Automotive MCU 2025: China Strengthens Supply Chain, Gains Market Share

Definition of Automotive MCUs

Automotive Microcontroller Units (MCUs) are specialized semiconductor devices designed to manage a wide range of control tasks in automobiles. These are self-contained systems with a central processing unit (CPU), memory (both volatile and non-volatile), and input/output peripherals integrated onto a single chip. Unlike generic MCUs used in consumer electronics, automotive MCUs must adhere to stringent standards for reliability, safety, and durability due to the demanding environments in which they operate—extreme temperatures, high vibrations, and electromagnetic interference.

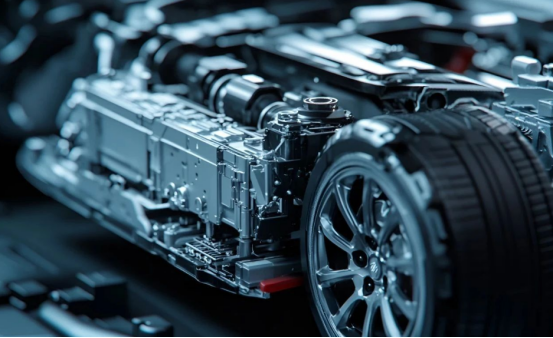

Modern vehicles use dozens, if not hundreds, of MCUs to control everything from basic functionalities like windshield wipers and power windows to complex systems such as electronic stability control, adaptive cruise control, and autonomous driving features. The growing complexity of automotive electronics has turned MCUs into one of the most critical components of vehicle design and performance.

The significance of automotive MCUs extends beyond control logic. They are essential in enabling software-defined vehicles (SDVs), which rely on frequent software updates and sophisticated code to add new features post-manufacture. This trend is shaping the future of the automotive industry, where vehicles are no longer defined solely by hardware but by their software capabilities.

Automotive Microcontroller Unit (MCU) Industry Trends

The automotive MCU industry is undergoing profound transformation, marked by rapid technological advances, increased demand for high-performance chips, and a reshaping of the global supply chain. The following are key trends influencing the sector:

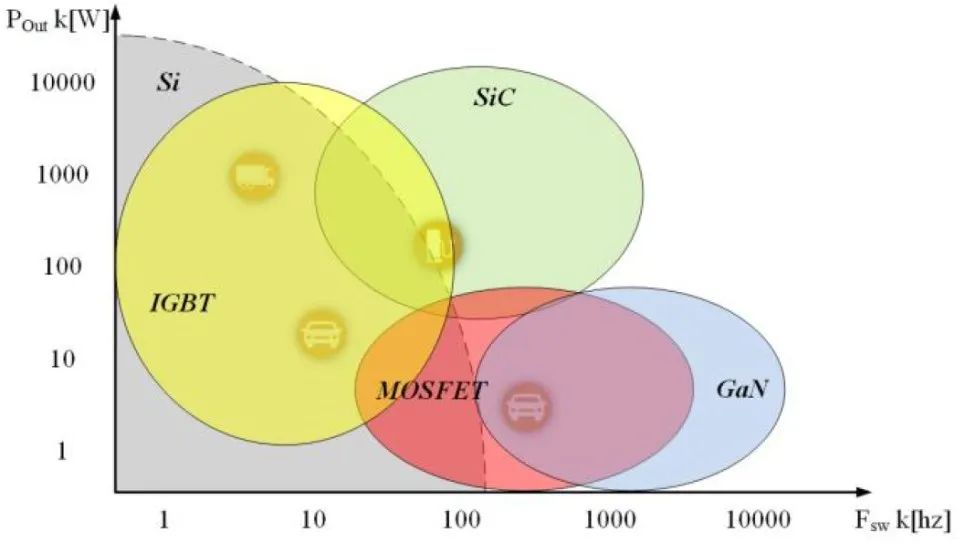

- Migration Toward High-Bit Architectures: As vehicles integrate more complex electronics, the demand has shifted from 8-bit and 16-bit MCUs to 32-bit and 64-bit MCUs. These higher-bit MCUs can process more data at faster speeds, enabling functionalities such as real-time sensor fusion, image processing for ADAS, and in-car AI applications.

- Edge Computing and AI Integration: With the rise of edge computing in automotive electronics, MCUs are evolving to include built-in support for machine learning algorithms. This reduces latency and bandwidth needs for tasks like object detection and voice recognition, allowing critical decisions to be made locally within the vehicle.

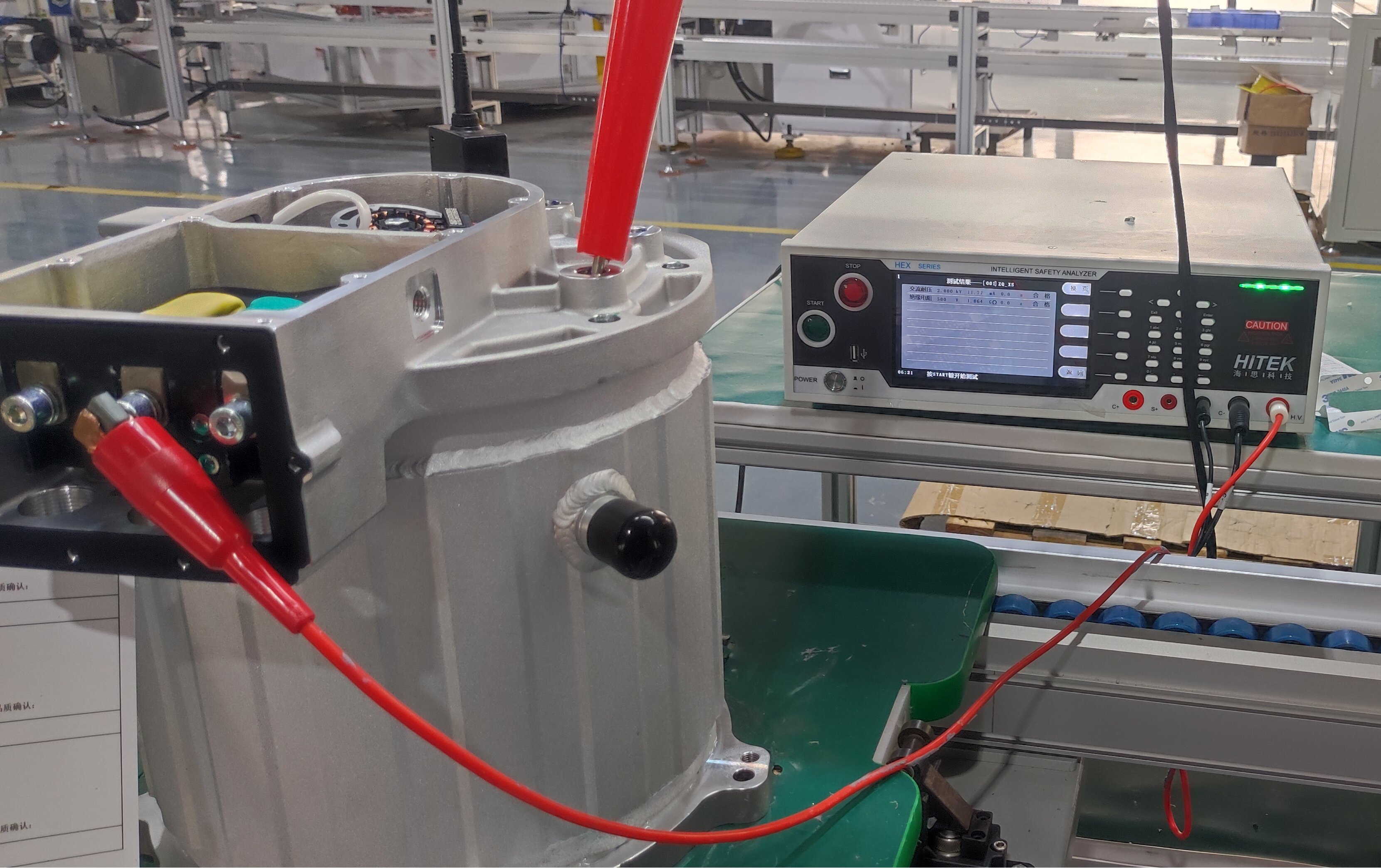

- Emphasis on Cybersecurity and Safety: Modern vehicles are constantly connected to the internet, making cybersecurity a top priority. MCUs are increasingly embedded with hardware-level encryption, secure boot, and other protections to comply with cybersecurity standards like ISO/SAE 21434. Functional safety, governed by ISO 26262, remains a cornerstone, particularly for systems involving braking, steering, and powertrain control.

- Semiconductor Supply Chain Realignment: The 2020–2022 global chip shortage exposed vulnerabilities in the automotive supply chain. Automakers are now taking a proactive stance by partnering with semiconductor companies, investing in chip fabrication facilities, and adopting dual sourcing strategies. This move has also sparked interest in regionalizing chip production, with countries like China accelerating efforts to build local capabilities.

- E-Mobility and Electrification: The electrification of the automotive sector is perhaps the most powerful catalyst for MCU demand. Electric vehicles (EVs) require significantly more computing power to manage batteries, electric motors, charging systems, and energy efficiency—all of which are driven by specialized MCUs.

