Why Rare Earth Elements Are Critical to the Future of Electric Vehicles

1. Introduction

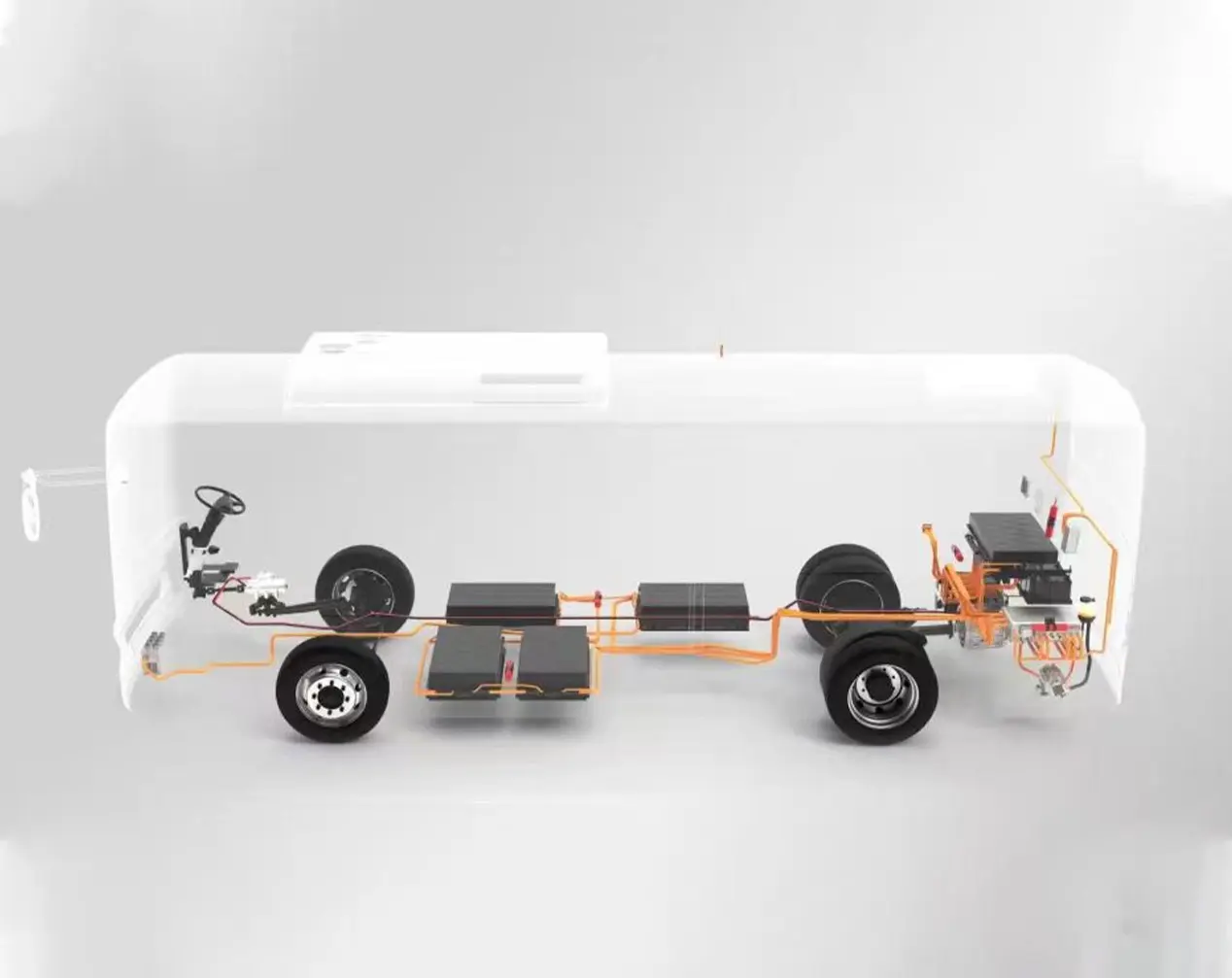

In an age where sustainable transportation is gaining urgency, electric vehicles (EVs) stand as the forefront solution to combat climate change, reduce pollution, and transform how we travel. But beneath their sleek exteriors lies a critical foundation of specialized materials—rare earth elements (REEs)—a group of strategic metals that play an outsized role in EV performance, efficiency, and technological advancement.

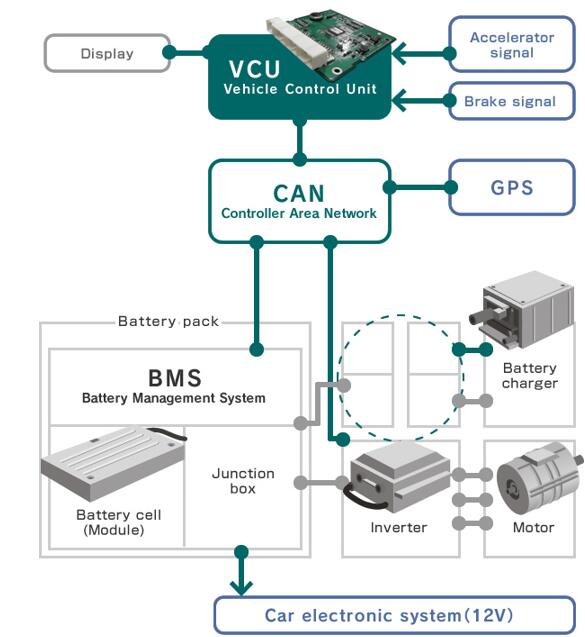

While EVs offer cleaner mobility, they depend on these niche materials—such as neodymium, dysprosium, terbium, praseodymium, and cerium—for their electric motors, batteries, and control systems. These elements, though called "rare," are environmentally and economically complex due to concentrated mining, refining challenges, and geopolitical risk. As global EV adoption accelerates, understanding the importance of REEs—and how to manage their supply sustainably—is paramount. This article explores why rare earth elements are indispensable to EVs, examining how they power performance, the challenges they present, and the path toward innovation, diversification, and environmental stewardship.

2. What Are Rare Earth Elements?

2.1 Defining Rare Earth Elements

Rare earth elements are a group of 17 chemically similar metallic elements on the periodic table: the 15 lanthanides (atomic numbers 57–71), along with scandium and yttrium. Despite being relatively abundant in Earth’s crust, they earned the name “rare” because they seldom occur in concentrated deposits suitable for economical extraction.

