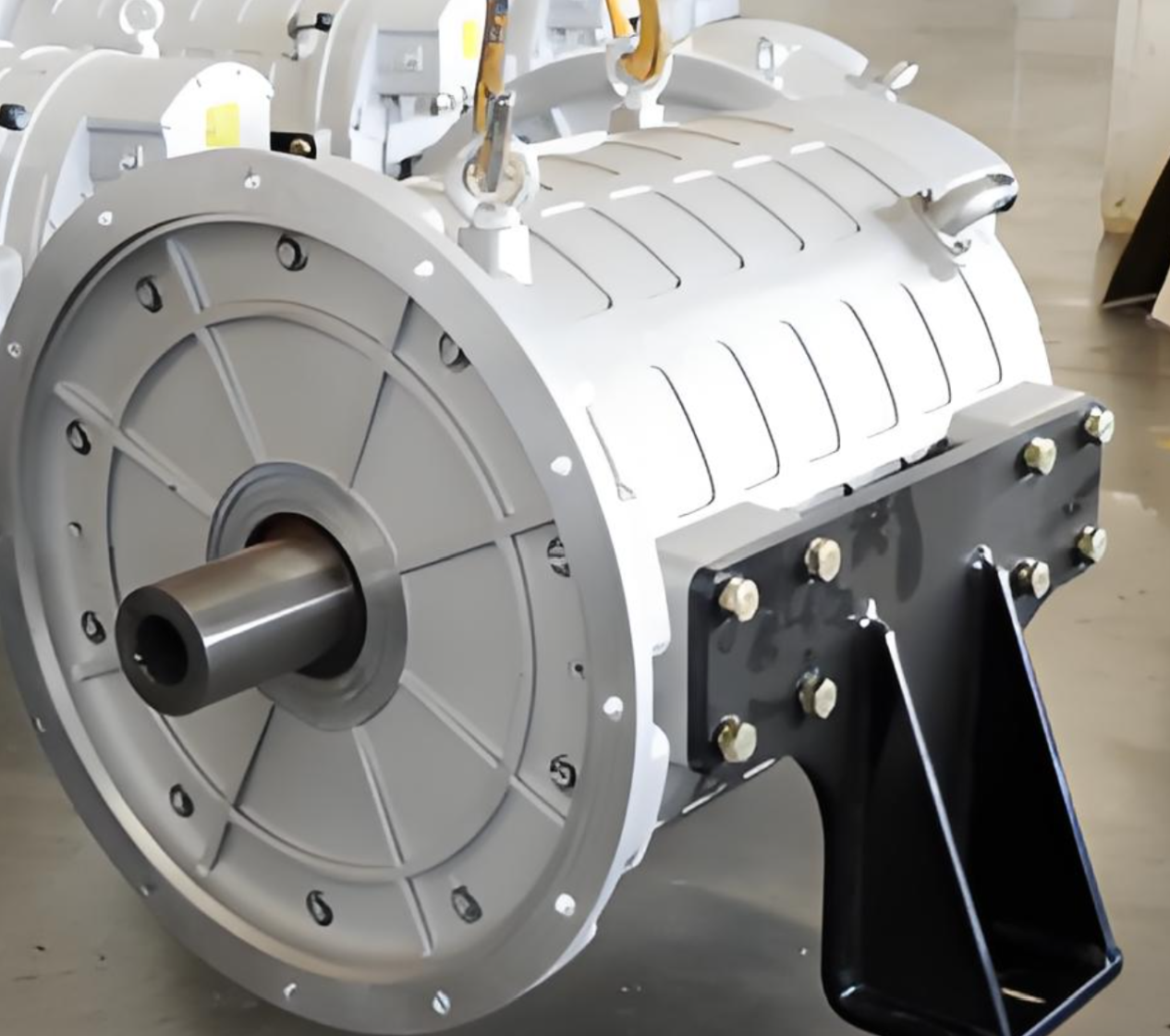

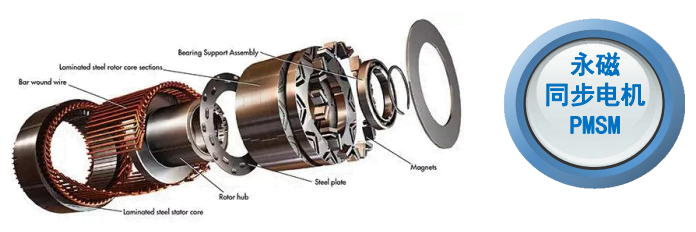

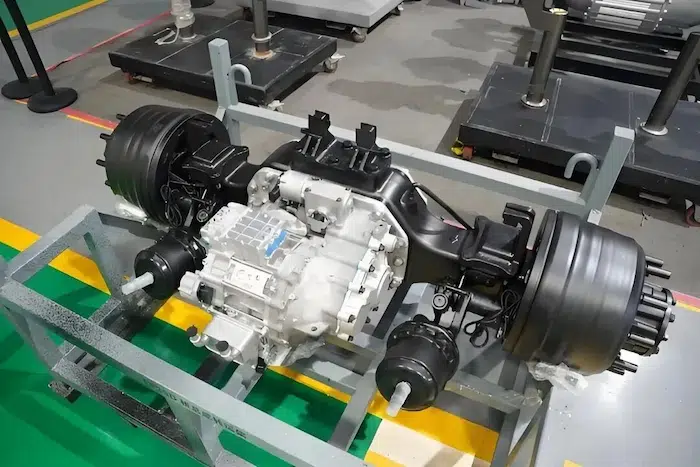

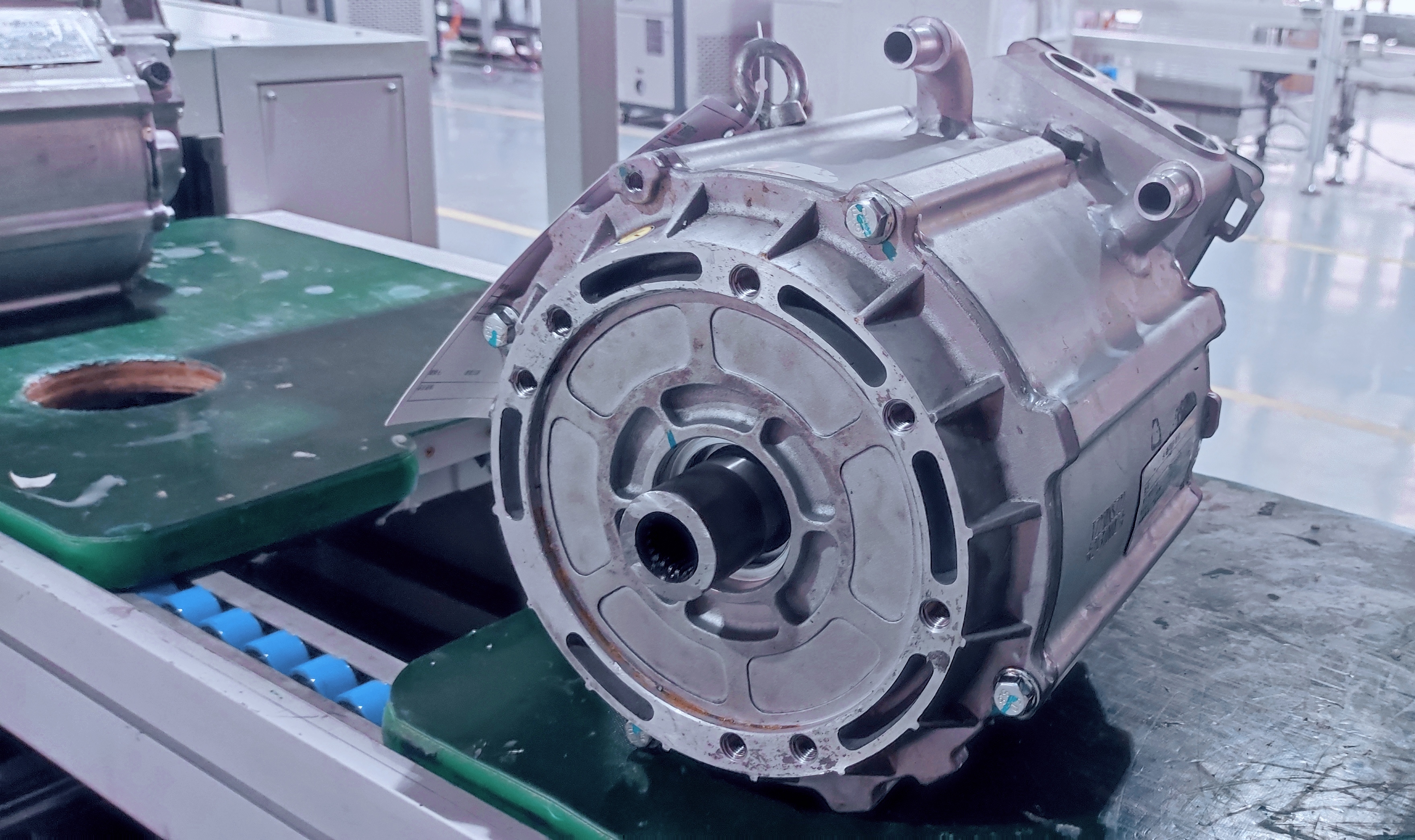

Analysis of the status quo and technical challenges of the core components of drive motor (stator and rotor)

Performance of motor magnetic steel material and current situation and challenge of core process

Neodymium iron boron is the third generation of rare earth permanent magnet materials. Due to its high coercivity, high magnetic energy product and other characteristics, it has been widely used in energy conservation, environmental protection and new energy fields. With the advent of new energy vehicles and the development of vehicle electrification, neodymium iron boron is playing an increasingly important role.

In the field of new energy vehicle drive motors, due to their stringent high-temperature operating environment requirements, most neodymium iron boron (NdFeB) magnets require heavy rare earth elements and grain boundary diffusion to enhance their high-temperature demagnetization resistance. Depending on different drive motor design specifications, NdFeB magnets typically need performance parameters ranging from magnetic energy product (MEP) of 42-54 MGOe to coercivity (Hc) values between UH and EH levels. Within this performance range, Tb-diffused magnets still dominate the market.

However, with the progress and development of NdFeB technology and motor technology, while the performance of magnets is constantly improving, the requirements for magnets in motors are gradually reduced, and the proportion of Dy diffused magnets in driving motors is also increasing year by year.

At present, Dy diffusion magnets can meet the performance requirements of drive motor magnets ranging from 44UH to 52SH. Of course, there are also some small power drive motors with relatively low requirements for magnet performance, such as 42SH, which can use heavy rare earth magnets or cerium neodymium iron boron magnets.