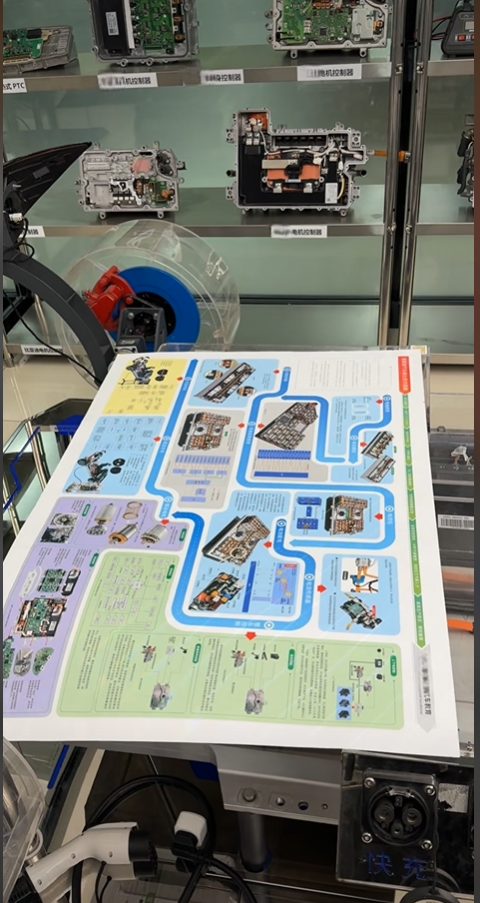

Application of Automotive Microcontroller Units (MCUs) by OEMs

Original Equipment Manufacturers (OEMs) are the primary consumers of automotive MCUs, integrating them into multiple vehicle systems to enhance functionality, efficiency, and safety. Here's how different automotive domains use MCUs:

