China's New Export Control on High-Energy-Density Lithium Batteries and Rare Earth Materials

Introduction

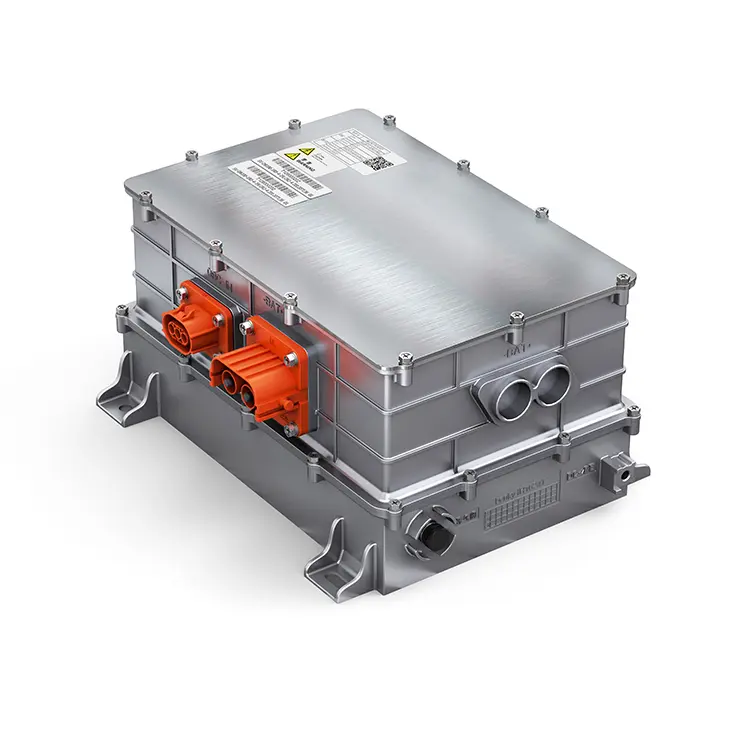

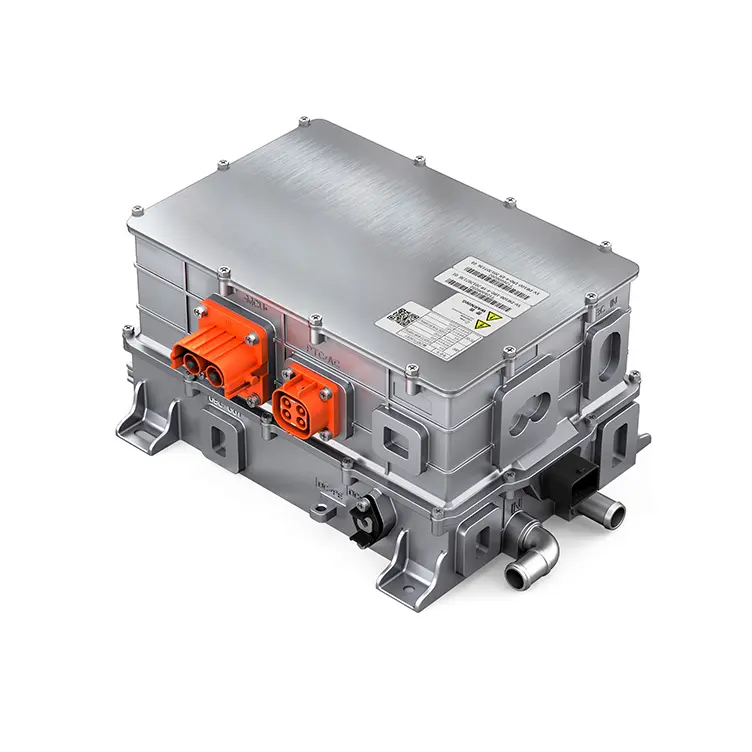

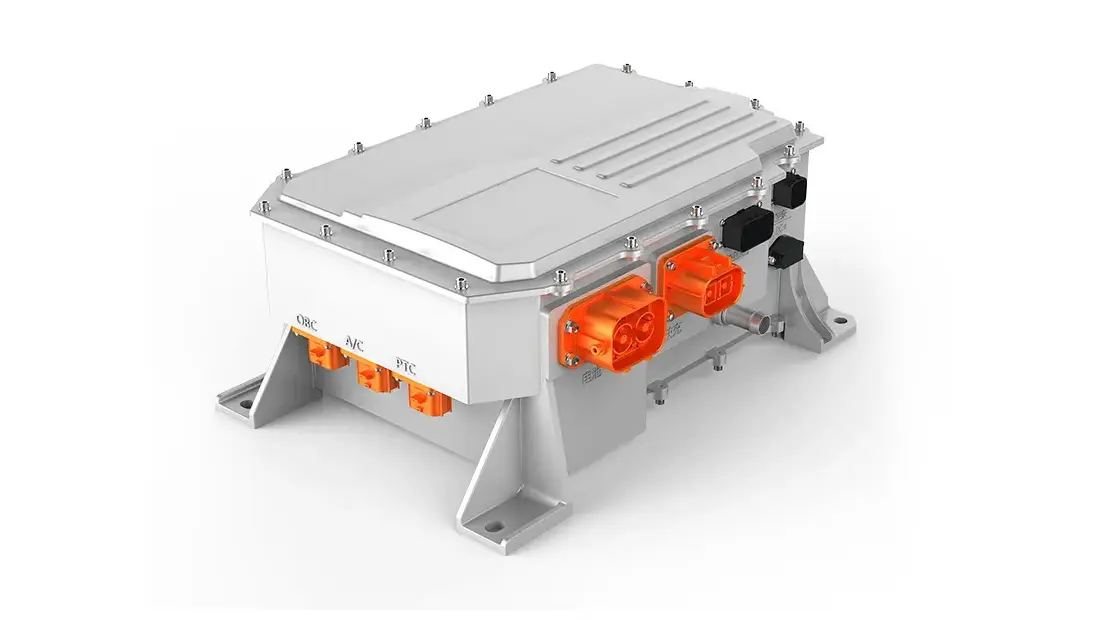

On November 8, 2025, China’s Ministry of Commerce and the General Administration of Customs will implement new export controls on specific lithium batteries, materials, and production equipment. The regulation covers rechargeable lithium-ion cells or packs with an energy density of 300 Wh/kg or above, alongside certain cathode and anode materials and manufacturing machinery.

