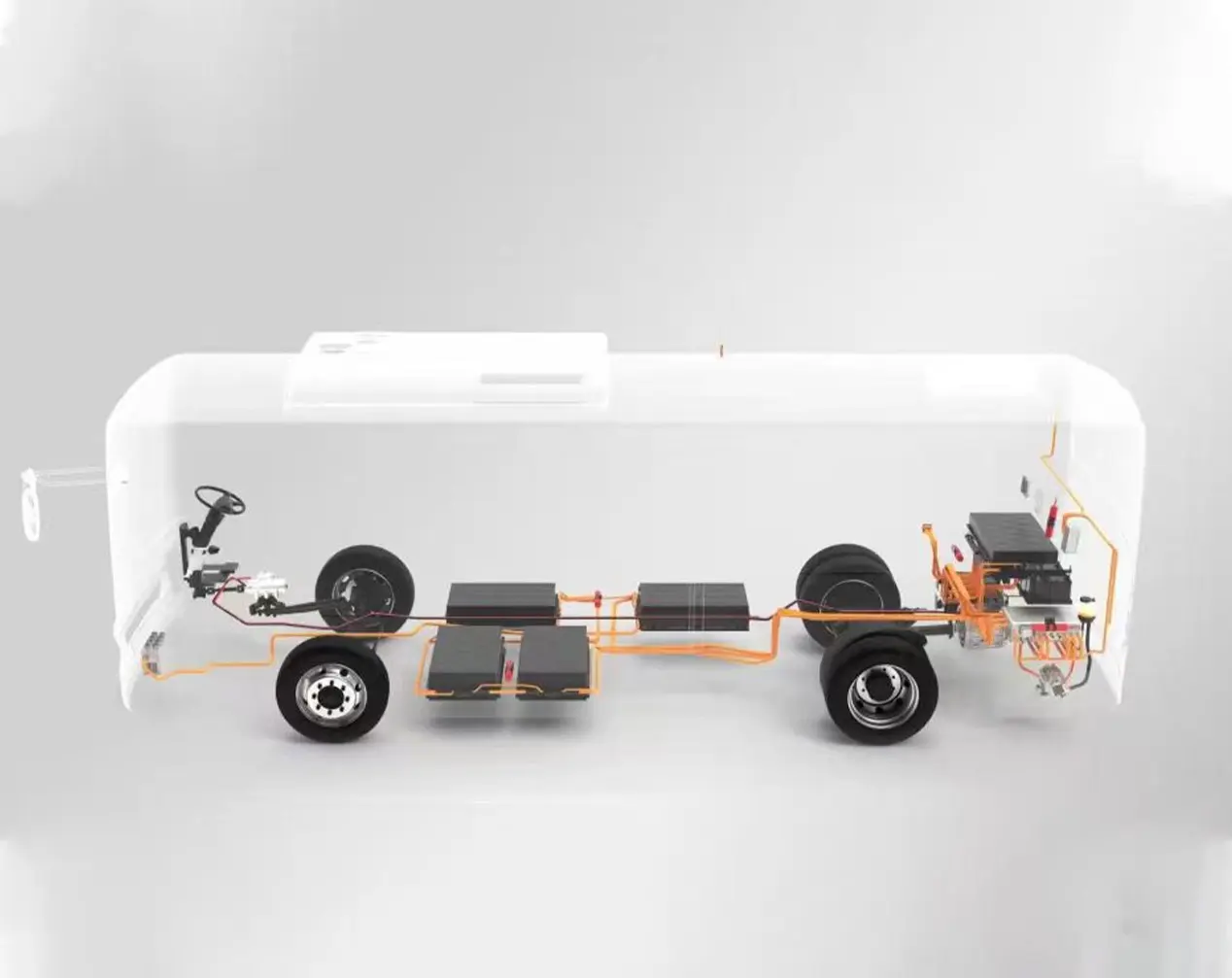

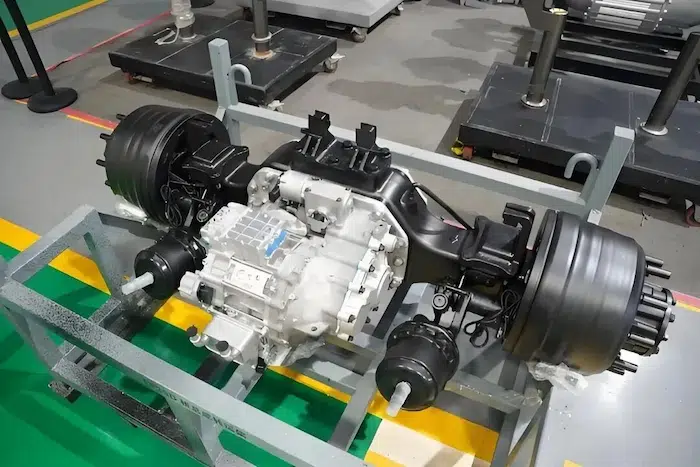

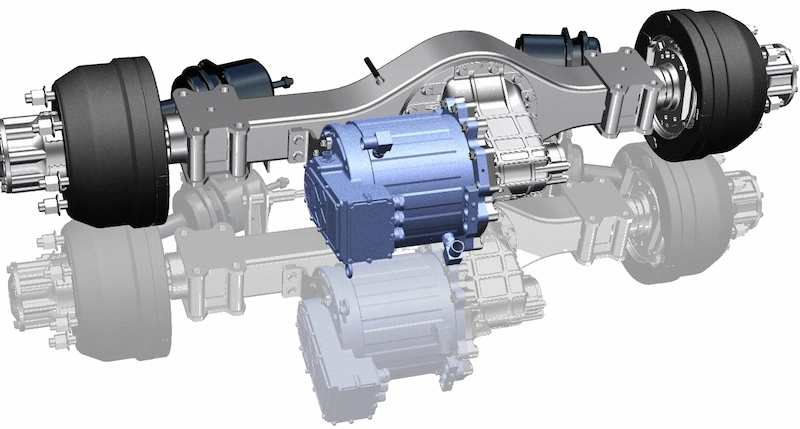

The commercial vehicle segment covers a range of vehicles, including vans, trucks, and heavy-duty vehicles used for freight and cargo transport. This segment is increasingly adopting electric vehicle technology to reduce operational costs and meet stringent emissions regulations. Permanent magnet synchronous motors are vital in this shift, as they provide the power and efficiency required for commercial operations.

These motors' durability, high torque output, and reliability make them ideal for commercial applications, where vehicles often endure heavy use and long operating hours. Growth in the commercial vehicle segment is further driven by the expansion of urban logistics, e-commerce, and public sector investments in eco-friendly transportation solutions.

As businesses and governments aim to reduce carbon footprints and cut operating costs, the adoption of electric commercial vehicles powered by permanent magnet synchronous motors is expected to rise, further driving growth in this market segment.

Regional Analysis

The Asia Pacific region is a key market for electric vehicle permanent magnet synchronous motors, fueled by strong economic growth, substantial investments in the automotive sector, and proactive environmental policies. Leading countries such as China, Japan, and South Korea are at the forefront, with China being particularly dominant due to its vast automotive market and significant government backing for electric vehicles (EVs).

The region benefits from advanced manufacturing capabilities and substantial investments in research and development, which help in the creation of high-quality and efficient motors. In addition, the growing consumer acceptance of electric vehicles, along with improved charging infrastructure, is driving market growth. The Asia Pacific market is expected to continue expanding, bolstered by ongoing technological advancements and government incentives aimed at reducing carbon emissions.

North America plays a crucial role in the electric vehicle permanent magnet synchronous motors market, with the US taking the lead. The region’s market is characterized by high consumer awareness, growing adoption of EVs, and strong regulatory support promoting emission reductions and sustainable transportation solutions.

