How to make low-carbon freight possible?

Abstract

Low-carbon road freight is key to mitigating global warming. However, heavy-duty vehicle electrification faces significant challenges due to high technical requirements and cost competitiveness. Future truck cost data remains scarce and uncertain, complicating the evaluation of Zero Emission Truck (ZET) technology. Through meta-prediction of over 200 primary sources, this study identifies the most probable cost trends for ZET component pricing. The findings reveal that costs are declining faster than expected, with battery system costs potentially decreasing by 64% to 75%, reaching €150 per kWh by 2035 at the latest. While fuel cell systems may see even greater reductions, they are unlikely to reach €100 per kWh before early 2040. This rapid cost reduction supports optimistic projections for ZET market adoption and holds significant implications for future energy and transportation systems.

Main

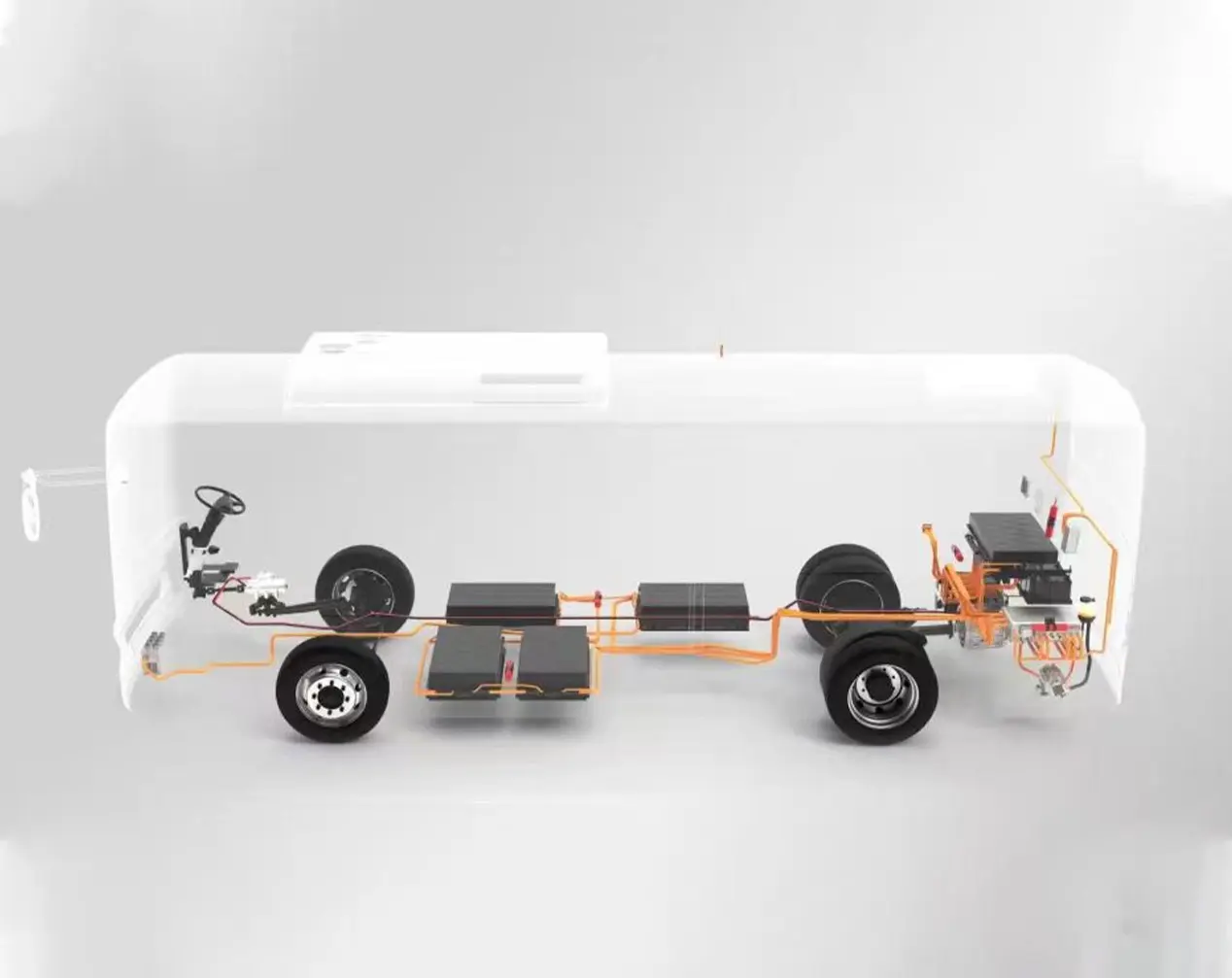

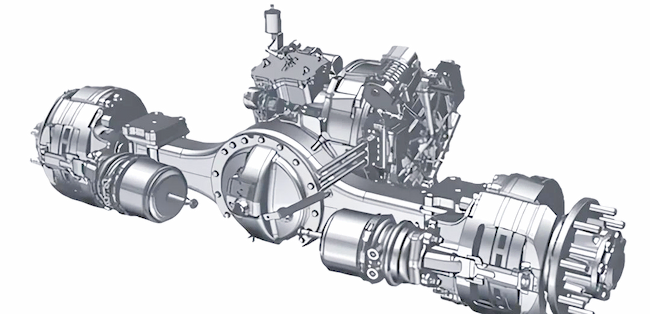

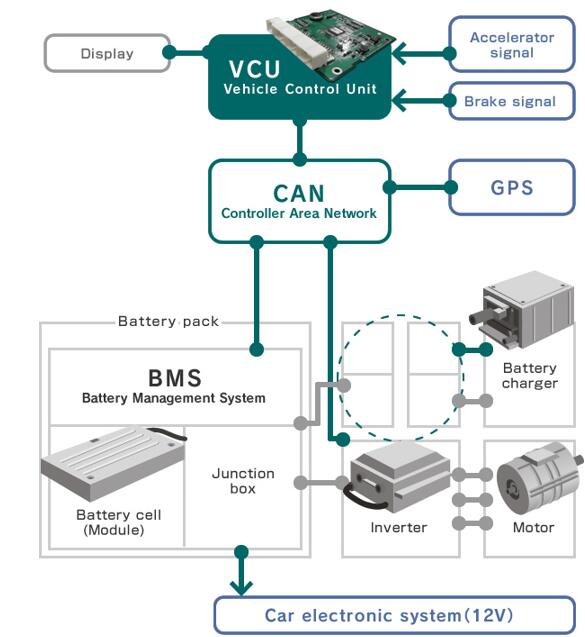

Given the substantial greenhouse gas emissions from heavy-duty vehicles (HDVs), rapid electrification of heavy-duty road freight is crucial for limiting global warming under the Paris Climate Agreement. The EU, US, and China have successively tightened emission targets for heavy-duty diesel trucks, necessitating swift deployment of zero-emission trucks where demand and operator affordability are key factors. However, high acquisition costs hinder the rapid adoption of zero-emission trucks. Electrification of heavy commercial vehicles faces significant challenges due to their technical complexity and cost competitiveness. Accurate and comprehensive data on zero-emission truck acquisition costs are vital for evaluating this technology. Yet, component cost data for zero-emission trucks remains scarce and uncertain. This study therefore poses the question: What is the most likely future cost trajectory for central zero-emission truck components by 2050? The paper analyzes projected costs for five critical battery-electric truck (BETs) and/or fuel cell truck (FCET) components. Rapid market penetration of zero-emission trucks can be achieved swiftly with required breakthrough costs. As the leading technology, battery-electric trucks demonstrate better prospects and immediate cost-effectiveness, supporting optimistic views on decarbonizing road freight.

Meta forecast using regression analysis

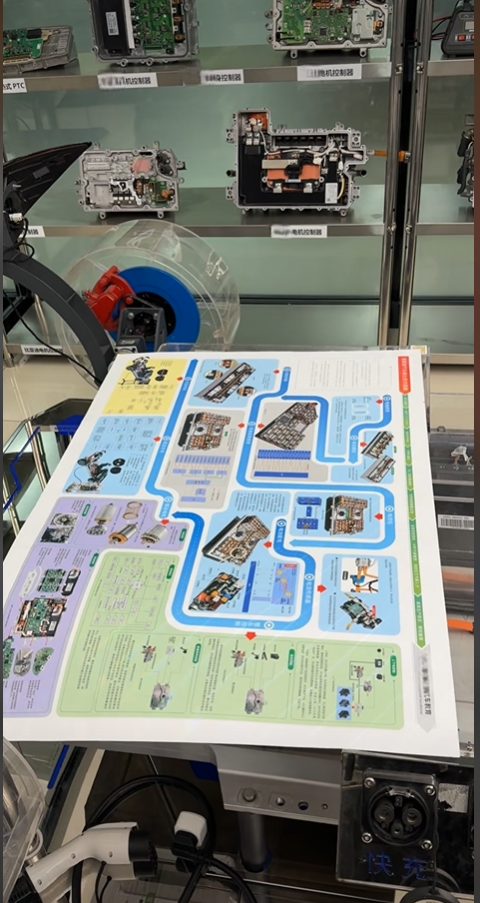

This study identified relevant literature through searches of Scopus and Google Scholar databases, categorizing sources into three types: near-market (market forecasts and industry announcements from renowned analysts and consulting firms), scientific (peer-reviewed papers), and others (non-peer-reviewed academic publications and reports). All cost values were standardized to the system-level OEM procurement prices for zero-emission truck components.