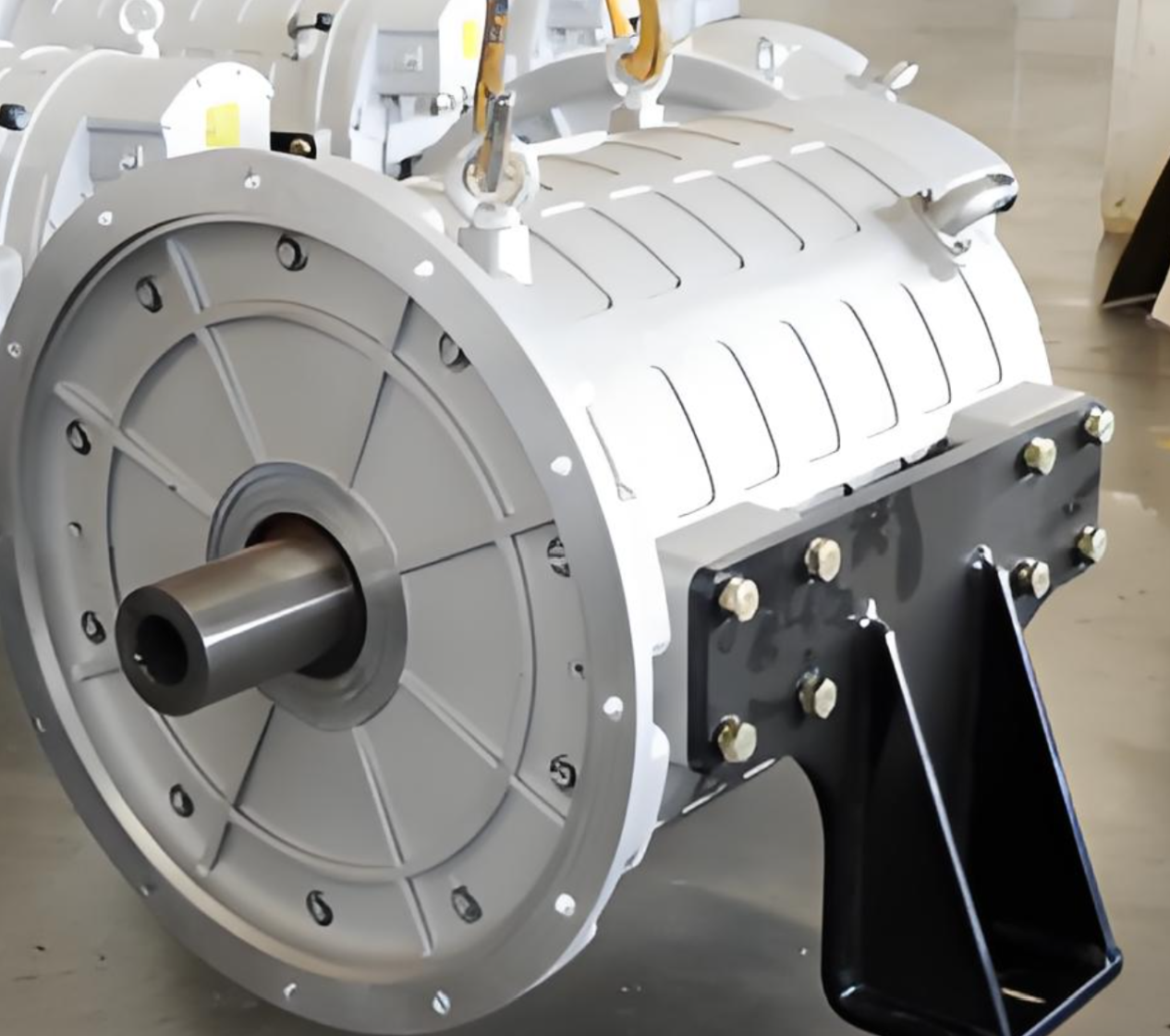

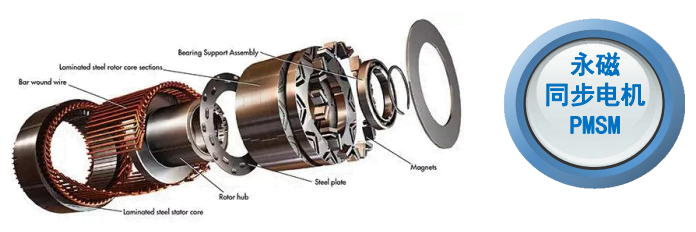

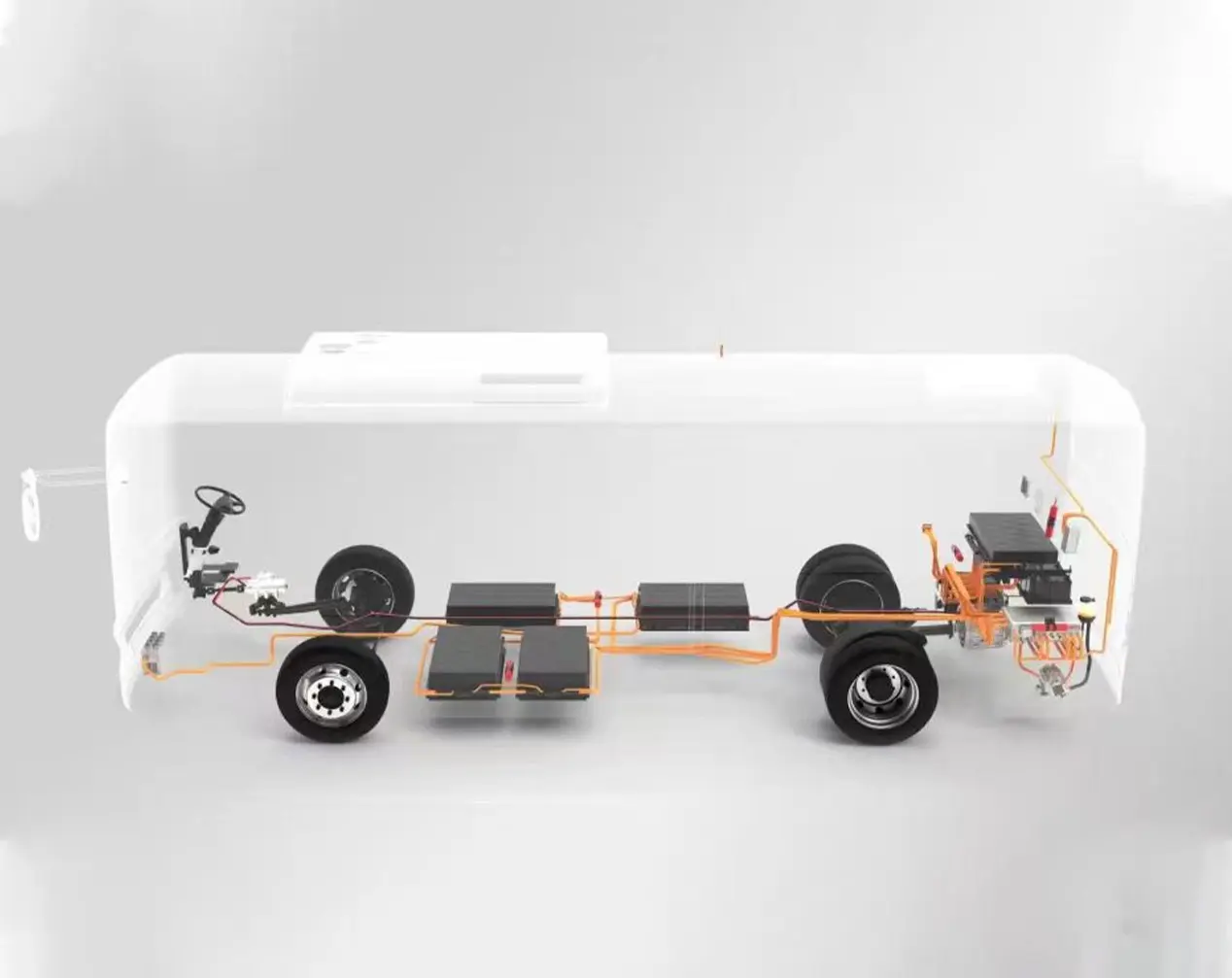

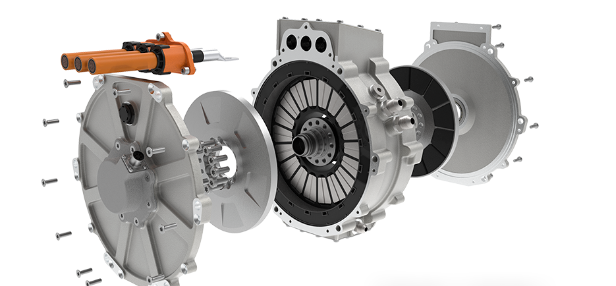

Simultaneously, rare earth permanent magnet materials — critical to high-efficiency electric motors — have come under stricter export scrutiny. This move marks a dual-front adjustment: battery export control ensures technology security, while rare earth regulation strengthens resource control. Together, they signal a shift from scale-based growth to quality- and security-based development in China’s new energy strategy.

Scope and Technical Thresholds

The lithium battery regulation defines a clear threshold at 300 Wh/kg, targeting high-performance, next-generation cells. Most mainstream EV and ESS (energy storage system) batteries remain below this level, minimizing immediate disruption.