2.2 Physical and Chemical Properties

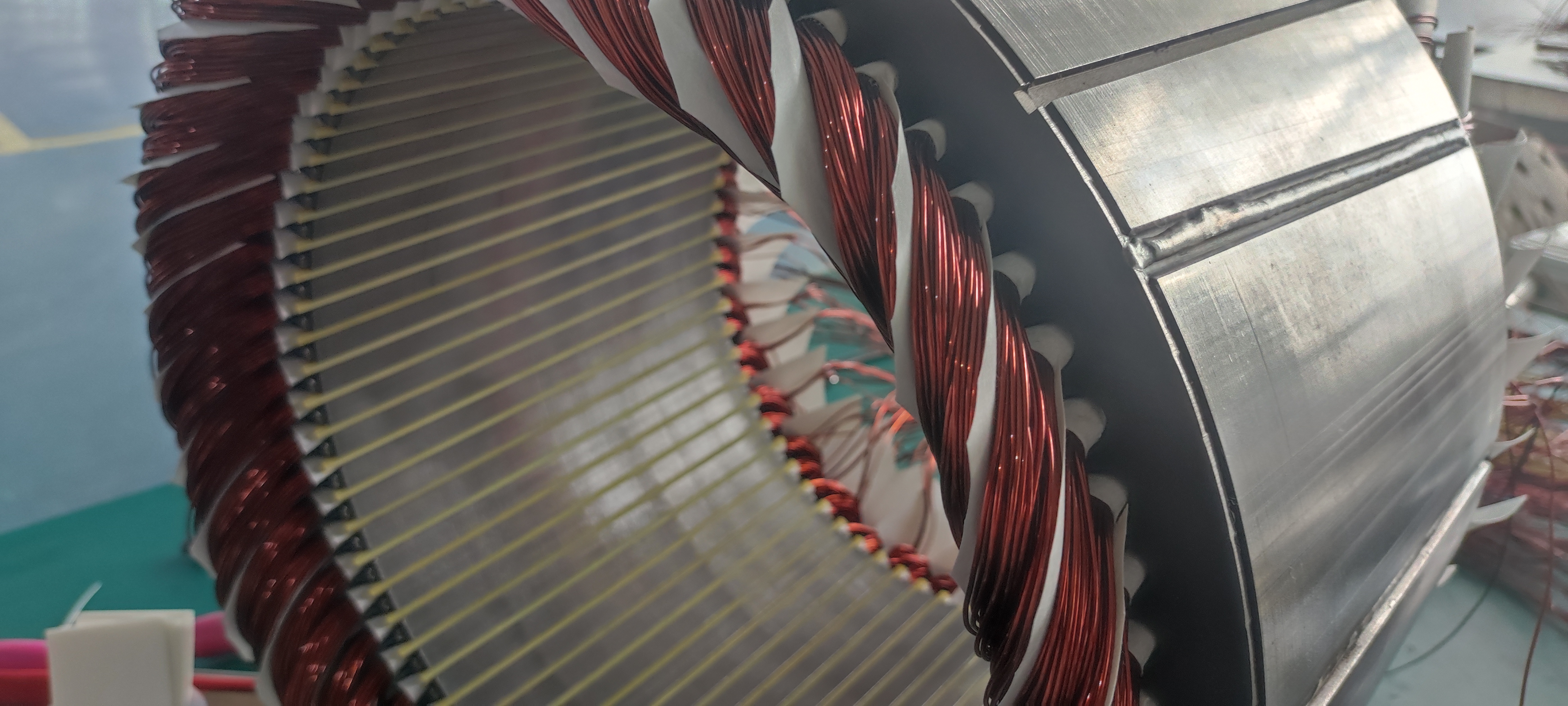

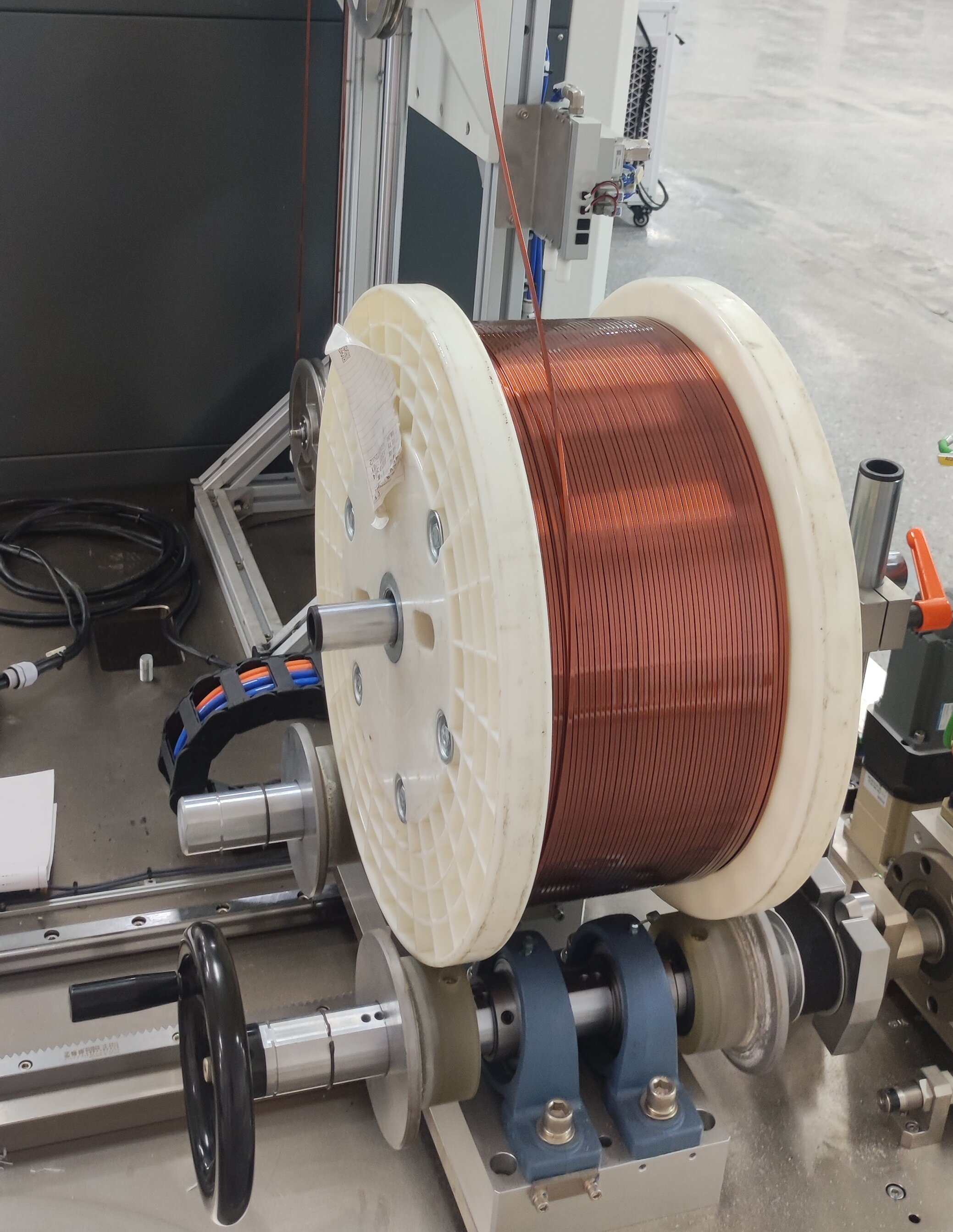

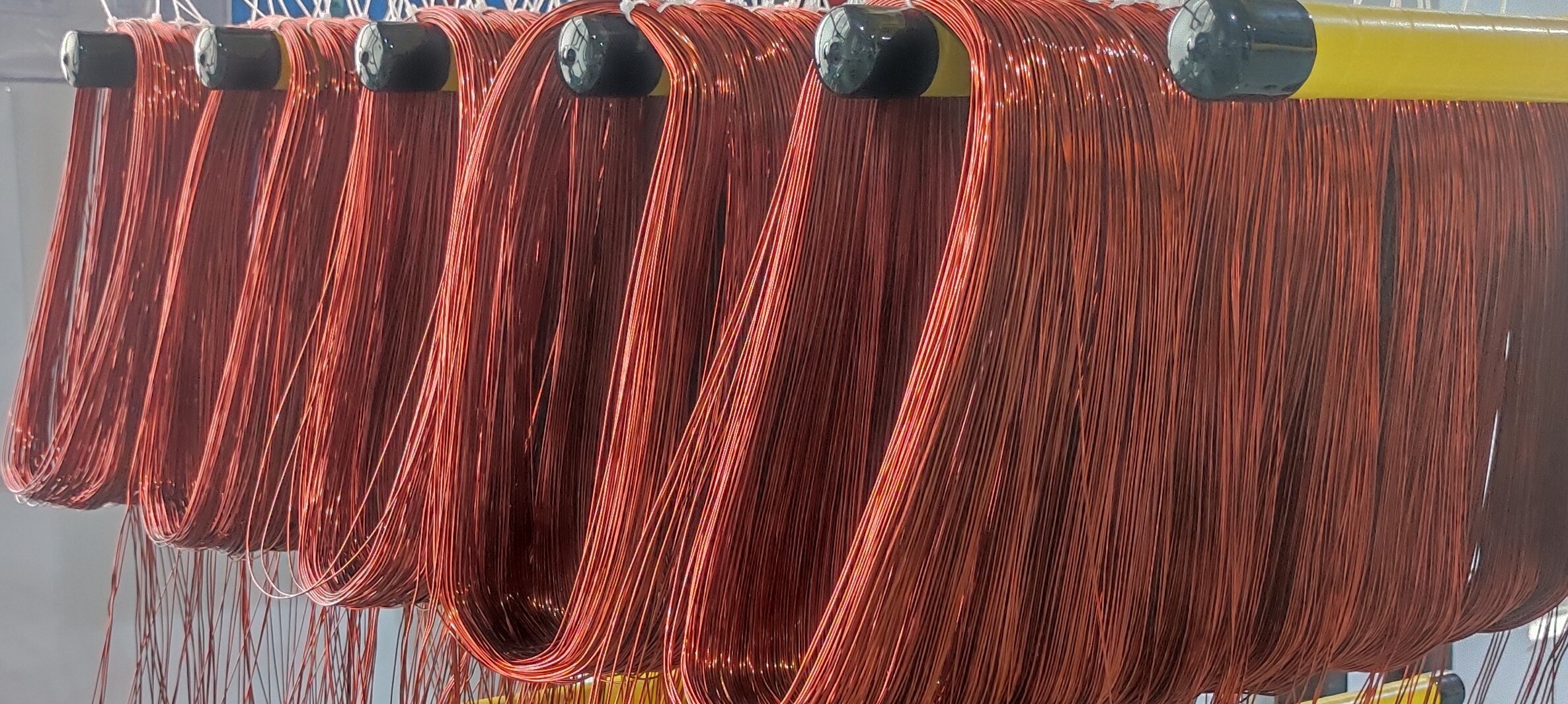

REEs possess unique magnetic, electrical, and optical properties. Their unpaired 4f electrons allow for strong permanent magnetism (as in neodymium-iron-boron (NdFeB) magnets), exceptional thermal resistance, and useful catalytic behaviors. These traits—like strong magnetism in compact sizes—make them vital in high-performance applications where mass and volume constraints exist.

2.3 Key Rare Earths for the EV Industry

Here’s a closer look at the most critical REEs in the EV sector:

Neodymium (Nd): Central to NdFeB magnets. Enables high magnetic energy in compact motor assemblies.

Dysprosium (Dy): Enhances thermal stability of NdFeB magnets at elevated temperatures, ensuring consistent motor performance.

Terbium (Tb): Similar to dysprosium, used for temperature resilience.

Praseodymium (Pr): Often alloyed with neodymium to increase magnetic strength and temperature tolerance.