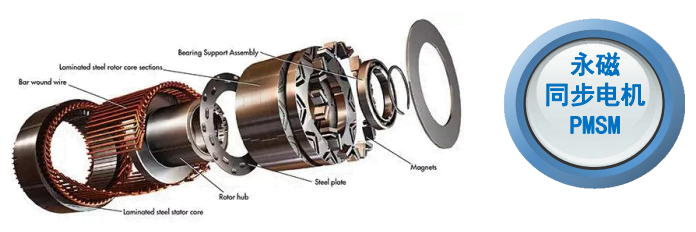

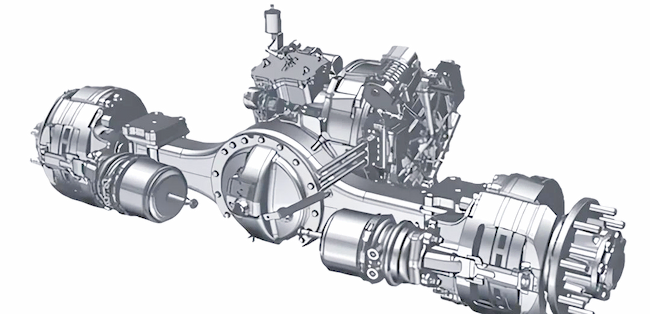

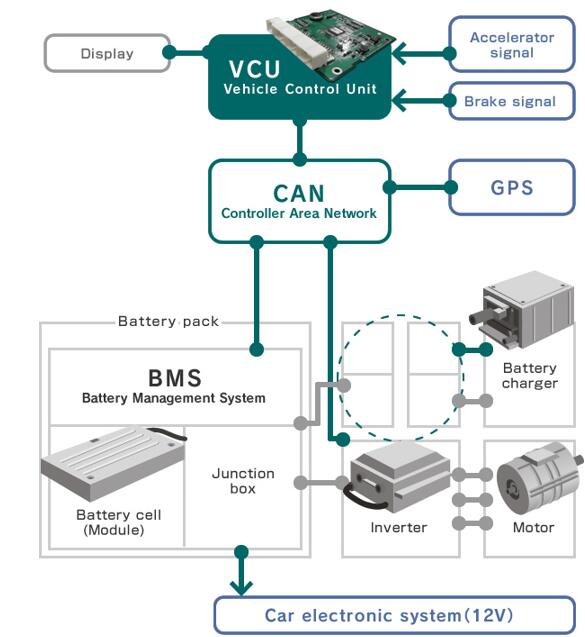

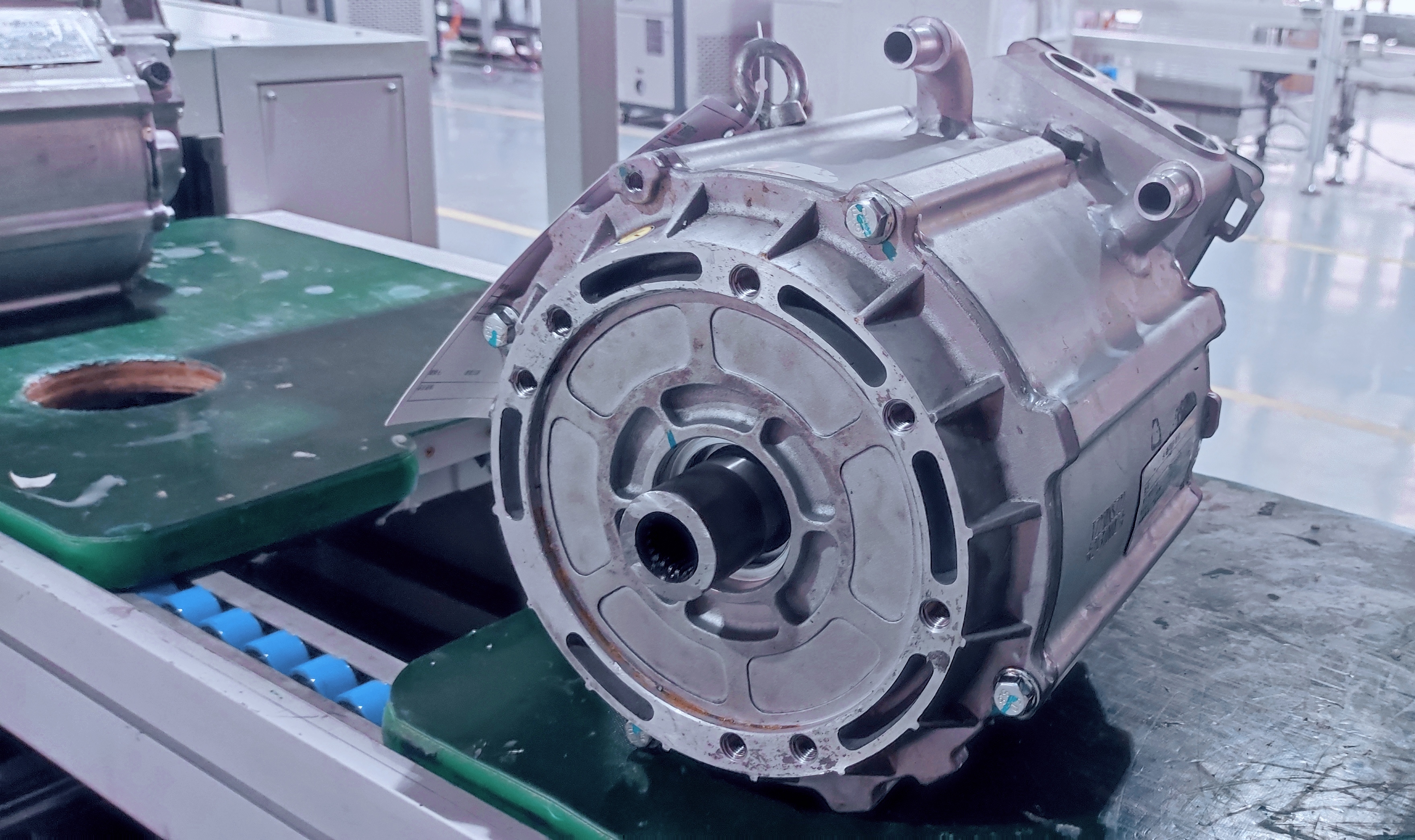

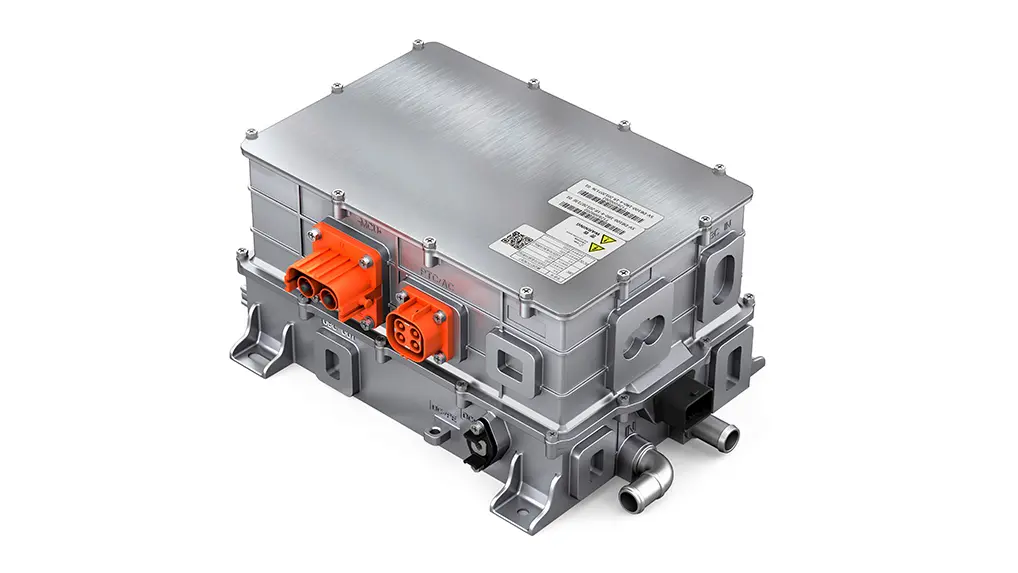

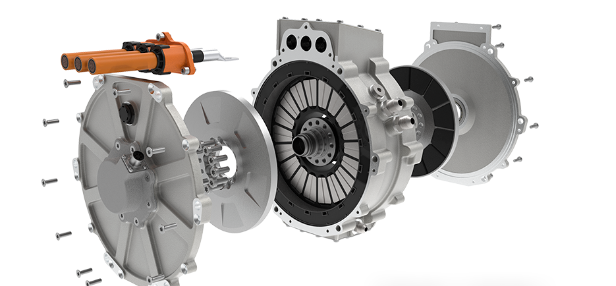

- Powertrain Management: MCUs control fuel injection, ignition timing, turbocharging, hybrid drive systems, and energy recovery. In EVs, they manage electric motor functions and interface with battery management systems.

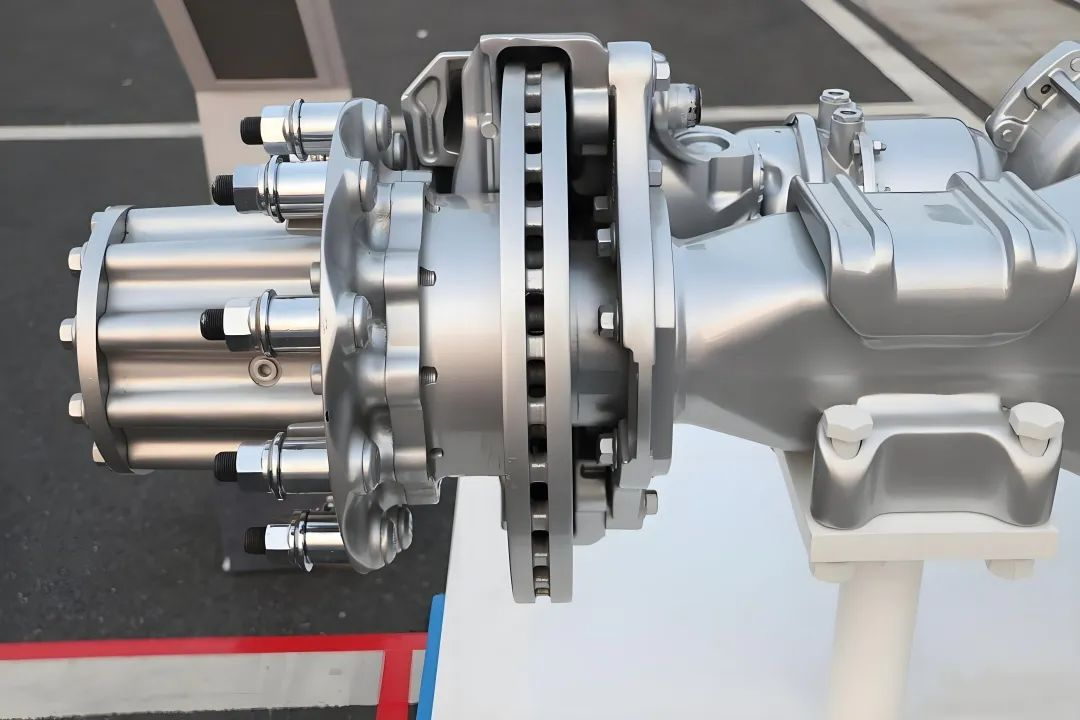

- Chassis Systems: These systems ensure vehicle stability and responsiveness. MCUs govern functions such as adaptive suspension, anti-lock braking systems (ABS), traction control, and electronic stability programs (ESP). These functions require real-time precision, often achieved with high-reliability MCUs.

- Advanced Driver Assistance Systems (ADAS): ADAS is one of the most MCU-intensive segments, requiring rapid data processing from cameras, radar, lidar, and ultrasonic sensors. MCUs interpret sensor data, make decisions, and send commands to actuators, all within milliseconds.

- Infotainment and Connectivity: As cars transform into mobile living spaces, infotainment systems demand MCUs with high-speed graphics processing, multi-channel audio, and connectivity options (Bluetooth, Wi-Fi, 5G). Voice-activated assistants, touch interfaces, and gesture recognition are becoming common.

- Body Control Modules (BCMs): These MCUs manage interior and exterior lighting, climate control, seat adjustments, keyless entry, and central locking. BCMs contribute significantly to user comfort and customization.

To maintain competitiveness, OEMs are increasingly working directly with semiconductor suppliers to develop custom MCU solutions. This vertical collaboration allows for tailored architectures, optimized software stacks, and better integration with vehicle platforms. Tesla, for instance, designs much of its own hardware in partnership with key chip vendors to ensure its vehicles have a distinct performance edge.

Major Application Scenarios of Automotive Microcontroller Units (MCUs)

Automotive MCUs are embedded in nearly every vehicle subsystem. Below are some of the major scenarios where their application is most prominent:

