Global Rare Earth Pricing and Its Impact on EV Motor Production in 2025

Introduction

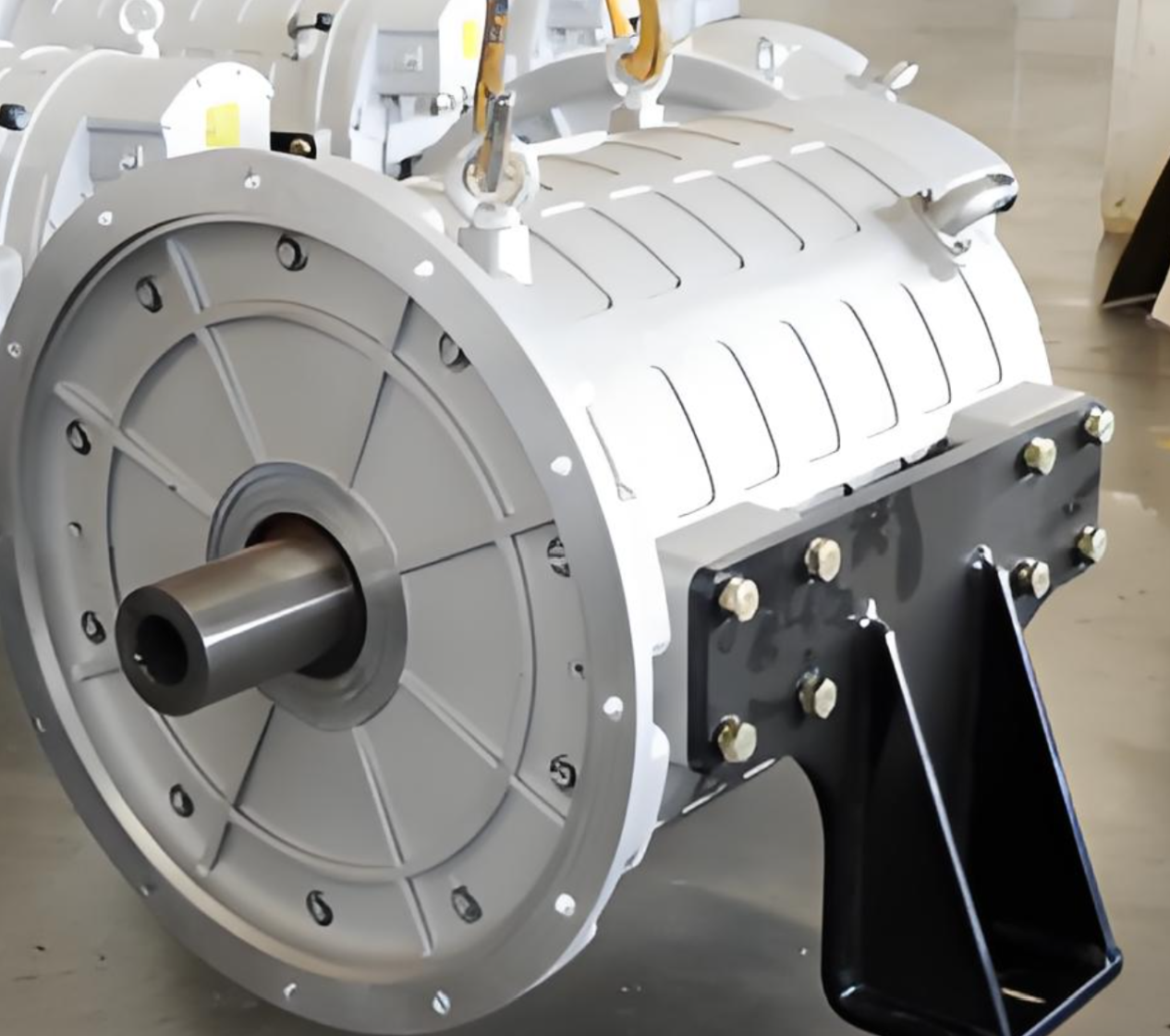

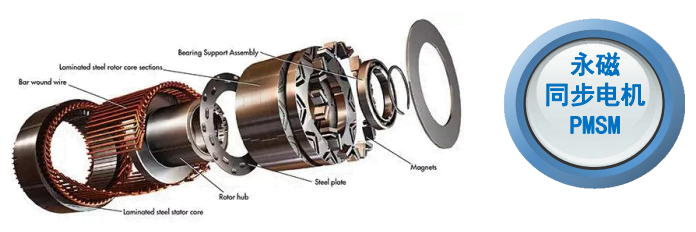

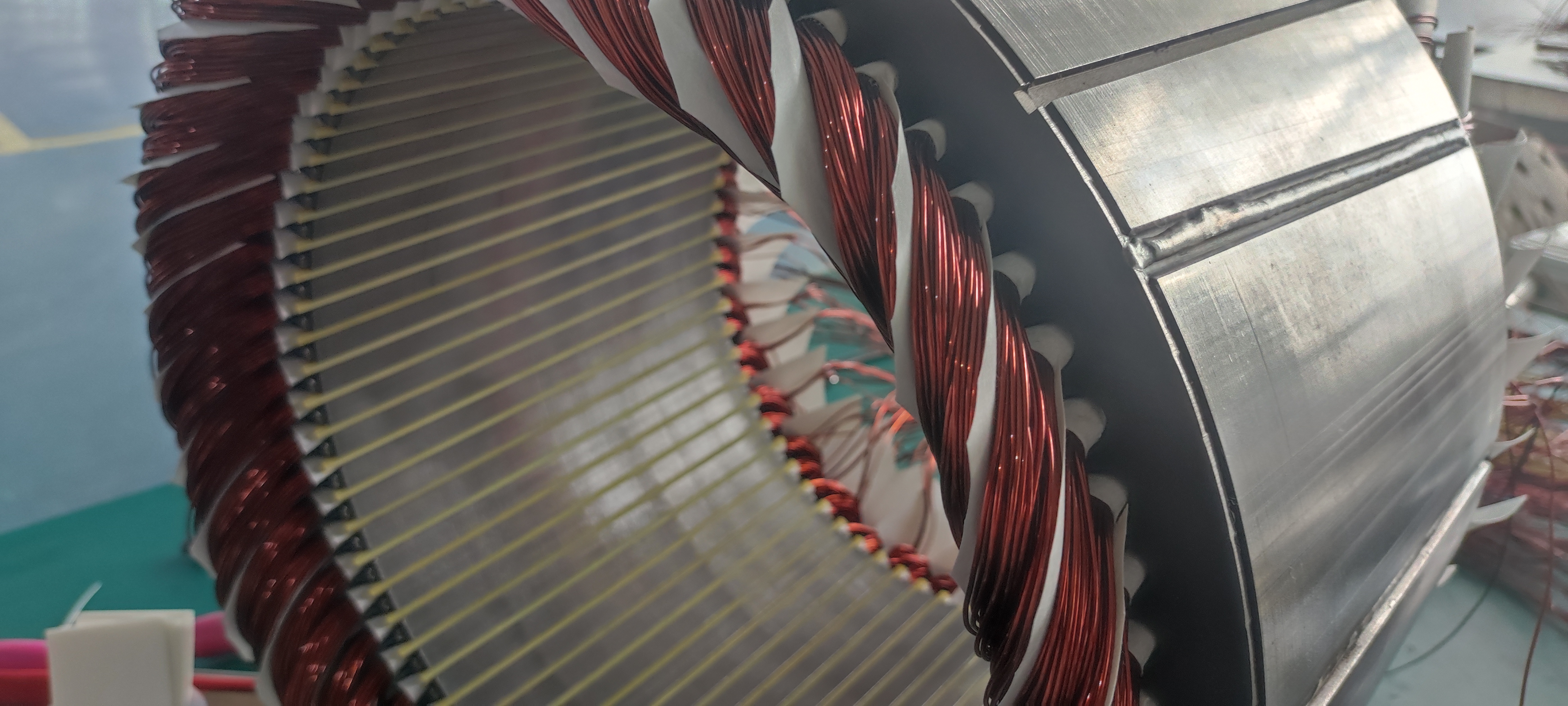

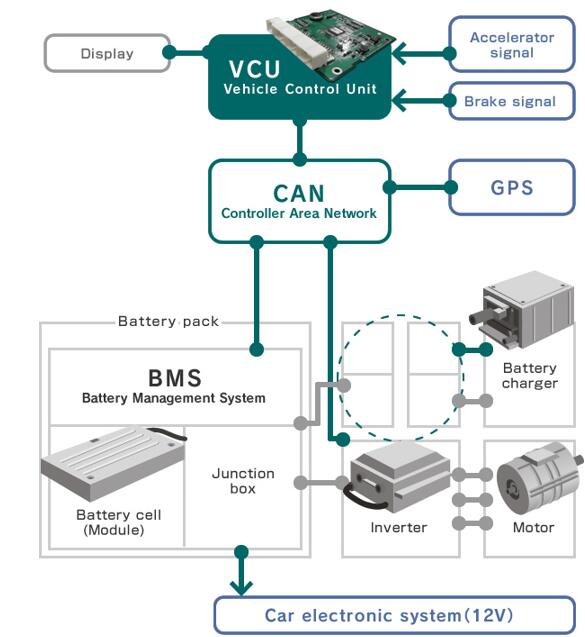

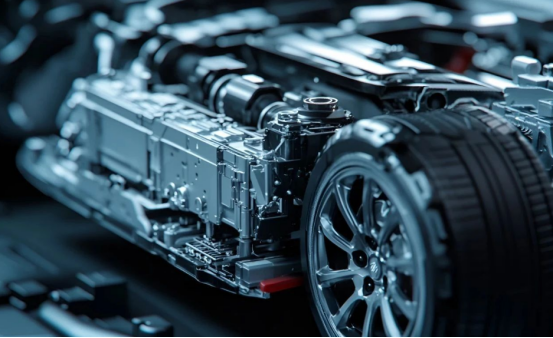

Rare earth elements (REEs) play an indispensable role in electric vehicles, particularly in the production of high-performance electric motors. Permanent Magnet Synchronous Motors (PMSMs), which power the majority of modern EVs, rely on rare earth-based permanent magnets to deliver high torque density and energy efficiency.

In 2025, the EV industry is not just growing rapidly; it's also undergoing a technological and supply chain transformation. Amid this evolution, the cost and availability of rare earths have emerged as critical concerns. With geopolitical shifts, environmental regulations, and