With the rapid development of high-power, high-speed motors, the eddy current heating effect in magnets has become increasingly prominent, making low-EDM magnets a key research focus. While designers typically use segmented magnet assembly with adhesive bonding, this approach suffers from complex manufacturing processes and reduced material efficiency. In recent years, cutting-edge non-through processing techniques have emerged as a promising solution to further reduce eddy current heating in magnets, which has garnered significant attention in the industry.

Neodymium iron boron (NdFeB) has been under research for over four decades since its invention, yet studies on ultra-high-performance sintered NdFeB magnets have reached a bottleneck. The maximum energy product of current sintered NdFeB magnets is approaching theoretical limits, making further breakthroughs increasingly challenging. While there remains significant room for improvement in the theoretical enhancement of NdFeB coercivity, achieving substantial advancements continues to prove exceptionally difficult.

The cost structure of sintered neodymium iron boron (NdFeB) magnets currently faces significant challenges. With the rapid growth of new energy vehicles in recent years, market demand for high-performance NdFeB magnets has surged, leading to substantial increases in consumption of raw materials—particularly rare earth elements like Pr, Nd, Dy, and Tb. This has caused dramatic price fluctuations and sustained inflation in rare earth prices. The supply-demand imbalance of these resources has further exacerbated price volatility in NdFeB products. As cost control requirements become increasingly stringent, the pressure to manage expenses continues to intensify.

