Analysis of Rare Earth Trends in Electric Vehicle Permanent Magnet Synchronous Motor (PMSM) Applications (As of July 2025)

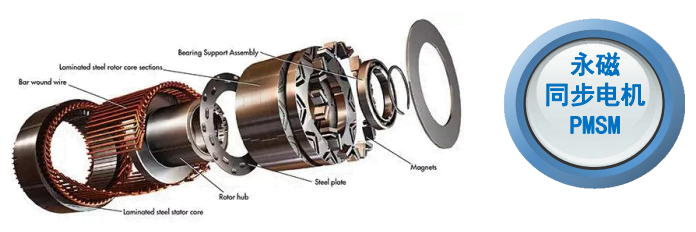

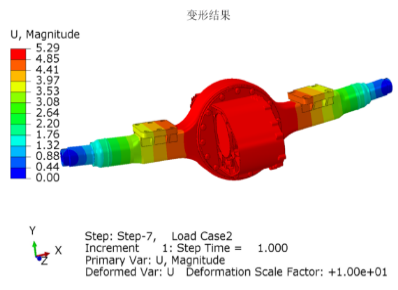

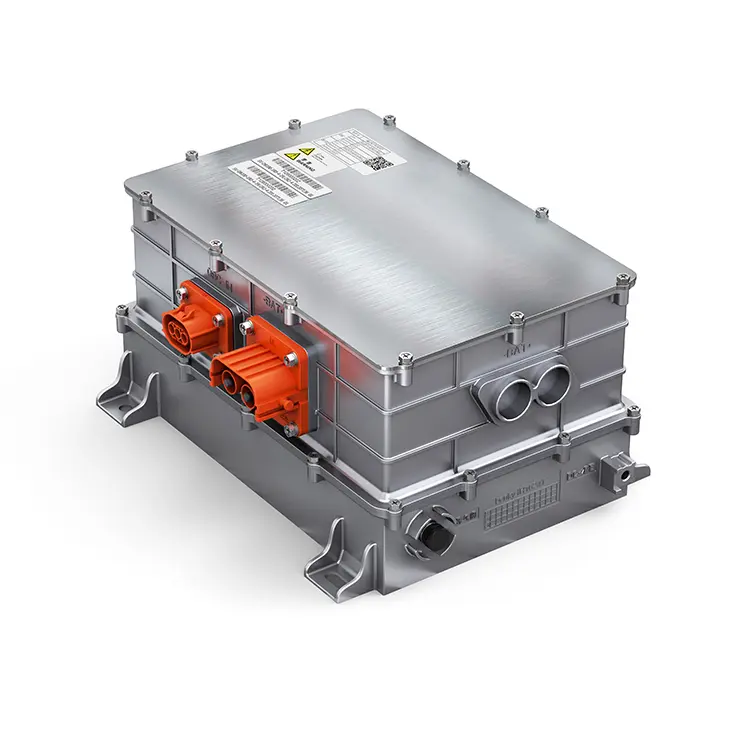

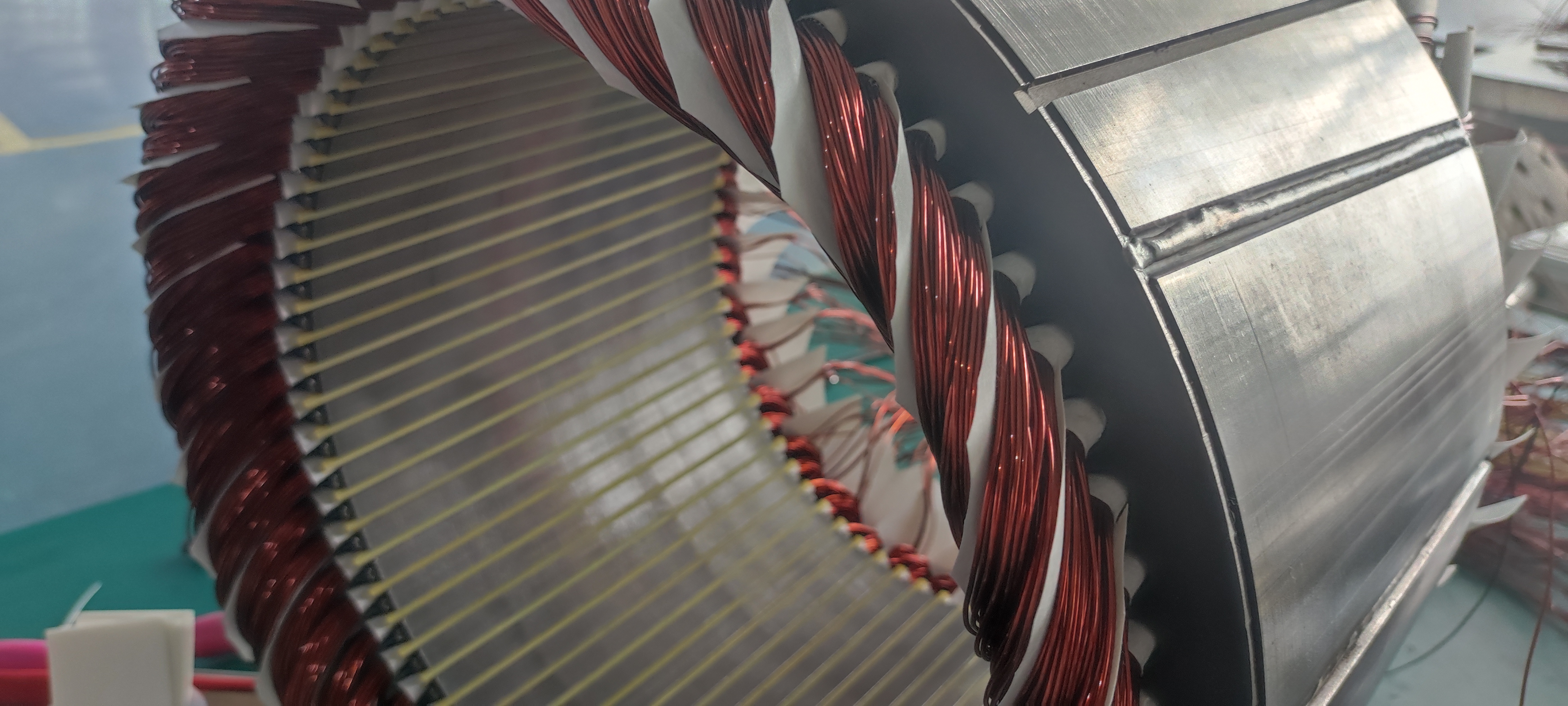

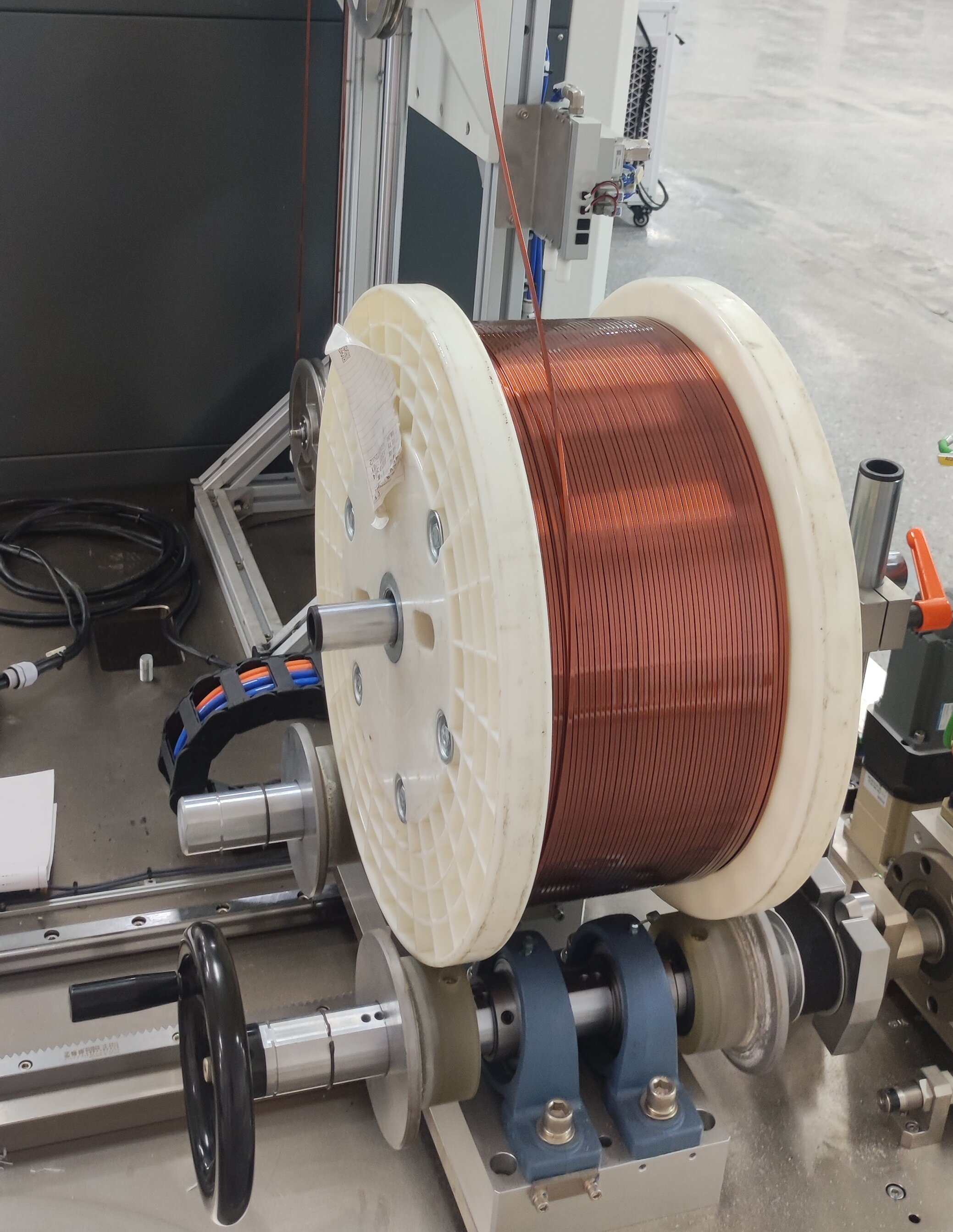

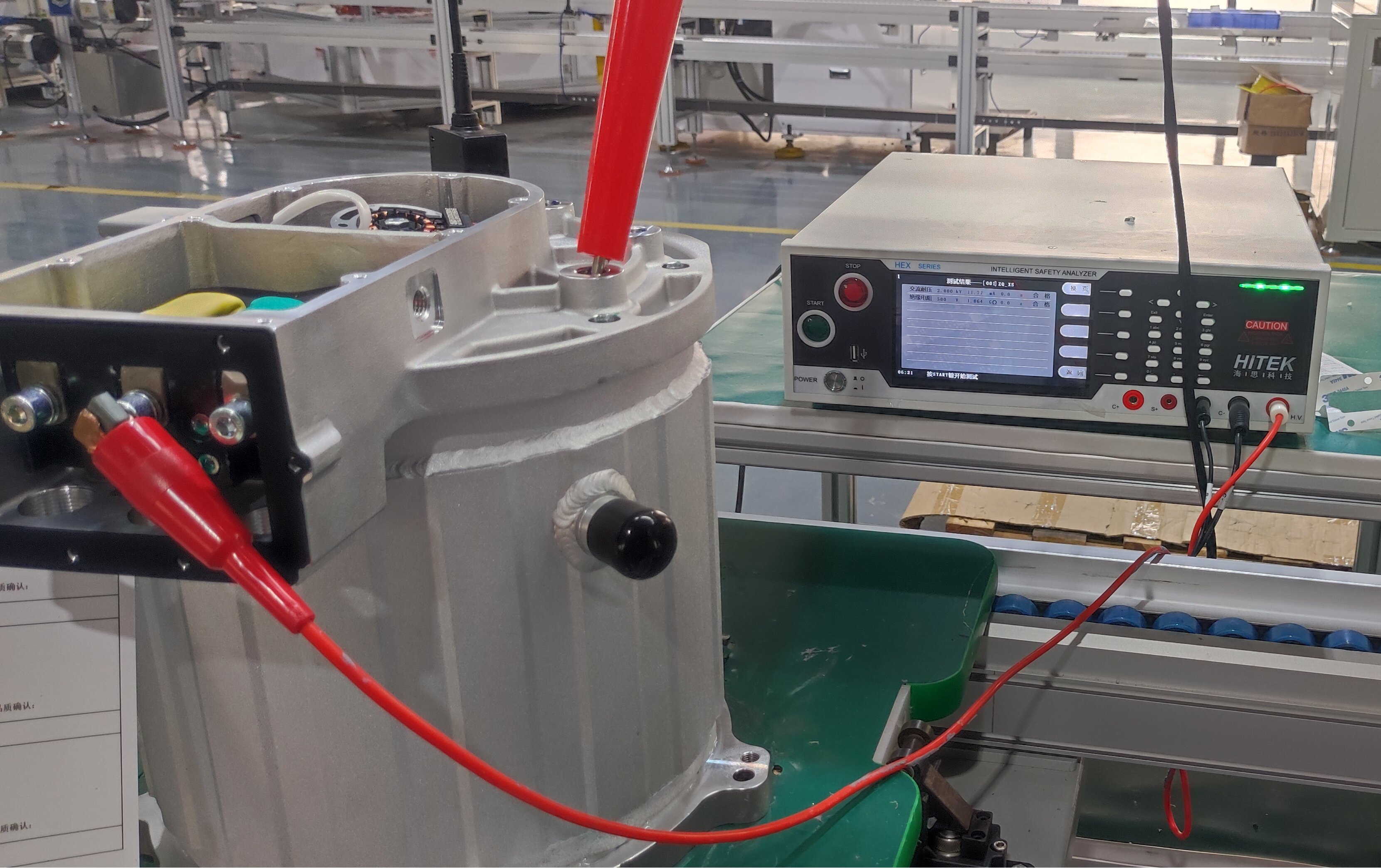

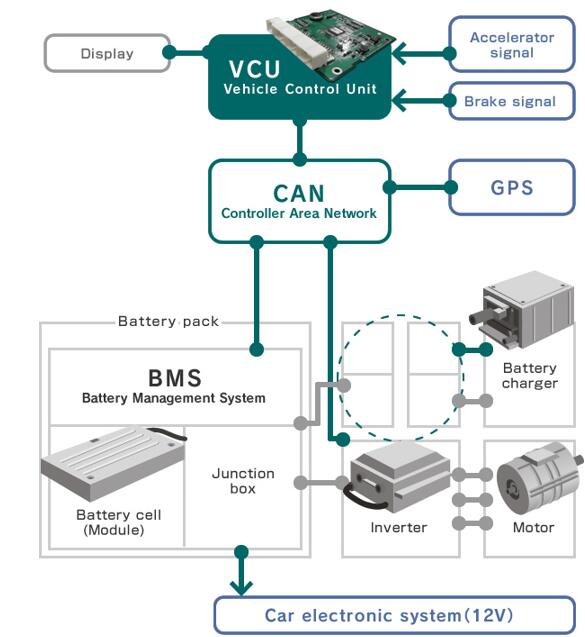

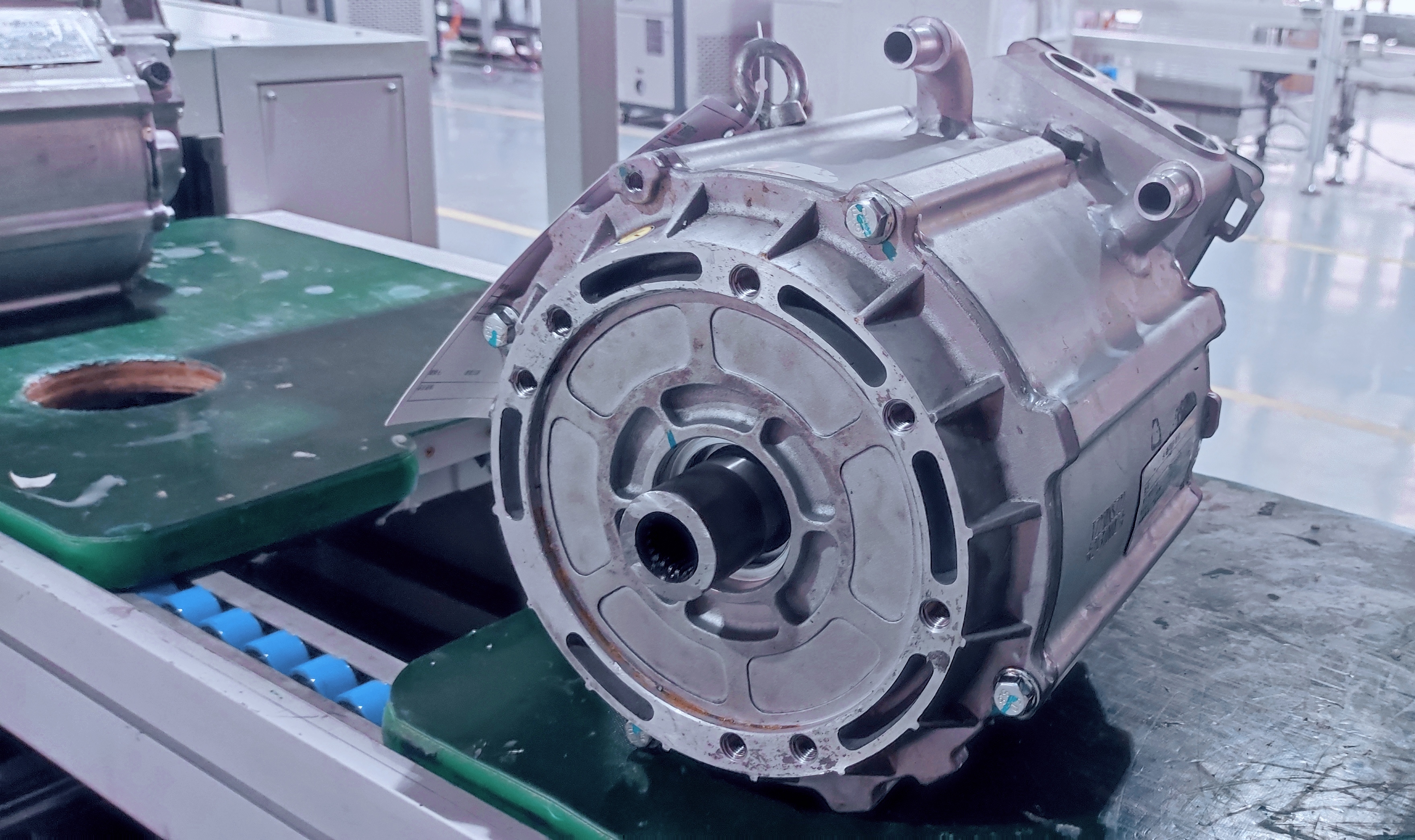