rising global demand, prices for key rare earths like neodymium (Nd) and dysprosium (Dy) have seen significant fluctuations, directly influencing motor production strategies. This article examines these dynamics in detail.

Rare Earth Elements in EV Motors: An Overview

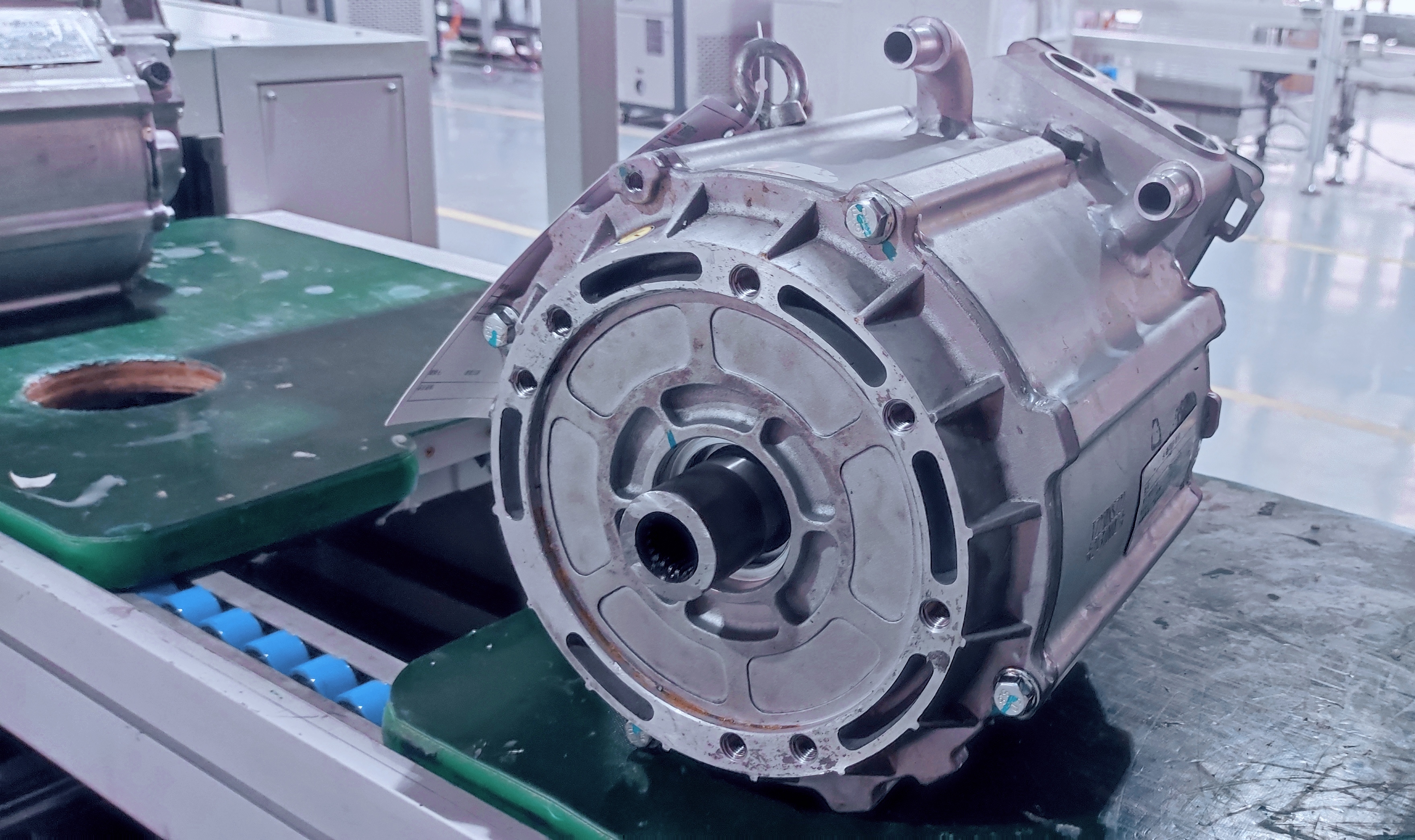

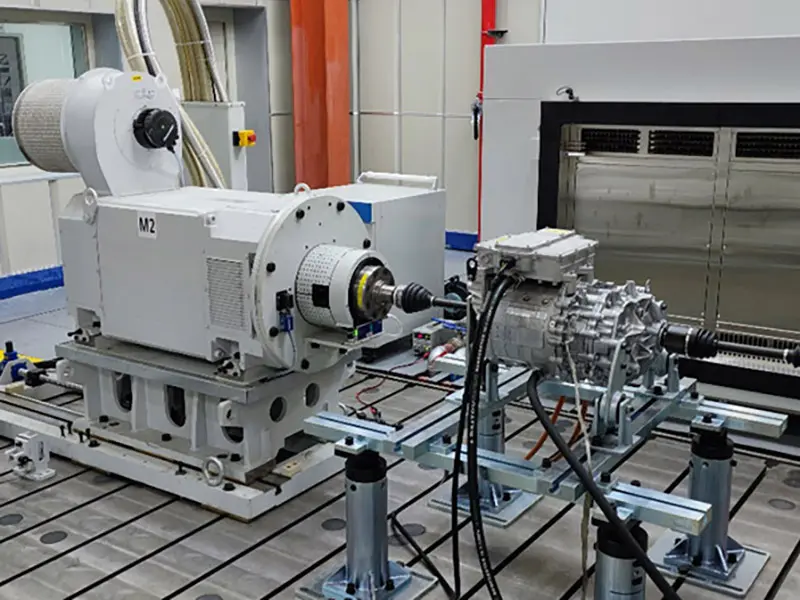

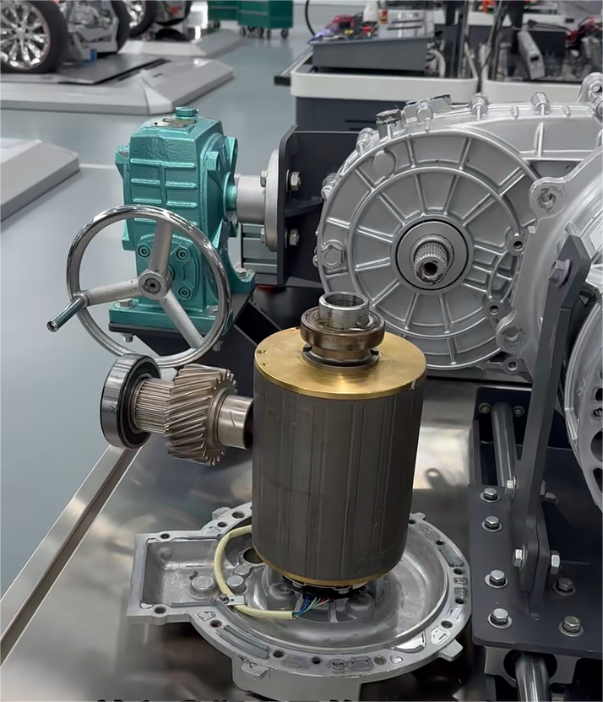

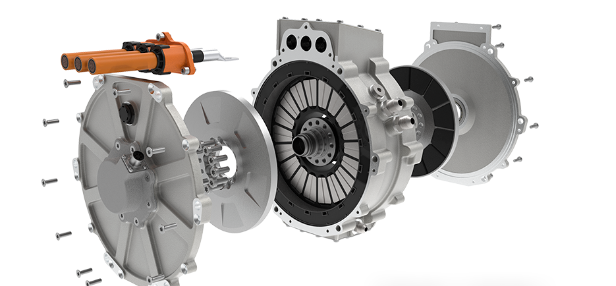

Electric vehicles (EVs) increasingly rely on Permanent Magnet Synchronous Motors (PMSMs) due to their high efficiency, compact design, and excellent torque density. A key performance advantage of PMSMs stems from their use of rare earth permanent magnets, which maintain a strong magnetic field without requiring a constant electrical current. This enables superior energy efficiency, especially at low speeds or under start-stop driving conditions.