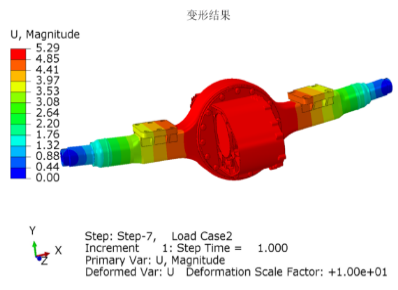

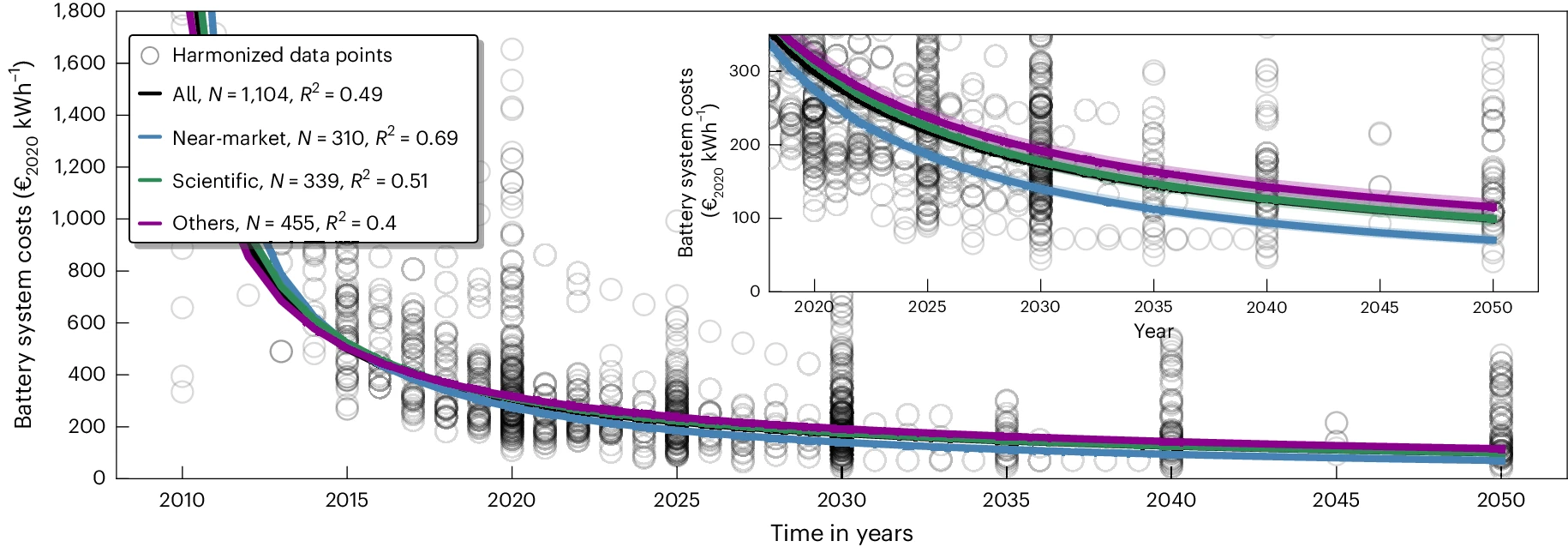

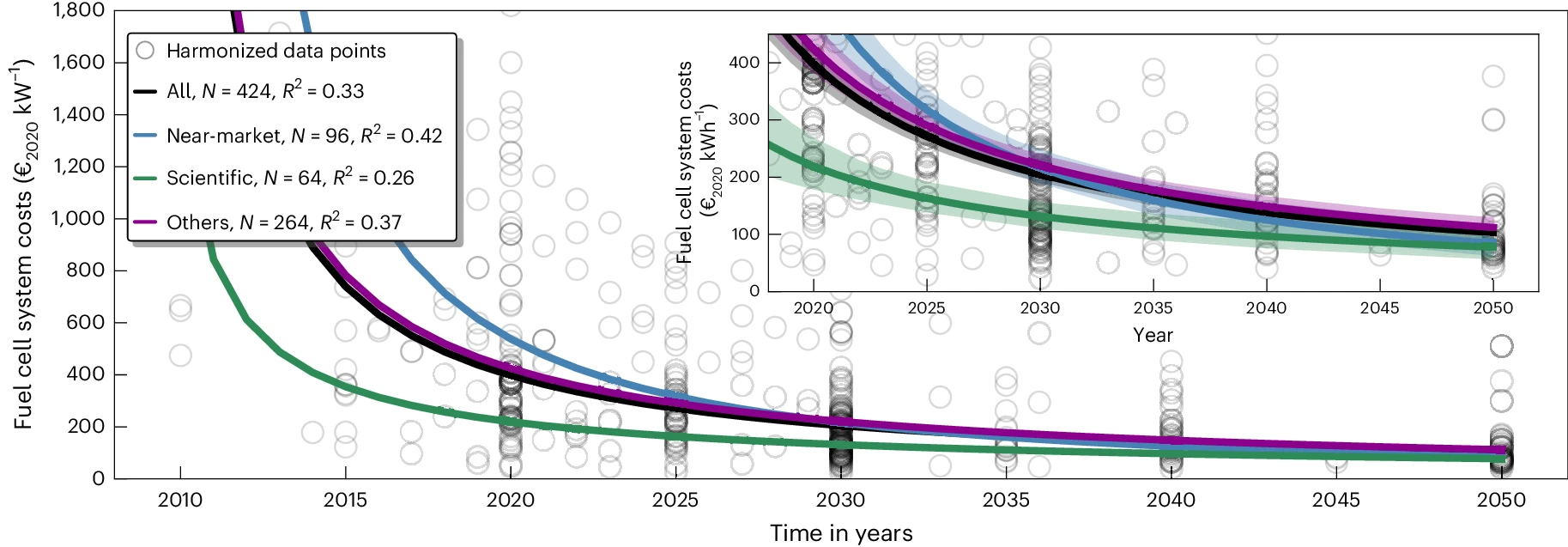

Rapidly declining battery system and fuel cell system costs

Figure 1 indicates that battery system costs could decrease by 64% to 75% before 2050, with annual declines remaining rapid and sustained. Compared to others, near-market estimates demonstrate greater optimism, showing smaller and more stable variations. This trend is reflected in projected cost projections: scientific and others models adopt a more conservative approach. For the years 2020,2030, and 2050, near-market (blue) forecasts project costs of €275, €140, and €70 per kWh respectively; scientific (green) estimates stand at €310, €180, and €100 per kWh; while others (purple) anticipate costs of €200 and €115 per kWh in 2030 and 2050 respectively.

As shown in Figure 2, the cost of fuel cell systems is projected to decrease by 65% to 85% by 2050. The near-market scenario (blue) is estimated at approximately €540 per kilowatt in 2020, falling below the €100 threshold by 2045 and reaching around €85 per kilowatt by 2050. In contrast, the scientific scenario (green) is expected to drop to €100 per kilowatt by the late 2030s, ultimately settling at about €80 per kilowatt by 2050. The other scenario (purple) lies between the near-market and scientific estimates, failing to reach the €100 per kilowatt level.