Cerium (Ce): Employed in catalytic processes and occasionally in battery components, especially in newer chemistries.

Understanding which REEs go where unlocks clarity on their indispensable role in driving the EV revolution.

3. Why Rare Earth Elements Matter in Electric Vehicles

3.1 The Magnet Advantage

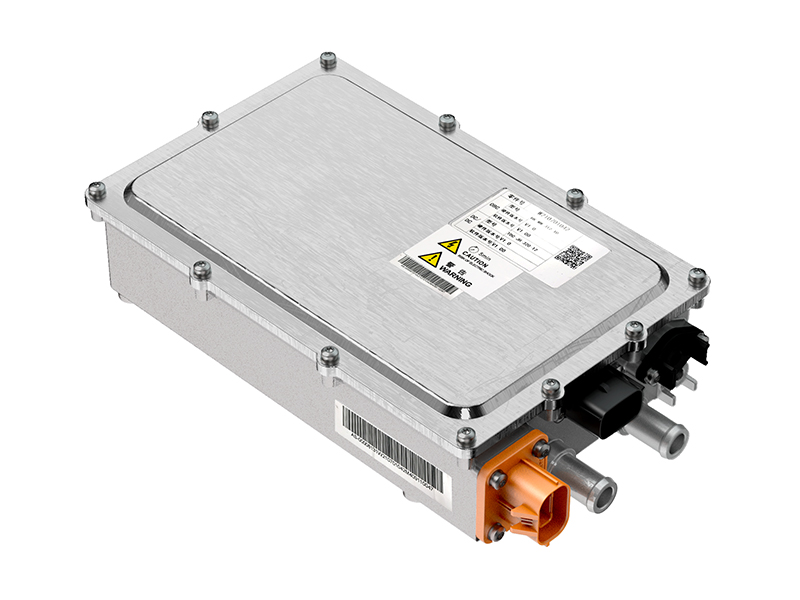

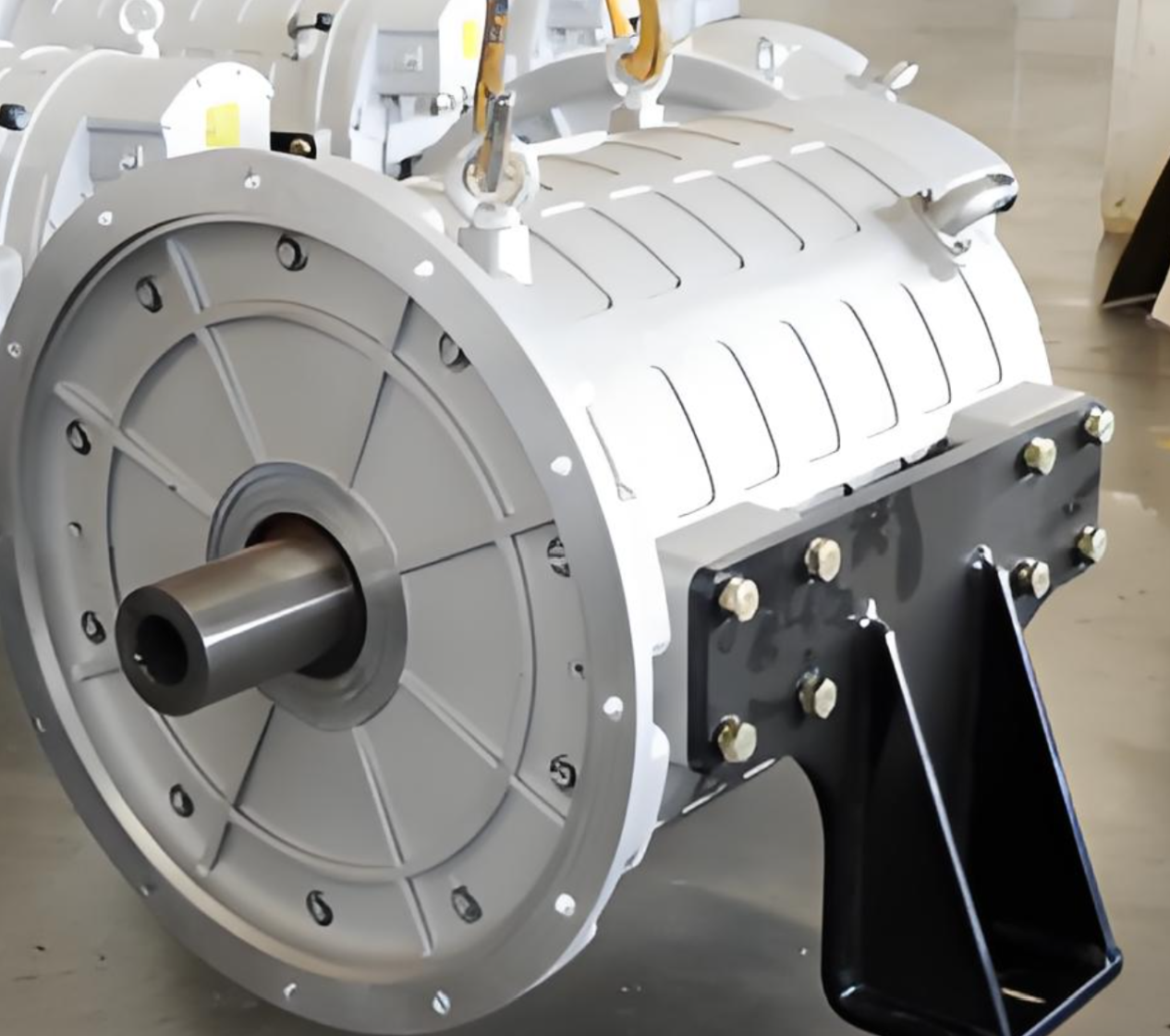

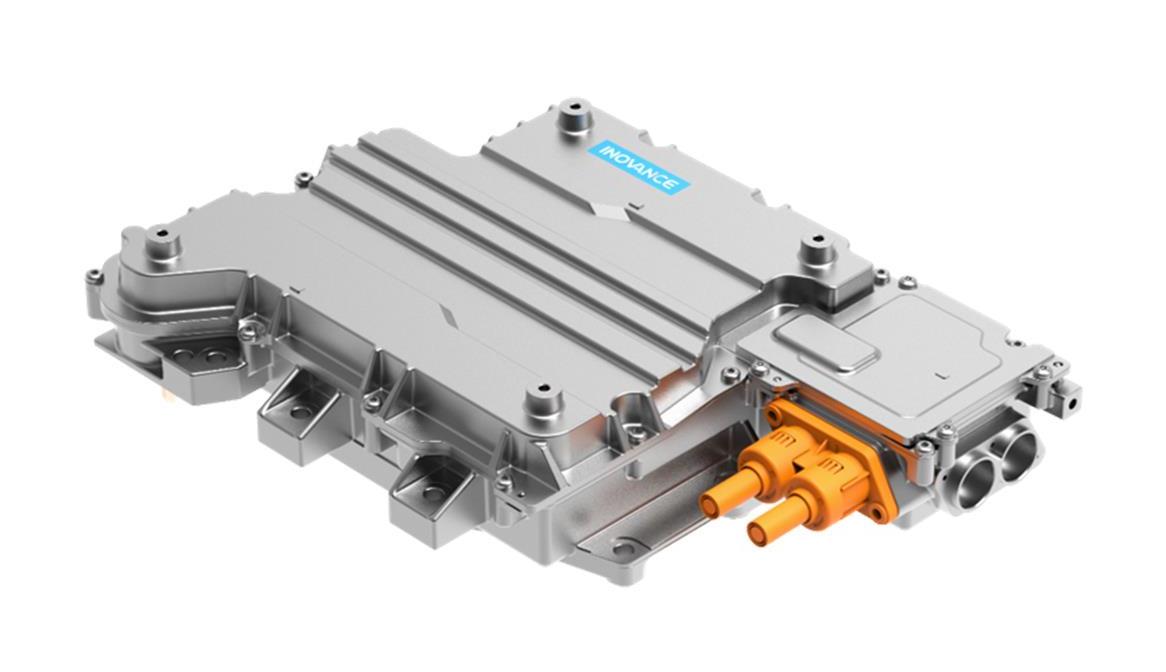

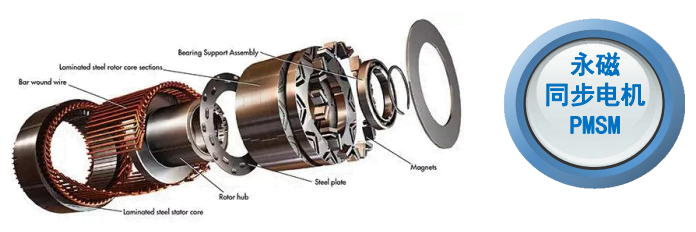

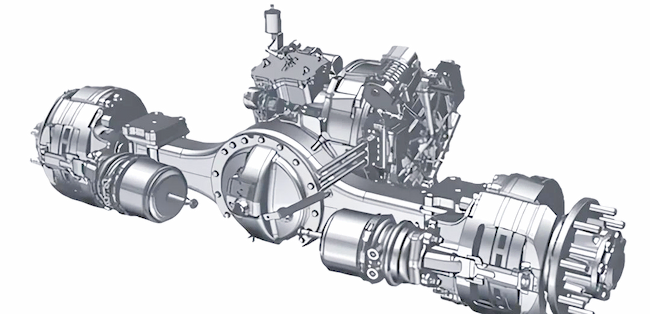

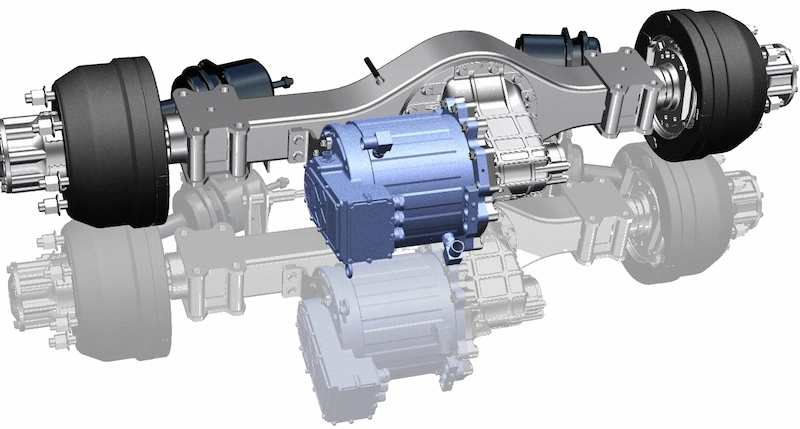