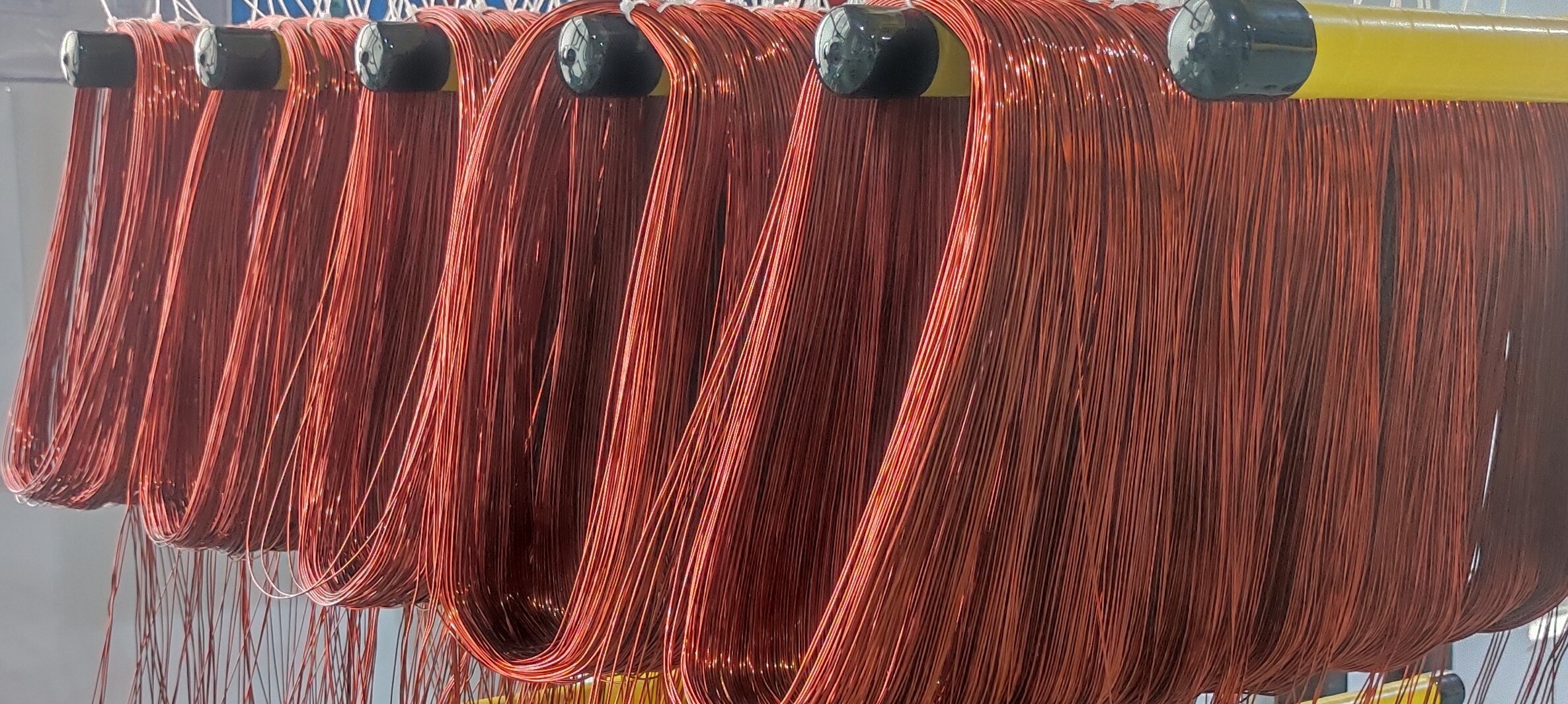

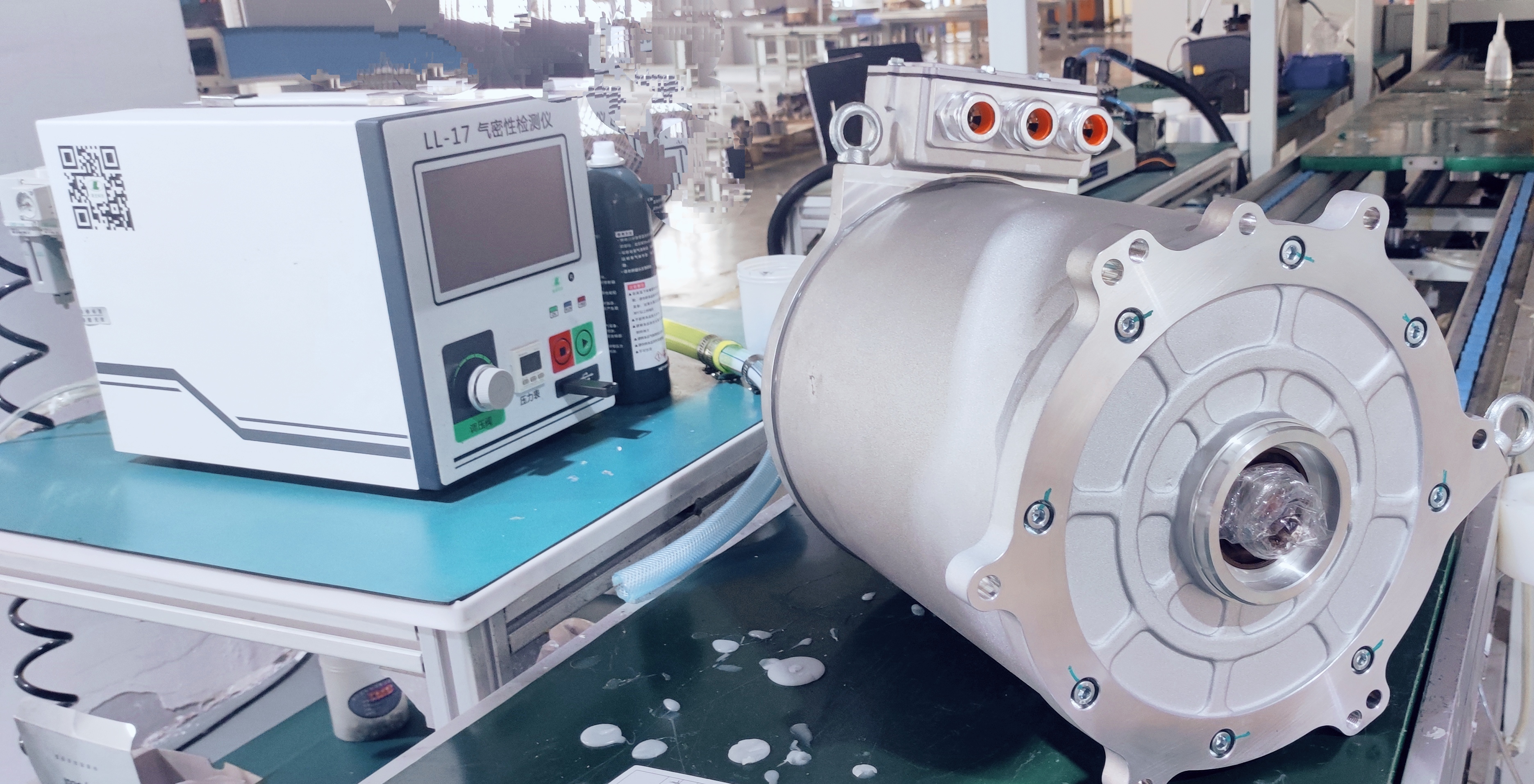

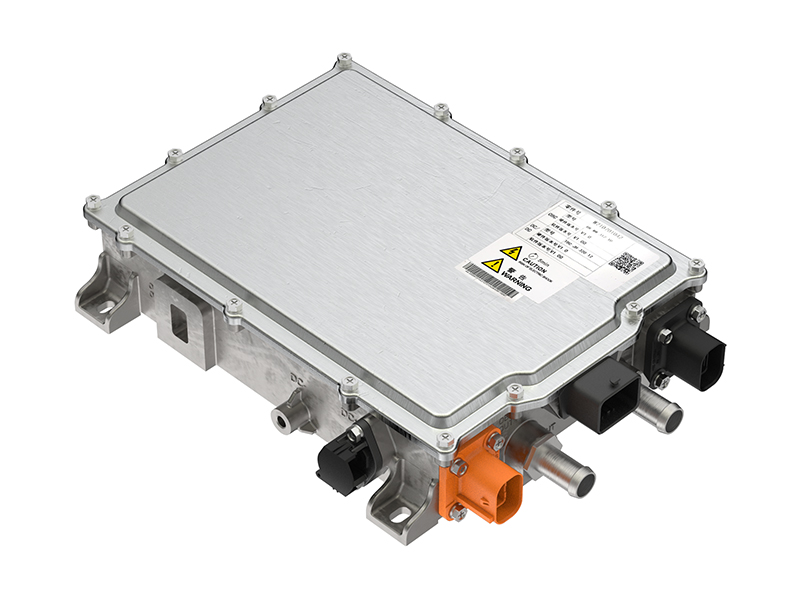

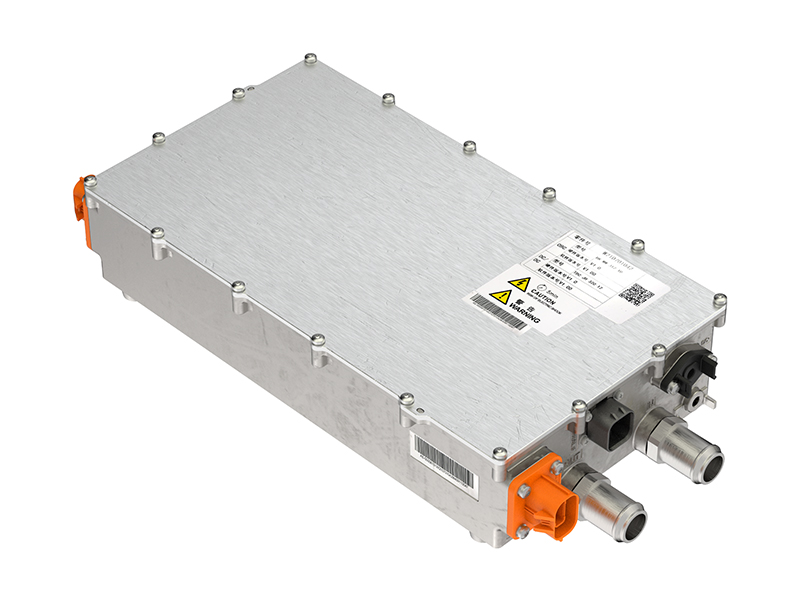

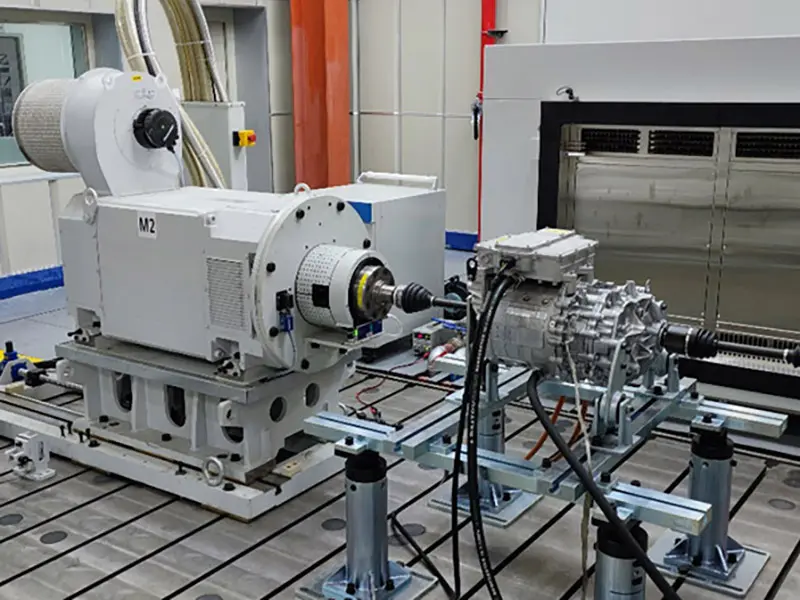

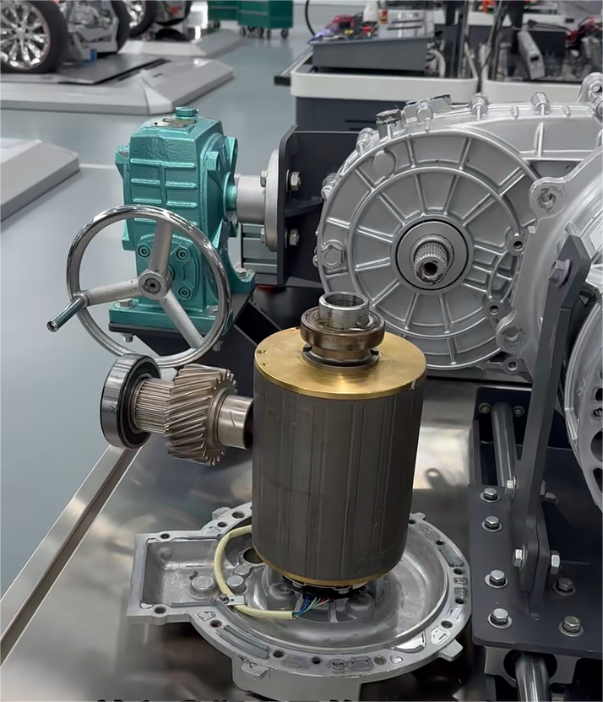

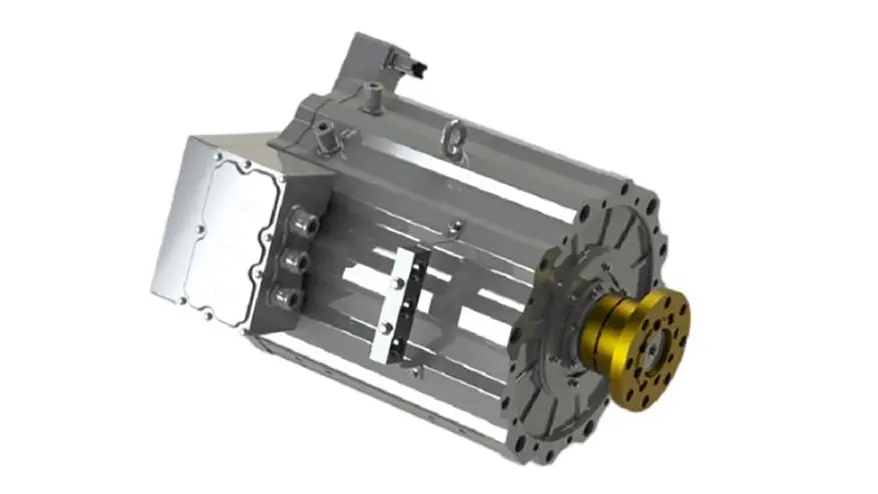

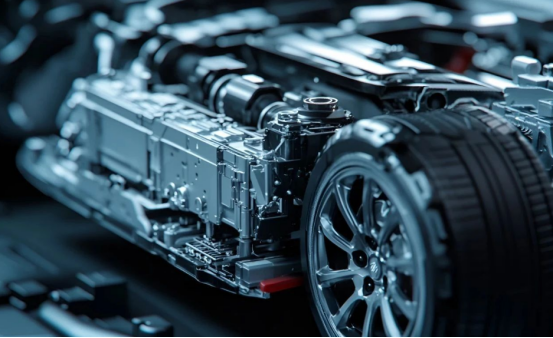

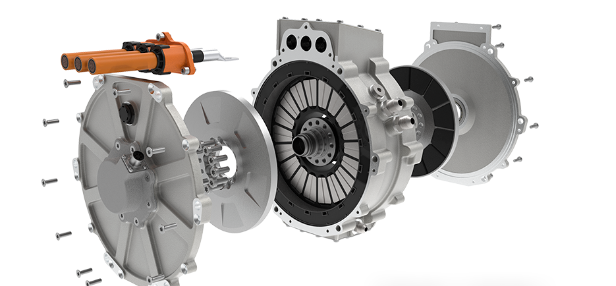

Permanent magnet synchronous motors (PMSMs) are a core application scenario for rare