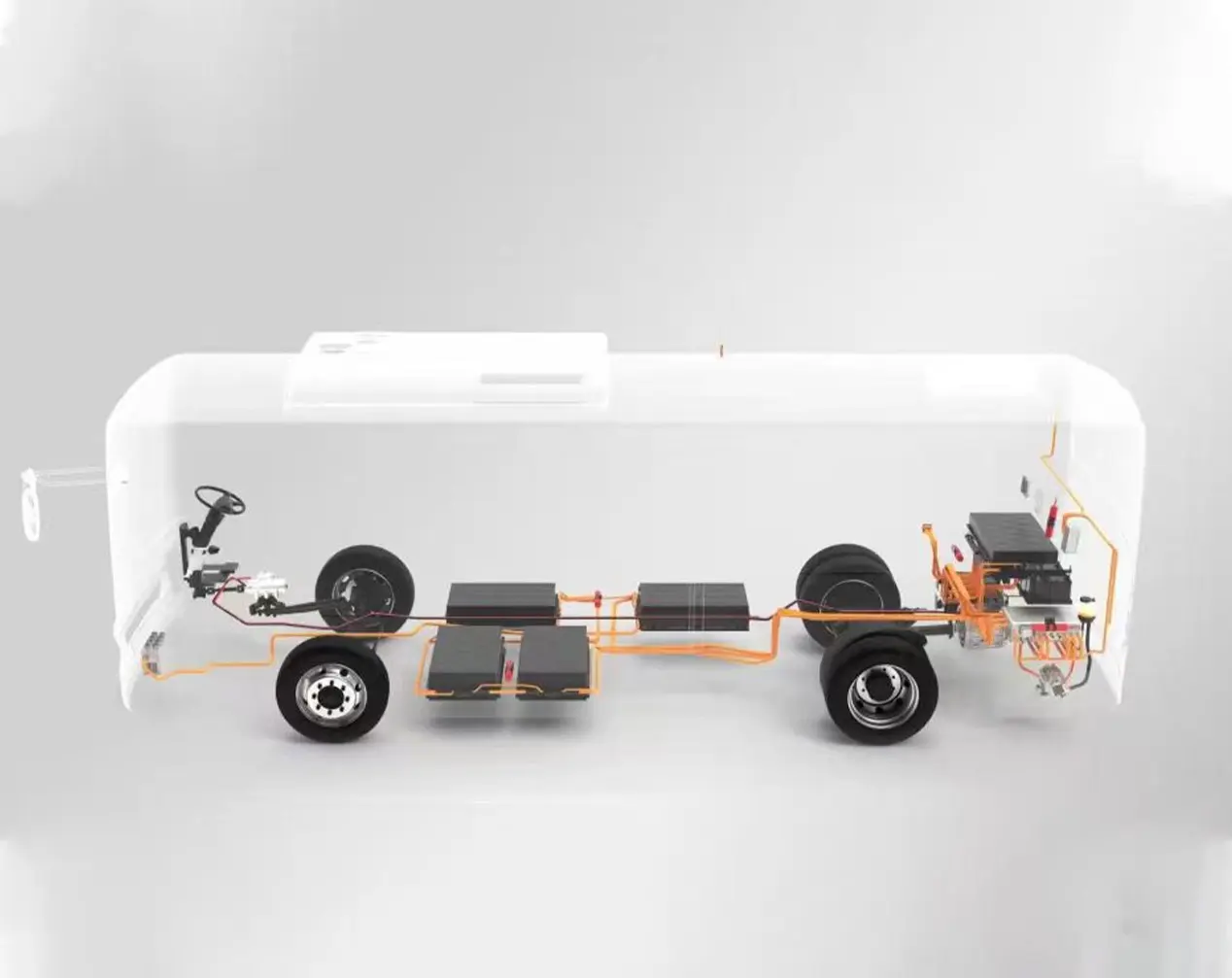

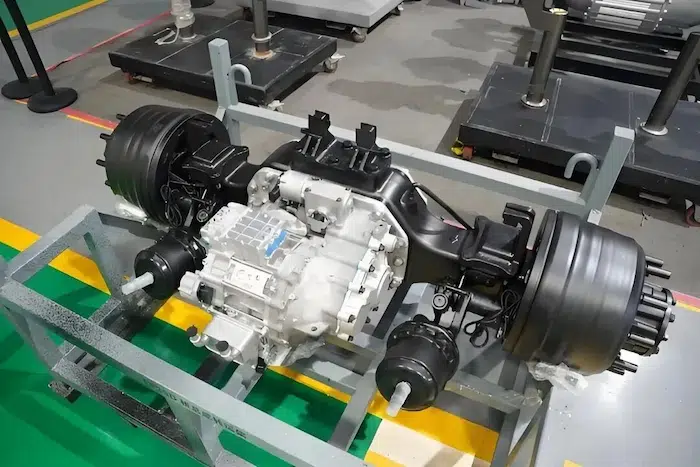

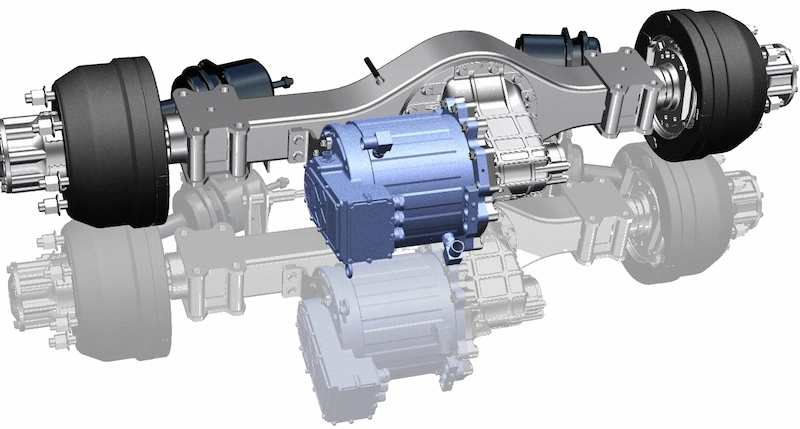

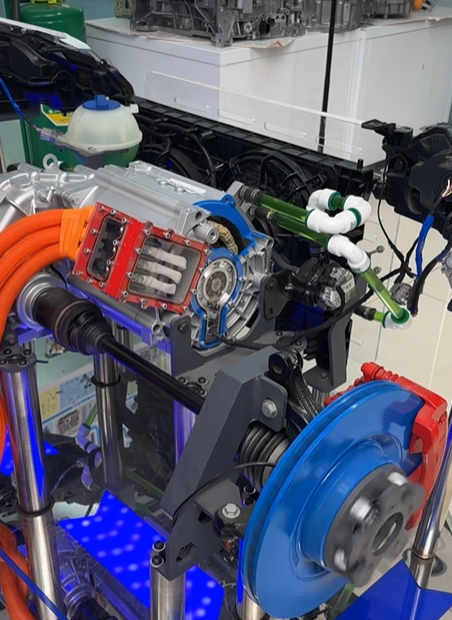

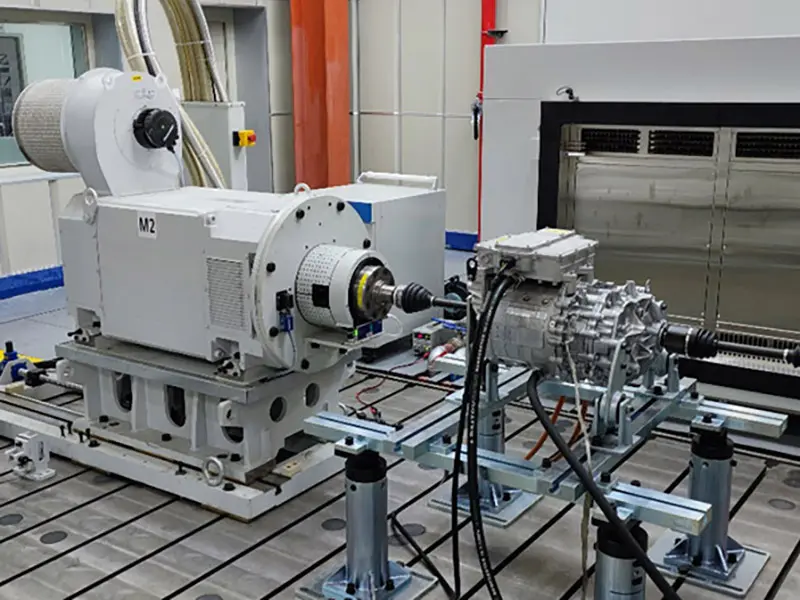

- Electric and Hybrid Vehicles: In EVs and hybrids, MCUs are vital for battery management systems (BMS), motor control units (MCUs—distinct from microcontrollers), DC-DC converters, and inverter control. These functions require real-time monitoring of temperature, voltage, and current to maximize range and ensure safety.

- Autonomous Driving Technologies: MCUs with AI acceleration capabilities support vision processing, sensor fusion, and decision-making for features like lane-keeping, adaptive cruise control, and emergency braking. While high-end processors handle the most complex tasks, MCUs play a crucial role in auxiliary decision loops and redundancy systems.

- Digital Cockpits and Smart Interfaces: The modern car dashboard has evolved into a multi-screen experience with digital instrument clusters, infotainment systems, and heads-up displays (HUDs). MCUs manage graphics rendering, multi-modal input, and synchronization across these displays.

- Connected Vehicles: V2X (Vehicle-to-Everything) communication is gaining momentum as 5G technology proliferates. MCUs facilitate secure communication between vehicles, infrastructure, and the cloud, enabling features like cooperative adaptive cruise control and intersection collision warnings.

- Predictive Maintenance and Telematics: MCUs gather data from various vehicle components to anticipate potential failures. This data is sent to cloud platforms for analysis, allowing OEMs and fleet operators to schedule maintenance before problems occur, reducing downtime and cost.

- Over-the-Air (OTA) Updates: Software updates are becoming as crucial as hardware upgrades. MCUs ensure secure and reliable delivery of OTA updates, which can include bug fixes, performance improvements, and new features.

Chinese Automotive MCU Vendors

China’s ambition to reduce dependency on foreign semiconductors has catalyzed a wave of domestic innovation, especially in automotive MCUs. Government initiatives and strategic investments are nurturing a rapidly expanding ecosystem of Chinese MCU vendors.

- GigaDevice: Based in Beijing, GigaDevice started with NOR Flash memory but has diversified into MCU design. The company’s GD32 series MCUs have found traction in industrial and consumer markets and are now being adapted for automotive use, focusing on 32-bit ARM Cortex cores with support for functional safety.

- AutoChips: A subsidiary of NavInfo, AutoChips focuses on in-vehicle infotainment and digital instrument clusters. Its strategic partnerships with domestic automakers have helped it tailor its offerings to local requirements, improving time-to-market and cost-effectiveness.

- BYD Semiconductor: This vertically integrated supplier began by designing MCUs for its parent company’s EVs. Today, it supplies a wide range of power semiconductors and MCUs to third-party automakers, with a strong focus on EV-specific functions such as motor control and BMS.

- Hua Hong Semiconductor and SMIC: As China’s leading foundries, these firms provide fabrication capabilities for fabless MCU designers. Their ability to manufacture at mature nodes (e.g., 55nm, 40nm) is essential for automotive-grade chips, which prioritize reliability over leading-edge miniaturization.

- ChipON and Nations Technologies: These companies are investing heavily in acquiring automotive certifications like AEC-Q100 and ISO 26262 to qualify their MCUs for use in safety-critical applications. They are also expanding their product portfolios to include secure MCUs with embedded cryptography for V2X and infotainment.