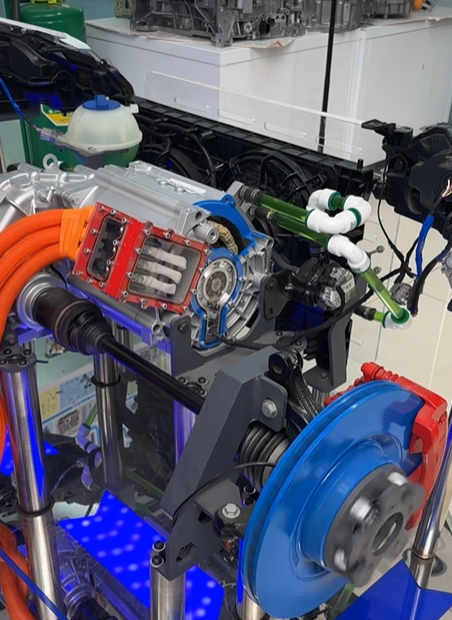

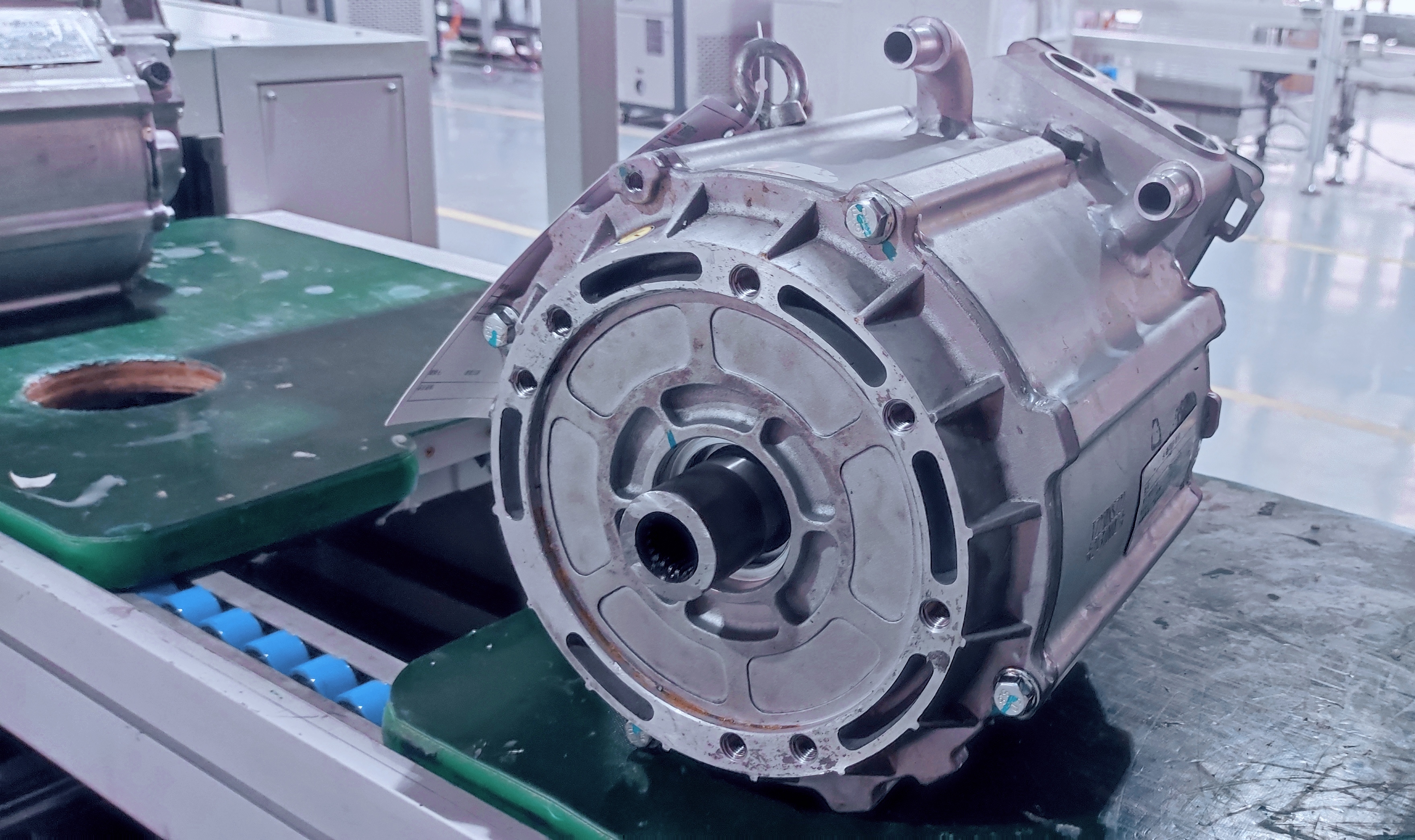

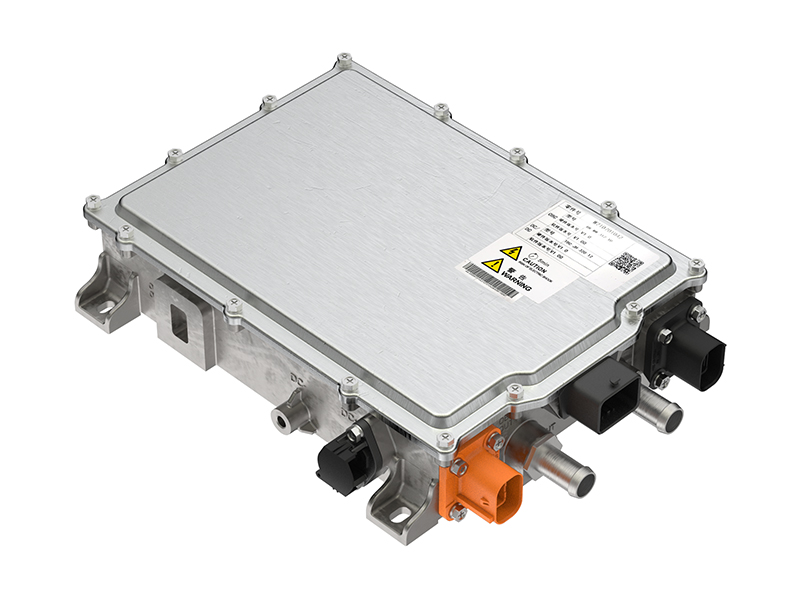

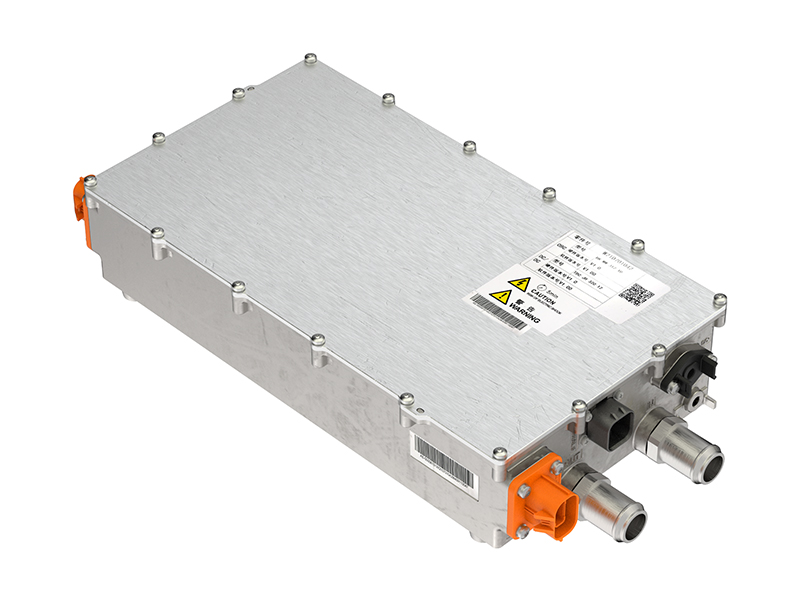

Permanent magnets are foundational for today’s Permanent Magnet Synchronous Motors (PMSMs). EV motors with NdFeB magnets deliver:

High torque density—more power per unit volume

Efficient energy conversion—extending driving range

Compact design—reducing weight and improving packaging

These traits enable automakers to craft lighter, faster, more efficient EVs with instant torque, responsive acceleration, and longer battery life.