earth elements, with their performance heavily dependent on neodymium (Nd), dysprosium (Dy), and terbium (Tb)—rare earth materials accounting for over 20% of the motor’s total weight. These materials are used to manufacture high-performance permanent magnets, enhancing motor efficiency, power density, and high-temperature stability. Below is an analysis of trends in rare earth usage for PMSMs, focusing on supply-demand dynamics, price trends, key drivers, and future outlook:

I. Supply-Demand Dynamics: Tight in the Short Term, Long-Term Reliance on Chinese Dominance

1.Supply Side: China’s Absolute Dominance, Short-Term Challenges Unlikely to Shift

China controls approximately 60% of global rare earth mining output and 90% of refining capacity, along with core technologies for separating and purifying medium-heavy rare earths (e.g., Dy, Tb) (e.g., Bayan Obo Mine, Ganzhou Mine in Jiangxi). In 2025, rare earth concentrate supply has tightened due to declining imports from Myanmar during the rainy season, stalled U.S. mine imports, and domestic environmental production restrictions (e.g., Baotou Iron & Steel’s third-quarter rare earth concentrate price rose 1.51% month-on-month).

Additionally, China’s April 2025 implementation of export controls on medium-heavy rare earths (e.g., Dy, Tb requiring separate approval) has further intensified global supply tensions.