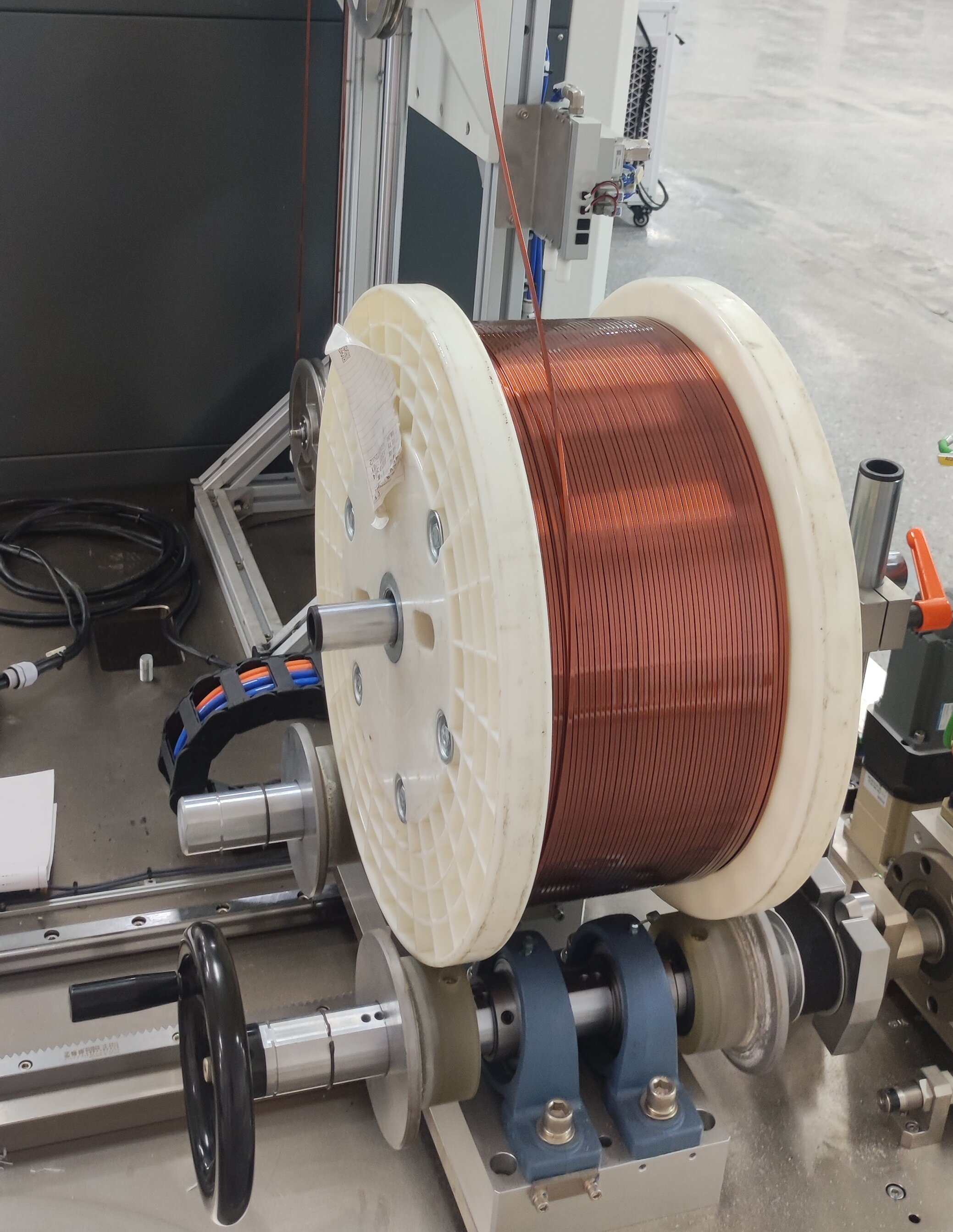

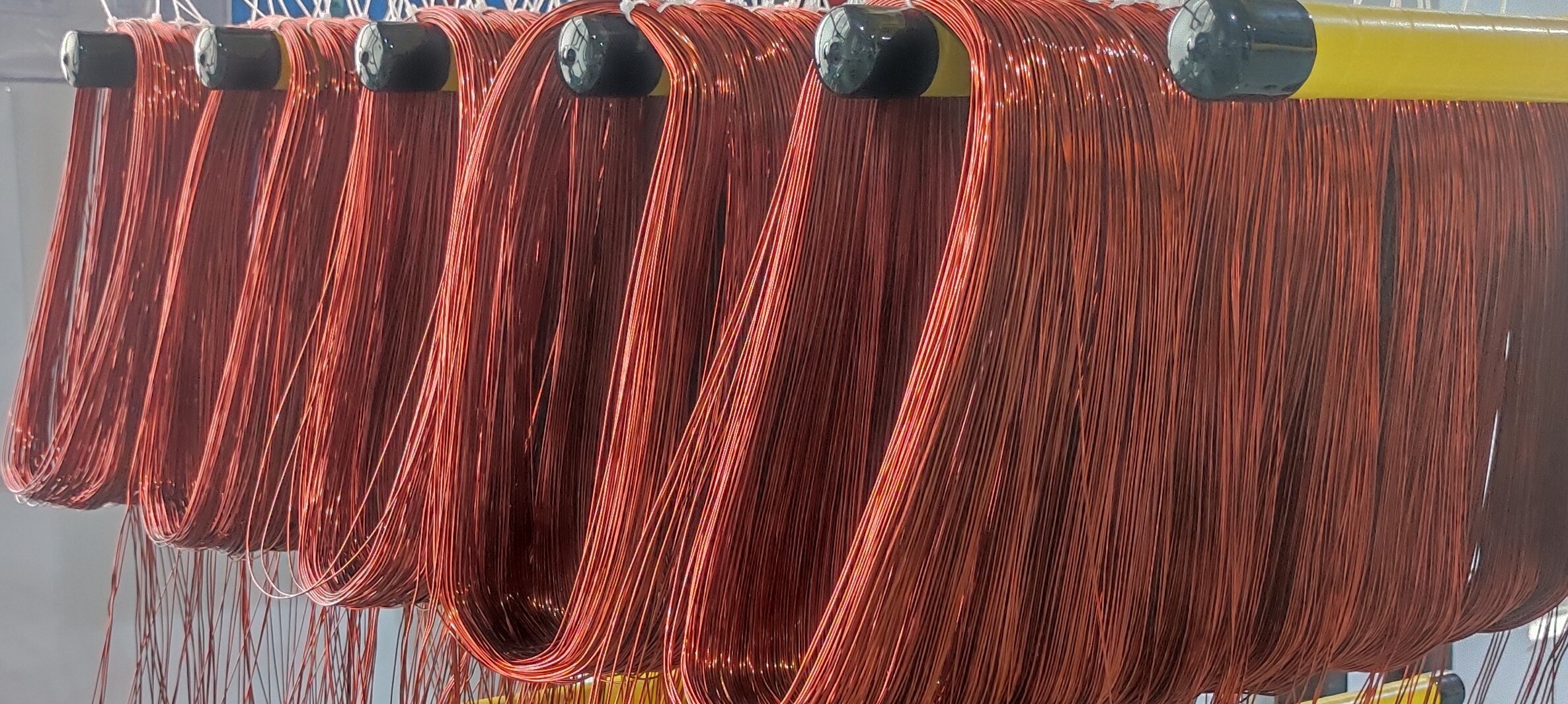

At the heart of these PMSMs are magnets made from neodymium-iron-boron (NdFeB) alloys. These magnets are considered the most powerful type of commercial permanent magnet available, capable of significantly enhancing motor performance. To tailor their thermal and magnetic properties for the demanding operational environment of EVs, these NdFeB magnets are often doped with small amounts of heavy rare earth elements, such as:

- Dysprosium (Dy): Added to improve thermal resistance and coercivity—the magnet’s ability to withstand demagnetization at high temperatures. This is critical because PMSMs in EVs can reach temperatures exceeding 150°C during prolonged operation or in aggressive driving modes.