3.2 Thermal Stability for Durability

Operating under high power loads or in varied climates can raise motor temperatures sharply. Dysprosium and terbium offset demagnetization risks by stabilizing magnetic performance at high temperatures, preventing degradation, and extending motor lifespan.

3.3 Energy Efficiency and Range Extension

Because NdFeB magnets are powerful for their size, EVs can use smaller motors with reduced electrical resistance and thermal loss. This efficiency gain translates into better mileage—crucial for consumers concerned about EV range and energy use.

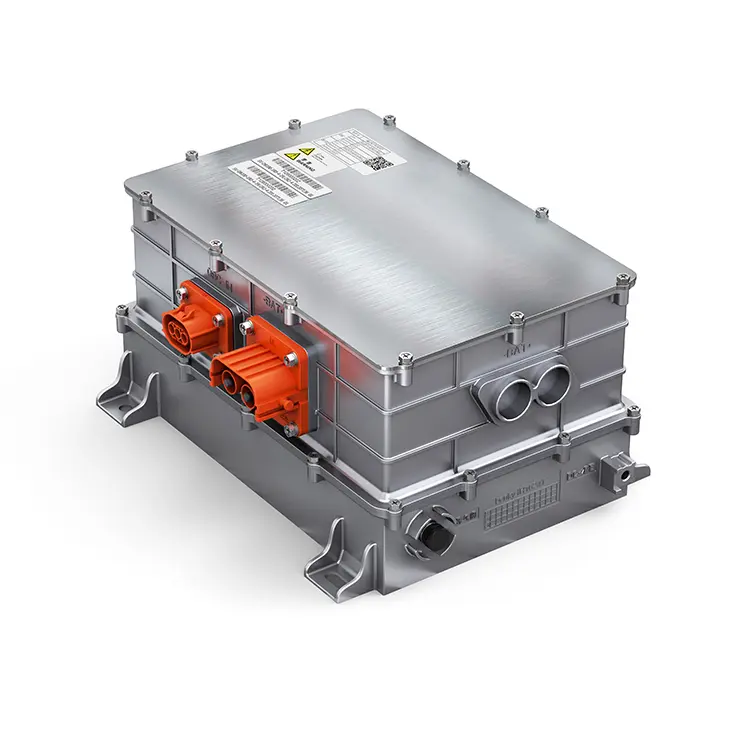

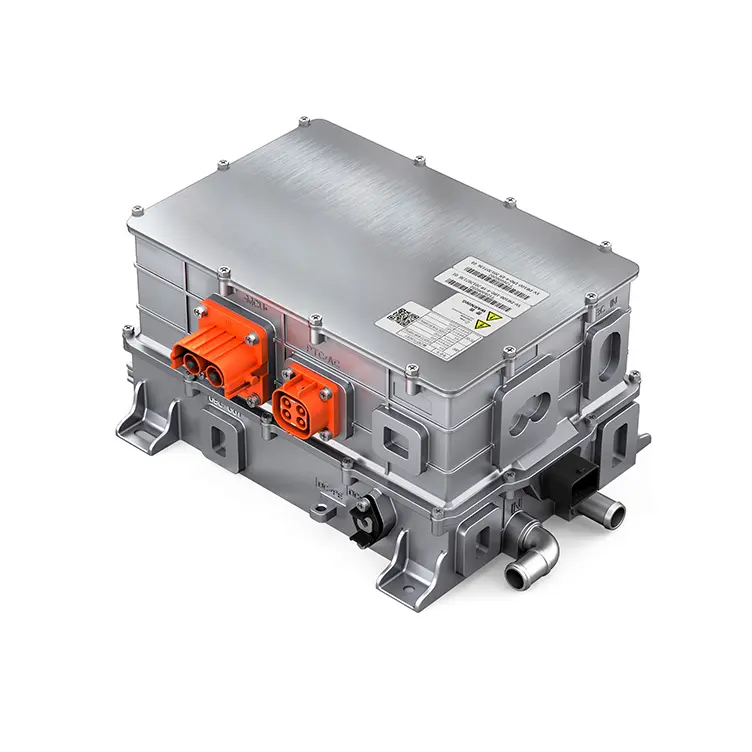

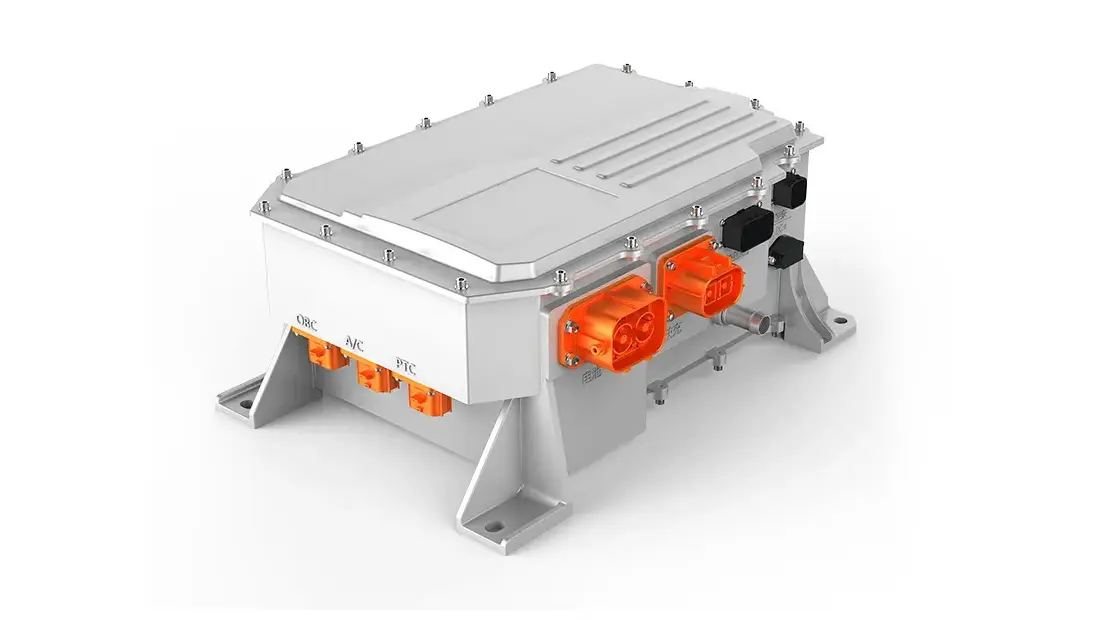

3.4 Battery and Electronics Support

Although less central than magnets, REEs like cerium play roles in battery electrode formulations, catalysts, and control electronics—enhancing charging efficiency, stabilizing cells, or reducing emissions in hybrid contexts.

3.5 Case Examples

Automaker reliance on REEs is clear: Tesla, BYD, Volkswagen, and BMW all integrate NdFeB magnet technology into their EVs for the perfect balance of power, size, and efficiency. Without REEs, they’d need bulky motors or accept performance compromises.