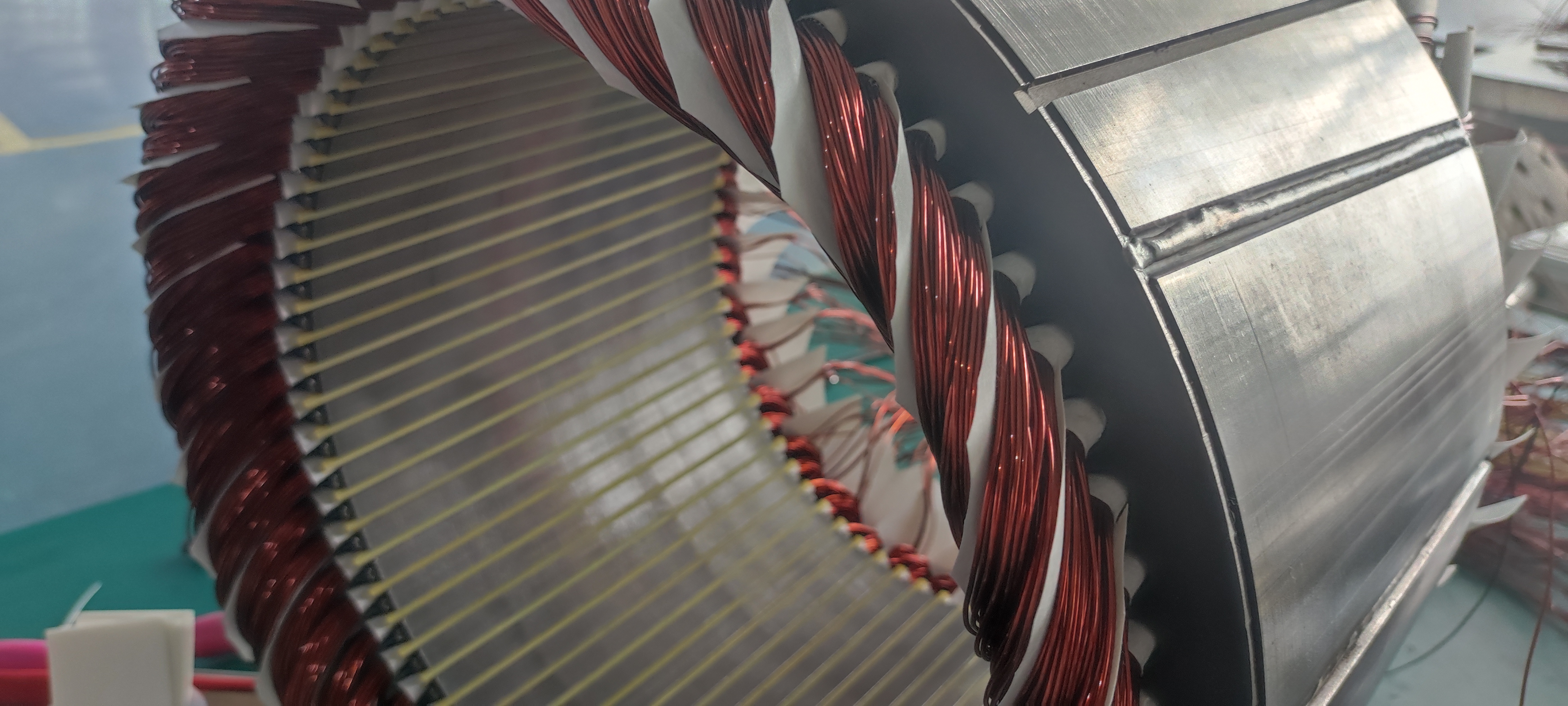

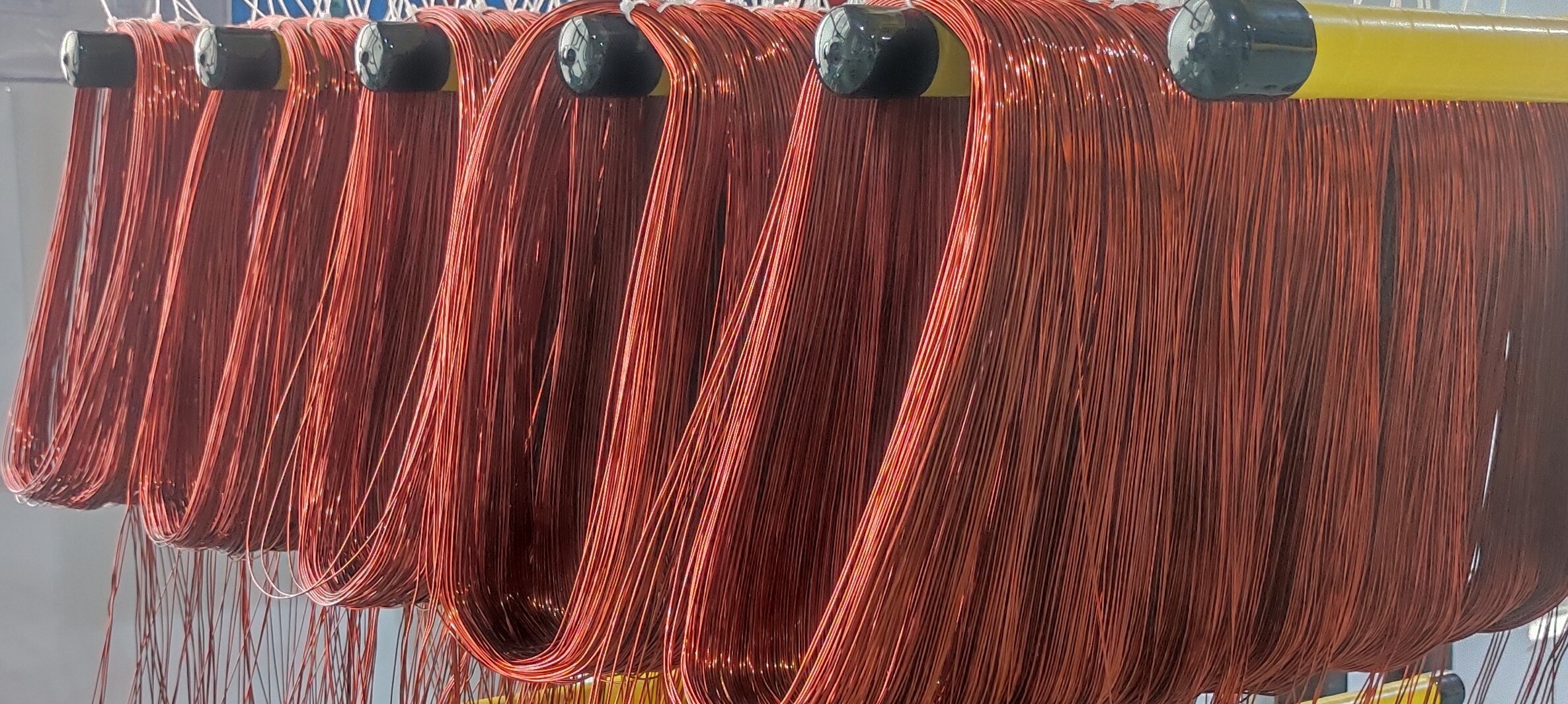

Current situation and challenge of motor enameled wire material

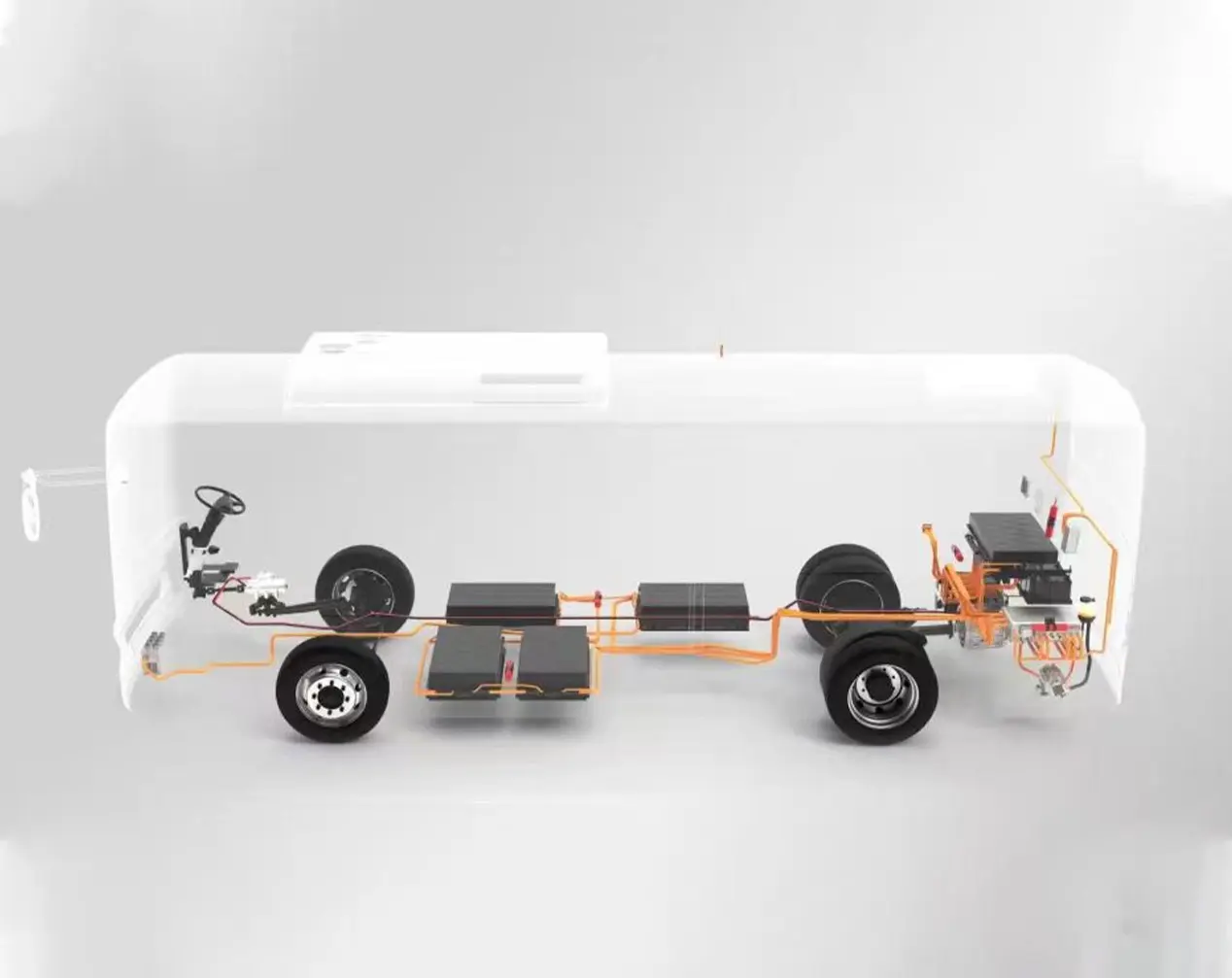

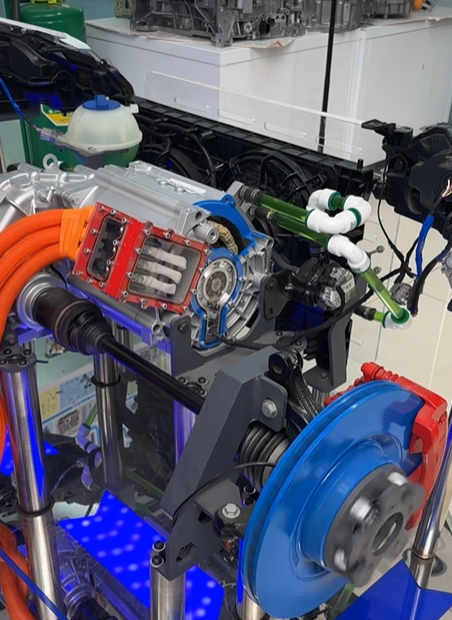

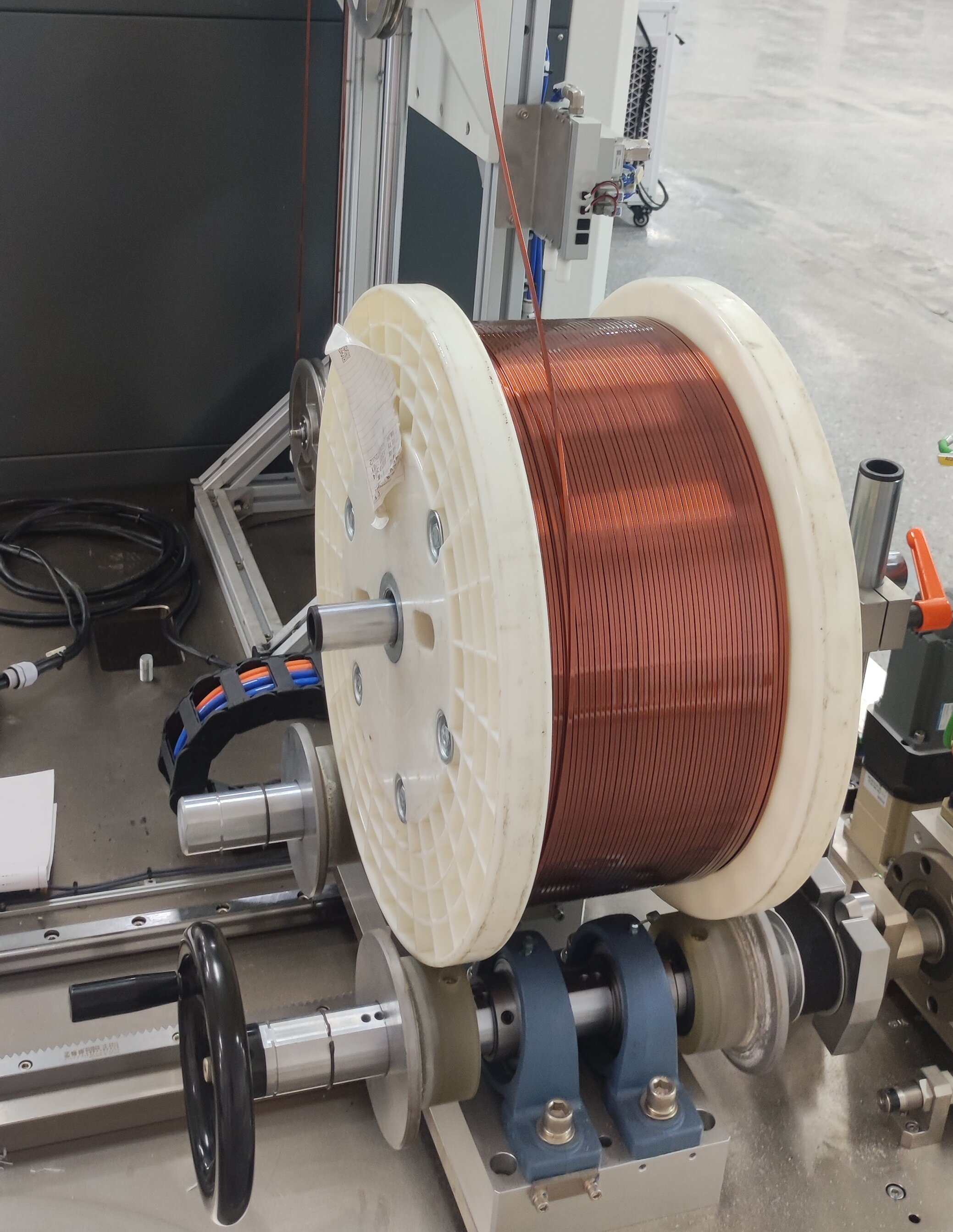

Current Status and Development Trends: Automotive drive motors have undergone a transition from round-wire to flat-wire motor designs, while currently experiencing rapid technological evolution from medium-low voltage flat-wire motors to high-voltage, high-speed oil-cooled flat-wire motors. The conductors used in drive motors have also evolved from round wires to flat wires, transitioning from low-voltage conventional insulated enamel wire to high-voltage, corona-resistant, oil-water resistant, and low AC loss specialty composite conductors.

High pressure and oil cooling lead to insulation system upgrades.