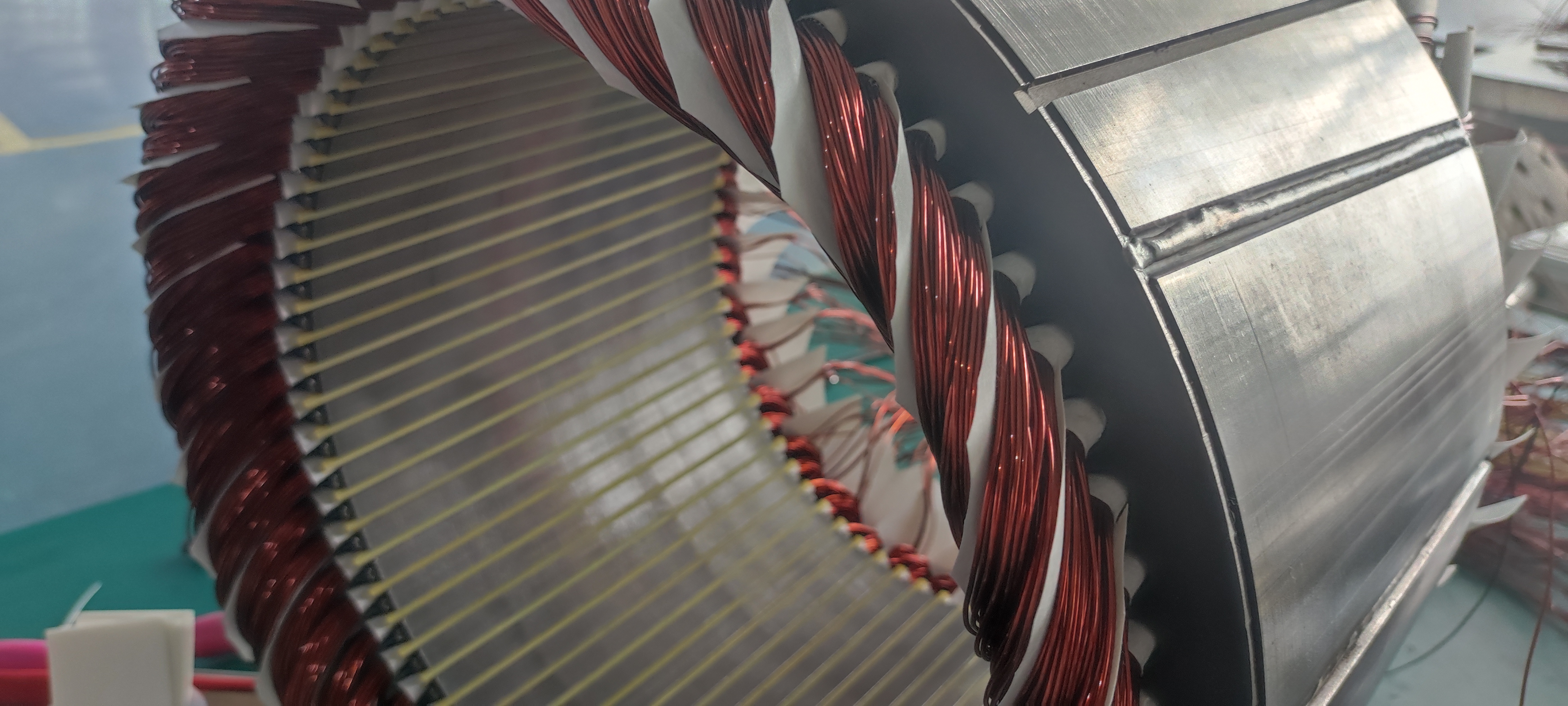

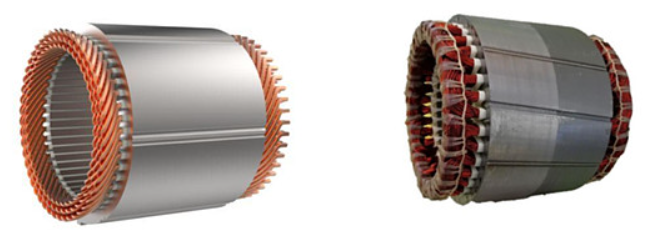

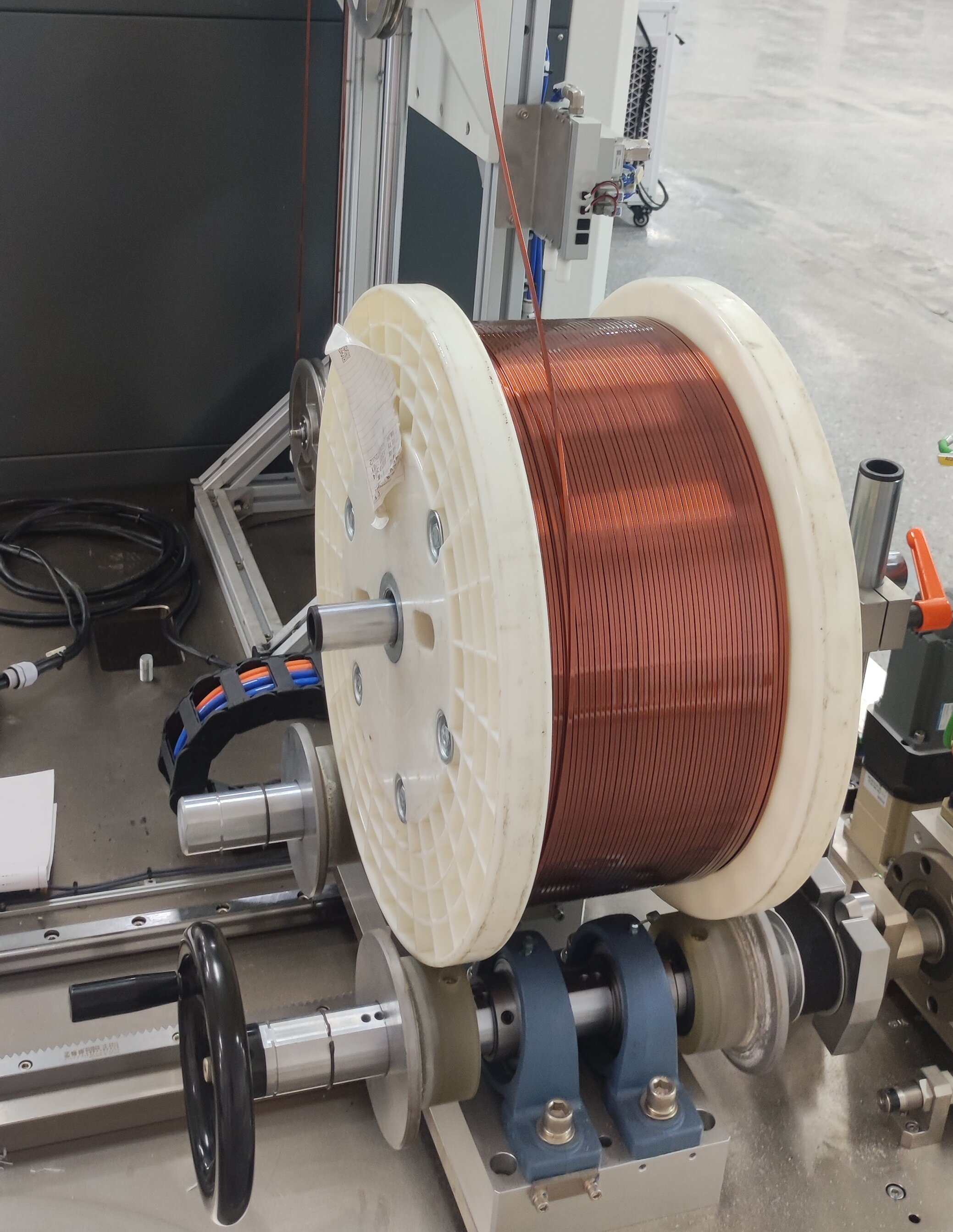

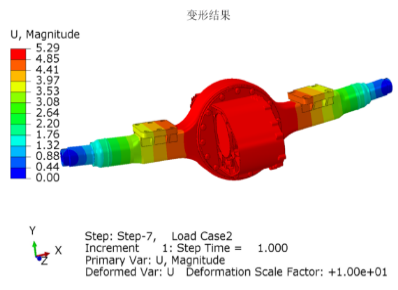

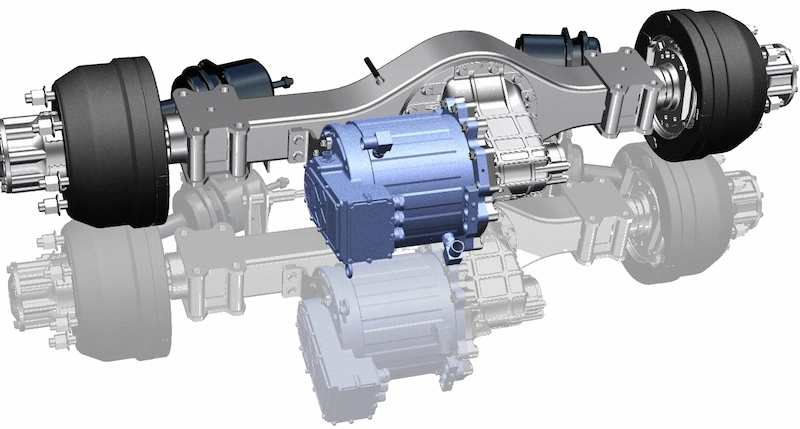

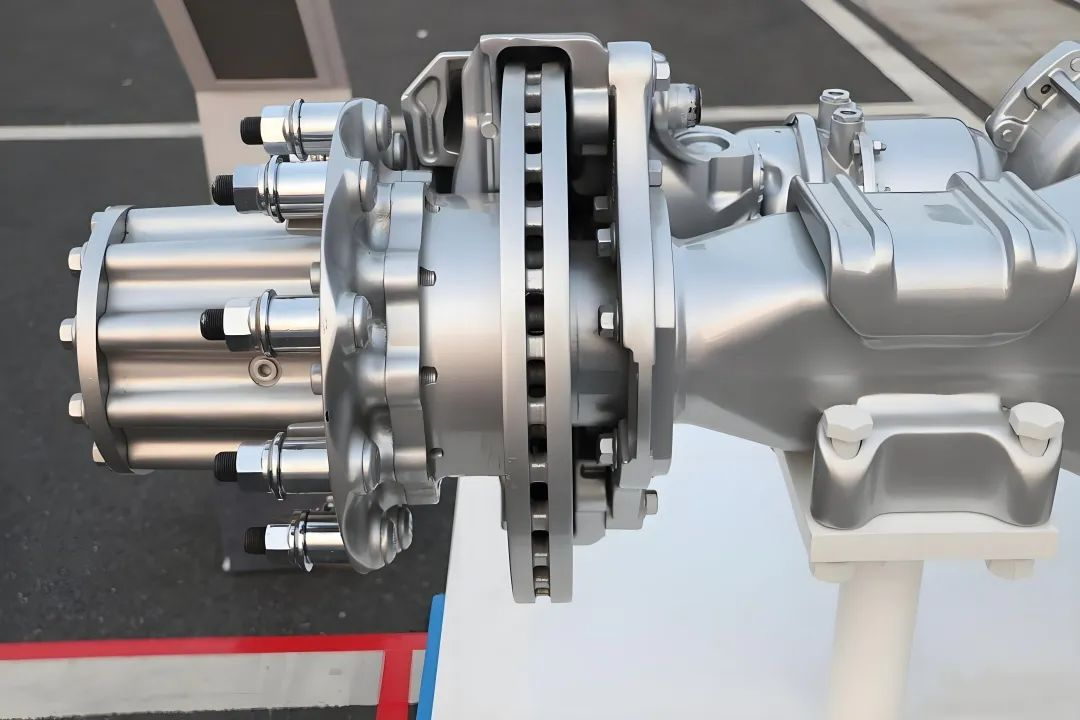

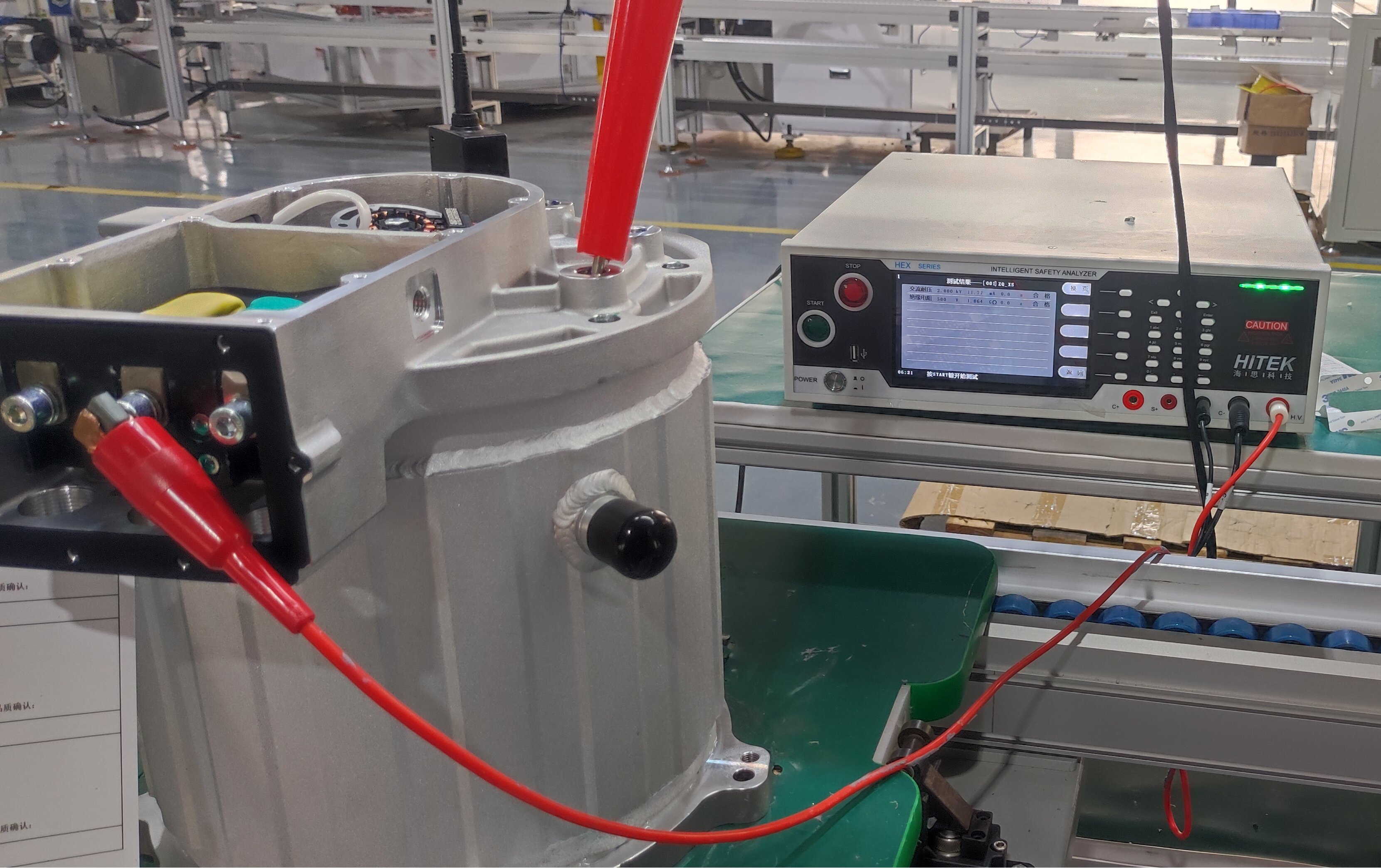