- Terbium (Tb): Offers even higher thermal stability than dysprosium and is sometimes used in high-performance EVs or in vehicles designed to operate in extreme climates (e.g., desert conditions or heavy-duty terrain).

- Praseodymium (Pr): Can partially replace neodymium in the alloy to help optimize cost and resource availability while maintaining adequate magnetic strength. This substitution is particularly attractive as neodymium prices remain volatile due to geopolitical supply risks.

Typical Material Usage in EV Motors

On average, a single electric vehicle motor contains 300 to 600 grams of NdFeB permanent magnets. This might seem like a minor amount on a per-vehicle basis, but the aggregate global demand is considerable. With the rapid acceleration of EV adoption—estimated to reach over 60 million EVs annually by 2030—the demand for rare earth materials like neodymium and dysprosium is projected to soar.

Application in EV Powertrains

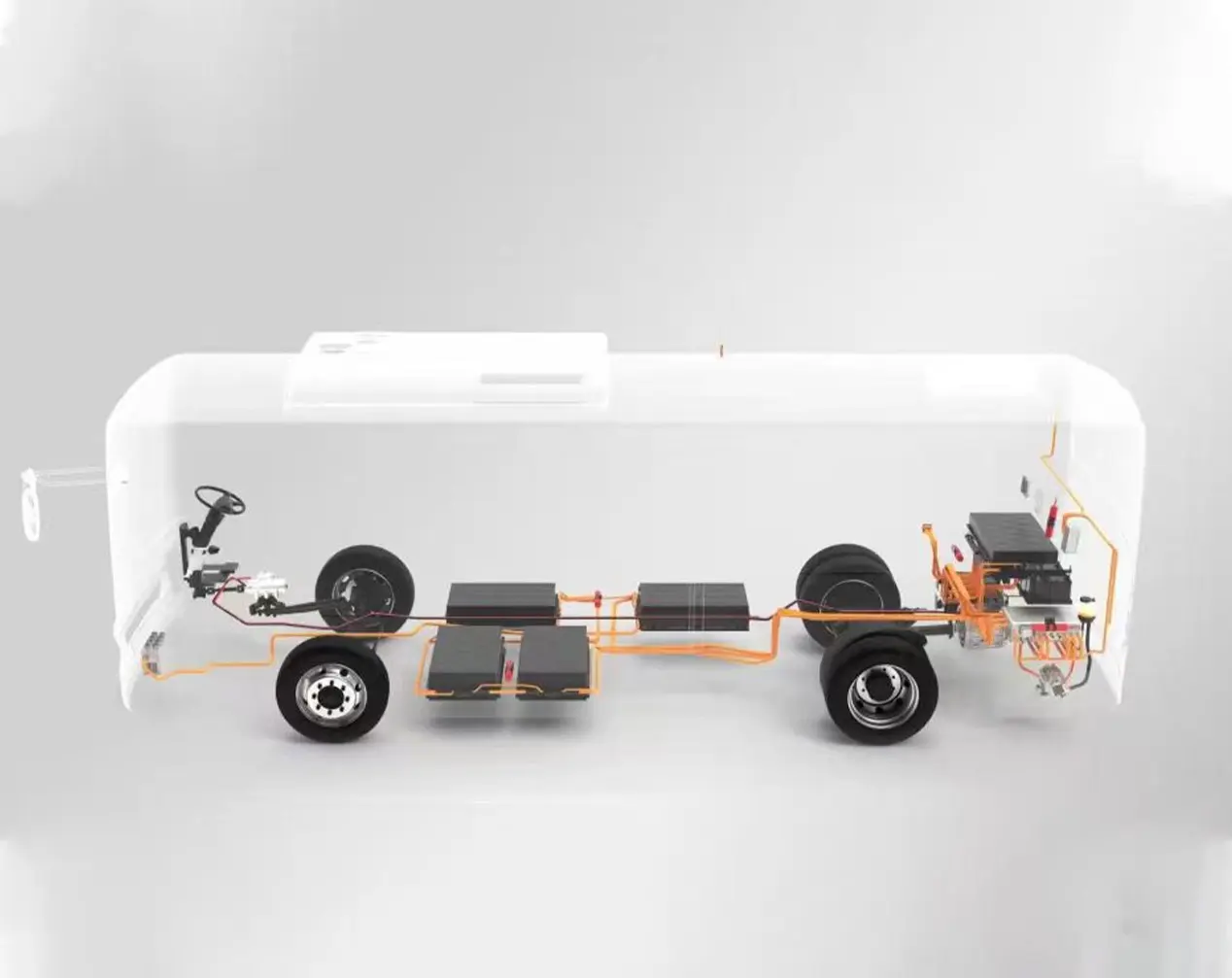

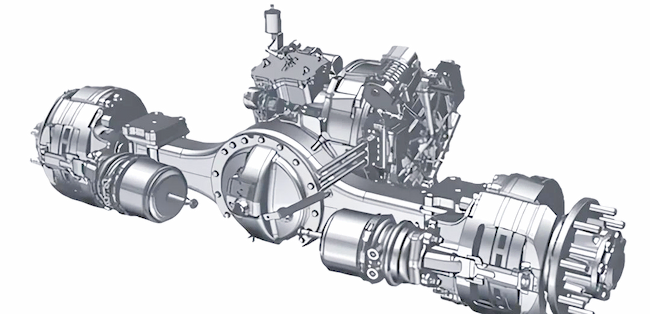

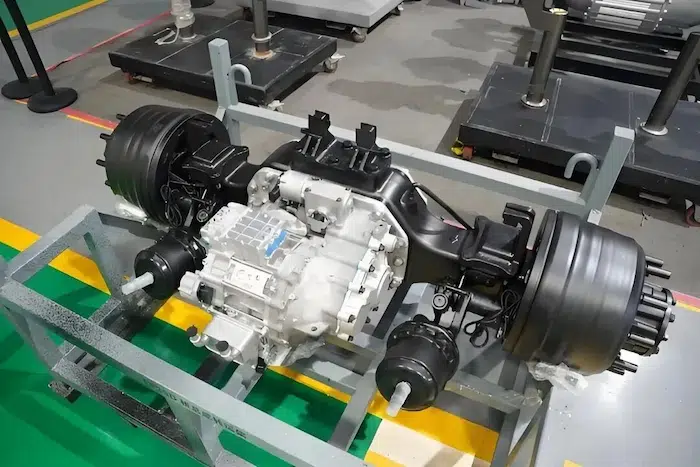

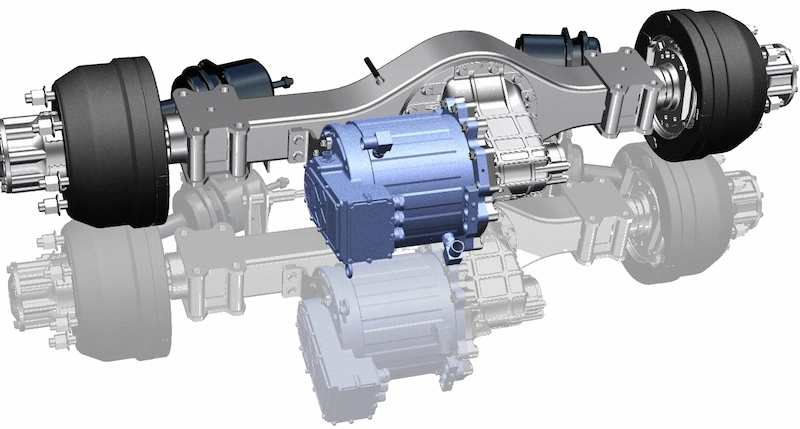

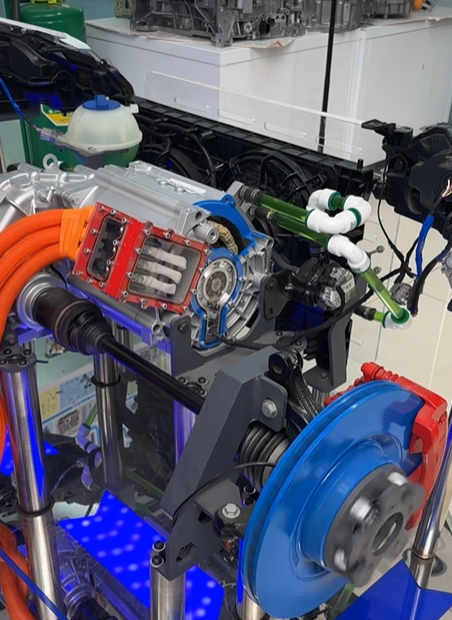

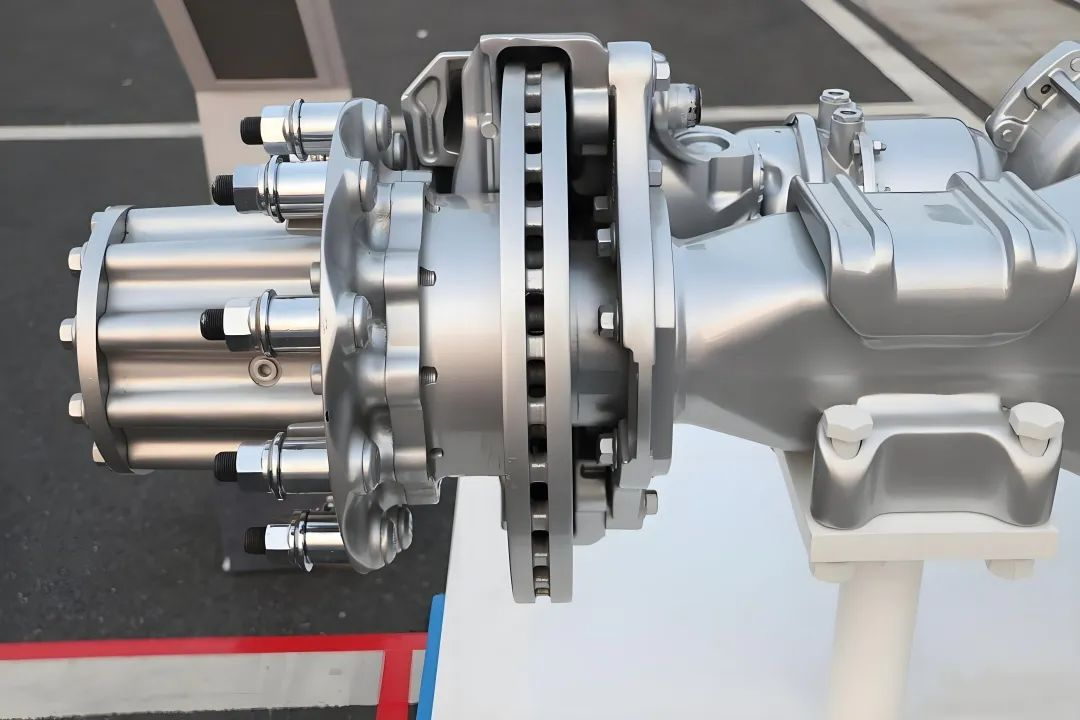

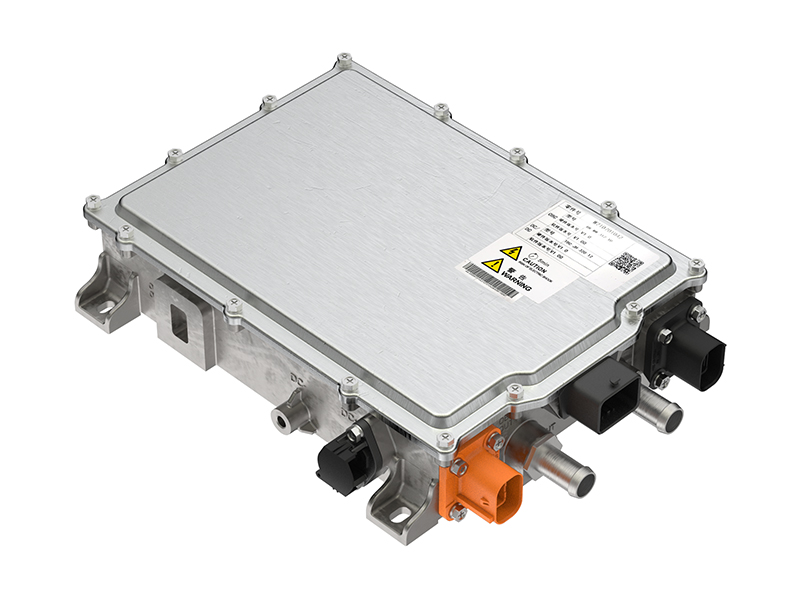

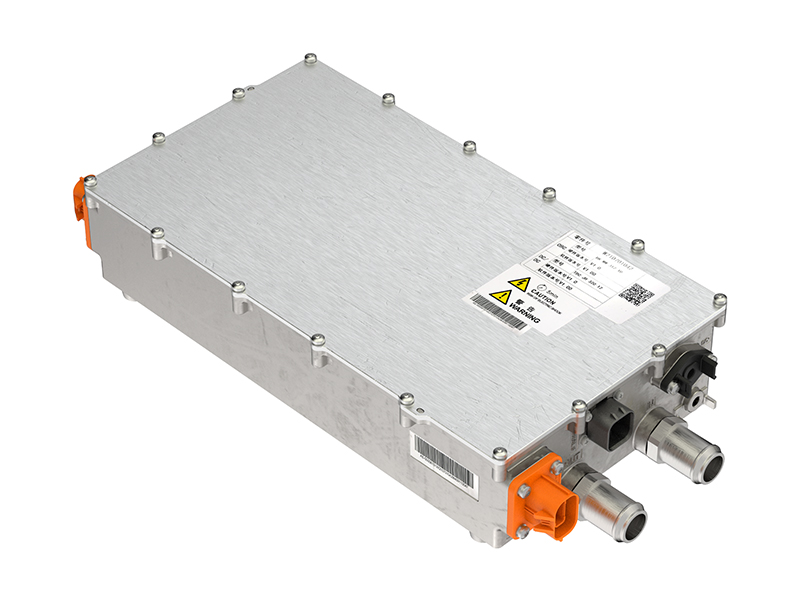

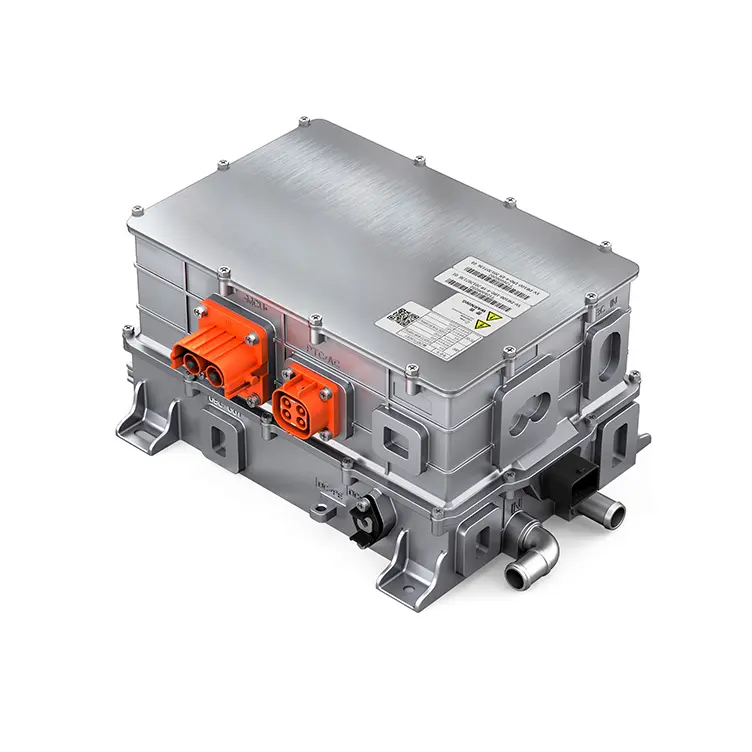

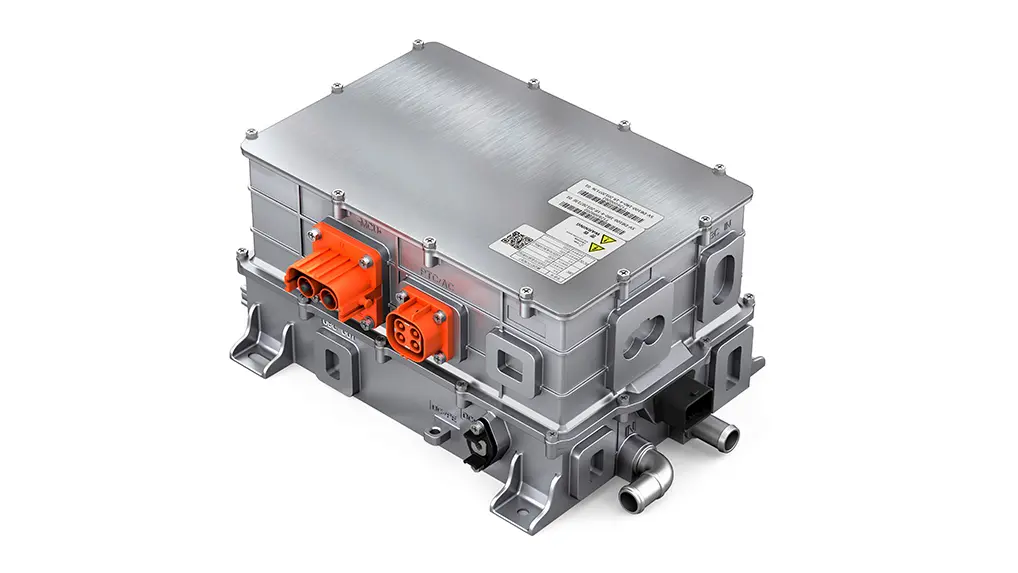

In EVs, PMSMs are used not just in main traction motors but increasingly in auxiliary drives and integrated electric drivetrains:

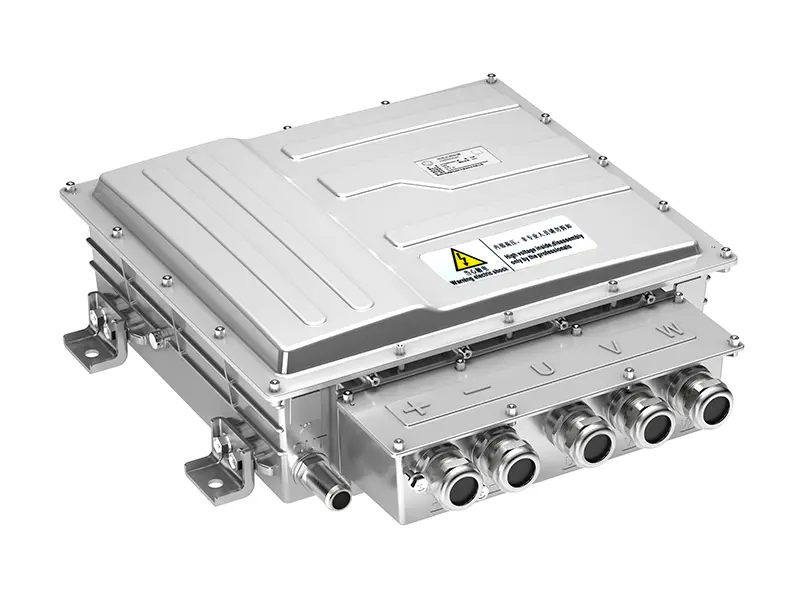

- Traction motors: These are the primary motors that drive the wheels, typically located on the front or rear axle or integrated into e-axles. PMSMs provide quick torque response, making them ideal for regenerative braking and energy-efficient acceleration.

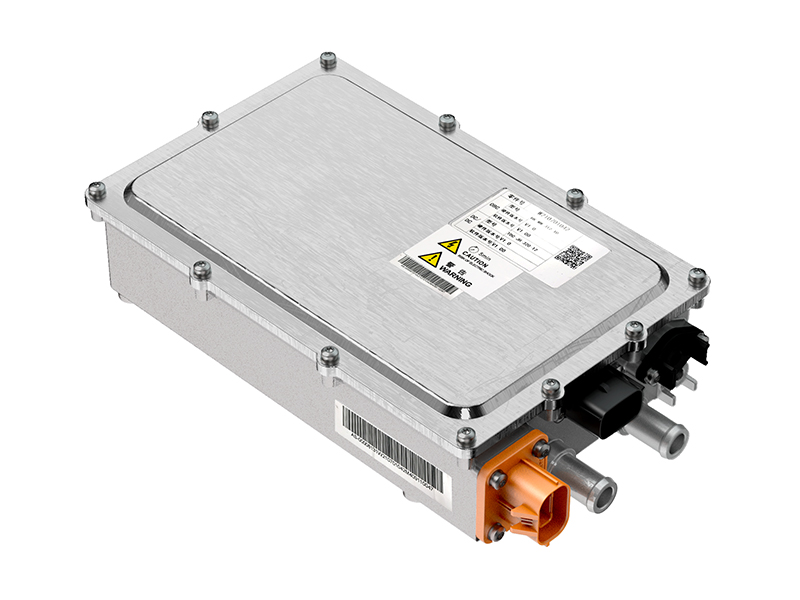

- Integrated starter-generators (ISGs): Some hybrid or mild-hybrid systems use compact PMSMs to assist internal combustion engines during startup or boost phases.

- Electric power steering (EPS) and electric pumps: These subsystems may also use smaller PMSMs enhanced with rare earth magnets for efficiency and reliability.

Strategic Importance and Supply Chain Challenges

The reliance on rare earth elements in PMSMs introduces several strategic and economic concerns:

- Supply concentration: Over 85% of the global rare earth processing capacity is controlled by China, making the EV industry vulnerable to export restrictions, tariffs, or political disputes.

- Price volatility: Prices for Dy and Nd can fluctuate dramatically based on changes in export policies, environmental regulations, and market speculation.

- Environmental impact: Mining and processing rare earths can be resource-intensive and polluting. Sustainable sourcing and recycling of rare earths are becoming critical industry goals.

Technological Alternatives and Innovations

To reduce dependence on rare earths, research is ongoing into:

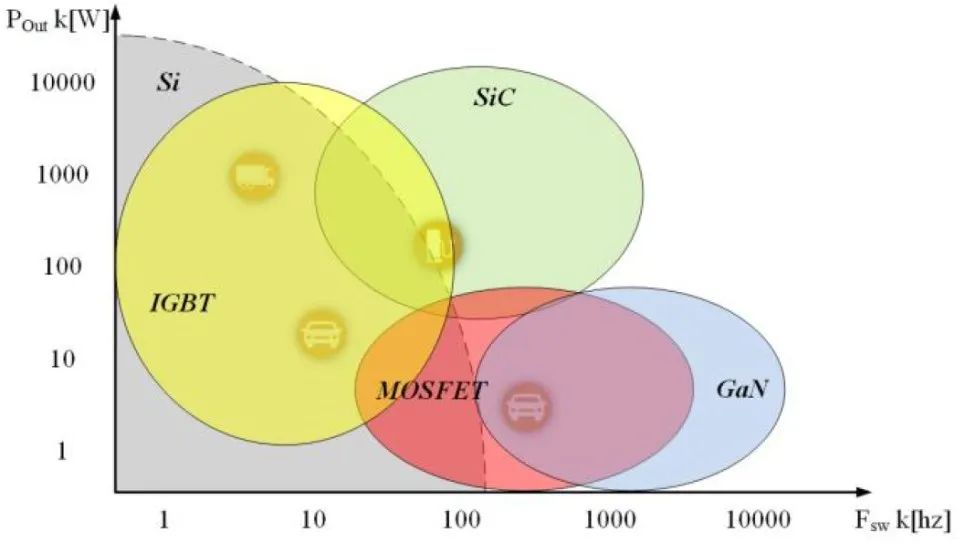

Magnet-free motor designs, such as induction motors (IMs) and switched reluctance motors (SRMs). These motors eliminate rare earths but often sacrifice efficiency or require complex control electronics.

Heavy rare earth-free magnets, such as grain boundary diffusion technology, which can improve NdFeB magnets’ high-temperature performance with minimal Dy or Tb usage.

Magnet recycling: Companies and research institutes are developing methods to extract and reuse rare earths from end-of-life EV motors and electronics.

Rare Earth Pricing Trends (2024–2025)

Over the past 18 months, rare earth markets have experienced substantial price shifts:

|

Element |

Avg. Price July 2024 |

Avg. Price July 2025 |

YoY Change |

|

Neodymium |

$105/kg |

$132/kg |

+25.7% |

|

Dysprosium |

$340/kg |

$415/kg |

+22.1% |

|

Terbium |

$990/kg |

$1,120/kg |

+13.1% |

|

Praseodymium |

$93/kg |

$117/kg |

+25.8% |

Key Factors Driving the Price Surge:

Export Restrictions from China: As the dominant supplier (over 60% of global output), China's quotas and environmental enforcement policies significantly influence global supply.

Instability in Myanmar: As a key producer of heavy rare earths like Dy and Tb, disruptions in Myanmar have tightened global supply chains.

Geopolitical Tensions: Trade barriers, national security concerns, and the need for local sourcing have raised procurement costs.

Growing Multi-Sector Demand: Beyond EVs, wind turbines, robotics, and military technologies are all competing for limited rare earth resources.

These forces have led to year-over-year increases in REE prices, creating budgeting challenges for EV manufacturers and powertrain suppliers.