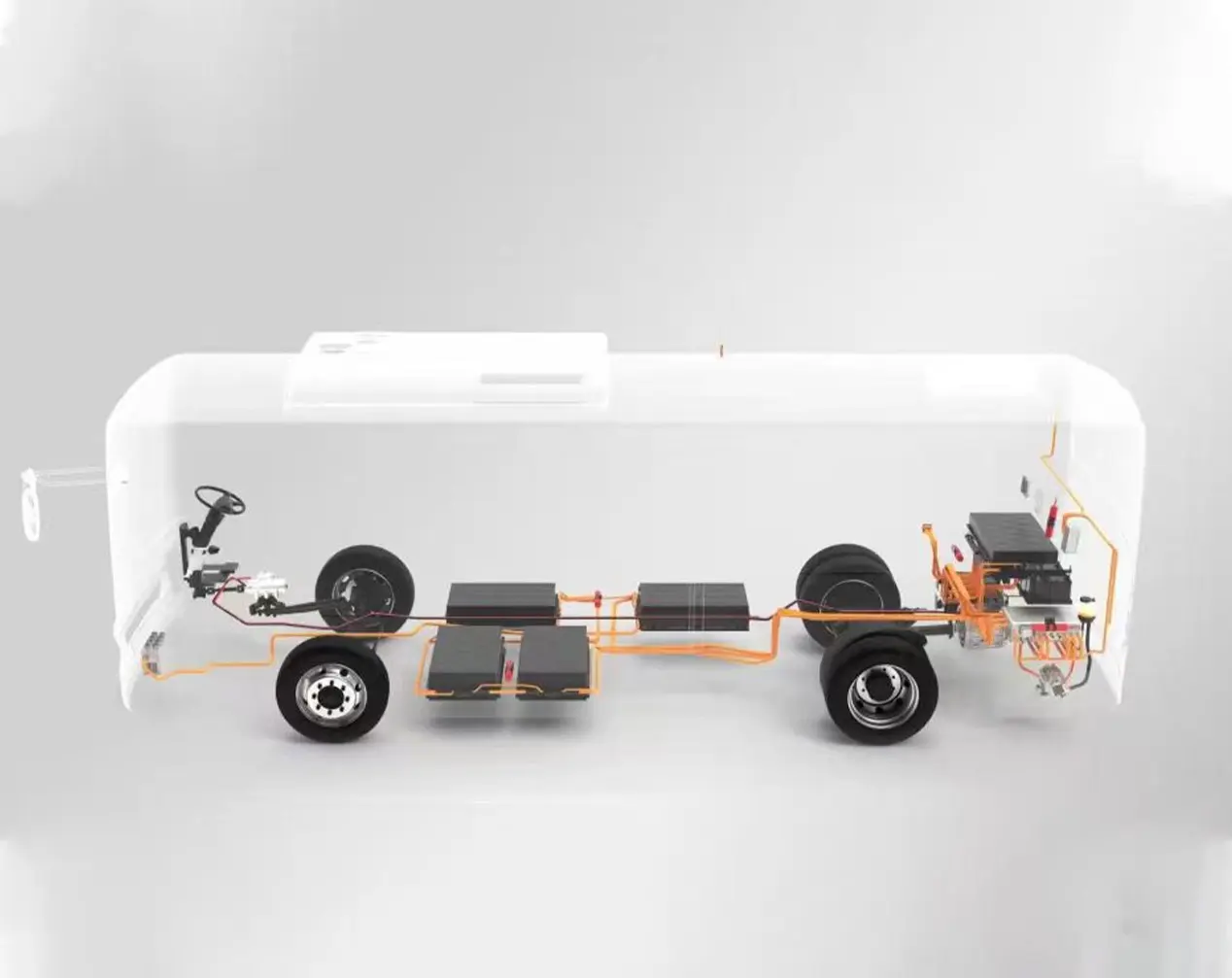

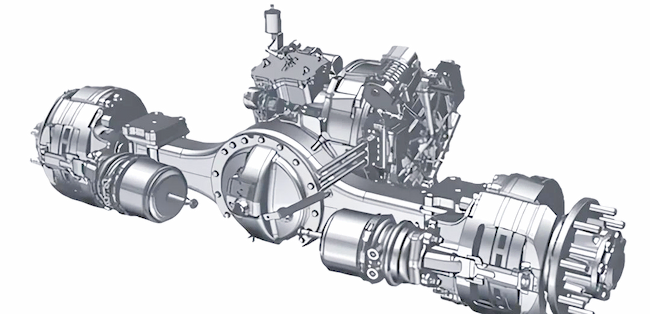

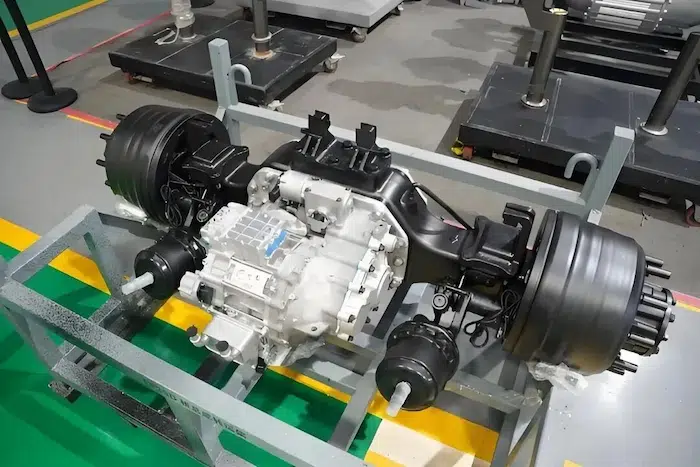

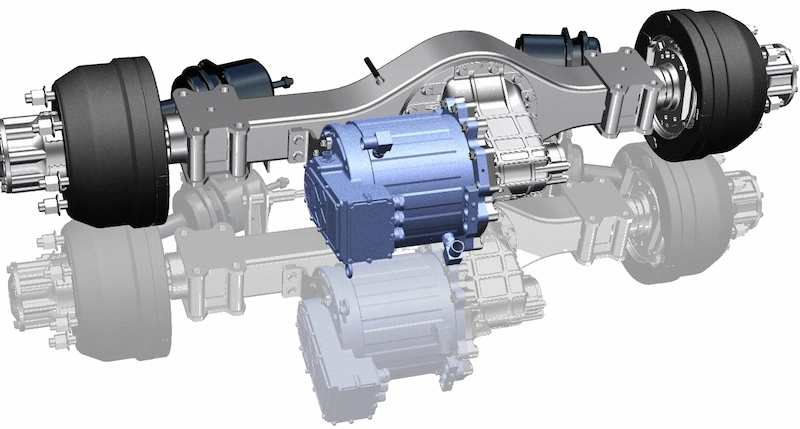

2.Demand Side: High Growth Driven by New Energy Vehicles

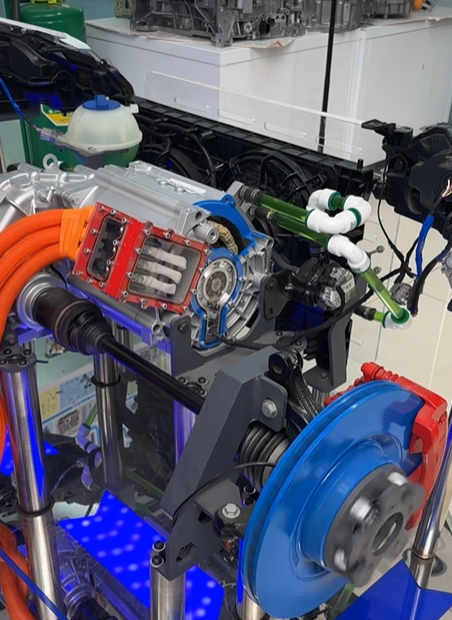

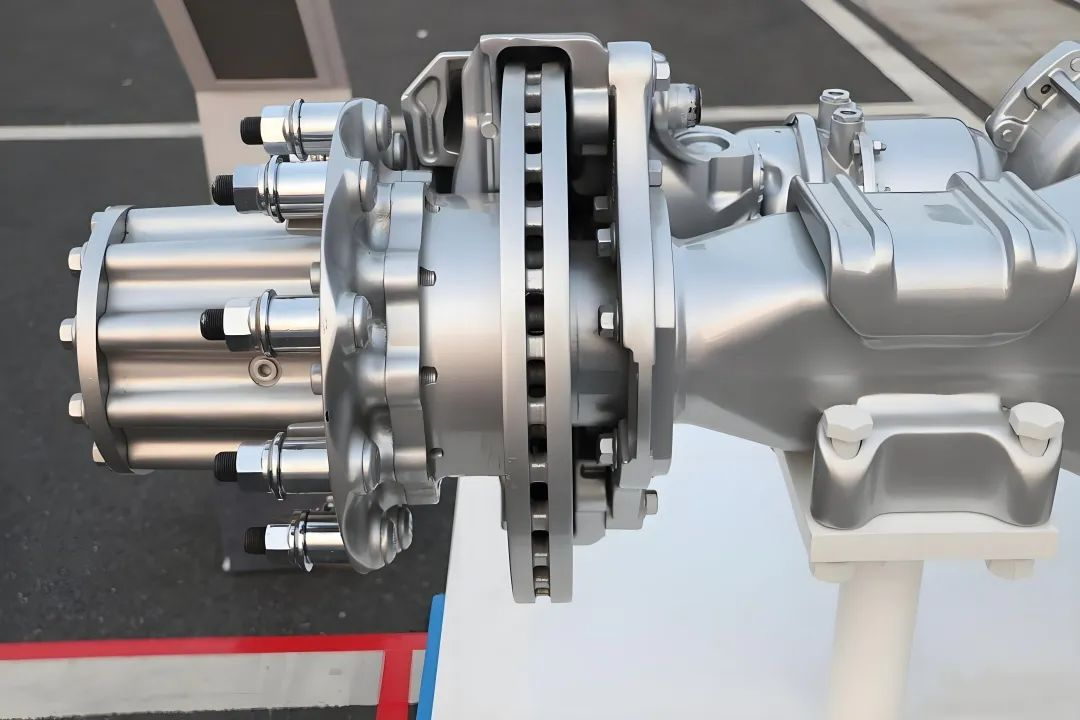

PMSMs are the mainstream technology for NEV motors (accounting for over 80% of applications). Their permanent magnet demand has surged with the rapid growth of NEV sales. Data from the International Energy Agency (IEA) shows global NEV sales are projected to reach 10 million units in 2025 (a 50% year-on-year increase), driving demand for rare earth permanent magnet materials (e.g., NdFeB) to grow by over 20%.

As the world’s largest NEV market (China’s 2025 NEV production is expected to reach 5 million units), China’s demand for rare earth permanent magnet materials exceeds 150,000 tons, accounting for over 30% of global demand.