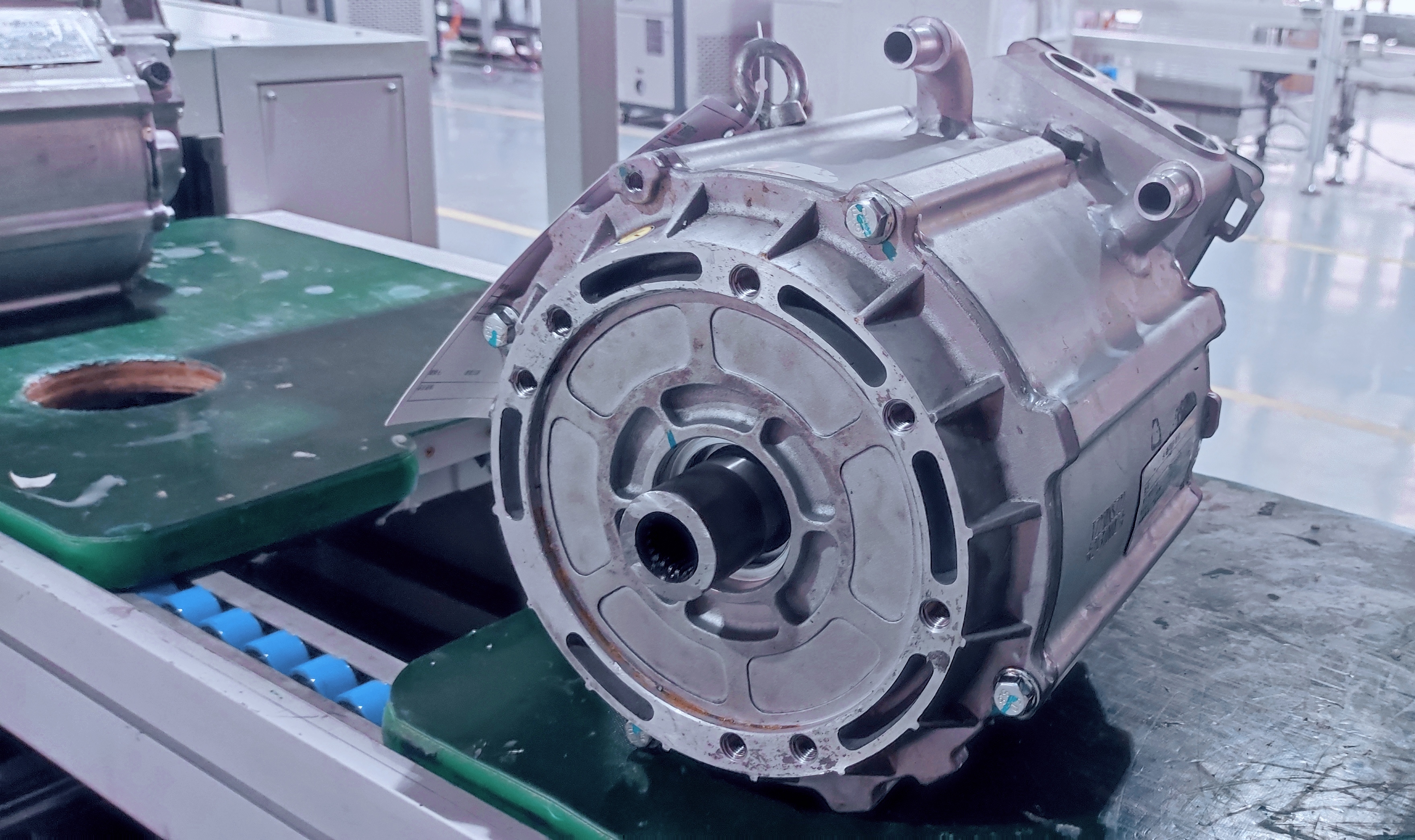

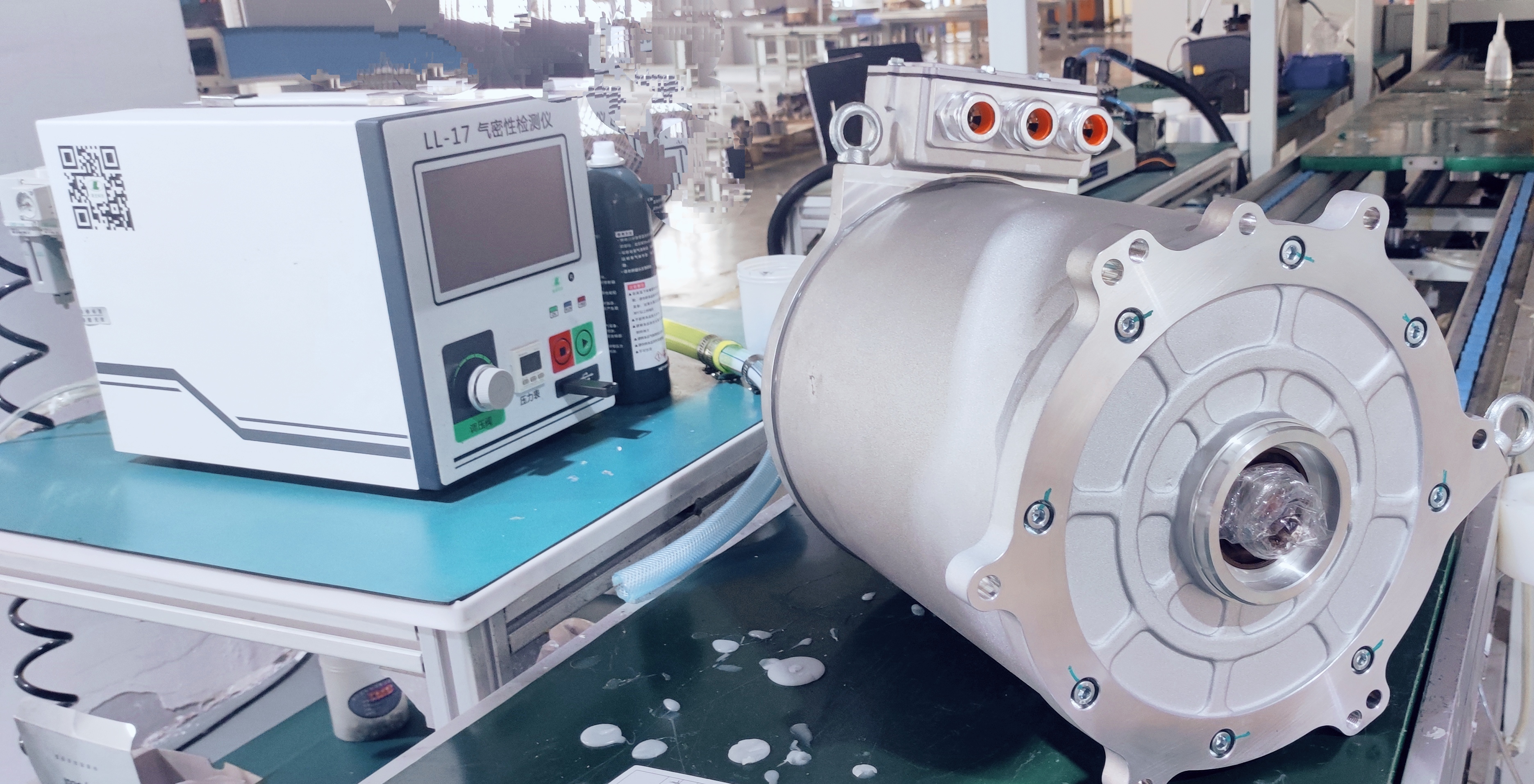

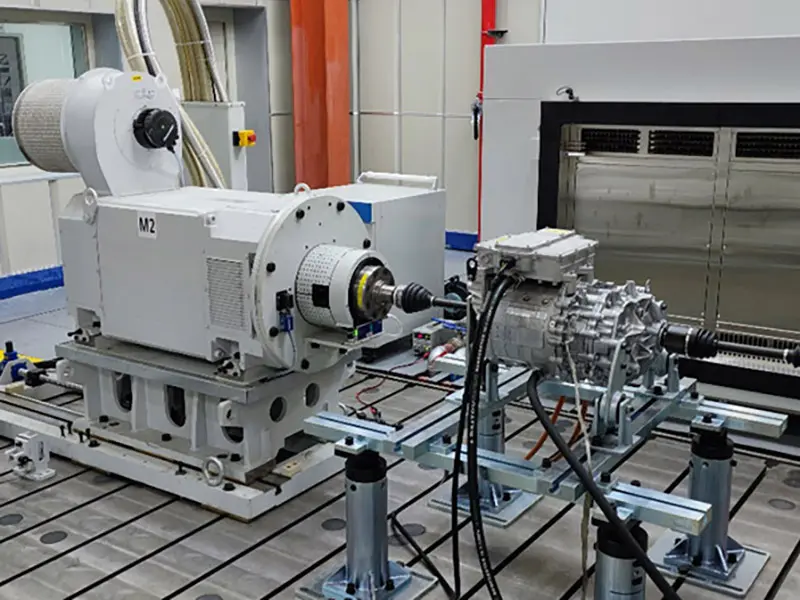

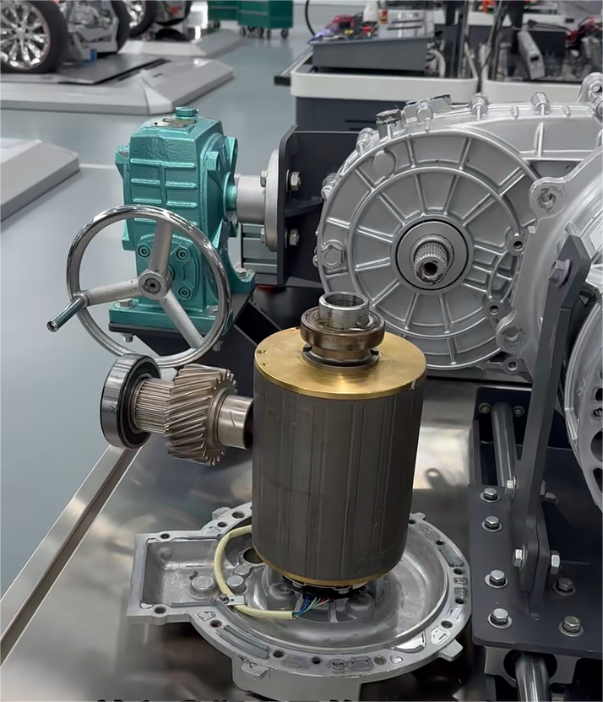

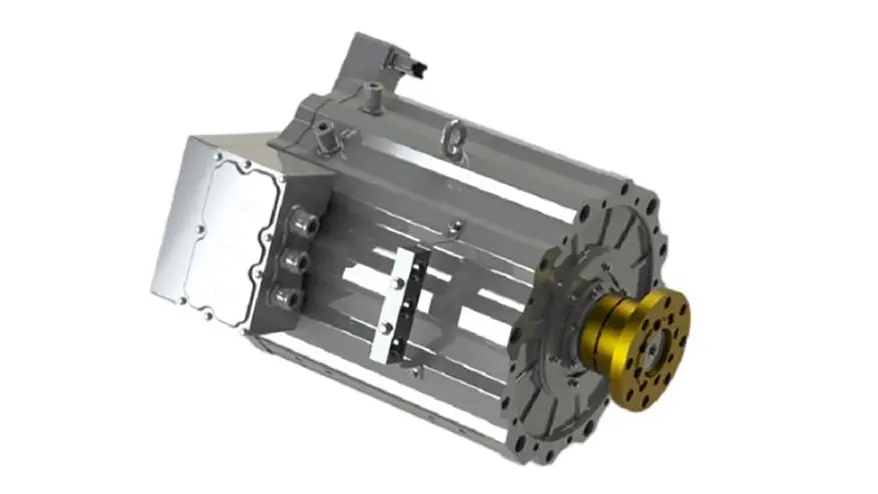

For rare earths, recent policy refinements expand control to include NdFeB magnetic materials, high-purity metal powders, and advanced sintering or coating technologies used in permanent magnet production. These components are essential for electric vehicle motors, wind turbine generators, and precision aerospace systems. The export of such materials now requires a licensing process similar to that of strategic dual-use goods.

Global Supply Chain Implications

The combined effect of lithium battery and rare earth export controls could reshape global supply chains for electric vehicles, renewable energy, and advanced electronics.