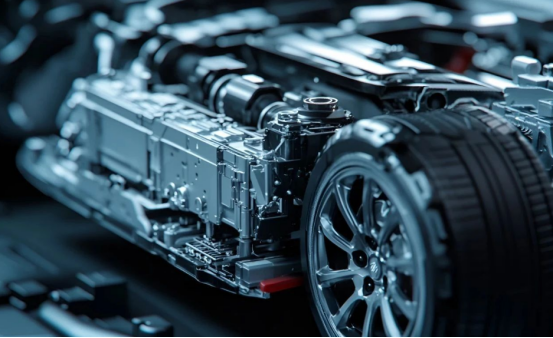

4. Rare Earths in EV Motors: Powering Performance

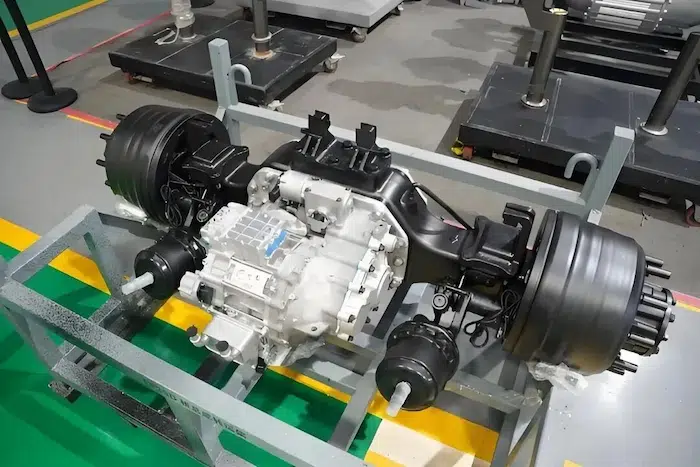

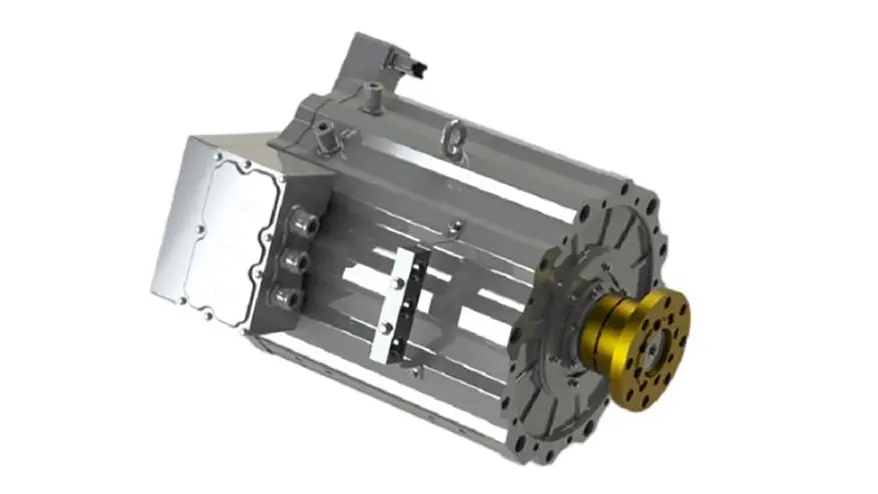

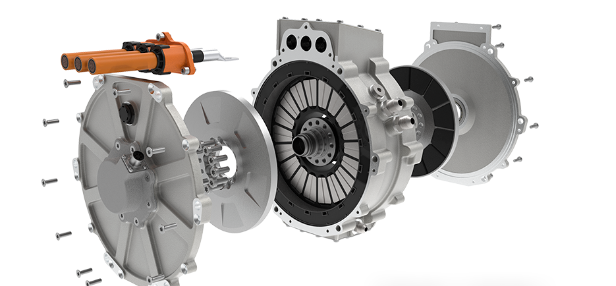

4.1 How NdFeB Magnets Work in Motors

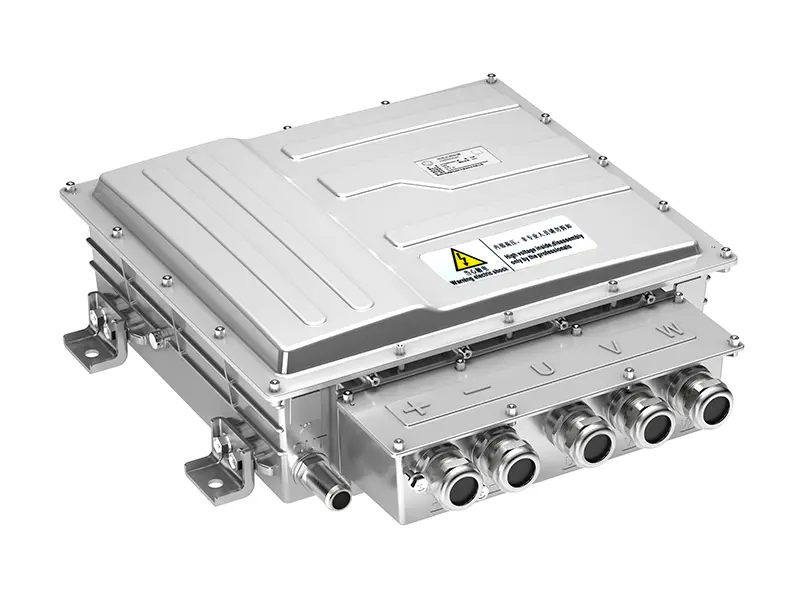

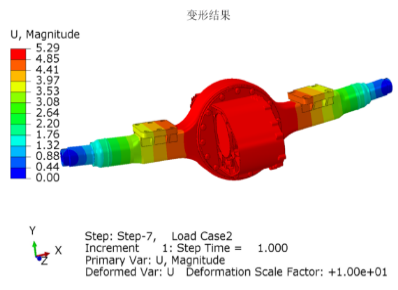

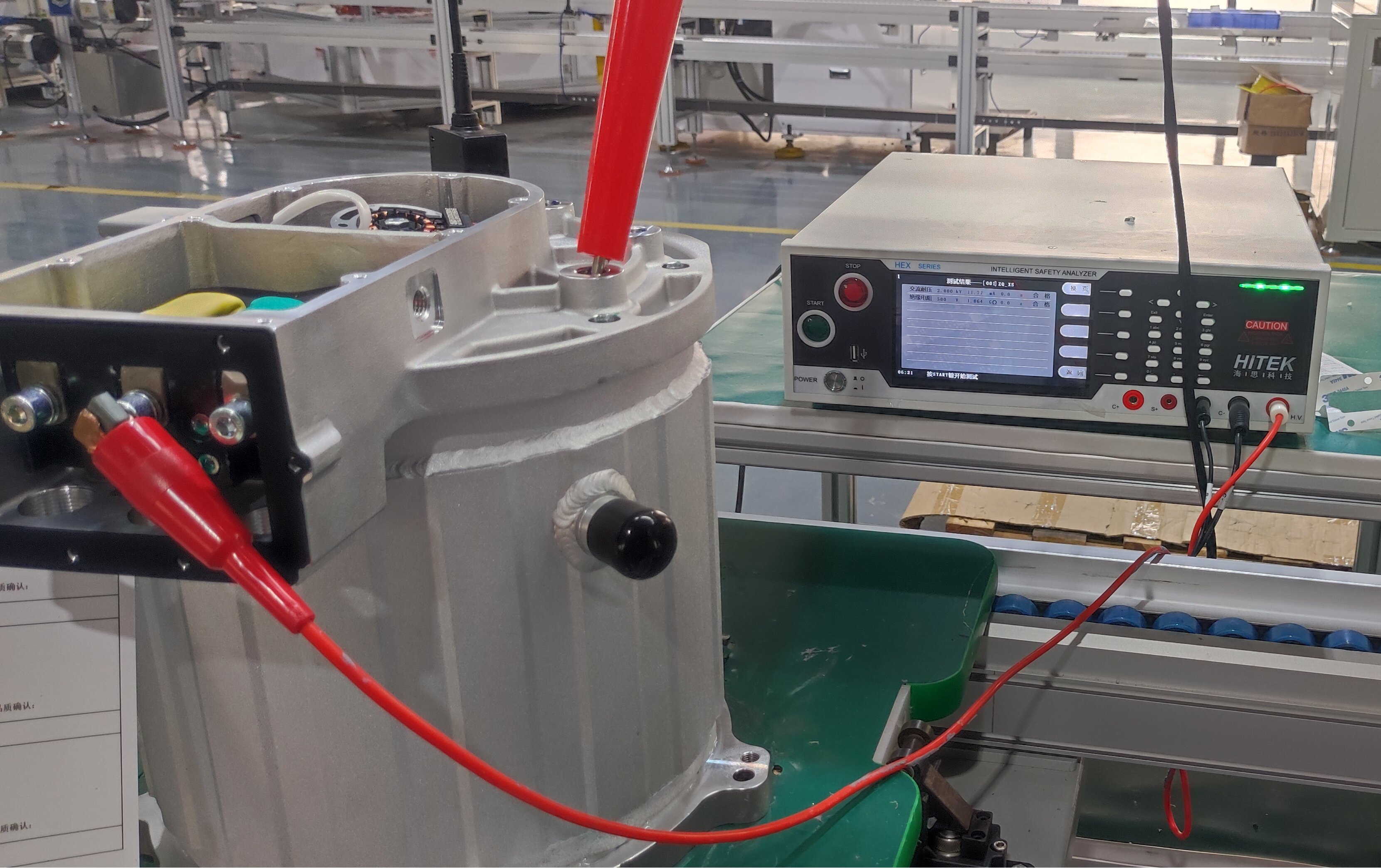

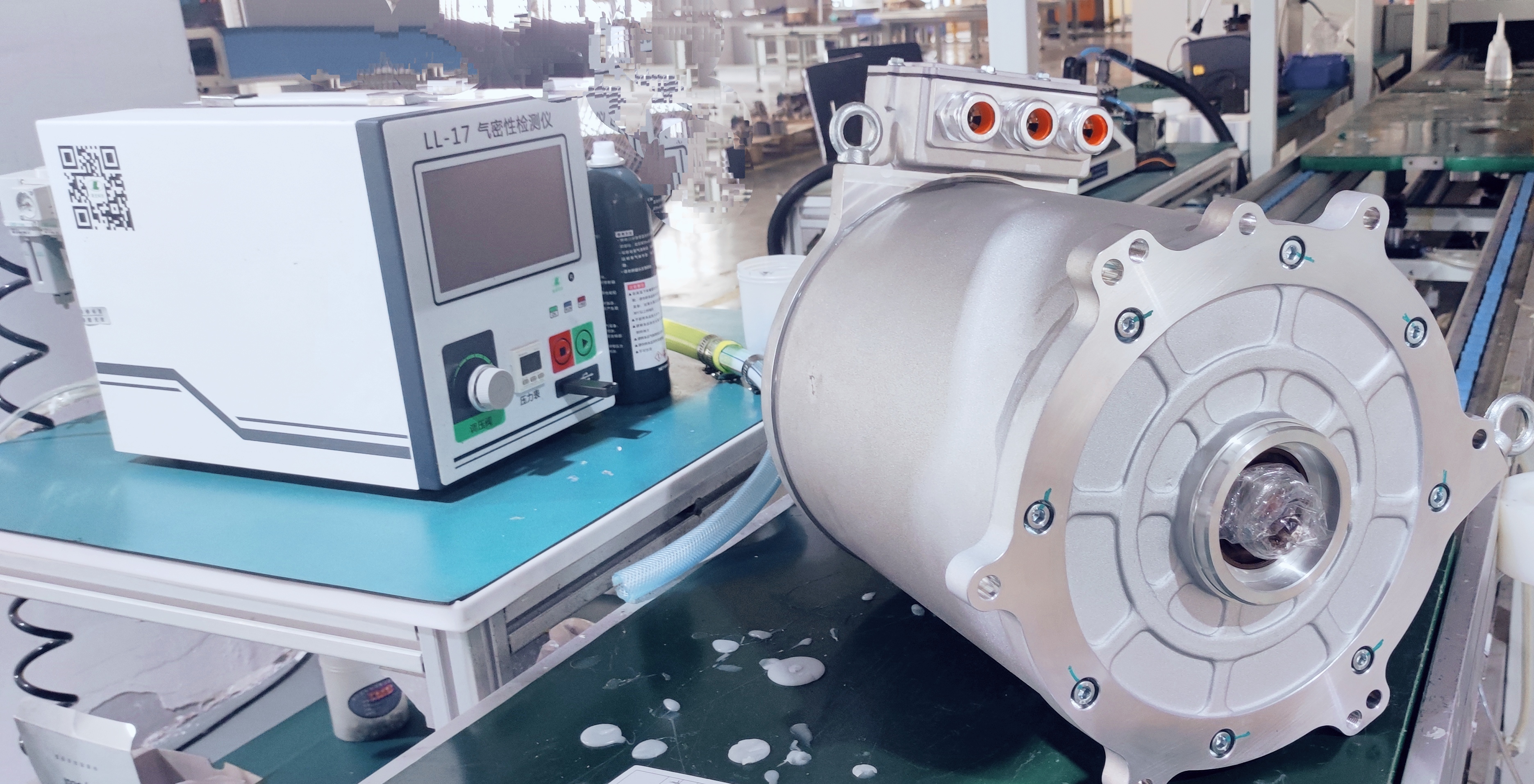

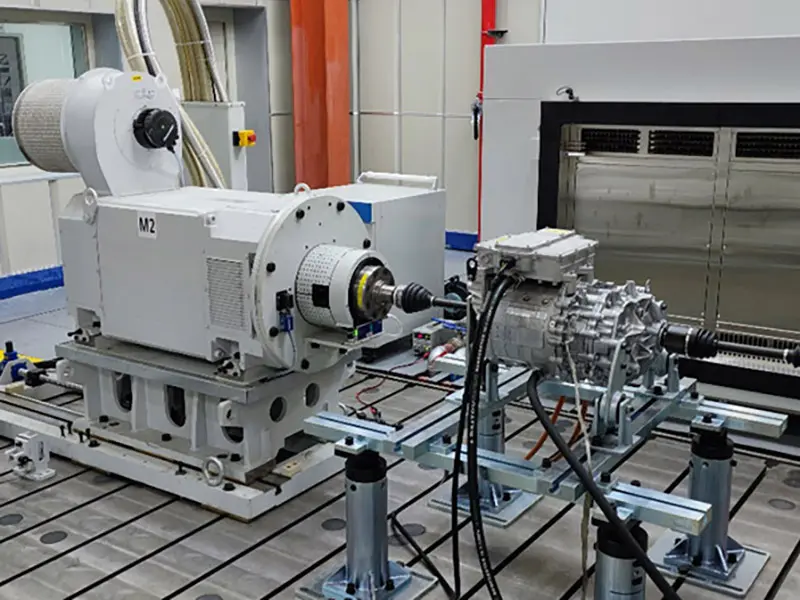

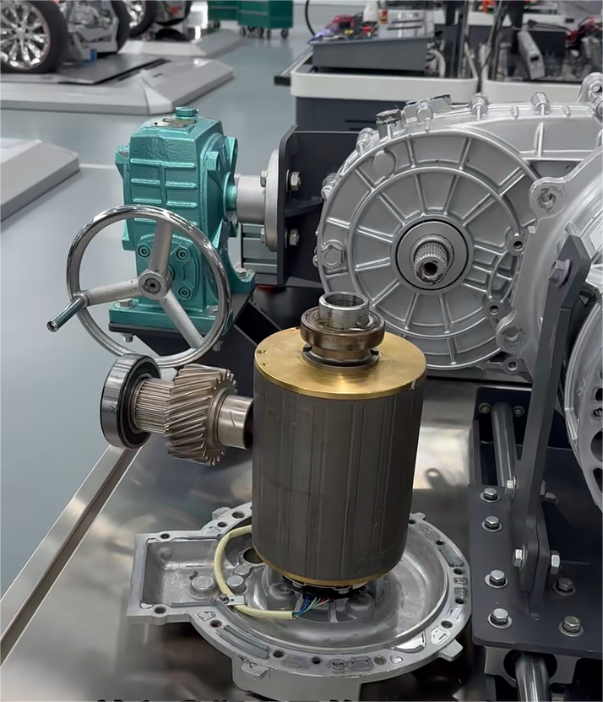

In PMSMs, NdFeB magnets are embedded on the rotor. When electricity flows through stator coils, it generates a rotating magnetic field that interacts with the rotor’s permanent magnet flux—the result? Smooth torque, instant acceleration, and high efficiency across speed ranges.

4.2 Performance Benefits

Vehicle agility: Instantaneous torque makes EVs feel quick and dynamic.

Driving range: Even a modest 5% efficiency gain from magnet quality can translate to significant real-world mileage improvements.

Noise reduction: Electric motors with permanent magnets operate smoothly and quietly—crucial for driver experience and EV brand identity.

4.3 OEM Insights

Tesla moved from induction motors to PMSMs with NdFeB magnets in models like the Model 3, optimizing efficiency for long-range variants.

BYD’s Blade Battery design pairs with high-efficiency magnet motors to deliver longer life and cost competitiveness.

German brands like Volkswagen and BMW deploy PMSMs in their ID and i Series.

4.4 Technological Nuances

Magnetic grades—from N35 to N52—determine strength and temperature resilience. Higher grades often cost more and rely more heavily on rare components like dysprosium.

Newer motor designs might use ferrite magnets (REE-free) in cost-sensitive models, or ferrite hybrid magnets, but at the cost of lower performance per volume.

5. Supply Chain Challenges and Geopolitical Risks

5.1 Global Supply Concentration