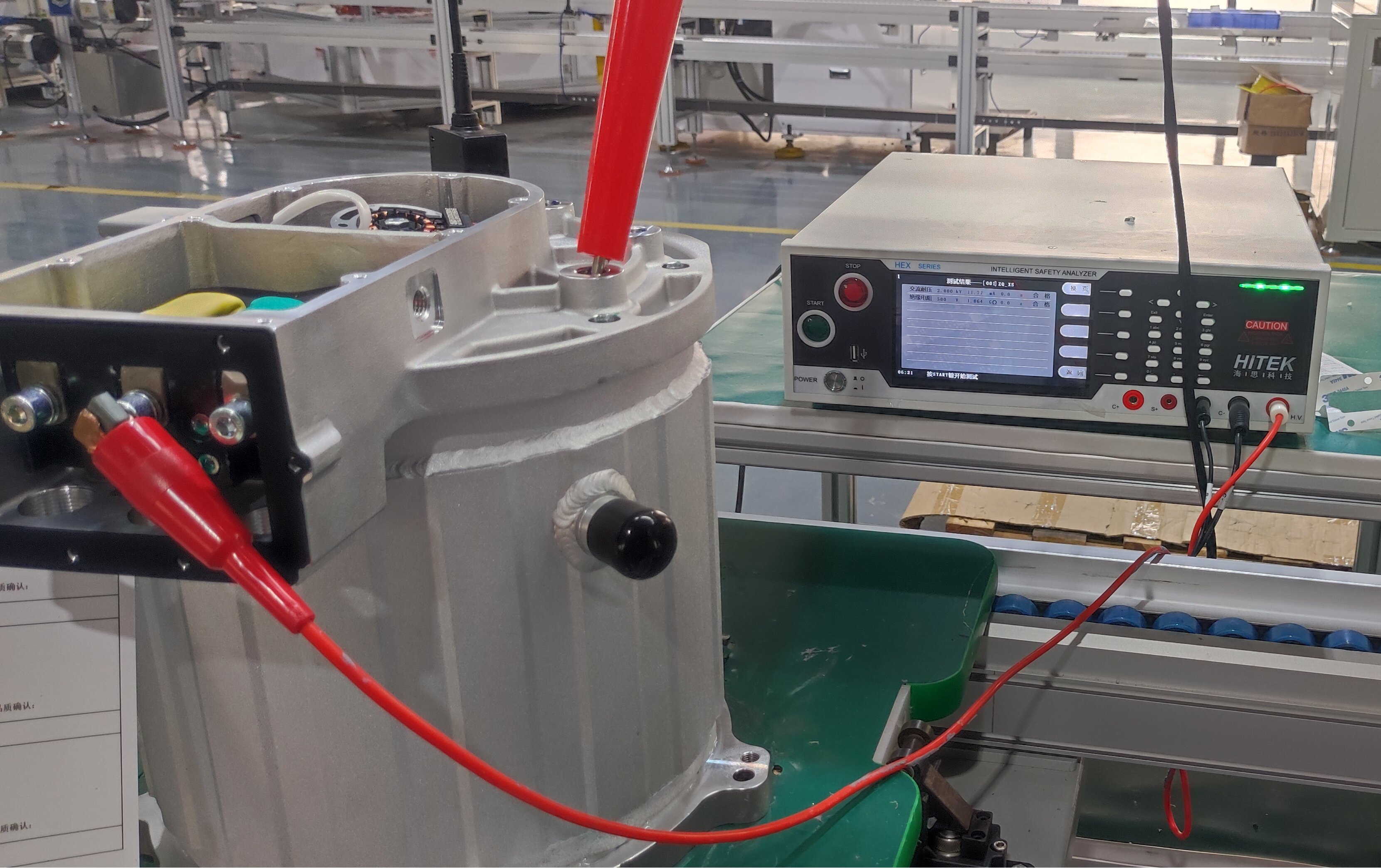

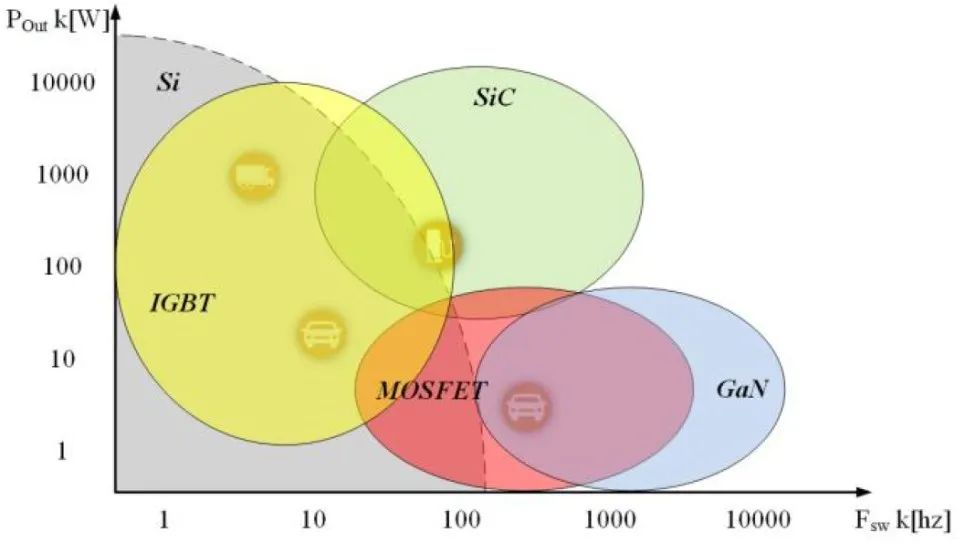

High-voltage development has become a pivotal trend in automotive motors, where advanced systems deliver significant advantages for high-efficiency and rapid charging. As drive motors evolve toward 800V and higher voltage platforms, the entire winding insulation system is transitioning from the original Type I non-potential breakdown (NBD) system to Type II insulation systems.

Unlike traditional high-voltage flat wire motors, automotive drive motors cannot implement secondary insulation and corona protection for entire windings. This necessitates enhanced corona resistance in electromagnetic wire insulation. Specialized designs like low-dielectric PI enamel wires, PEEK-sheathed wires, and sintered enamel-coated wires have significantly improved the PDIV value of electromagnetic wires, playing a crucial role in preventing corona initiation. In recent years, the head department has intensified R&D efforts in enamel wire technology and equipment, developing ultra-thick-pigmented and ultra-long-corona-resistant PI/PAI flat wire series. These products achieve a maximum corona resistance lifespan exceeding 600 hours, demonstrating over tenfold improvement compared to conventional anti-corona enamel-coated round wires.

Oil cooling technology has achieved dual benefits: it significantly enhances winding heat dissipation, reduces system temperature rise, and extends motor service life. However, it also poses substantial challenges regarding insulation compatibility with oil formulations. Although oil-water resistant enameled wire has been successfully developed and entered mass production, inconsistent testing methodologies and evaluation standards for oil compatibility persist across the industry. Balancing cost efficiency with technical specifications remains a critical challenge we must address.

High-speed operation represents another pivotal technological advancement in drive motors. As rotational speeds continue to increase, the frequency of electronic PWM control systems keeps rising, while AC losses caused by skin effect and proximity effects in windings become increasingly pronounced. Currently, only a handful of industry leaders are developing specialized components such as non-sinusoidal grooved conductors, Litz wires, staggered conductors, and composite staggered conductors. These advanced conductor configurations are poised to become effective solutions for addressing AC losses in high-speed motors.