II. Price Trends: Volatile Upswing in the Short Term, Supported by Supply-Demand Fundamentals Long-Term

Rare earth prices have trended upward with fluctuations since early 2025, driven by tight supply, strong demand, and policy impacts:

· Praseodymium-neodymium oxide (Pr-Nd oxide): July 2025 average price ≈ RMB 443,700/ton (up 3.4% month-on-month);

· Praseodymium-neodymium metal (Pr-Nd metal): July 2025 average price ≈ RMB 543,900/ton (up 3.2% month-on-month);

· Dysprosium oxide: July 2025 average price ≈ RMB 1.7 million/ton (slight weekly increase);

· Terbium oxide: July 2025 average price ≈ RMB 7.15 million/ton (slight weekly increase);

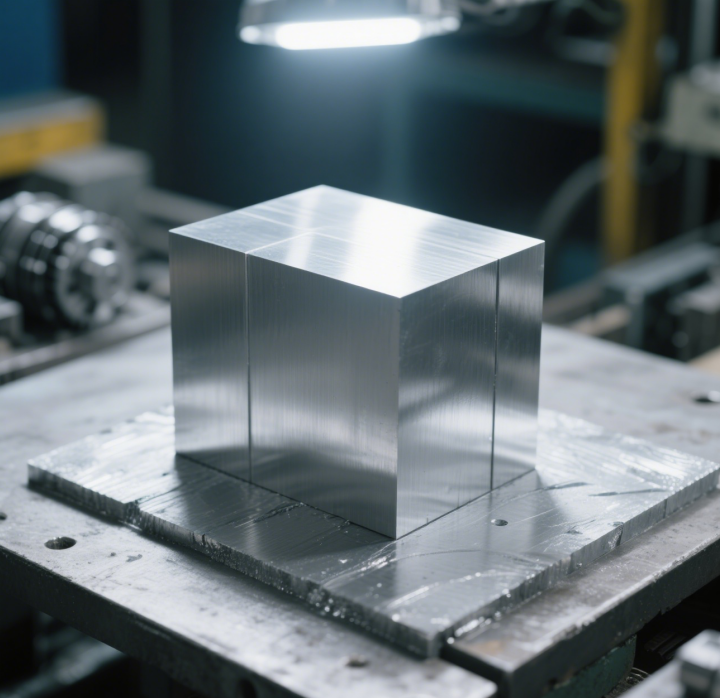

· NdFeB blanks: Driven by rising raw material costs, 55N blank blocks rose by RMB 3/kg; N35 and H35 blanks increased by 2.67% and 1.64%, respectively.

In the short term, supply tightness + demand growth will support high rare earth prices. Long-term trends depend on adjustments to China’s export policies and progress in diversifying overseas supply chains (e.g., the U.S. MP Materials’ Mountain Pass mine, set to begin production in 2028, but with no clear timeline for medium-heavy rare earth separation capacity).

III. Key Drivers: Policy, Technology, and Market Convergence

1. Policy Drivers: China’s Regulatory Measures Strengthen Supply Chain Security

China has implemented policies such as export controls and total output quotas to ensure rational utilization of rare earth resources (e.g., raising export tariffs and restricting medium-heavy rare earth exports in 2025), driving global rare earth price increases.

2. Technology Drivers: NEV Performance Relies on Rare Earth Permanent Magnets

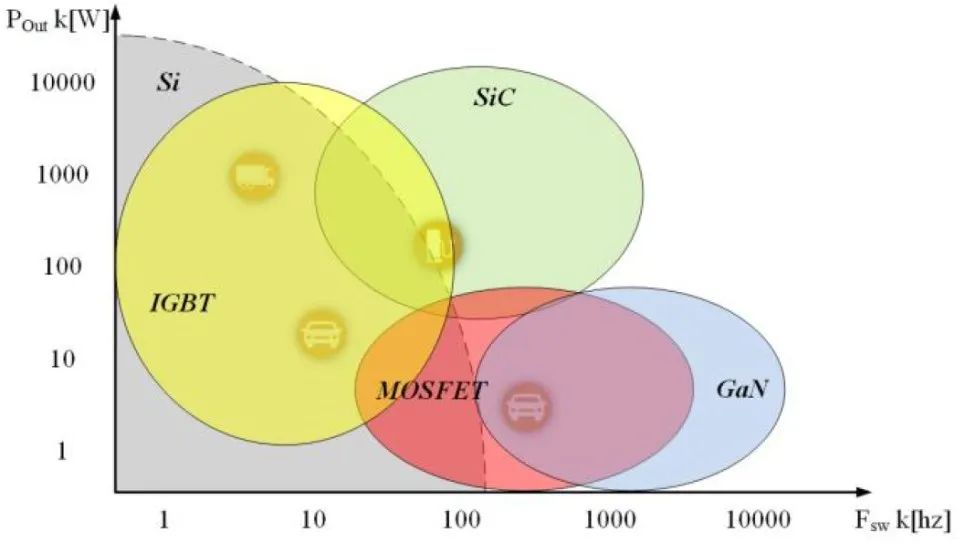

The high magnetic energy product and coercivity of rare earth permanent magnets (e.g., NdFeB) are critical for PMSMs to achieve high power density (e.g., Tesla Model 3 motors achieve 93% efficiency). Technological substitutes (e.g., ferrite magnets) are unlikely to replace them in the short term.

3. Market Drivers: Explosive Growth in the NEV Market

Continuous growth in global NEV sales (projected to reach 10 million units in 2025) has fueled surging demand for PMSM motors, thereby driving demand for rare earth permanent magnet materials.

IV. Future Outlook: Short-Term High Volatility, Long-Term Dependent on Technology and Supply Chains

1. Short Term (2025–2026):

Prices: Supported by supply tightness + demand growth, rare earth prices will remain high with fluctuations (Pr-Nd oxide may trade in the RMB 400,000–500,000/ton range; NdFeB blanks in the RMB 40–50/kg range).

o Supply-Demand: China will continue to dominate global rare earth supply, while overseas supply chains (e.g., U.S., Australia) are unlikely to bridge the gap in the near term.

2. Medium to Long Term (2027 and Beyond):

o Technology Substitution: Developments in rare-earth-free motors (e.g., induction motors, switched reluctance motors) and low-rare-earth magnets (e.g., cerium-doped NdFeB) may alleviate rare earth demand pressure, but large-scale application is unlikely in the short term.

o Supply Chain Restructuring: Efforts by the U.S., Japan, and other nations to “de-China” supply chains (e.g., the Quad’s collaborative rare earth mining projects) face challenges due to technological limitations (e.g., separation and purification), higher costs (30%–50% greater than China’s), and time constraints (5–10 years to scale), making it difficult to challenge China’s dominance.

Risk Warnings

.Policy Risks: Adjustments to China’s rare earth export policies (e.g., relaxed controls) could ease supply tensions.

. Technological Risks: Breakthroughs in rare-earth-free or low-rare-earth magnet technologies could reduce rare earth demand.

·Market Risks: Slower-than-expected NEV sales growth could dampen rare earth demand.

In summary, rare earth usage in EV PMSMs will maintain a high-volatility equilibrium in the short term, with long-term trends hinging on China’s policies, progress in overseas supply chain diversification, and the pace of technological substitution. Near-term dynamics are driven by supply tightness and demand growth; medium- to long-term trends depend on the marginal impact of innovation on rare earth demand.