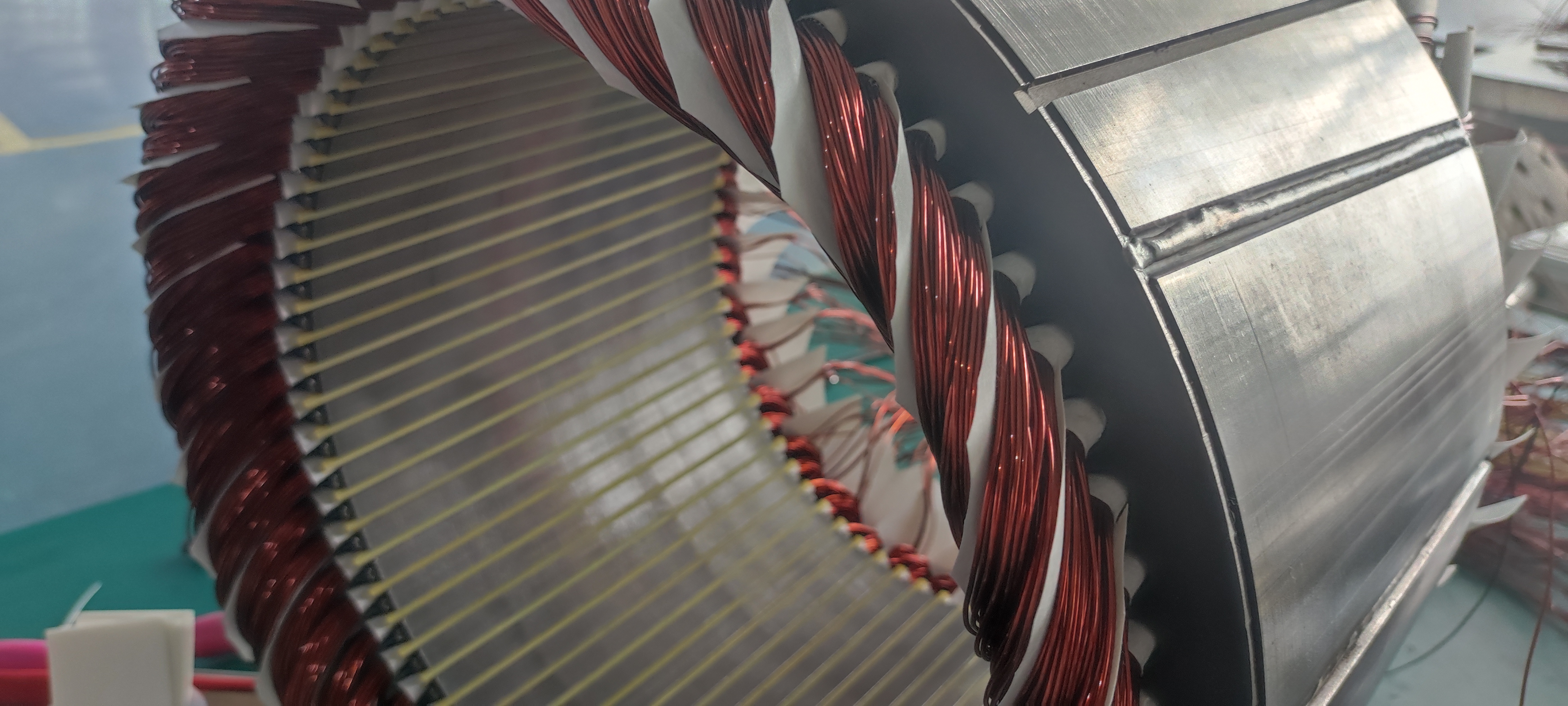

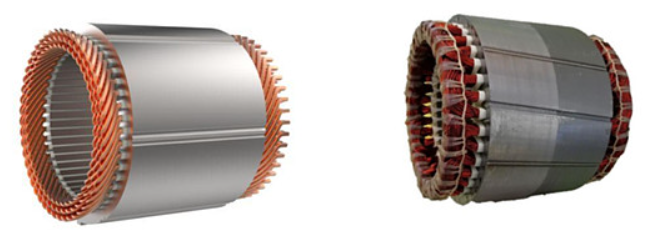

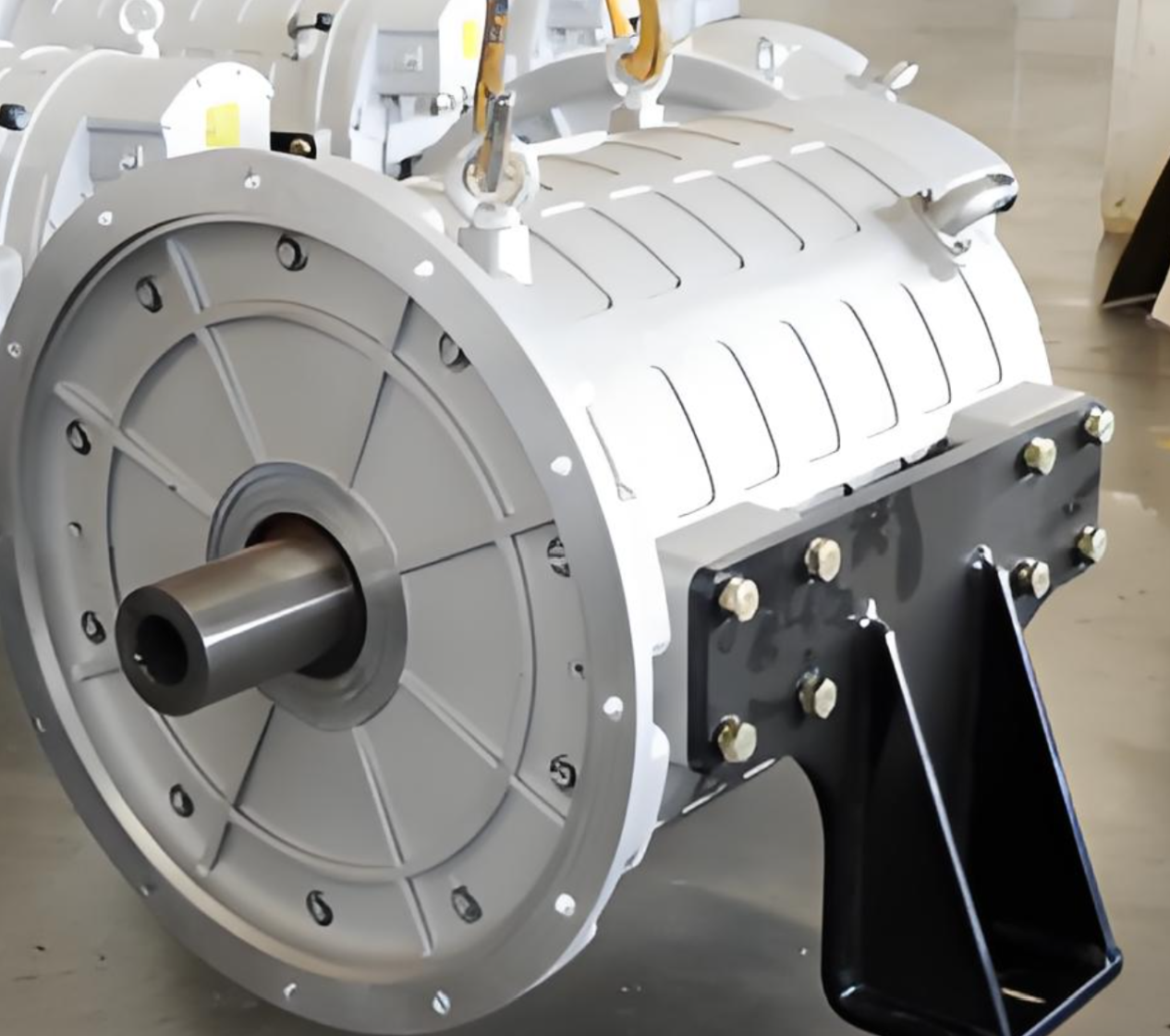

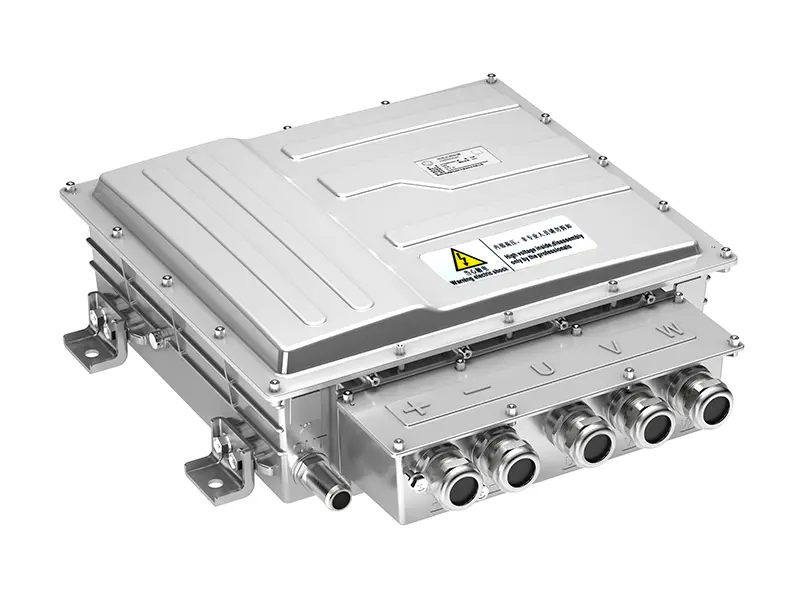

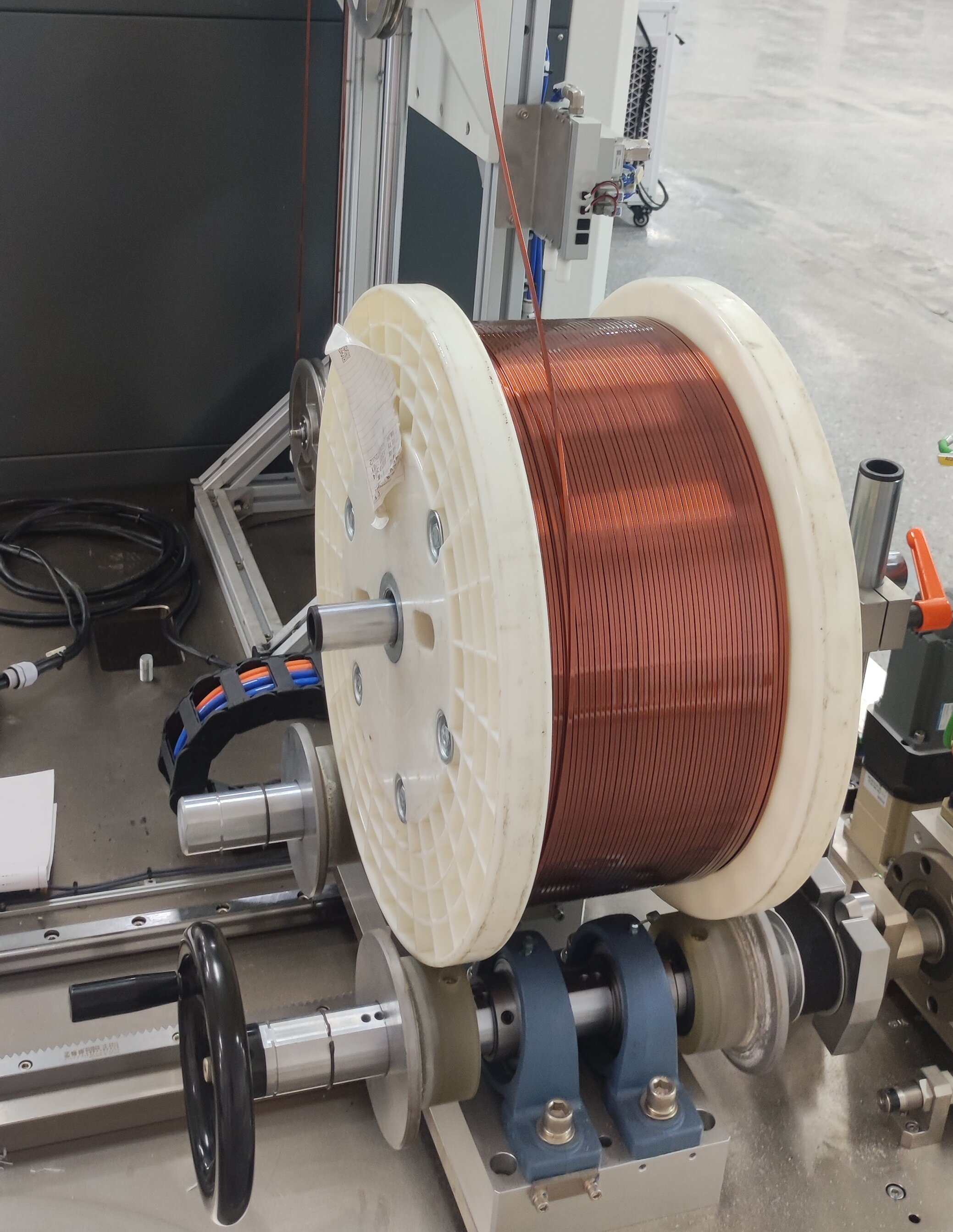

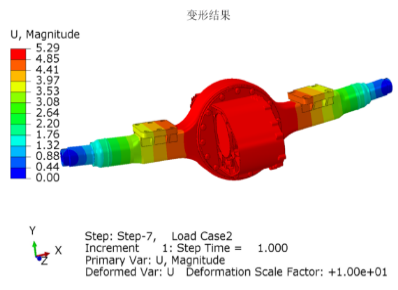

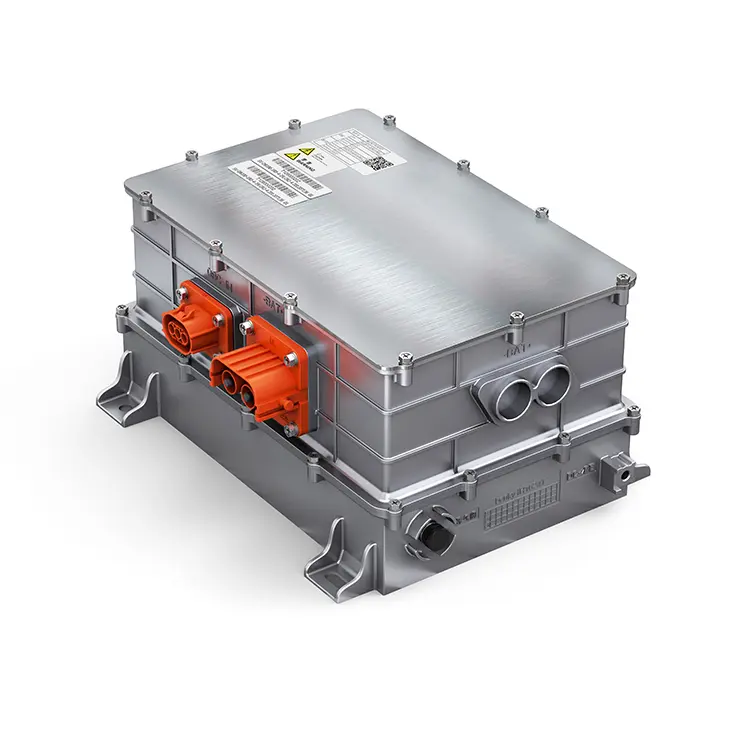

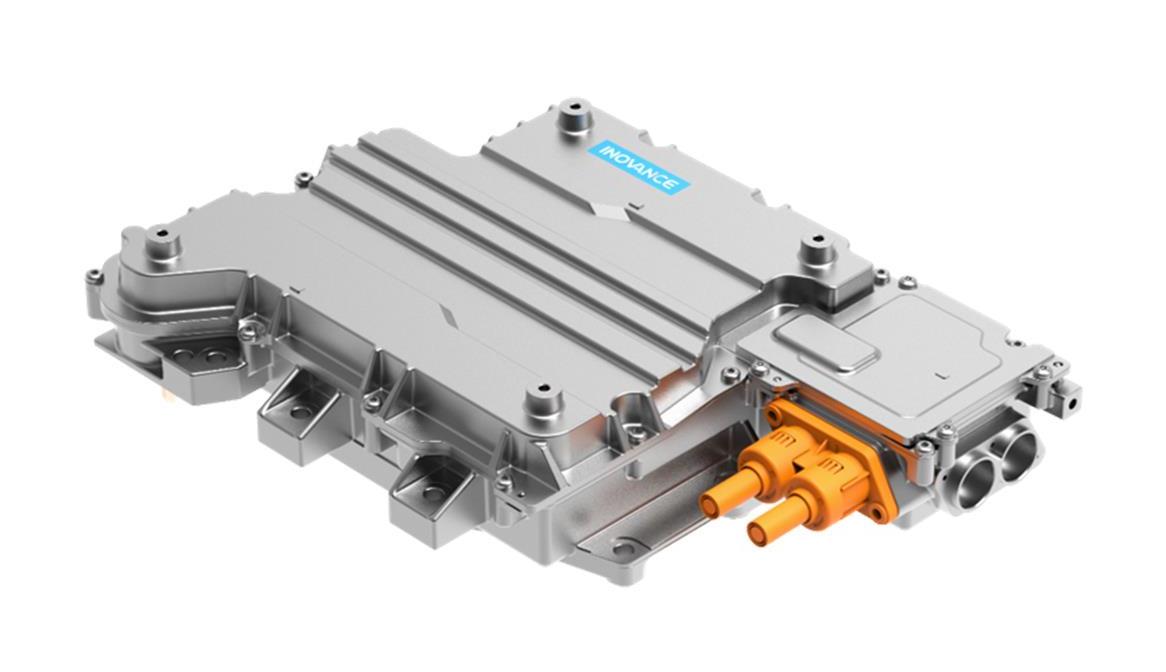

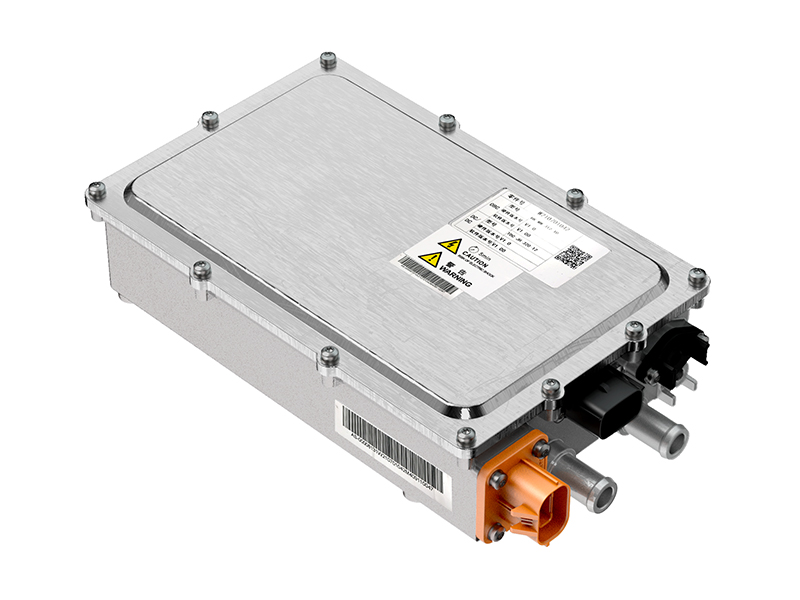

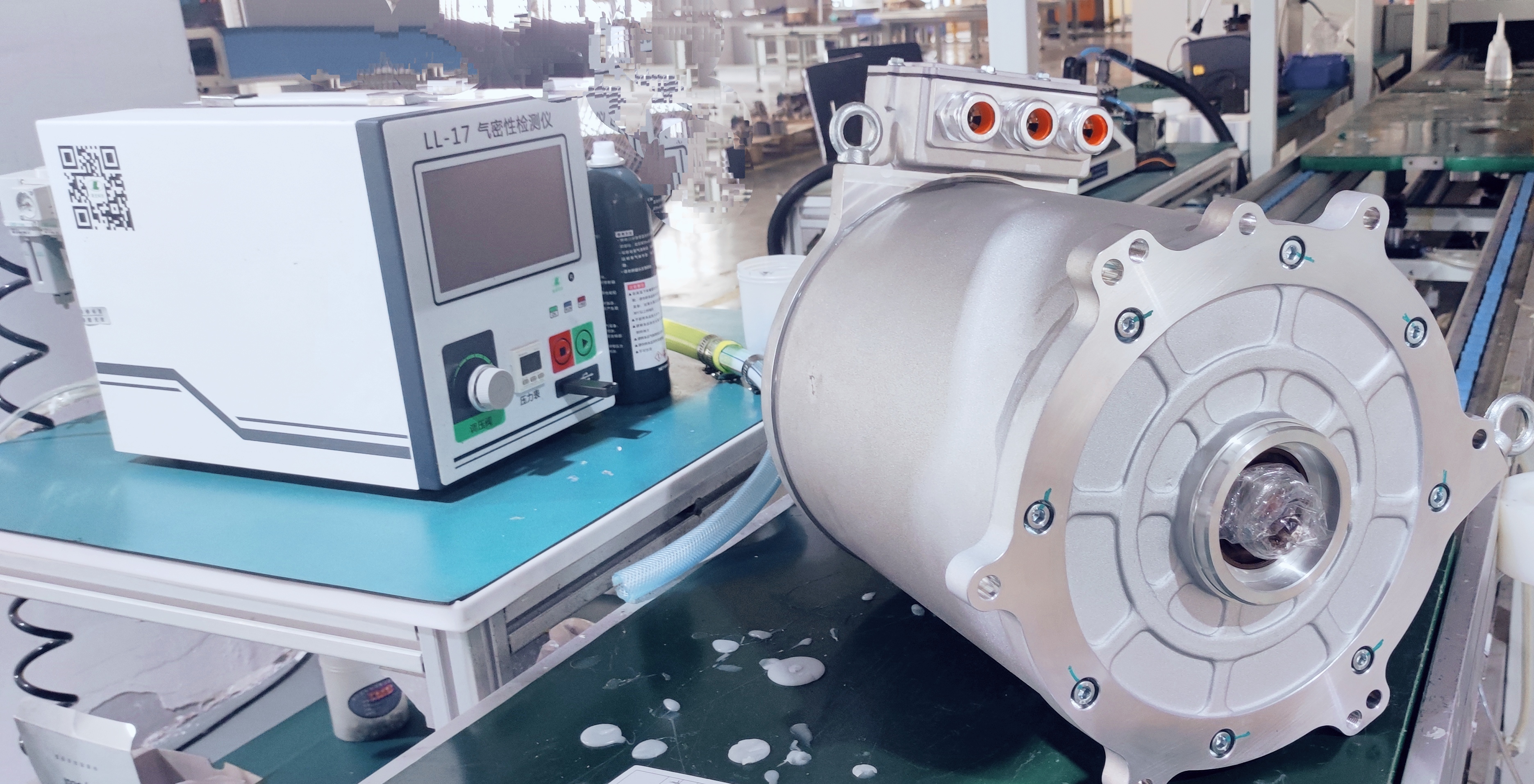

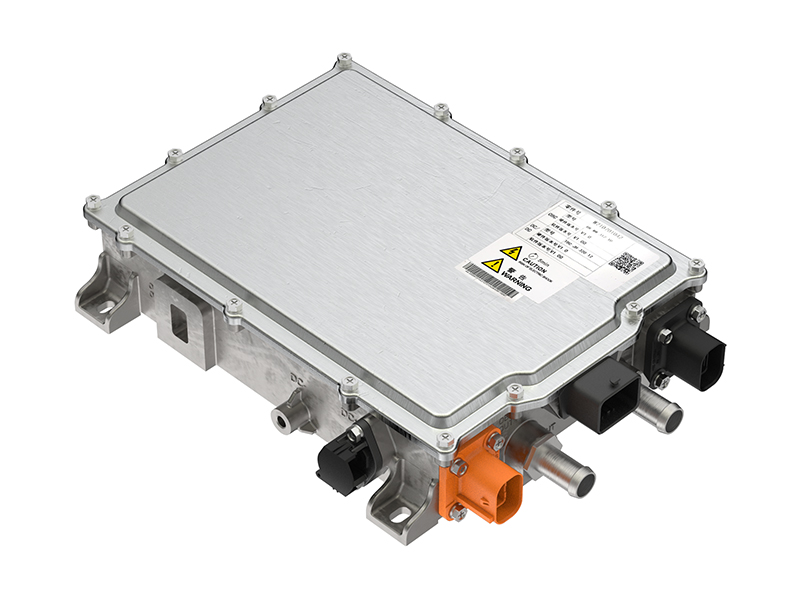

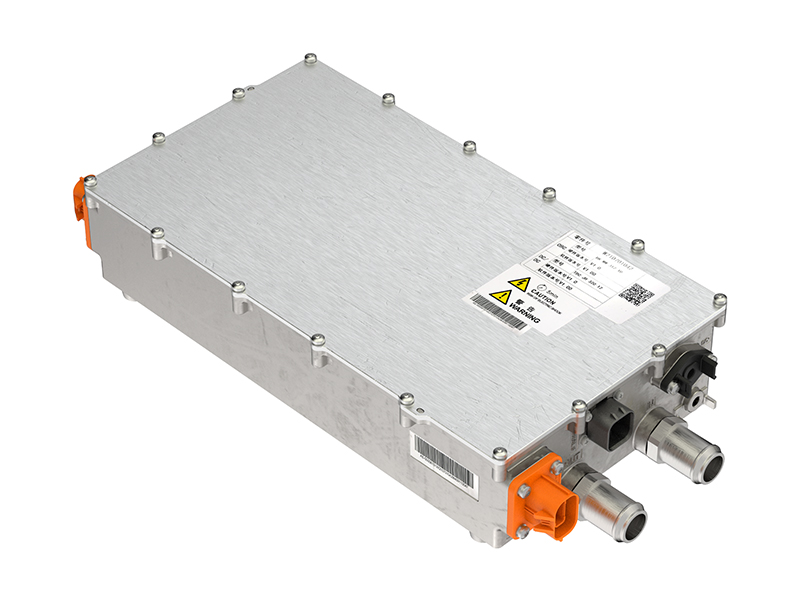

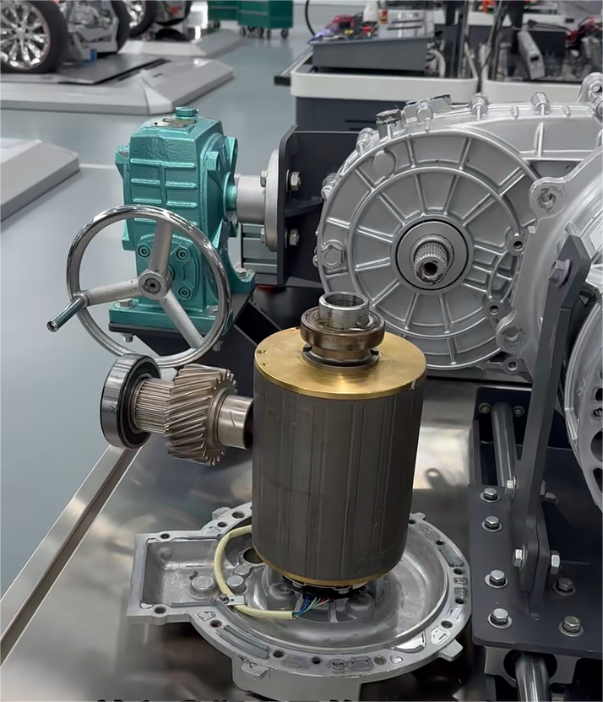

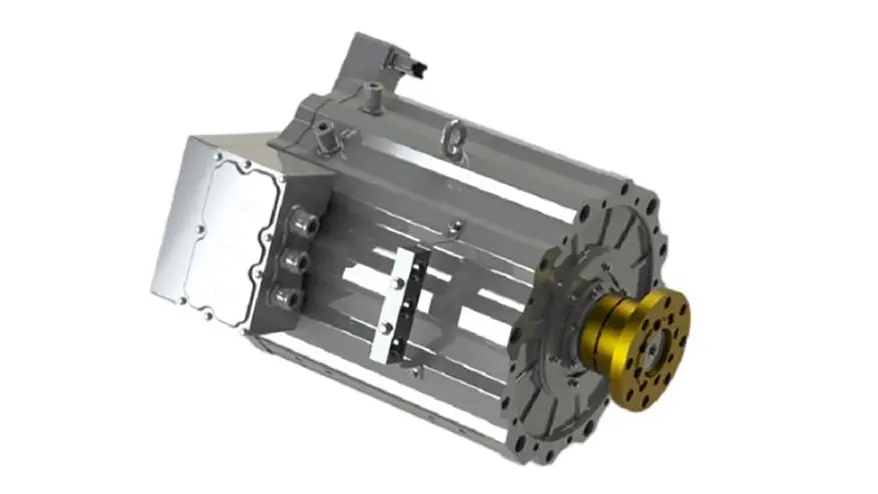

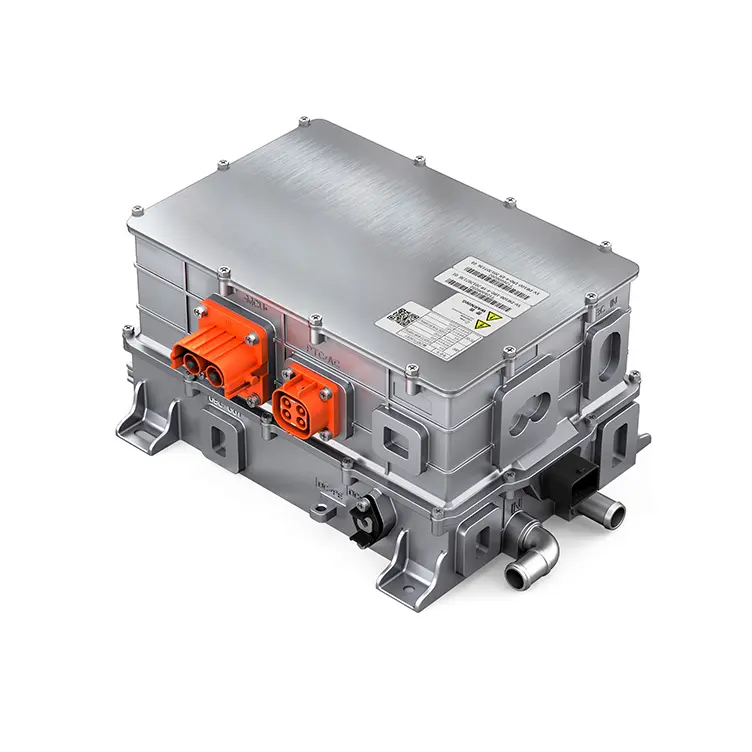

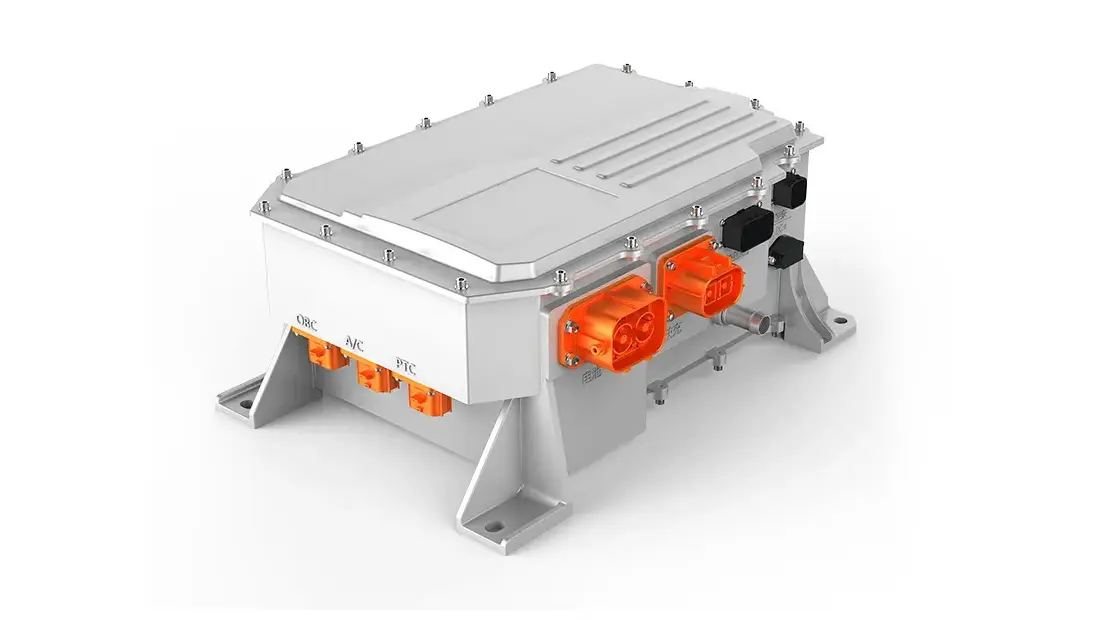

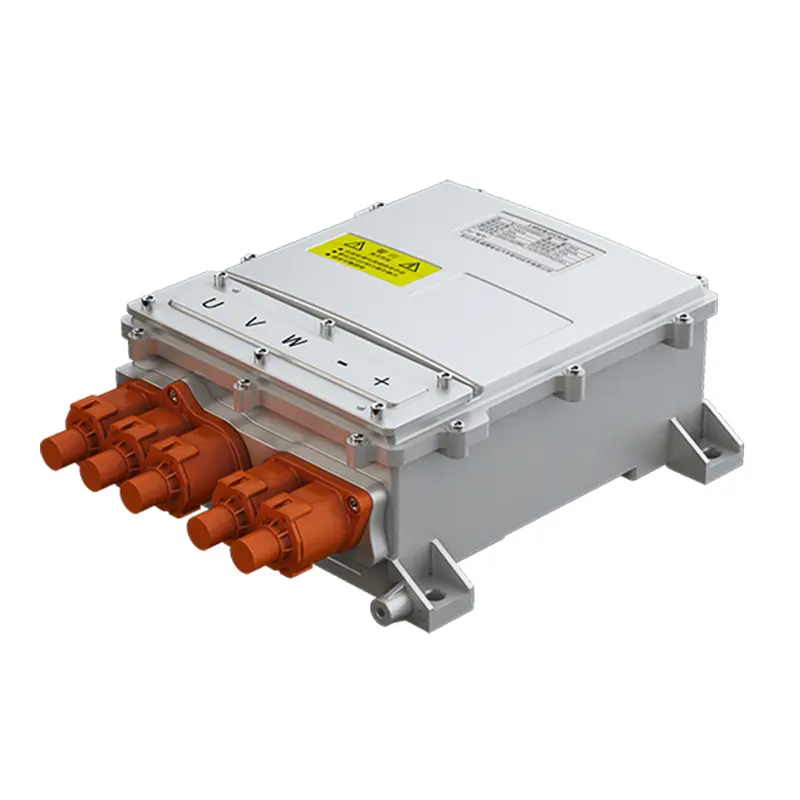