Innovations and investments from major automotive manufacturers and tech companies in the US are accelerating the development and adoption of advanced motor technologies. Furthermore, Canada and Mexico are increasingly embracing electric mobility, supported by trade agreements that benefit the automotive sector. The market in North America is expected to see steady growth as consumers and businesses increasingly opt for electric vehicles to take advantage of cost savings and environmental benefits.

Europe represents a strong market for electric vehicle permanent magnet synchronous motors, driven by stringent environmental regulations, high consumer awareness, and significant government incentives. The European Union’s ambitious emission reduction goals and support for electric vehicles are major factors contributing to the market's expansion.

Countries like Germany, France, and Norway are leading in EV adoption, supported by established automotive industries and policies that favor electric mobility. The region is also a hub for technological innovation, particularly in electric motor and battery technologies, which further fuel market growth. Europe is expected to maintain its strong position in the global market, driven by continued policy support and growing consumer demand for sustainable transportation options.

Conclusion

In conclusion, the electric vehicle (EV) market is experiencing a significant transformation, with permanent magnet synchronous motors (PMSMs) at the heart of this revolution. From passenger cars to commercial vehicles, PMSMs provide the power, efficiency, and reliability that are crucial for the growing demand for electric mobility. Whether it's the high-performance demands of luxury vehicles or the cost-effective needs of smaller cars and commercial fleets, PMSMs continue to be the motor of choice due to their excellent torque characteristics, compact size, and energy efficiency.

As environmental concerns push for more sustainable solutions, governments around the world are offering incentives to accelerate the transition to electric vehicles. Advancements in motor technology, improved battery systems, and expanding charging infrastructure are all contributing to the continued growth of the EV market. Regions such as Asia Pacific, North America, and Europe are at the forefront, each playing a vital role in driving the global shift toward greener, more efficient transportation.

As the electric vehicle industry evolves, the demand for high-performance permanent magnet synchronous motors will only continue to grow. With ongoing innovations in motor design and a growing emphasis on sustainability, the future of electric mobility looks promising, paving the way for a cleaner, more energy-efficient world.

Read More: Everything You Need to Know About E-Axle Motor