China dominates REE supply—accounting for over 70–80% of global processing capacity. This stronghold extends to refining and manufacturing. While raw mineral deposits exist worldwide (e.g., in Australia, the U.S., and Africa), few countries possess integrated systems for efficient refining of usable REE materials.

5.2 Export Restrictions and Market Volatility

China has, in the past, used export quotas and tariffs to influence REE availability globally—triggering sharp price spikes and supply instability. Even strategic stockpiles or supplier relationships may not fully shield downstream users from political and trade shifts.

5.3 Scarcity Beyond Mines

Mines face space constraints—adjusting output to surging demand (driven by EV ramp-up) is not instantaneous. Securing long-term supplies means navigating exploration, permitting, capital investment, and refinery construction. That cycle can span years or even over a decade.

5.4 Efforts to Diversify

Governments and firms worldwide are accelerating efforts to diversify supply:

USA’s Mountain Pass mine was revitalized to restore domestic REE output.

Australia’s Lynas is building refining capacity in both Australia and the U.S.

Canada and Brazil are pursuing expansion in exploration and processing.

5.5 Economic and Political Risk

Price surge risk: If demand outpaces supply or a critical supply chain link falters, prices—or shortages—can spike.

Import dependence: EV manufacturers reliant on external markets face unpredictable sourcing costs and supply reliability.

Current strategies—investment in new sources, international alliances, or recycling—are essential to managing these geopolitical and market risks.

6. Sustainability and Environmental Concerns

6.1 Mining Ecosystem Disruption

REE extraction often involves environmentally intrusive methods—like open pit mining or strip mining—that destabilize land, destroy habitats, and produce large volumes of waste.

6.2 Chemical and Radioactive Risks

REE ores may contain low-level radioactive elements like thorium or uranium. Refining often uses strong acids, solvents, and reagents—creating hazardous tailings and contaminated water that can leach into ecosystems.