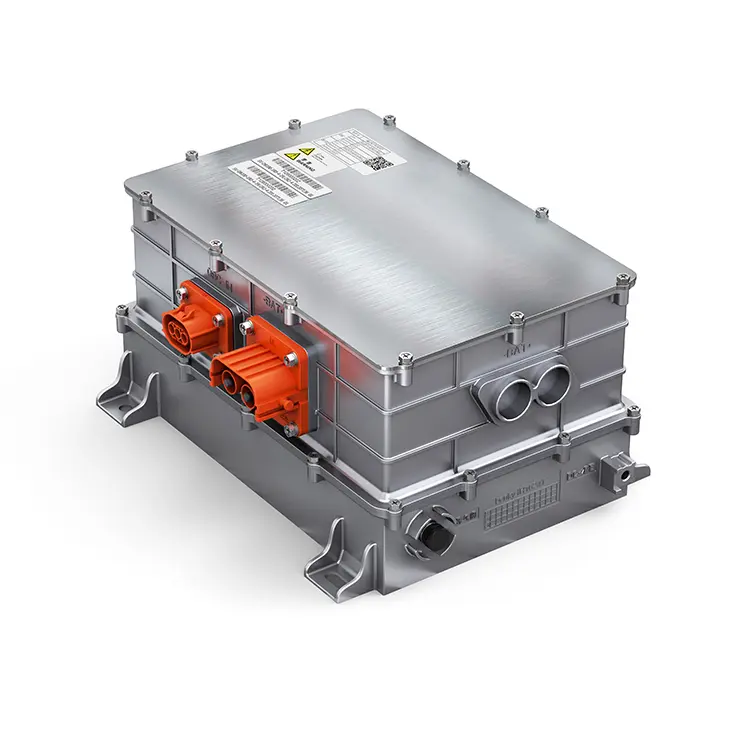

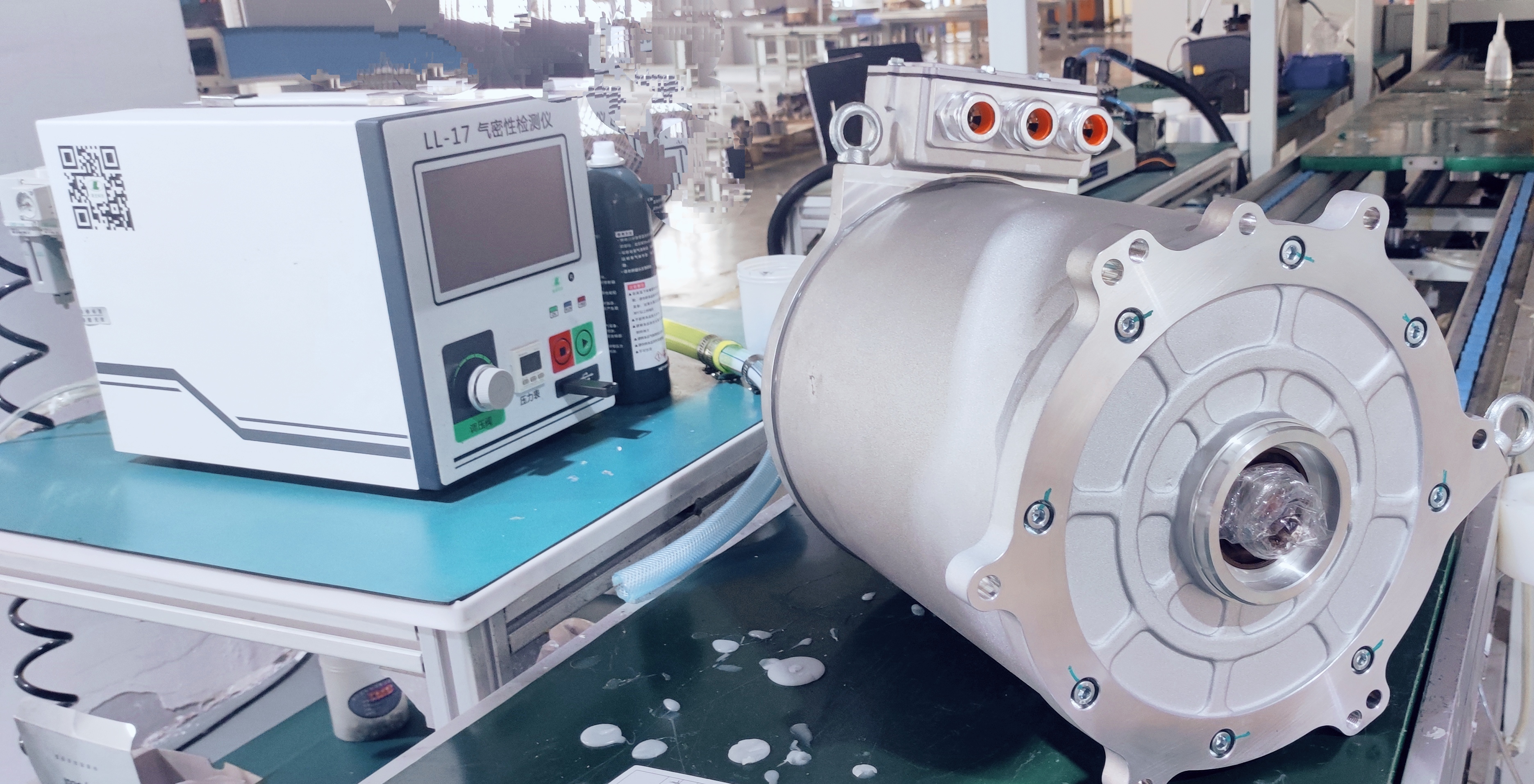

Current situation and challenge of secondary insulation material for motor

Current Status and Development Trends: Since Xiaopeng Motors pioneered the development of an 800V oil-cooled electric drive system in 2021, significant improvements have been made in motor cooling conditions. Meanwhile, the evaluation system for SiC-based high-voltage insulation systems has been progressively refined. Heat dissipation potential measures for motors have shifted from the stator rotor periphery to the internal stator structure. The next focus in the motor industry will be enhancing the reliability and thermal management capabilities of insulation systems. However, current motor insulation materials generally exhibit thermal conductivity between 0.2~0.3W/m.k, which falls far short of meeting the demands of power density development trends in the industry.

The industry faces dual challenges: while demanding superior insulation performance from motor systems, insulation materials remain the primary bottleneck in heat dissipation, driving the sector's pursuit of enhanced thermal conductivity. However, insulation and heat dissipation inherently conflict as opposing parameters in any single material. Moreover, when using insulating materials, the critical dimensions of insulation thickness and conductor isolation directly determine reliability. These dimensions critically affect motor slot utilization rates, thereby limiting performance improvements. The industry particularly anticipates breakthroughs in composite insulation materials with superior thermal conductivity and their application technologies, including insulating films, impregnated varnishes, enameled wire coatings, and related manufacturing processes and equipment.