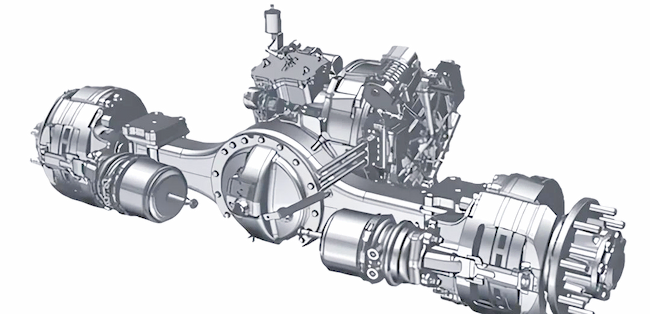

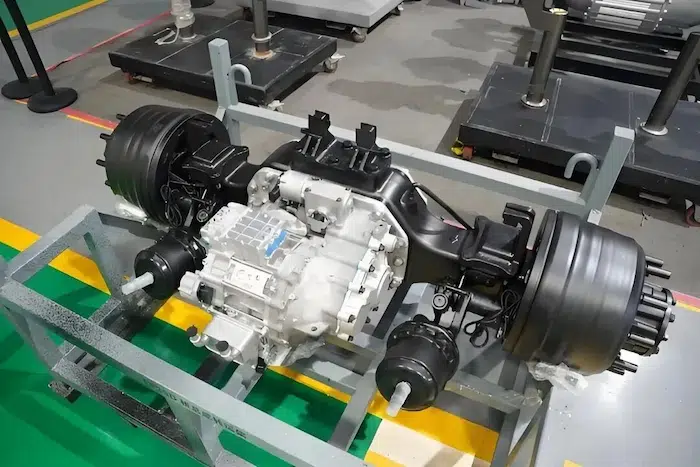

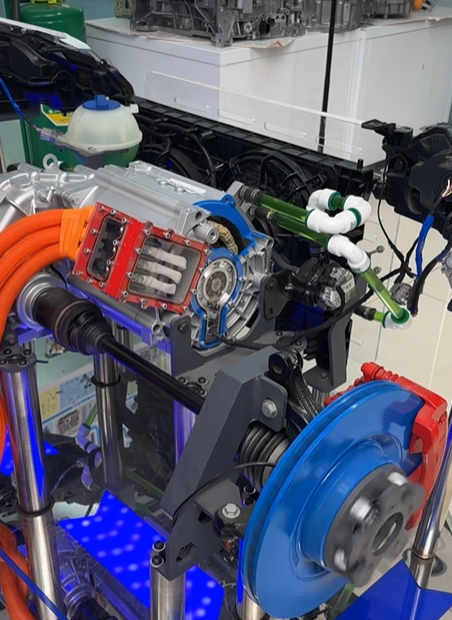

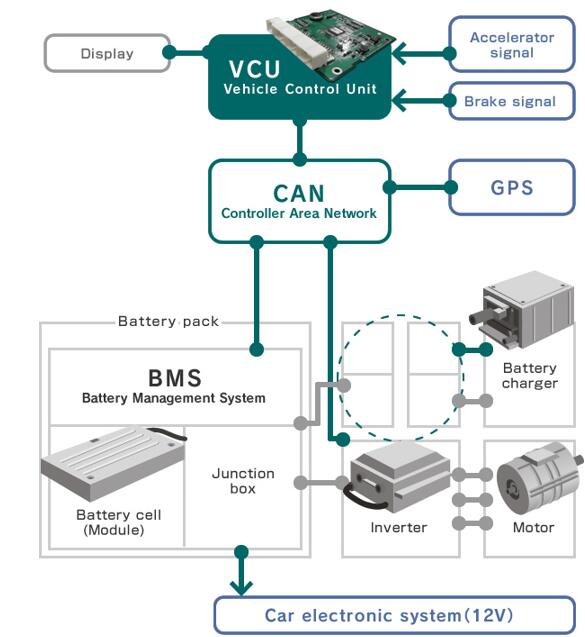

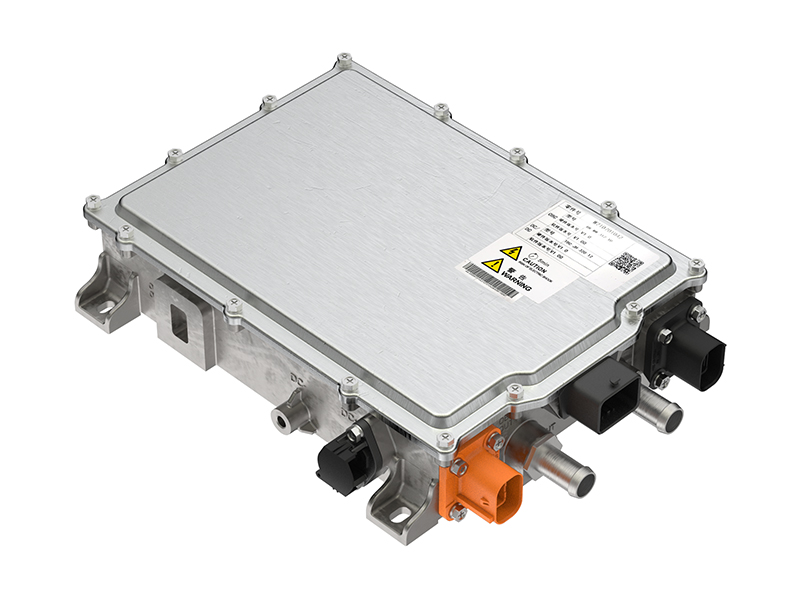

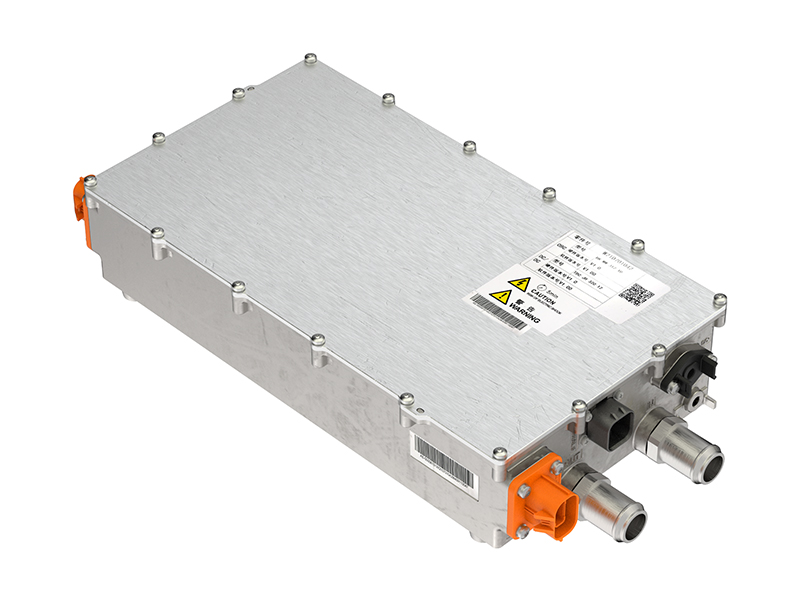

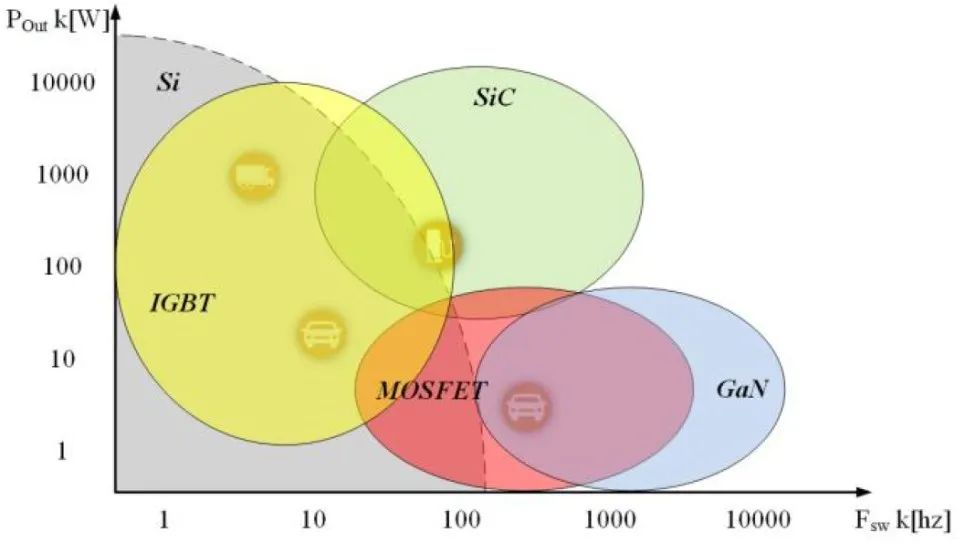

While lithium battery restrictions mainly influence energy storage density and performance in EVs, the rare earth measures directly affect motor efficiency and power output. Together, they touch two irreplaceable pillars of electrification — energy and motion.

Europe, Japan, and North America, which depend heavily on Chinese rare earth magnets and high-density battery cells, are expected to face supply challenges. The measures may accelerate localization of manufacturing, stimulate alternative material research, and promote joint ventures in friendly jurisdictions to secure stable access to key components.

Differentiated Impact on Domestic Enterprises

Domestically, the new policy environment will drive further differentiation within the industry.

Tier-one manufacturers with mature export compliance systems, strong R&D, and government alignment will consolidate advantages and gain greater control over licensing and quota allocations.

Mid- and small-sized exporters dependent on low-cost production may experience decreased flexibility and higher compliance costs, leading to industry consolidation and technological upgrading.

For the rare earth sector, integration across mining, separation, alloying, and magnet fabrication is becoming the mainstream trend. Companies capable of achieving full-chain control — from ore to motor component — will secure stronger positions under the export license regime.

Strategic Intent: From Scale Expansion to Resource Sovereignty

China’s dual control on lithium batteries and rare earths reflects a strategic transition: from being the “factory of the world” to becoming the technological and resource core of the green transition.

With over 1,000 GWh of annual battery capacity and 91% global market share in rare earth permanent magnets, China is reinforcing both ends of the energy supply chain — advanced materials and system integration.

By securing control over the export of high-value technologies and rare raw materials, China not only safeguards its national security and intellectual property, but also shapes global industrial dependencies.