6.3 Carbon Footprint of Processing

Energy-intensive refining plants often rely on fossil fuels—undermining some intended environmental gains of electrification. If the energy grid isn’t clean, the lifecycle carbon savings of EVs are less and less definitive.

6.4 Biodiversity and Land Rights

Mining zones sometimes overlap with culturally significant lands or ecologically sensitive areas. Displacement, water scarcity, or pollution affect local communities—raising ethical questions as demand for REEs grows.

6.5 Reclamation and Regulation

Countries with robust environmental policies—like Australia and Canada—often enforce strict rehabilitation plans, tailings management, and water treatment. In contrast, looser regulations in other jurisdictions may lower costs but increase ecological damage.

6.6 Green Certification and Accountability

EV industry leaders and regulators are exploring standards—such as the EU’s Battery Regulation, or frameworks like the Airfinity Rare Earth Transparency Index—to ensure REE supply chains are eco-friendly and socially responsible.

7. Innovation and Alternatives: Is the Industry Diversifying?

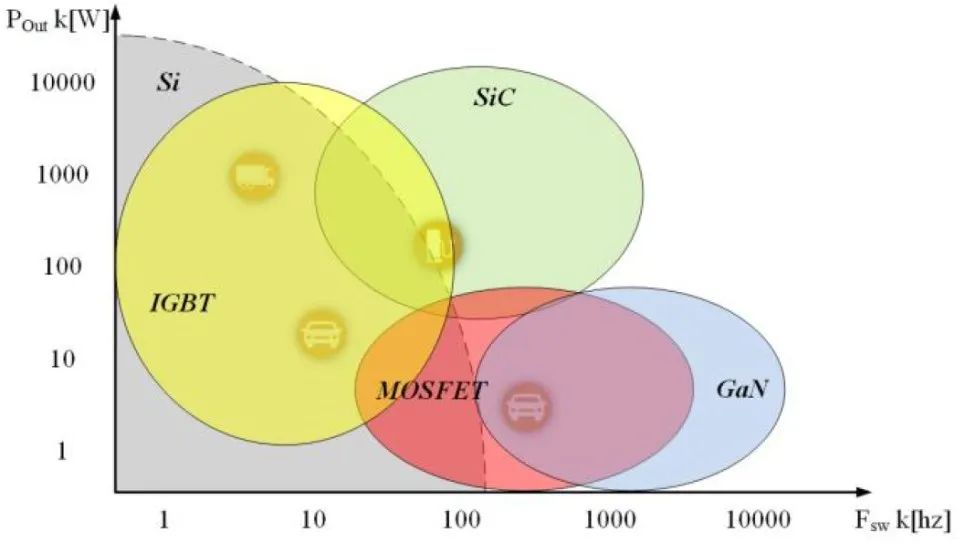

7.1 Motor Technology Alternatives

7.1.1 Induction Motors (AC Motors)

No permanent magnets—so no REEs required.

Historically larger, less efficient, but highly durable and cheaper.

Tesla famously used them in early models for robustness. Still, PMSMs now offer better efficiency for long-range EVs.

7.1.2 Switched Reluctance Motors (SRMs)

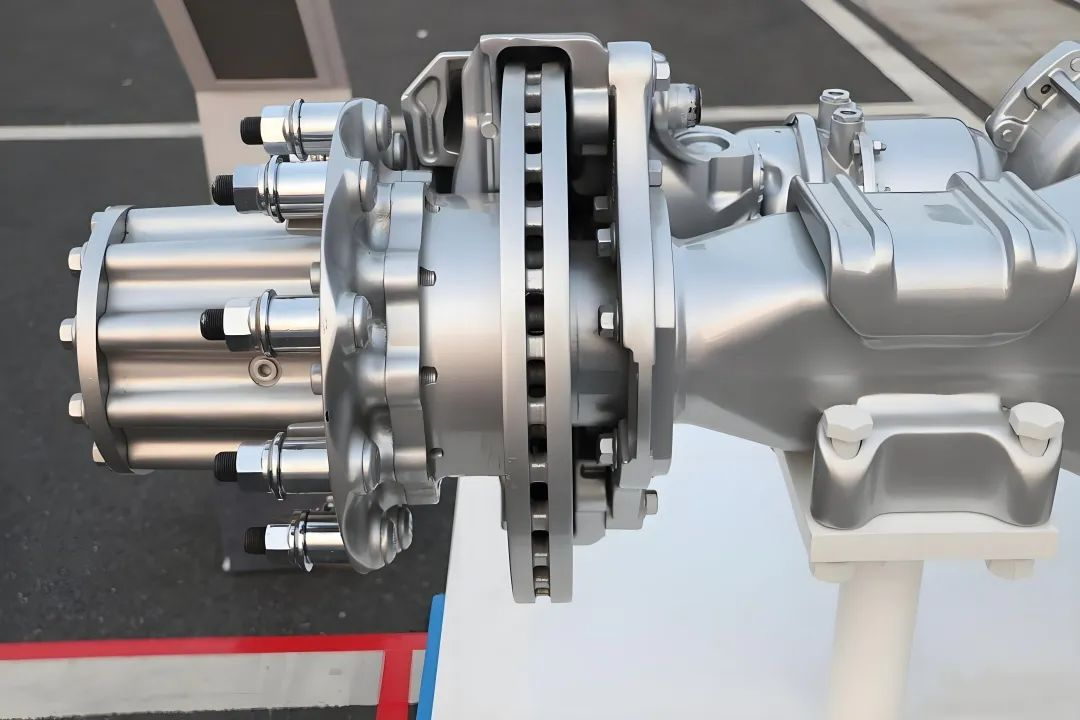

Rugged and magnet-free.

Historically known for vibration and noise—but modern controllers and designs are mitigating those issues.

Less efficient by a small margin, but attractive for future low-cost or high-durability EV segments.

7.1.3 Ferrite Magnet Motors

Use abundant, non-REE-based magnets.

Lower magnetic strength per volume means larger motor size or reduced torque.

Still viable for budget or city-range EVs.

7.2 Recycling and Magnet Reclamation

With EV scrap volumes set to surge in the next decade, recyclers are ramping capabilities:

Hydrometallurgy processes dissolve magnets and recover REEs with recovery rates approaching 95% in lab settings.

Mechanical separation and sorting improvements allow efficient dismantling of EV motors and electronic waste.

Early pilot recycling facilities in Europe, Japan, and the U.S. are operating prototype reclamation lines—calling back materials from end-of-life products to mitigate mining demand.

7.3 Advanced Materials and Research

Nanotechnology and alloy design: Scientists are engineering REE-reduced or REE-free magnets with comparable strength via advanced alloying techniques.

High-entropy alloys, intermetallic compounds, and spintronics research may unlock new magnetic materials that lean less on scarce REEs.

Quantum and magnetic domain manipulation is under investigation to reduce reliance on rare components in motor systems.

7.4 Battery Chemistry Diversification

Lithium-Iron-Phosphate (LFP) battery chemistries are widely used in China; they contain no REEs and offer better stability, albeit with slightly lower energy density.

Sodium-ion technology—an emerging alternative—contains no REEs and benefits from abundant raw materials, though energy density remains lower.

As EV adoption segments diversify (e.g., budget models, city commuting, heavy-duty transport), material needs are tailoring to fit—with fewer REEs in some pathways.

7.5 Strategic Policy Measures

7.5.1 Supply Diversification

Government-backed initiatives to develop new mines and processing facilities.

Incentives for domestic refining and value-chain integration.

7.5.2 Strategic Stockpiles

The U.S., Japan, and EU are exploring reserve strategies—maintaining baseline REE inventories to buffer against diplomatic or trade disruptions.

7.5.3 International Collaboration

Partnerships between the U.S., EU, Australia, and Japan—such as through the Energy Resource Governance Initiative (ERGI)—to build shared, ethical REE supply frameworks.

Projects like Critical Materials Innovation reaching across borders to fund R&D and recycling efforts.

7.5.4 Corporate Responsibility

EV manufacturers building magnet recycling programs.

Automakers committing to REE-supply chain audits and ethical sourcing commitments.

8. Conclusion

8.1 Synthesis

Rare earth elements, with their distinctive magnetic and thermal properties, are the unsung champions powering efficient, high-performance electric vehicle motors. They enable the compact design, enduring range, and responsive handling that EVs promise. But their strategic value brings complex challenges—geopolitical risk, environmental impact, and supply fragility—that the world must confront.

8.2 The Path Forward

Diversification—through new mines, refining hubs, and reclaimed sources.

Innovation—in REE-free motor designs, advanced materials, and efficient recycling infrastructures.

Regulation and Accountability—enforcing environmental standards, traceability, and ethical sourcing.

Collaboration—across governments, industry, and research institutions to build resilient, sustainable value chains.

8.3 Final Thoughts

As EV adoption accelerates, securing the future of electric mobility hinges on more than just batteries and charging networks—it depends equally on the tiny but mighty rare earth elements that make these vehicles possible. Their stewardship must be intelligent, sustainable, and diverse.

The good news? The collective commitment of policy, private sector innovation, and international cooperation already points to a future where EVs are not only clean and efficient—but also grounded in material resilience and ecological integrity.