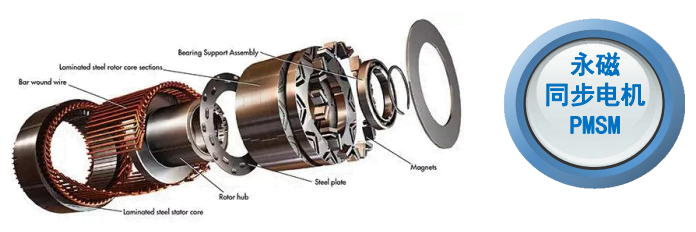

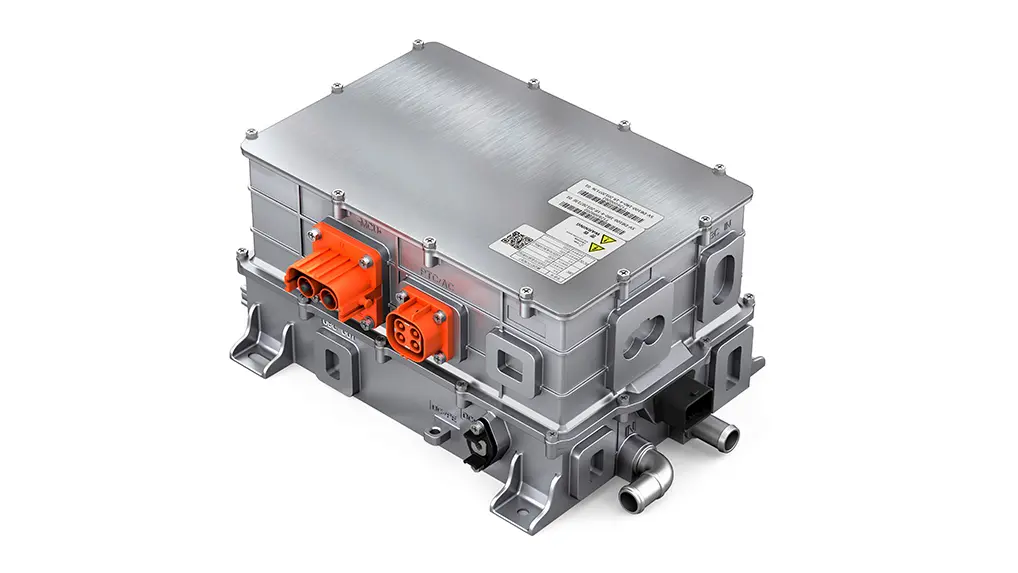

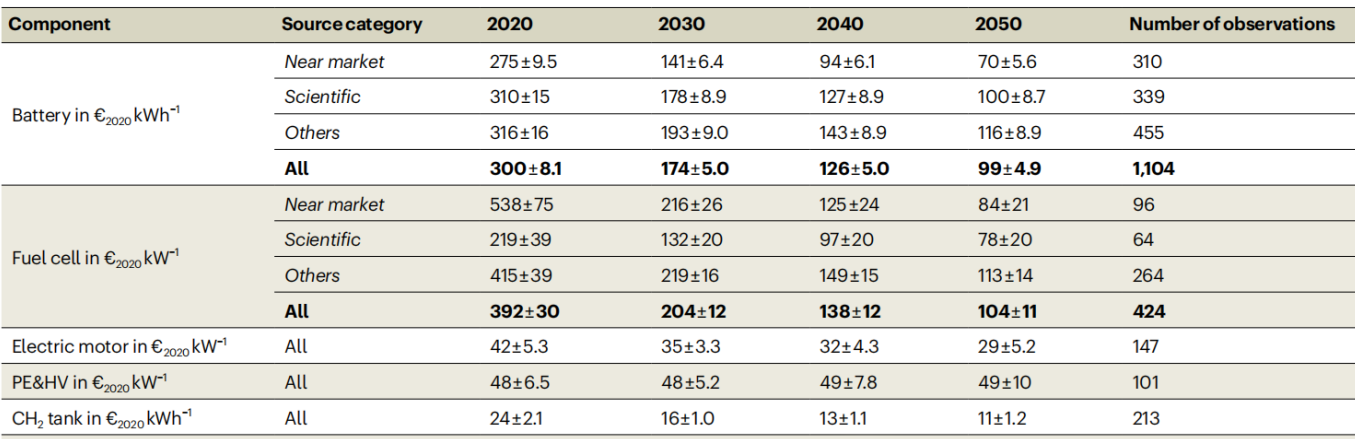

Cost overview for five major ZET components

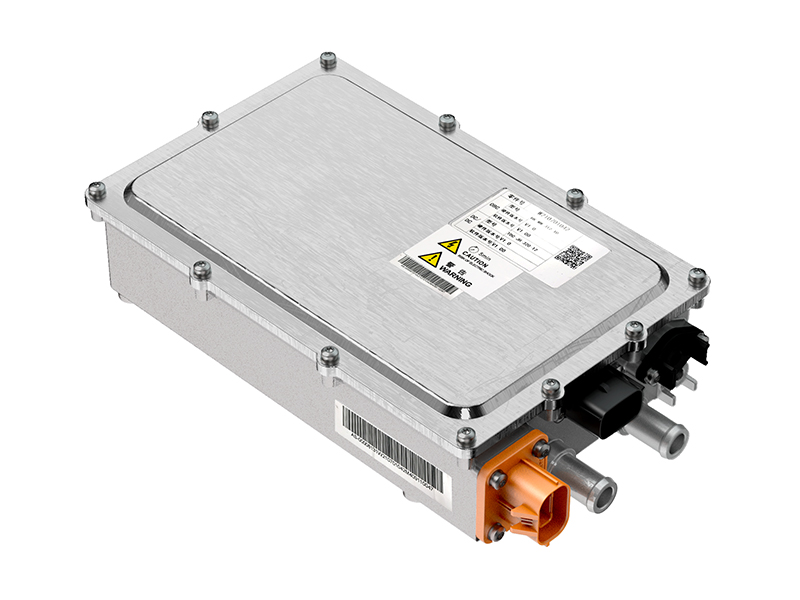

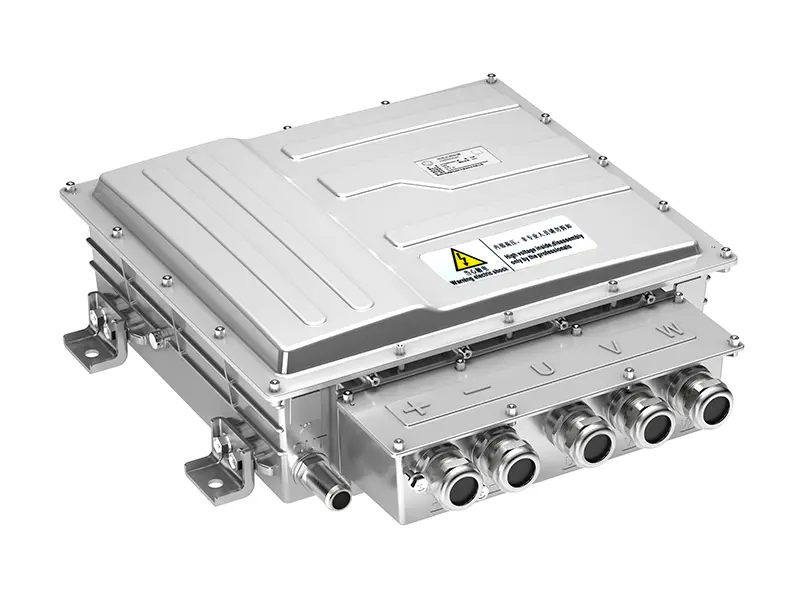

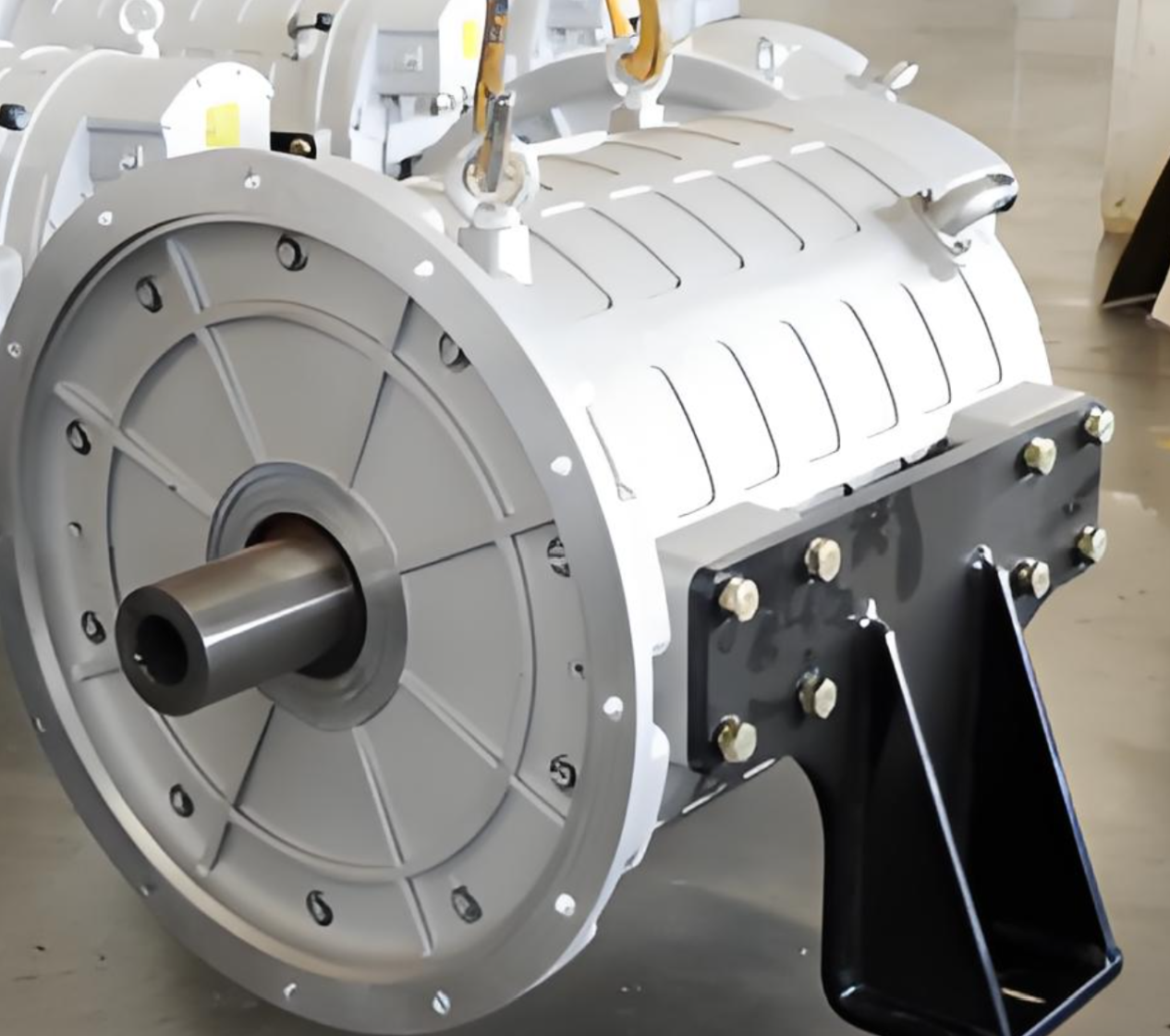

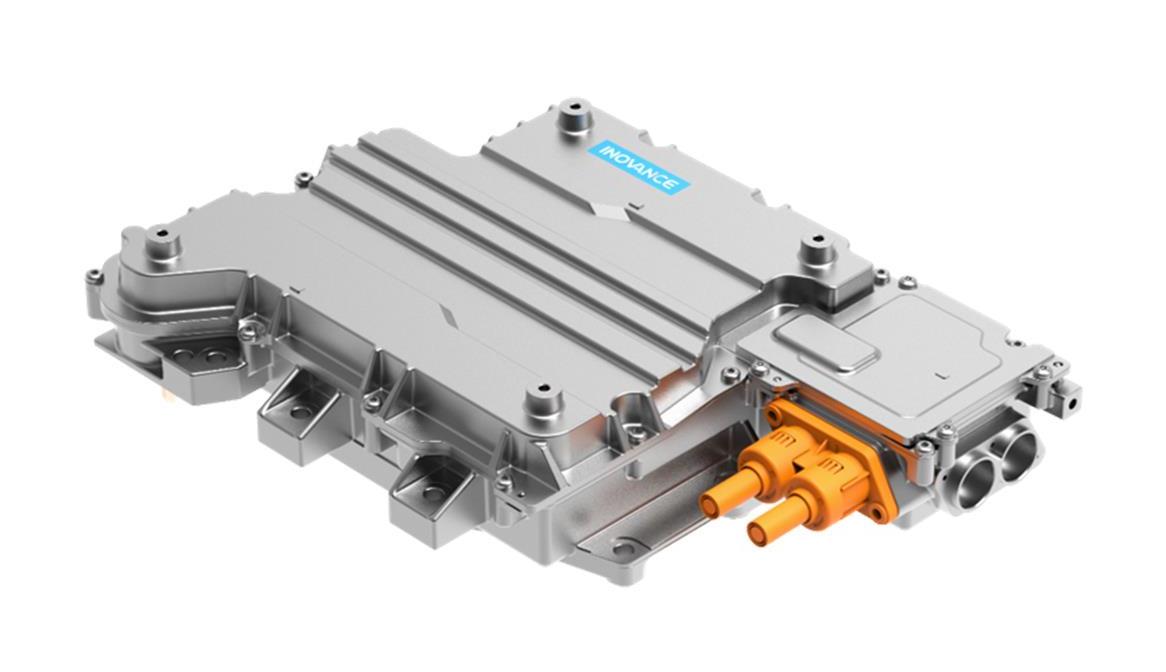

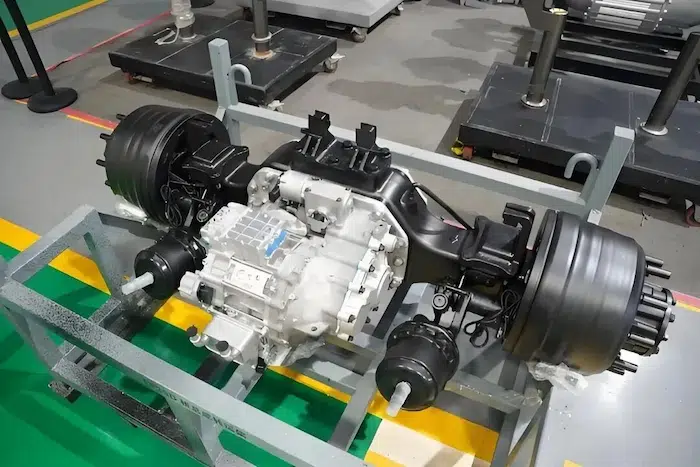

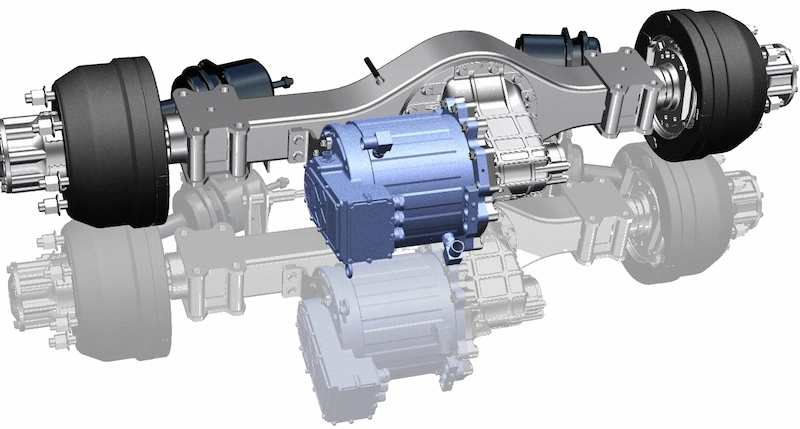

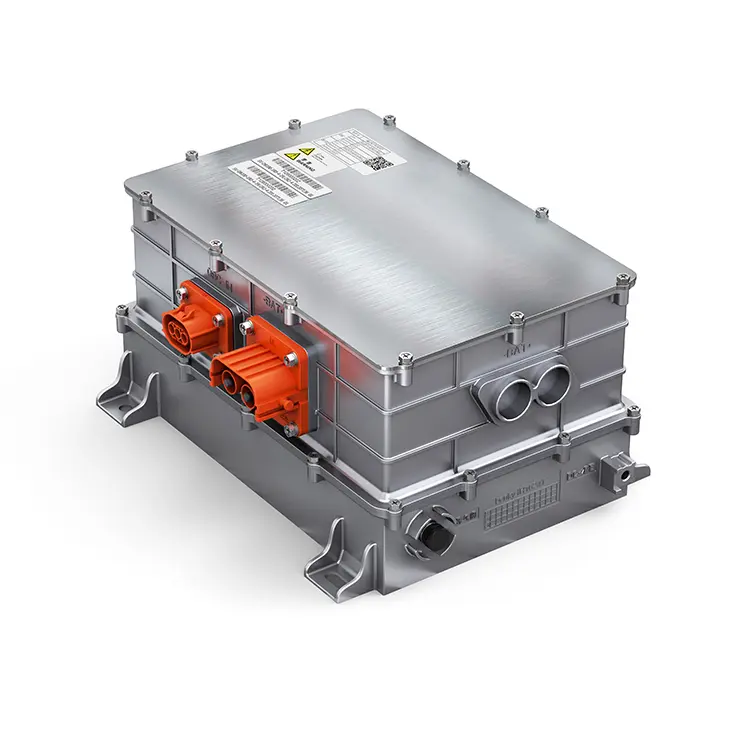

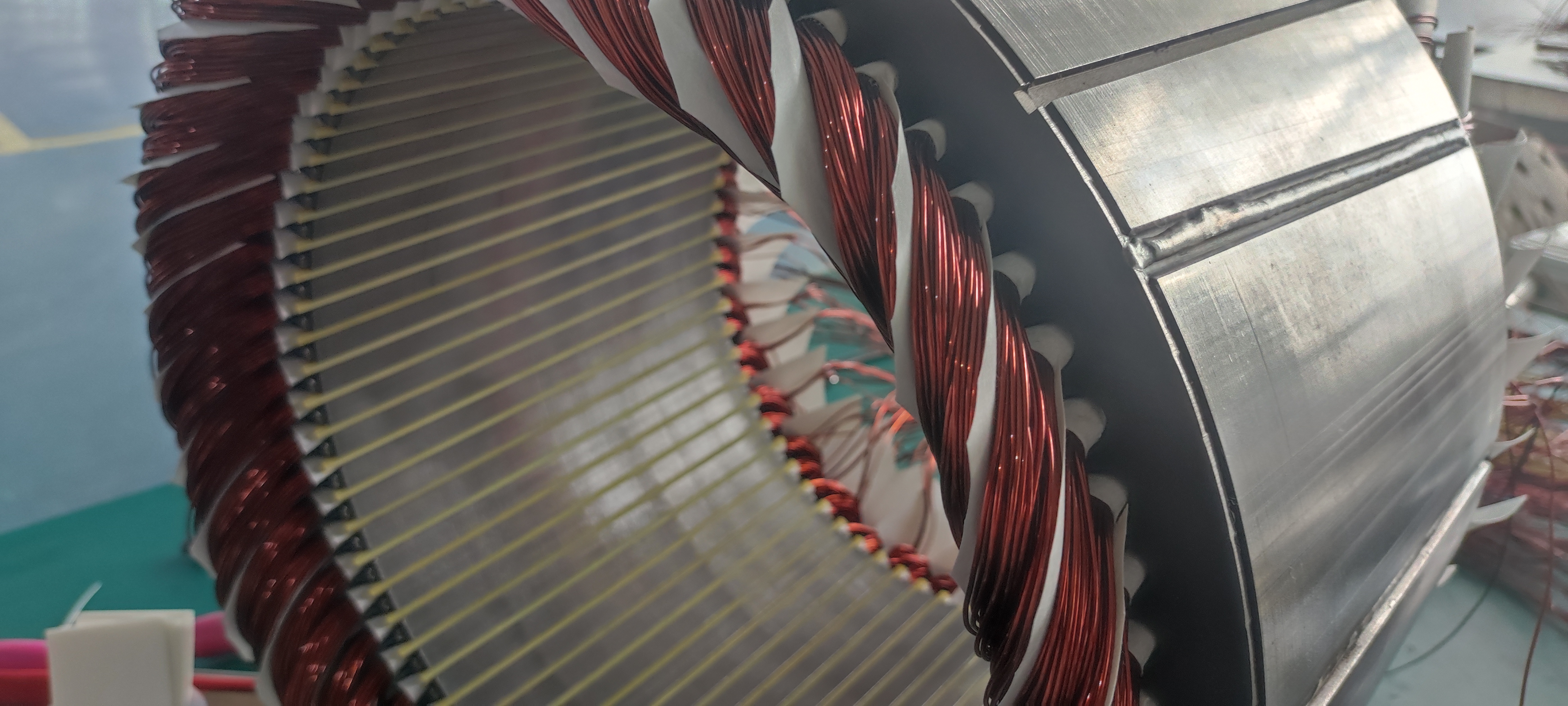

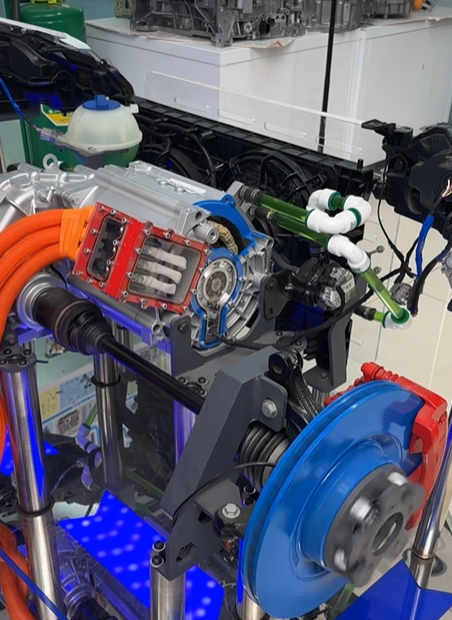

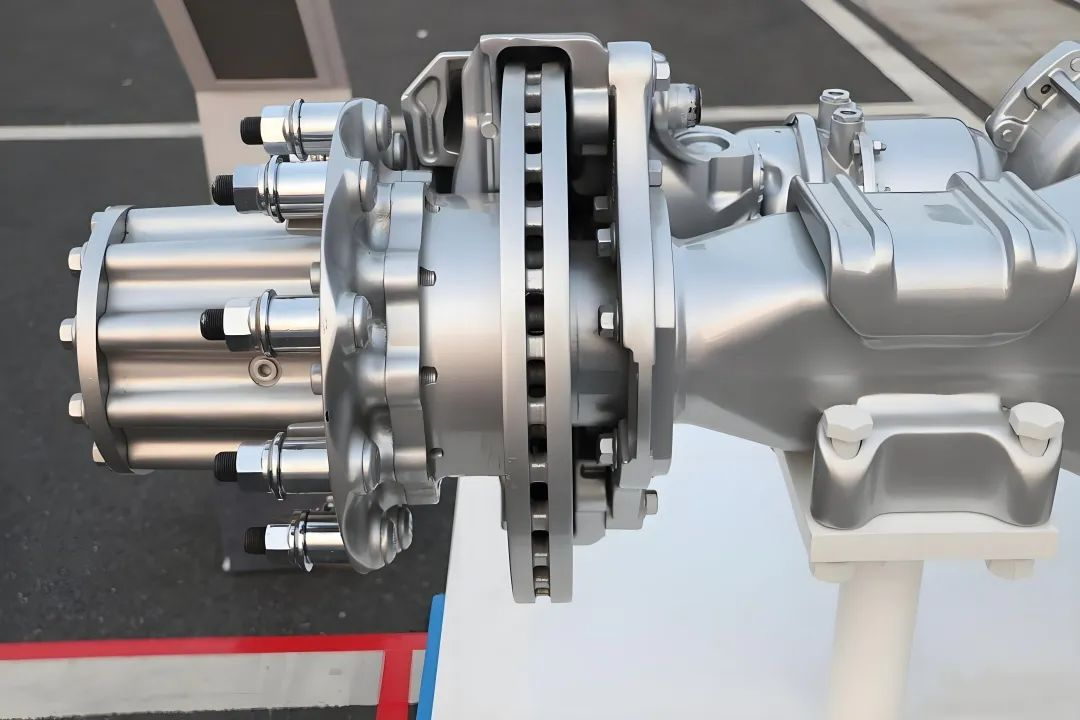

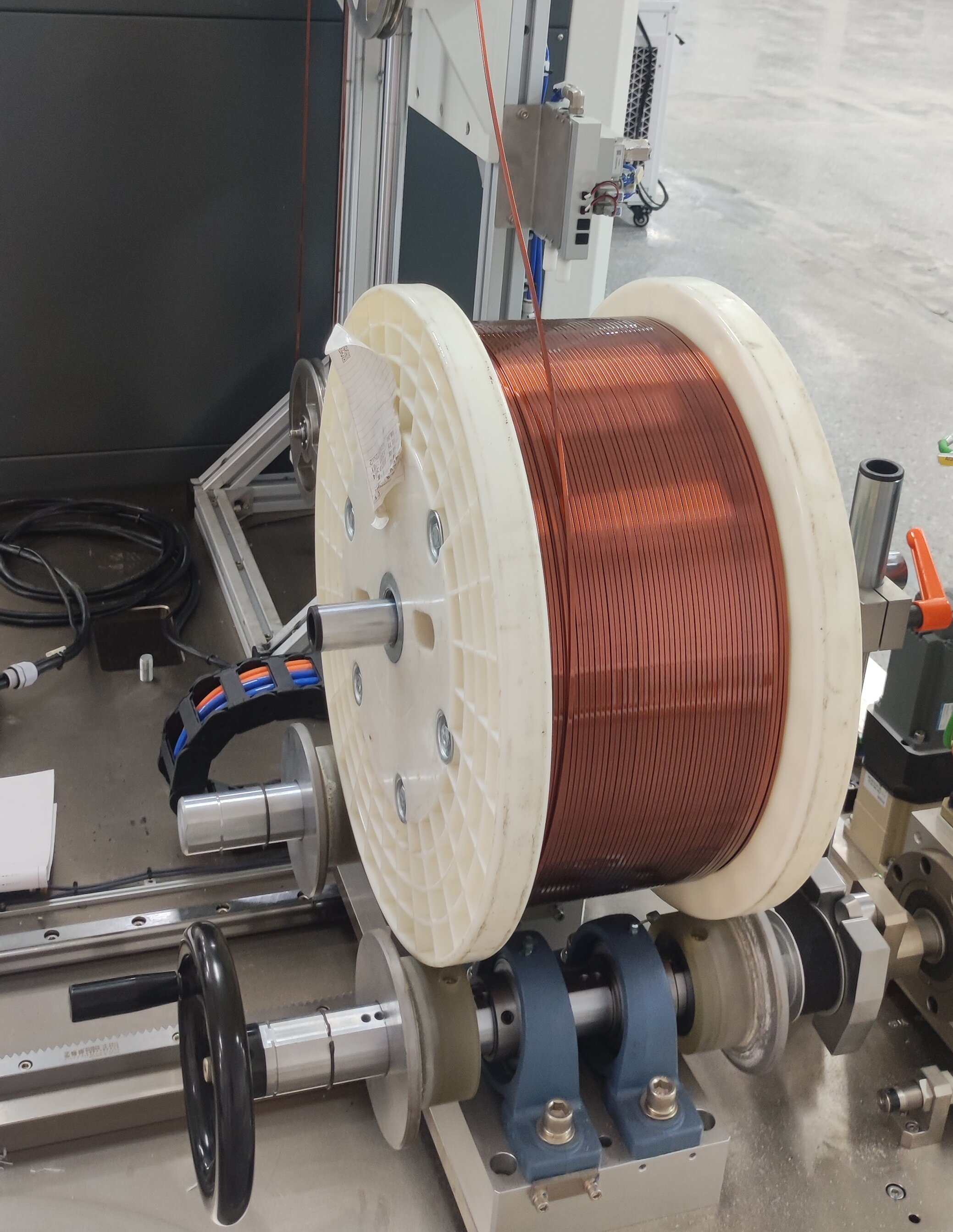

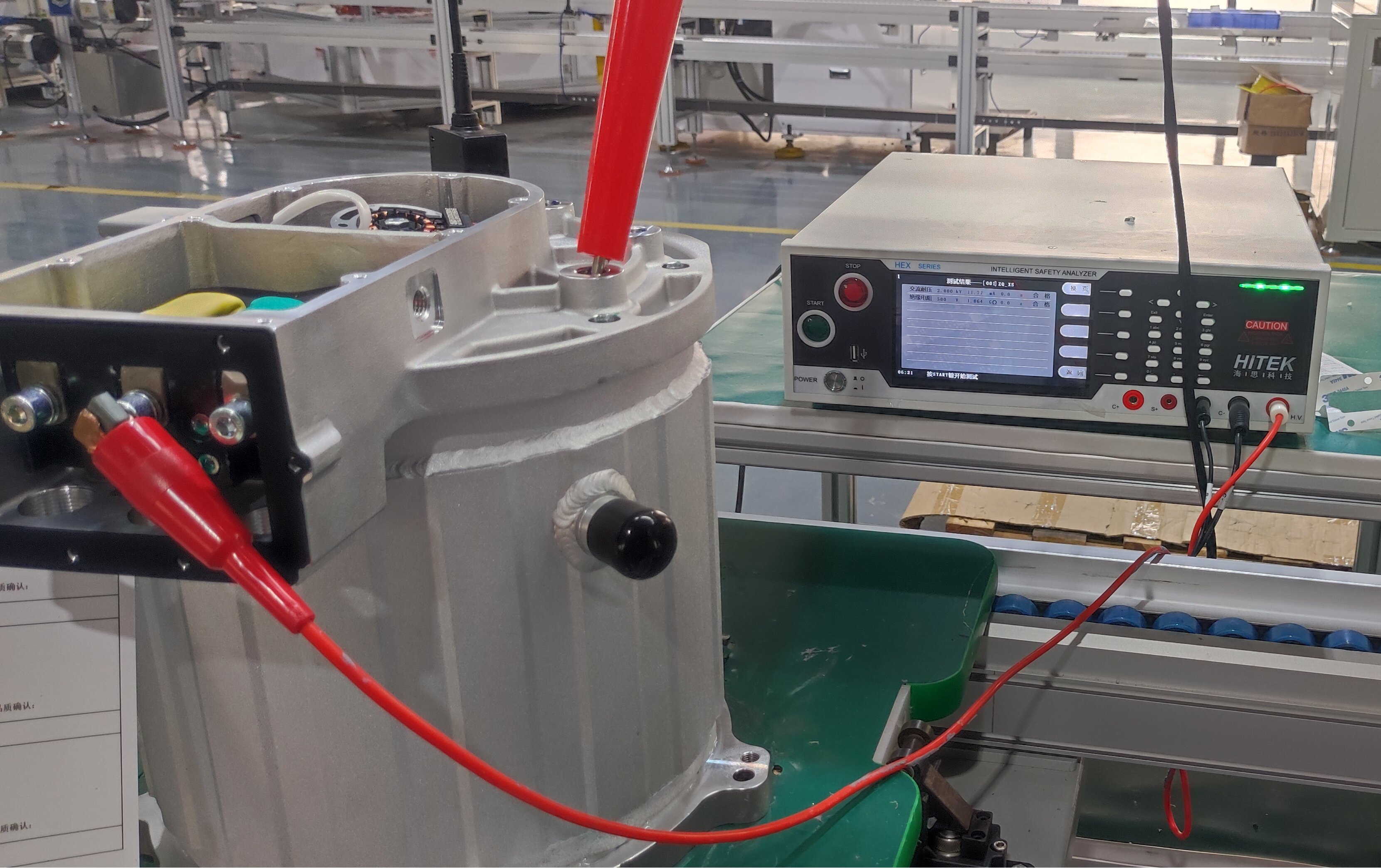

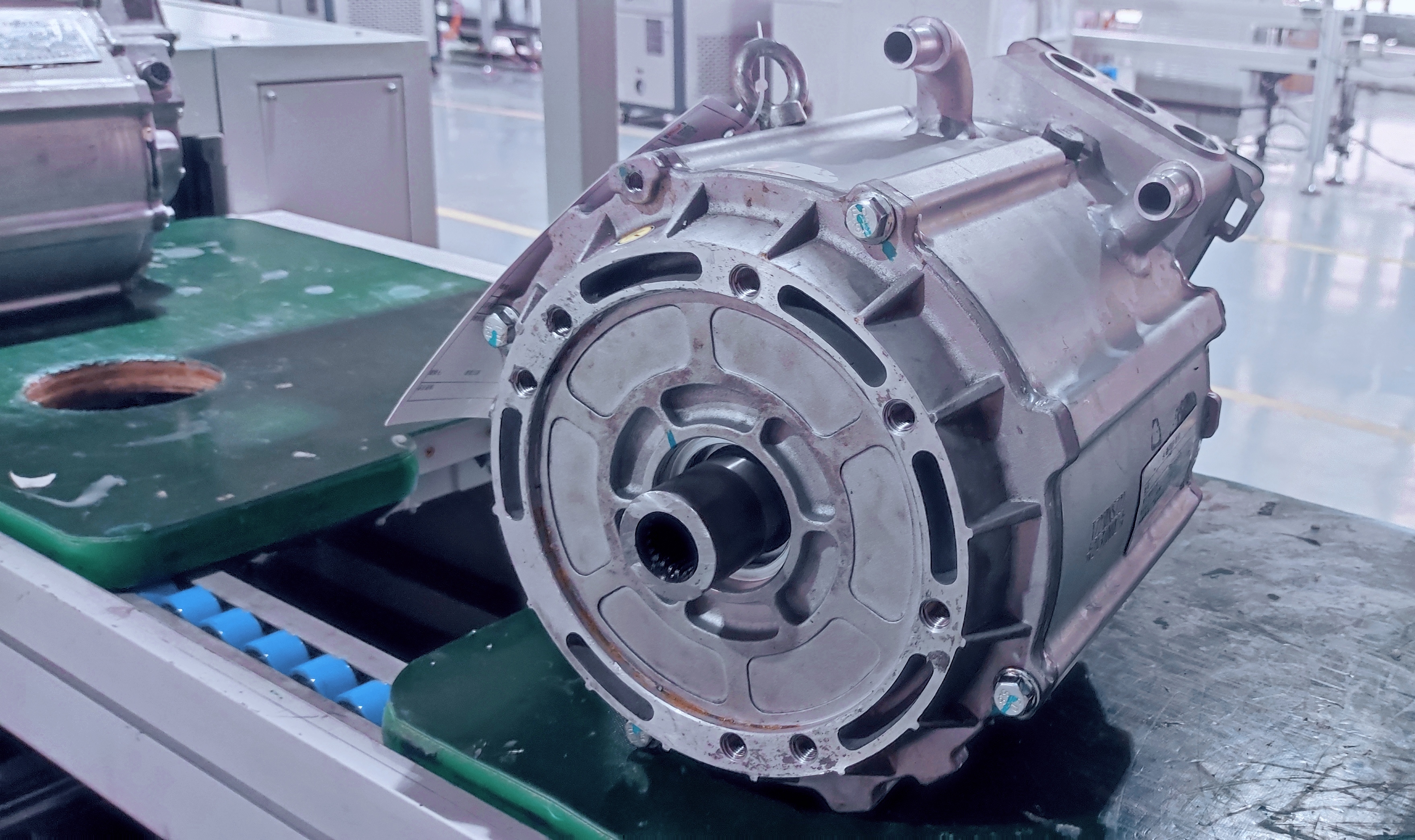

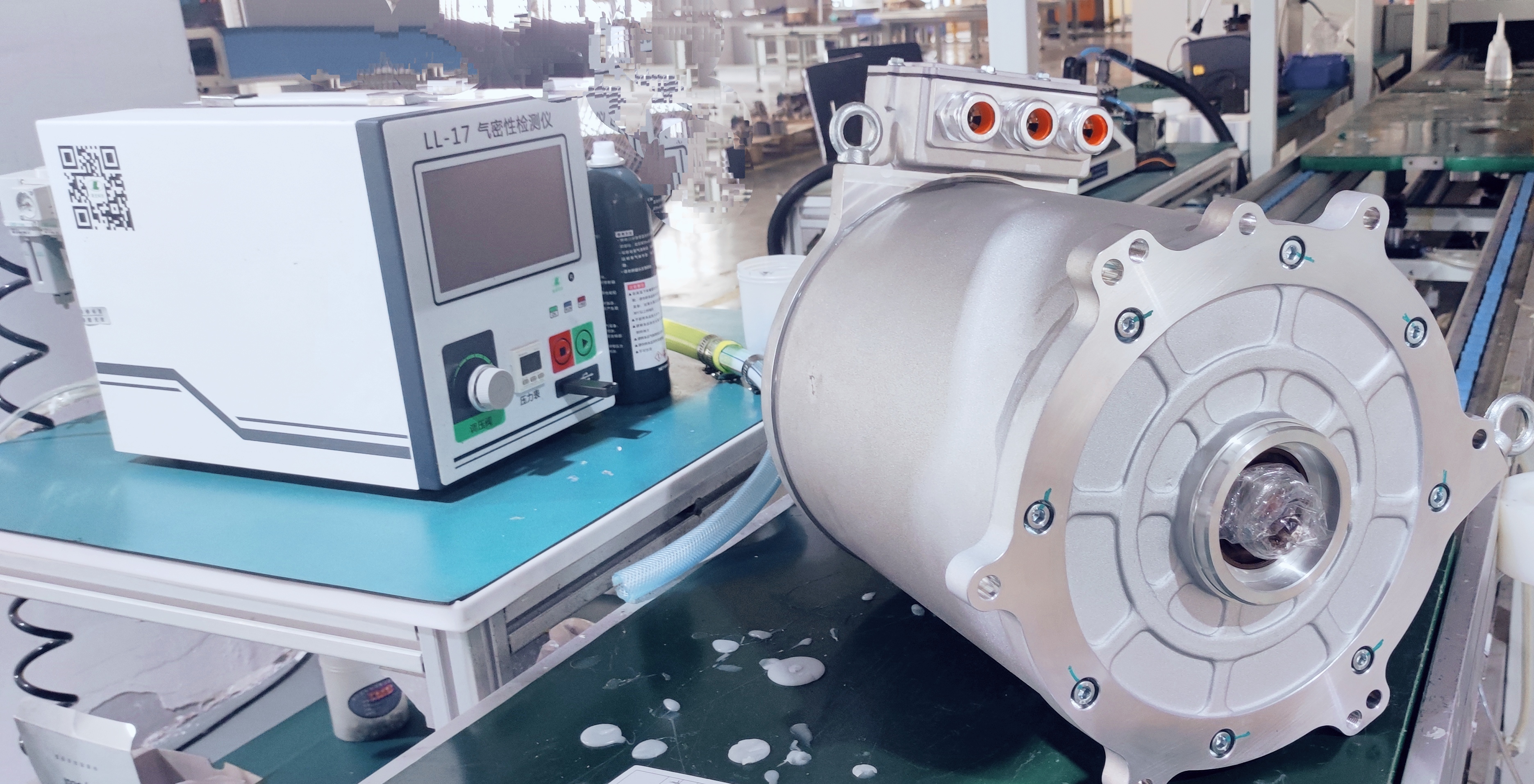

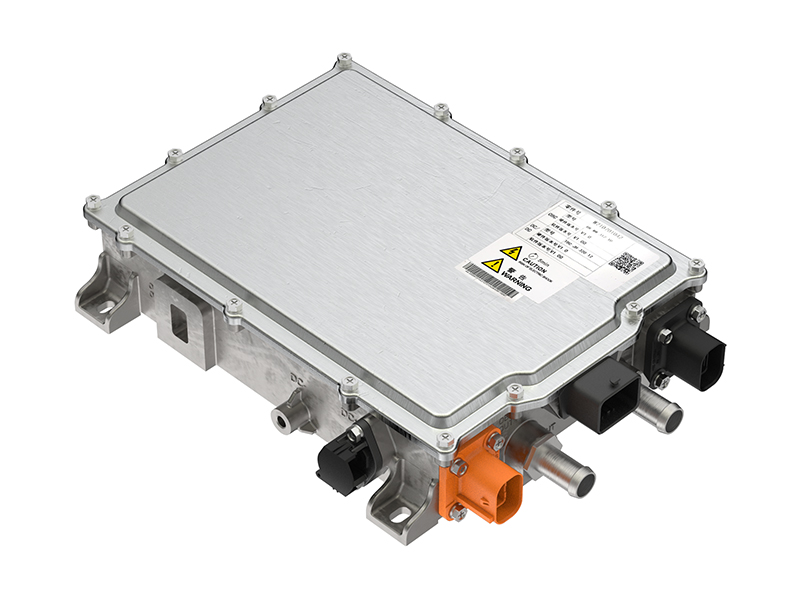

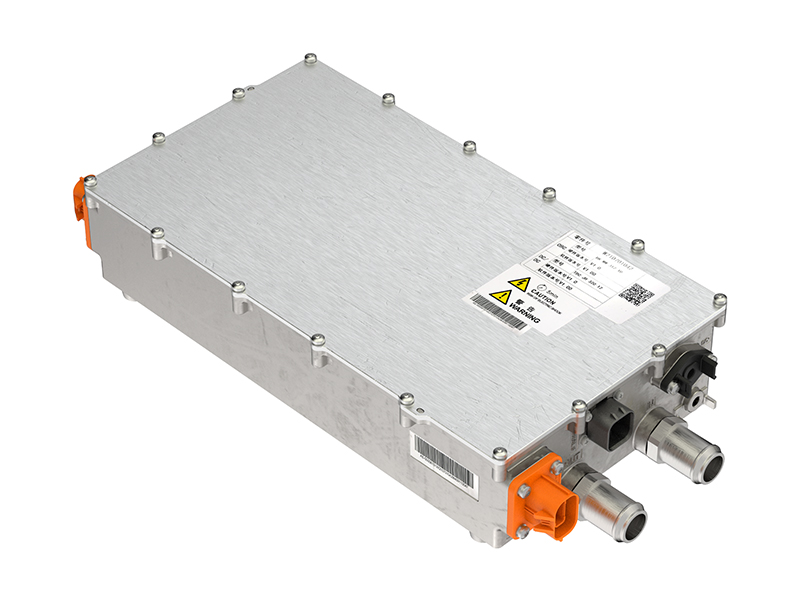

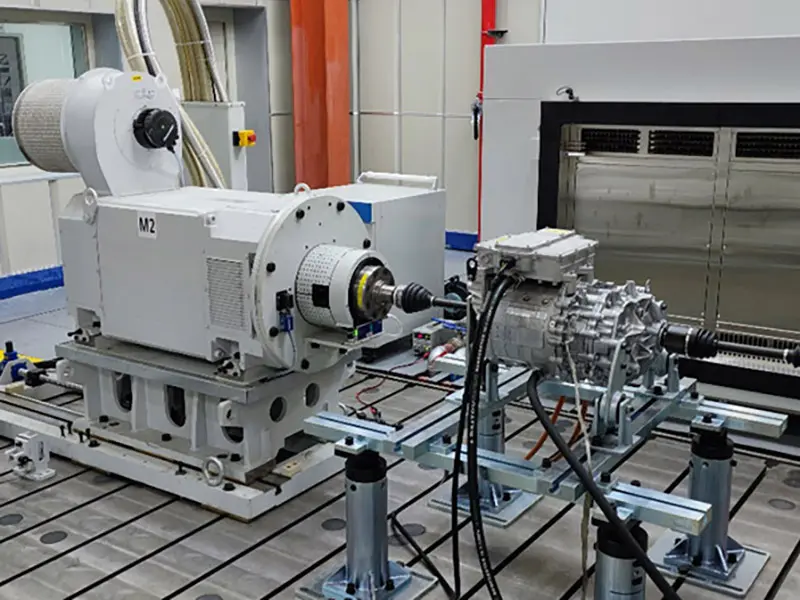

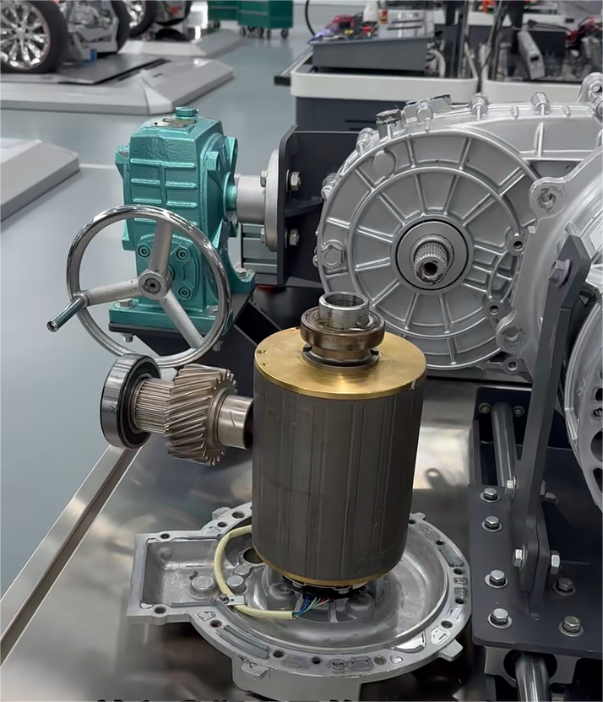

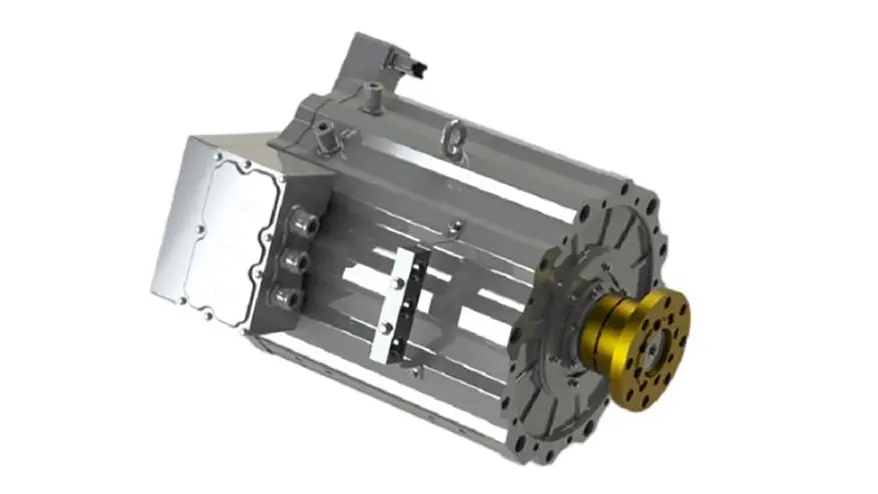

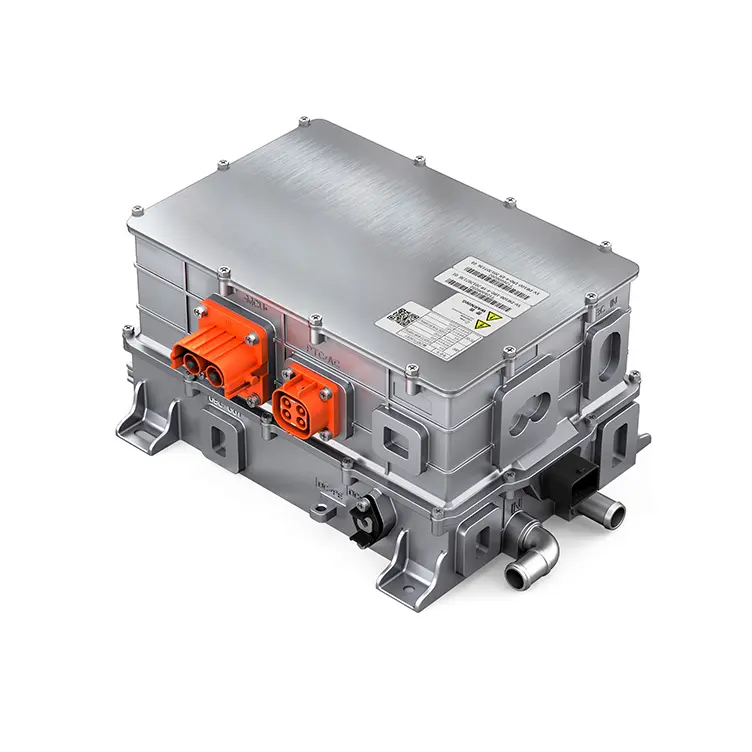

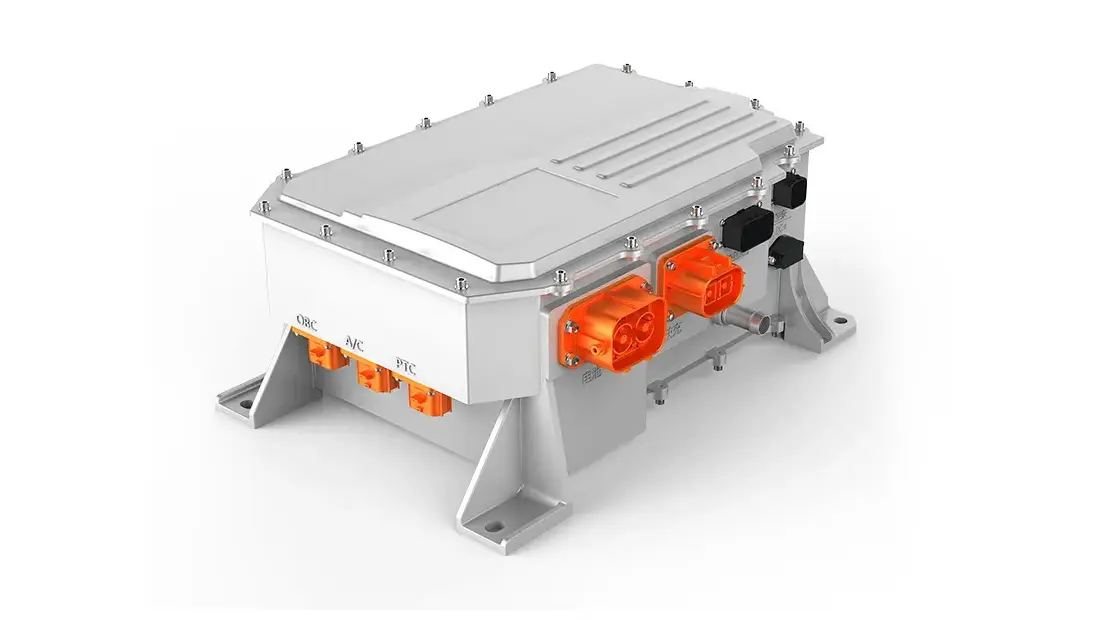

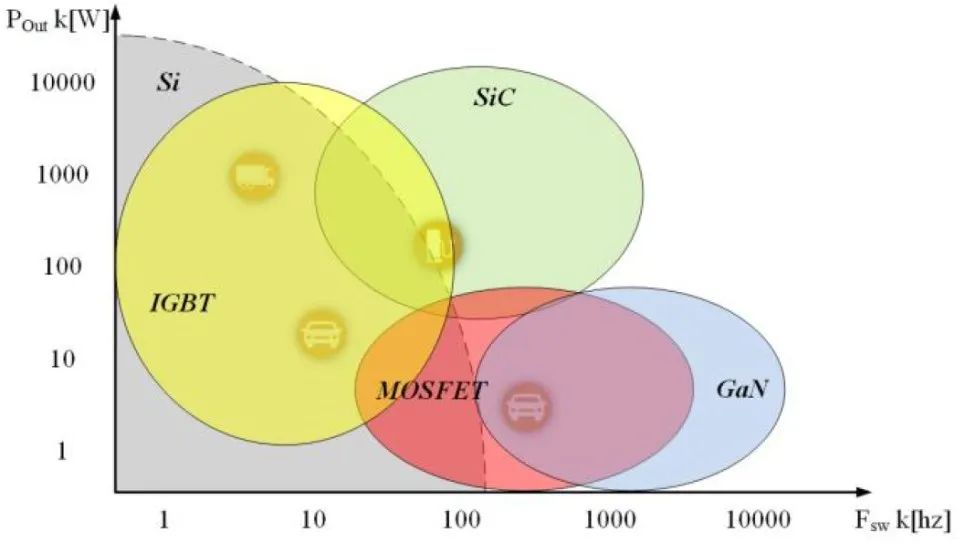