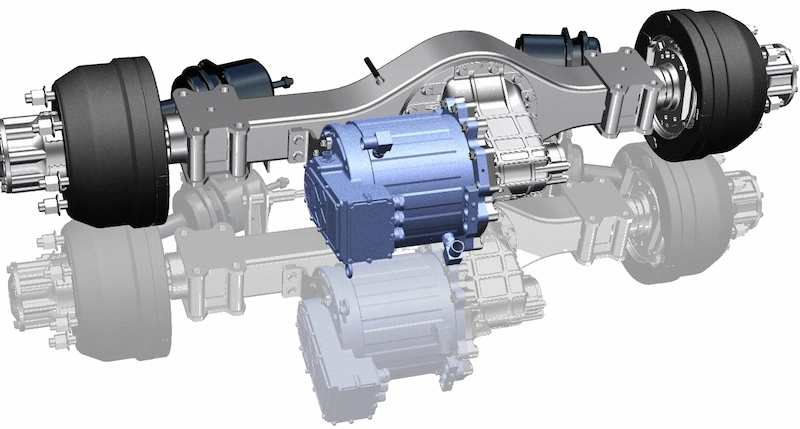

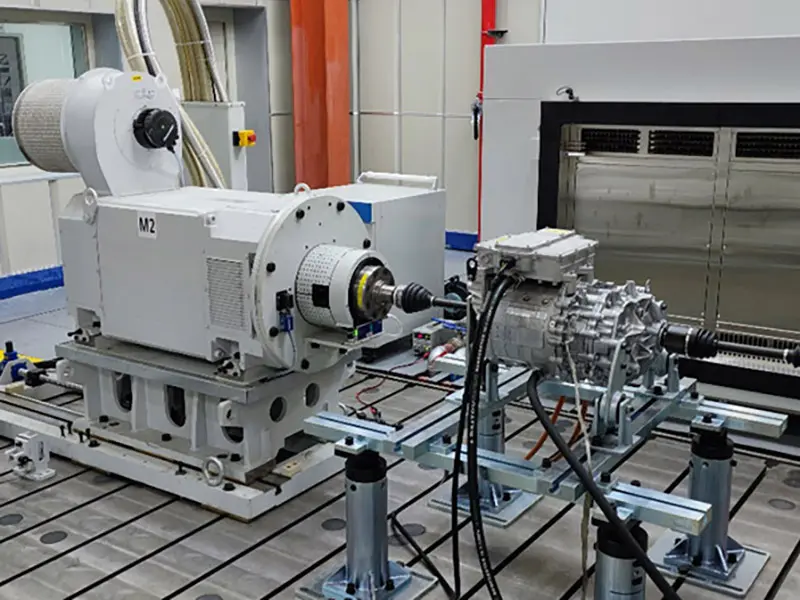

New structure and new process route planning and objectives of motor (stator and rotor)

Flat Wire Stator and Manufacturing Technology: The adoption of flat wire design in motor windings has become a crucial industry standard. However, to compete effectively, flat wire motors must enhance flexibility and reduce AC losses. Conventional flat wire designs lack sufficient flexibility, whereas continuous forming winding technology simplifies wire formation and welding processes while eliminating critical steps like wire pressing, flaring, and twisting, enabling better flexible production. To address the current challenge of difficult wire formation under existing continuous forming processes, the industry anticipates developing new core-structured continuous forming winding systems with optimized equipment by 2026. This will resolve issues of oversized slot dimensions and low slot fill rates, fundamentally addressing the pain points of high investment costs and limited flexibility in flat wire motor production. Additionally, to tackle winding losses and temperature rise at operating speeds exceeding 30,000 rpm, breakthroughs in specialized slot specifications and material-guided wire applications with corresponding manufacturing technologies are expected to be achieved between 2026 and 2028.