Catalyst for Technological Innovation

Restrictions are not merely defensive—they act as a stimulus for next-generation innovation.

For batteries, Chinese R&D institutions are pushing rapid progress in semi-solid-state and all-solid-state batteries, targeting 400–500 Wh/kg with higher safety.

For rare earths, focus has shifted toward grain boundary diffusion, hydrogen decrepitation recycling, and heavy rare earth substitution to reduce critical material consumption while maintaining magnetic performance.

Such dual innovation will strengthen China’s long-term competitiveness in both material science and applied engineering.

Recommended Strategies for Enterprises

1.Compliance and Export Licensing

Establish robust internal compliance frameworks to identify regulated products, obtain export licenses in advance, and maintain transparent reporting systems.

2.Technology Diversification

Develop parallel product lines — mainstream LFP or sodium-ion batteries for global mass markets, and solid-state systems for advanced applications.

3.Resource and Supply Chain Resilience

Secure rare earth and lithium upstream resources through equity participation, recycling systems, or international partnerships to mitigate supply shocks.

4.Localized Global Operations

Explore joint ventures, OEM cooperation, or technical licensing in key markets to reduce regulatory friction while maintaining technological influence.

5.Industry Collaboration and Policy Dialogue

Work closely with regulators, industry associations, and research bodies to shape future policy execution and build a transparent export environment.

Conclusion

China’s new export controls on high-energy-density lithium batteries and rare earth materials represent a comprehensive adjustment of the global energy supply architecture. While the short-term effect may be limited to high-end products, the long-term significance is profound: it redefines how technology, resources, and national strategy intertwine in the era of electrification.

By controlling the “brains” (battery technology) and the “muscles” (magnetic materials) of the green transition, China is consolidating its position as the anchor of the global new energy ecosystem—balancing innovation, security, and sustainable development.