Table 1 presents the component costs of zero-emission trucks. The cost reduction potential for adjacent components is relatively limited. The cost of electric motors is projected to decrease from approximately €42 per kilowatt in 2020 to €30 per kilowatt by 2050. For hydrogen storage tanks, the cost reduction during the 2020-2050 period is estimated at 2.6% -2.9%. The stable system cost for PE & HV components remains around €50 per kilowatt. Table 1: System-level component costs of five major zero-energy components in €2020

Different cost expectations for batteries and fuel cells

According to meta-predictions, both battery and fuel cell costs are expected to decline rapidly. The comparative analysis revealed in this study highlights the complex interplay between scientific projections and actual market realities for emerging technologies at various commercial maturity stages. Analysis of battery cost forecasts indicates near-market stability across different timeframes, while scientific cost estimates published between 2010 and 2023 face significant downward revisions. Fuel cell systems demonstrate an inverse trend. Compared with near-market projections, scientific models show greater stability and consistently more optimistic outlooks. The divergence may stem from differences in technological maturity and uncertainties regarding future development trajectories of these two technologies.

Required volumes, learning rates and breakthrough costs

This study compares cost estimates with the potential market expansion of S-type zero-emission trucks in North America, Europe, and China, projecting annual production totals between 2.5 million to 3 million units. Regression results indicate that achieving battery system costs around €150 per kWh by 2028 (near market) to 2032 (scientific) would require cumulative production between 1,300 GWh (near market) and 5,200 GWh (scientific), corresponding to learning rates of approximately 16% (scientific) to 19% (near market). To achieve electricity generation below €100 per kWh by 2039 (near market) to 2049 (scientific), 11,000 GWh (near market) or even 68,000 GWh (scientific) of electricity output would be needed. Given the significant market share of battery-powered electric trucks, the former scenario is likely feasible in the late 2030s. For fuel cell systems targeting €150 per kW by 2027 (scientific) to 2035 (near market), cumulative production would need to range from 135,000 units (scientific) to 1.4 million units (near market). The corresponding adoption rate is projected to range from 14% (scientific phase) to 26% (near market phase). Given the widespread adoption