Impact on EV Motor Production

4.1. Cost Implications

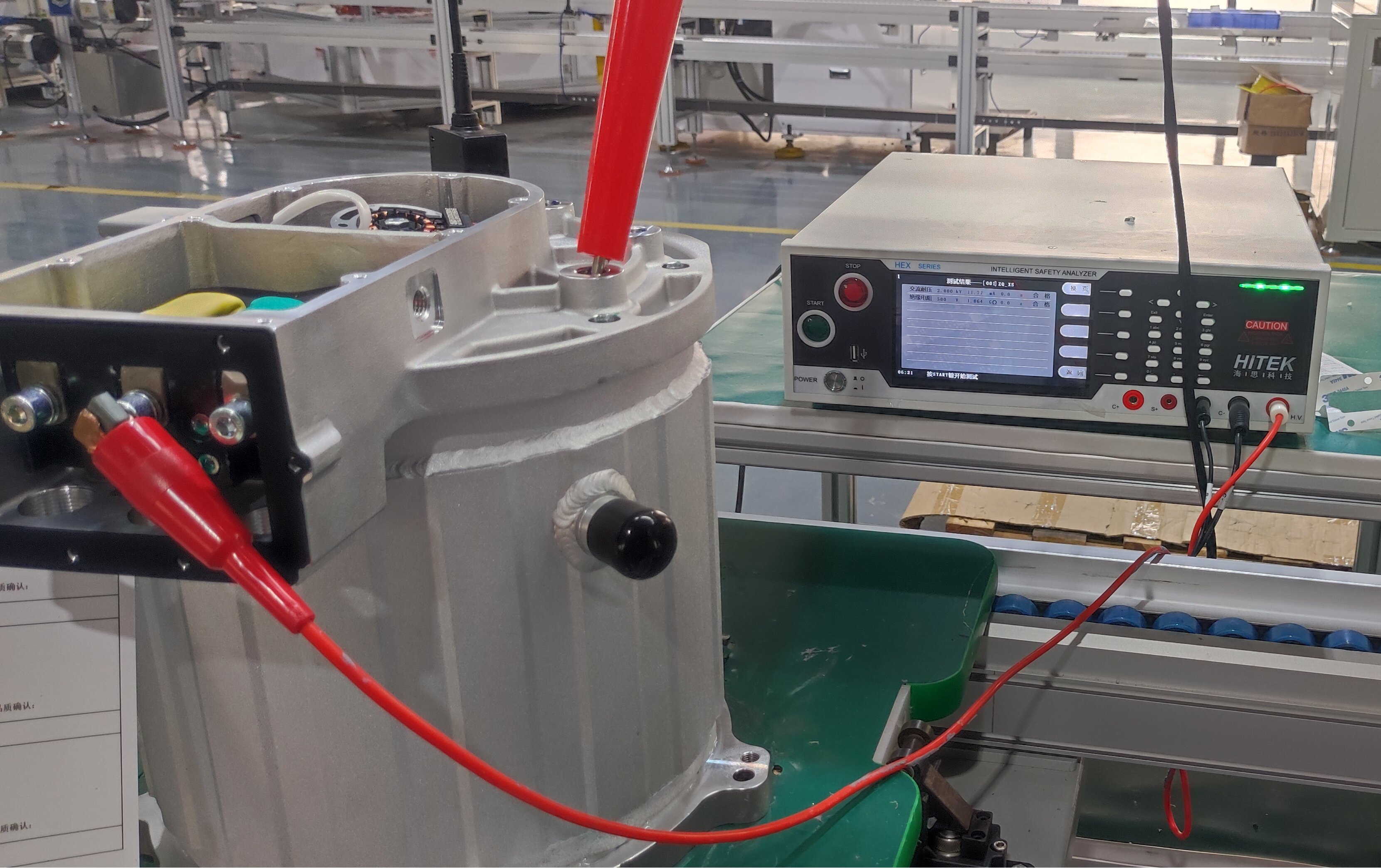

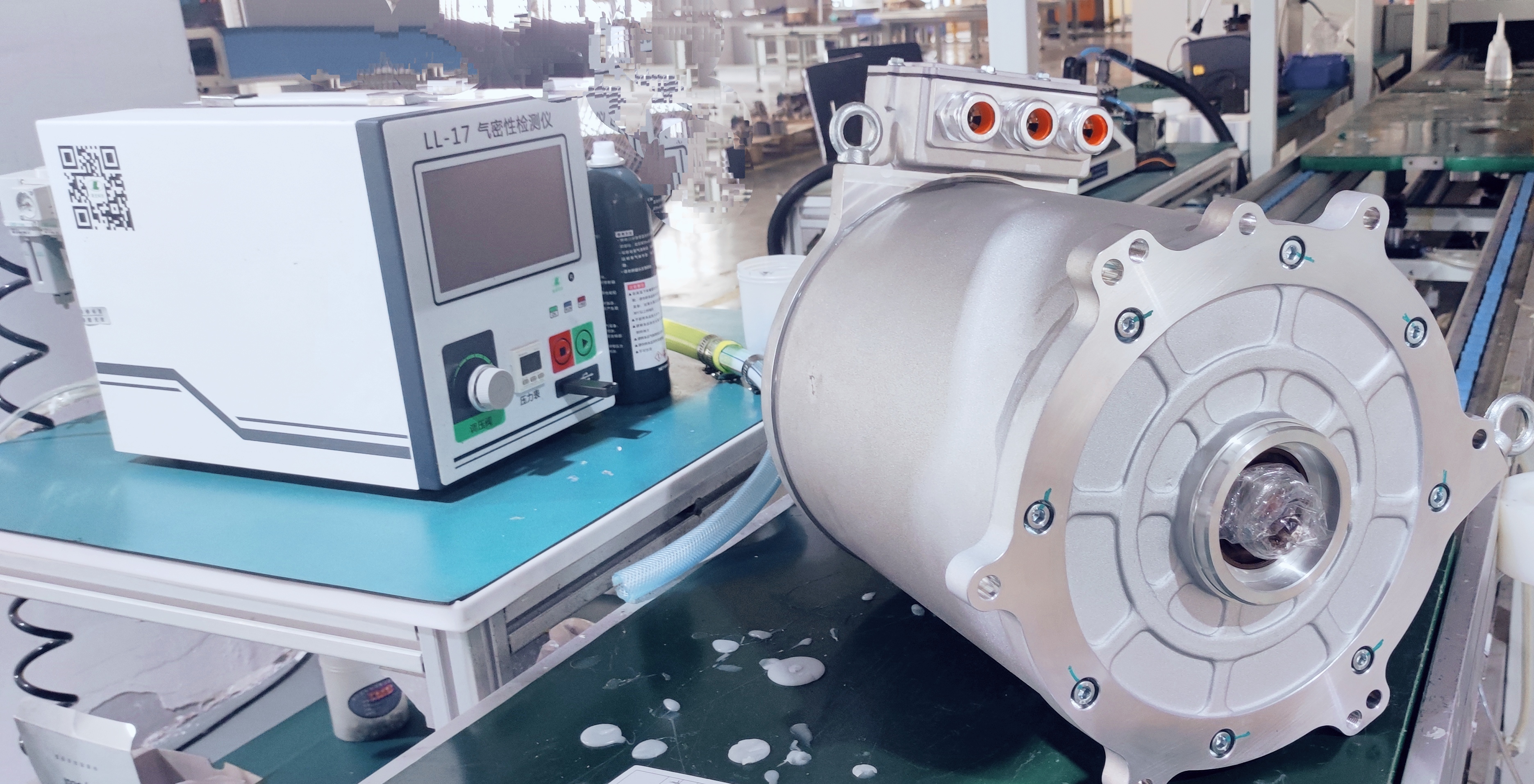

The rise in rare earth prices has directly increased the production cost of PMSMs. In some cases, OEMs report a 10–18% rise in motor component costs. This poses a major challenge for low- and mid-tier EV producers that already operate with narrow margins.

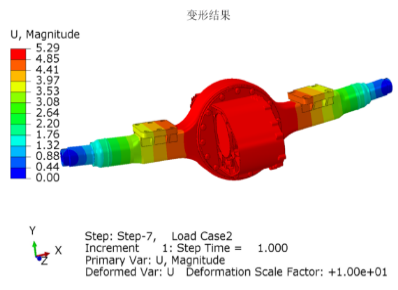

4.2. Motor Design Adjustments

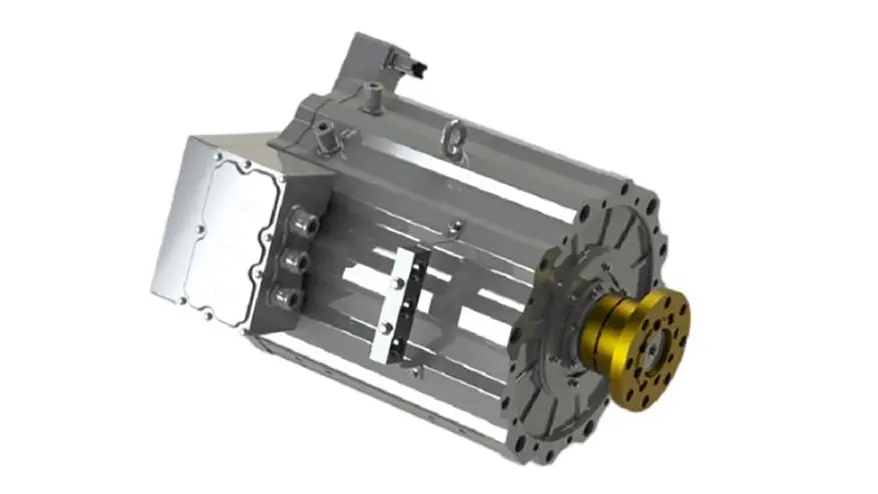

To mitigate these cost pressures, engineers and designers are exploring alternative approaches:

Reducing Dy/Tb Content: Improving heat dissipation and cooling systems to lower high-temperature magnet requirements.