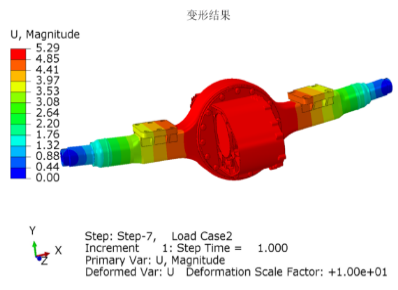

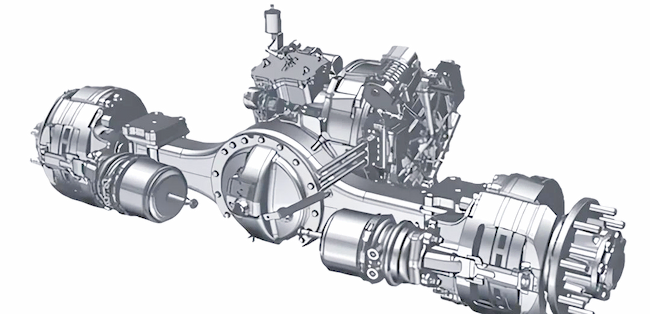

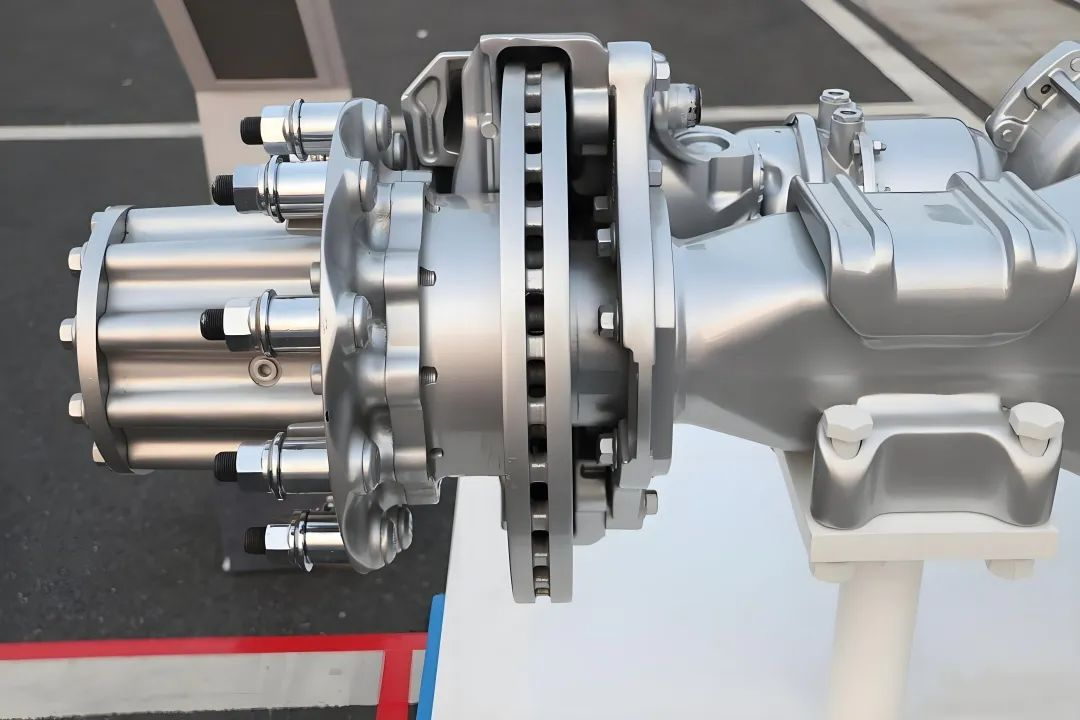

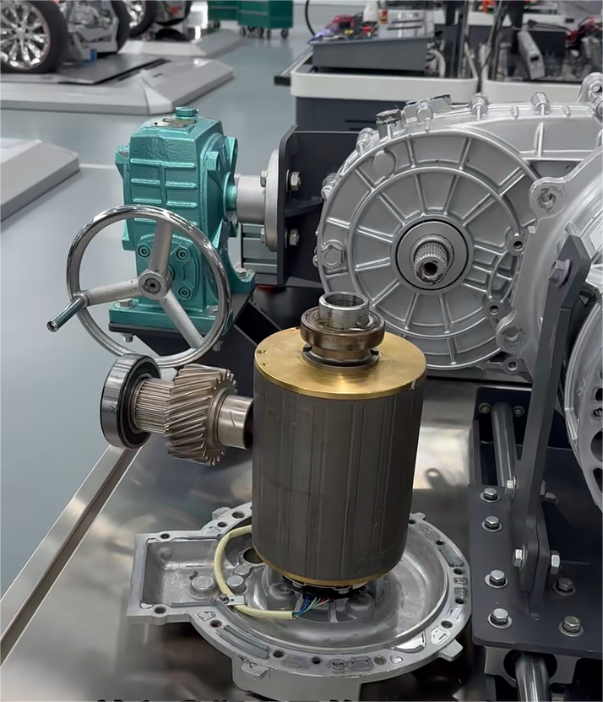

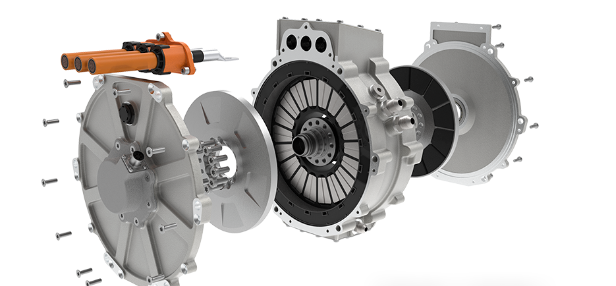

Rotor structure and process

In the face of high speed and low cost market trend, motor rotor needs to solve more reliable structure form of centrifugal stress resistance, and hopes to improve the distribution characteristics of motor's high efficiency area through rotor design.

Therefore, on one hand, the industry needs to resolve low-cost manufacturing challenges for carbon fiber winding or similar reinforced structures within two years. Industry forecasts indicate that rotor wire-to-wire carbon fiber winding equipment will be developed by 2026, with mass production of ultra-thin carbon fiber sleeve components and mature assembly processes expected to be achieved by 2028. On the other hand, brushless hybrid excitation rotor technology (including electric hybrid excitation and memory magnet materials) is projected to mature between 2025 and 2030. When combined with appropriate control technologies, this advancement will enhance motor efficiency by over 2 percentage points at high rotational speeds.

The main material process route and development goal and plan of the motor

New laminated core process route, new motor punch material development goal and plan

· Development and application of 600MPa and higher strength and high machinability non-oriented silicon steel.

· Thickness 0.25mm 1150,1100 and higher grades of high energy efficiency non-oriented silicon steel development and thinning.

· Development and stable application of low iron loss and high magnetic induction oriented silicon steel without bottom layer or composite coating.

· High stability, rapid self-adhesive thin specification non-oriented, thin specification oriented product development, rapid self-adhesive iron

· Core high efficiency and stable production process technology breakthrough.

· Redesign and application of stator structure for soft magnetic materials with multiple varieties.

The research and development objectives and plans of new magnetic steel materials

The technological progress of NdFeB materials is mainly to improve the performance of magnets and reduce the cost of magnets, so as to obtain low-cost and high-performance NdFeB magnets.

On one hand, by adjusting composition and optimizing microstructure to enhance the magnetic properties of neodymium iron boron (NdFeB) magnets, or through macroscopic shape design optimization to reduce eddy current losses and improve product performance, we can lower the required coercivity of magnets in motors. This approach also reduces heavy rare earth (HRE) consumption, particularly of the heavy HRE element Tb, ultimately achieving the development goal of low or even zero HRE magnets.

In recent years, various research institutions have been reducing the use of heavy rare earth Dy and Tb in the substrate by studying crystal boundary strengthening and crystal boundary reconstruction technologies; and gradually developing a new generation of low heavy rare earth, no heavy rare earth or non-rare earth composite diffusion materials to reduce the use of heavy rare earth Dy and Tb in the diffusion process and reduce the cost of magnets.

On the other hand, by developing the application technology of high abundance and cheap rare earth Ce, La and Y in NdFeB, the use of key rare earth elements Pr and Nd can be reduced, the cost can be reduced, the diversified demand for permanent magnet materials in the middle and low-end market can be met, the supply and demand difference of rare earth resources can be reduced, and the balance of supply and demand of rare earth resources can be realized.

In the next two years, NdFeB technology will mainly develop in the following aspects:

· Improve and control the neodymium iron boron production process to improve product consistency.

· Reduce the use of heavy rare earths. The plan includes improving the performance of low or no heavy rare earth non-proliferation magnets; improving the performance of Dy diffusion magnets to replace some Tb diffusion magnets.

· Improve the performance of high abundance rare earth NdFeB magnets, reduce the cost of raw materials, and realize the rational utilization of rare earth resources.

· Over the next five years, neodymium iron boron (NdFeB) technology development will focus on two key areas. First, while maintaining performance stability, efforts will be made to reduce the usage of Dy and Tb in diffusion processes. Second, magnetic material design will prioritize low-inductance magnets through innovative structural configurations that enhance demagnetization resistance during operational cycles.

Research and development objectives and plans for new enameled wire

The role of winding wire in enhancing the performance and cost optimization of automotive drive motors is becoming increasingly prominent. The development of electromagnetic wire products will continue to focus on four key requirements: high voltage, high speed, high efficiency, and low cost for automotive motors. Research efforts will address these challenges through three primary approaches: optimizing insulation structures/materials, improving conductor materials, and refining conductor structure designs.

In the next two years, electromagnetic wire technology will mainly develop in the following aspects:

·The 800V platform is the starting point of high-voltage drive motors, but its endpoint remains unknown. Through research on low dielectric high-strength insulating materials and electromagnetic wire processing technology, continuously improving the PDIV level of electromagnetic wires and even stator assemblies will remain an important topic in future electromagnetic wire insulation research.

· In addition to improving PDIV to reduce the partial discharge time of the motor under all working conditions, continuous research and development of highly flexible and ultra-long corona resistant enameled wire, and improvement of stator winding electrical aging life are also important research directions of electromagnetic wire insulation technology.

· With the continuous improvement of the speed of the drive motor, the AC loss under high frequency and high speed is more and more significant. The development of products such as Liz wire, combined wire, small flat wire and their manufacturing process can help reduce the AC loss of high-speed motors.

Research and development direction of electromagnetic wire in the next 5 years

· High-conductivity materials (such as graphene copper) have entered the vision of automotive engineers, but due to the complex manufacturing process and high cost, they are still in the stage of a small number of prototypes. It is expected that through 5-10 years of research and development and improvement, great progress will be made in both cost and technical stability.

· Research, development and application of lightweight and low-cost conductor materials: Aluminum and copper-clad aluminum conductor materials have obvious advantages in terms of lightweight under the premise of the same current carrying capacity; Meanwhile, with the continuous rising trend of copper price, it will be possible to replace copper wire with aluminum and copper-clad aluminum in the application of drive motor windings.