of fuel cell truck models in the late 1920s, the latter scenario may become feasible. Prices below €100 per kilowatt could be achieved between 2040 (scientific phase) and 2045 (near market phase), with cumulative demand expected to fluctuate between 2.3 million units (scientific phase) and 6.8 million units (near market phase).

Discussion

This study compares research findings with target or minimum cost estimates to avoid overly conservative projections. After recalibrating battery system costs, the estimated price is approximately €90 per kWh by 2030 and €70 per kWh by 2050, aligning closely with projected targets set by the U.S. Department of Energy and Europe's Hydrogen SRIA48 initiative. The cost-centric meta-prediction approach may overlook scenario dependencies and technical specificity/trends. Core scenarios and assumptions influence production volumes, which in turn affect component cost evolution. Further regression analysis indicates that optimistic cost scenarios demonstrate enhanced cost-effectiveness for batteries and fuel cells. Critical factors like technical design and material selection significantly impact both cost and performance. Component uncertainties and data gaps hinder comprehensive techno-economic evaluations of individual technologies from 2020 to 2050. While battery and fuel cell costs are expected to decrease with improved technical performance, technological advancements involving new components and emerging trends could offset these cost reductions. Electric trucks currently demonstrate cost competitiveness compared to diesel trucks. However, due to potentially high green hydrogen prices, fuel cell trucks may struggle to achieve total cost-of-ownership parity throughout the 2030s. The purchase cost ratio for zero-emission trucks rises substantially compared to current diesel trucks. Beyond economic factors, technological capabilities also influence truck purchasing decisions. Zero-emission electric vehicles have achieved technical parity with diesel trucks. Ultimately, infrastructure availability and user acceptance will play decisive roles in adoption.

Conclusion

This study provides an overview of cost estimates for five key components of zero-emission trucks through meta-prediction and regression analysis, yielding four key conclusions: First, component costs for zero-emission trucks are projected to decrease significantly. Future battery system costs are expected to stabilize at €150 per kWh by 2035 and exceed €100 per kWh by 2050. Fuel cell system costs may reach around €150 per kWh in the late 2030s, with maximum potential approaching €100 per kWh by the late 2040s. Second, cost projections show systematic variations across technology categories, which may depend on technological maturity. While near-market batteries demonstrate the most stable cost projections among sources, their forecasts remain more optimistic than those for scientific systems. For fuel cells, scientific approaches tend toward lower or target costs. Third, substantial cost reduction potential supports optimistic outlooks for both technologies. This indicates that rapid deployment of zero-emission trucks will have significant impacts on participants in transportation and energy sectors. Finally, the research highlights competition among zero-emission truck technologies and raises questions about market leadership and the necessity of adopting different technologies. All anticipated cost reductions hinge on successful transition to low-carbon road freight. Compared to fuel cell trucks, zero-emission trucks may offer the most cost-effective pathway to achieve total cost-of-ownership parity, while fuel cell trucks might still require additional policy support through 2030.