Surface-Mounted Magnet Designs (SPM): Easier to manufacture and consume fewer rare earths than interior magnet configurations.

Alternative Magnetic Materials: Exploring ferrite-based magnets or hybrid topologies, though these often compromise size or efficiency.

4.3. Production Delays and Procurement Issues

Supply chain instability has led to inconsistent deliveries of rare earth magnets, delaying production timelines for several manufacturers, particularly in India, Southeast Asia, and Eastern Europe.

Supply Chain Response and Industry Adaptation

5.1. OEM Strategies

Tesla: Actively working to eliminate rare earths in base models (e.g., Model 3 RWD). Developing internally produced SRMs.

BYD: Diversifying suppliers with new agreements in Africa and South America. Investing in REE recycling.

Toyota: Advancing magnet-reduced PMSM designs and scaling domestic magnet production.

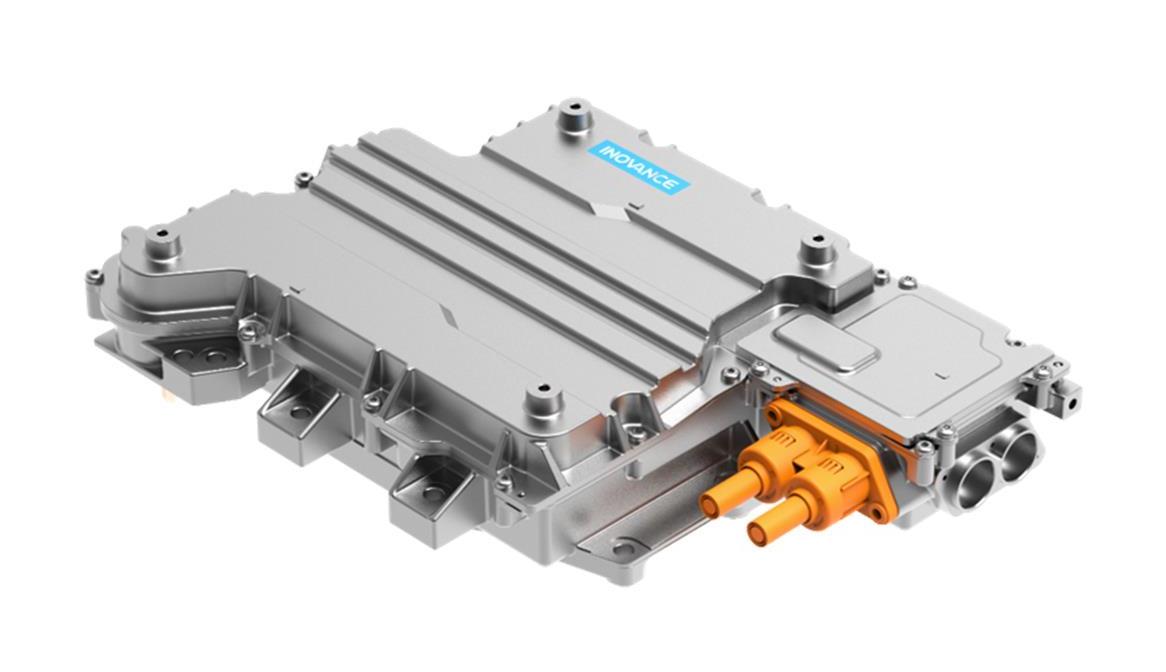

5.2. Tier 1 Supplier Adjustments

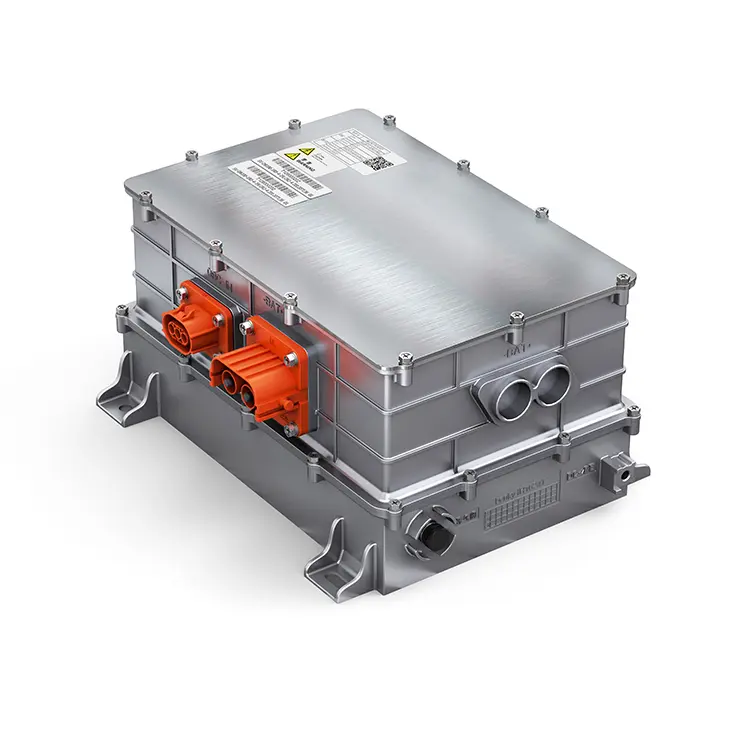

Major suppliers such as Nidec, Bosch, and ZF are investing in:

Local REE refining facilities in Southeast Asia and North America

Recycling technologies for extracting magnets from end-of-life vehicles and electronics

R&D into alternative motor topologies

5.3. Recycling Efforts

Although magnet recycling is still in early stages, it is gaining momentum. Europe and Japan lead this trend, with pilot programs showing promise in capturing neodymium and dysprosium from waste electronics and battery systems.

Regional Comparison: China, Europe, and the U.S.

|

Region |

Supply Chain Role |

2025 Strategy Highlights |

|

China |

Leading producer and refiner |

Tightening quotas, promoting vertical integration |

|

Europe |

Heavy importer |

Building refining capacity (Estonia, France); funding R&D |

|

U.S. |

Rich in raw ores, lacks refining |

Investing in local processing (MP Materials, Texas Minerals) |

While China remains the most influential player in the rare earth market, other regions are pushing for more control and transparency through legislative support, tax incentives, and joint ventures.

Future Outlook: 2025 and Beyond

7.1. Price Projections

While prices may remain volatile through 2026, analysts expect:

New refining projects to come online in Australia, Vietnam, and the U.S.

REE recycling to meet up to 15% of demand by 2030

Growing substitution technologies to relieve pressure on Dy and Tb markets

7.2. Technical Innovations

New magnet technologies under development include:

Iron Nitride (Fe16N2): Promising high magnetic performance without rare earths

Manganese-Bismuth (MnBi): Heat-resistant and sustainable

Axial Flux Motors: Compact and efficient with less reliance on traditional NdFeB

7.3. Policy Landscape

Governments are increasingly involved in rare earth strategy:

The U.S. Defense Production Act has funded multiple domestic REE projects

The EU Critical Raw Materials Act mandates REE content disclosure and sustainability standards

Carbon footprint tracking of REE mining and processing is on the rise

Strategic Recommendations

|

Stakeholder |

Action Plan |

|

EV OEMs |

Invest in R&D for magnet-efficient motor designs; diversify raw material sources |

|

Suppliers |

Develop recycling infrastructure; collaborate with alternative magnet researchers |

|

Governments |

Support mining and refining; ensure environmental compliance; offer incentives |

|

Investors |

Focus on sustainable rare earth mining, recycling, and motor innovation firms |

Conclusion

The landscape of EV motor production in 2025 is intrinsically tied to the economics and logistics of rare earth materials. As demand continues to climb and supply remains volatile, manufacturers must strike a balance between performance, cost, and sustainability.

From recycling to redesign, the industry's response will shape not just electric vehicle affordability, but also the geopolitical and environmental future of clean transportation. As rare earth pricing becomes more central to industrial strategy, proactive adaptation is no longer optional—it's imperative.

FAQ Section

Q1: Why are rare earth materials important in EV motors?

They enable high-performance magnets required for compact, efficient, and powerful PMSM motors.

Q2: Can EVs function without rare earths?

Yes. Some models use induction or reluctance motors, but often with trade-offs in size or efficiency.

Q3: Which EV brands are moving away from rare earth magnets?

Tesla, BMW, and Toyota are investing in rare earth-free or reduced magnet designs.

Q4: What are the alternatives to neodymium and dysprosium?

Alternatives include ferrite magnets, iron nitride, and hybrid motor designs like axial flux motors.