- Pumbaa: PUMBAA EV’s motor control unit plays a pivotal role in the intelligent management of electric vehicles, serving as the central processor that harmonizes the functions of the EV motor controller. By leveraging cutting-edge microcontroller technology, it delivers precise control over motor speed and integrates seamlessly with BLDC motor inverters to support smooth acceleration and deceleration. This system is engineered to optimize energy usage, enhancing both performance and efficiency. Moreover, the robust EV inverter built into the unit ensures efficient power conversion and delivery, making it a dependable solution for a wide range of electric vehicle applications.

China’s progress is underpinned by significant policy support. The “Made in China 2025” strategy includes semiconductors as a core focus area, offering tax incentives, funding programs, and infrastructure development. Moreover, the rise of new energy vehicles (NEVs) and local EV startups like NIO, Xpeng, and Li Auto are driving demand for domestic MCUs that can deliver performance at scale.

Conclusion

The automotive MCU industry is at the heart of a revolution in mobility, defined by electrification, automation, and connectivity. As vehicles become smarter and more software-defined, the importance of MCUs continues to grow. These chips not only execute core control functions but also enable transformative capabilities such as autonomous driving, predictive maintenance, and seamless human-machine interaction.

China’s emergence as a strong player in the automotive MCU market is reshaping the global semiconductor landscape. With robust government backing, rising technical capabilities, and a booming domestic market for smart vehicles, Chinese MCU vendors are becoming formidable competitors to established Western and Japanese suppliers.

By 2025, the convergence of policy, innovation, and market demand will likely position China as a leading hub for automotive MCU production. This will not only bolster its domestic auto industry but also contribute to a more diversified and resilient global supply chain.

The next decade will be critical as the industry grapples with new demands in AI, cybersecurity, and sustainability. Automotive MCUs—small yet mighty—will be central to navigating this complex, exciting future. For automakers, suppliers, and policymakers alike, understanding and investing in this technology is no longer optional—it’s essential.