EV inverter market to hit $29.26T by 2034 amid global EV boom

The electric vehicle (EV) revolution is changing the face of the global automotive industry. At the heart of every EV lies a powerful yet often overlooked component: the electric inverter. As EV adoption surges globally, so too does the demand for high-performance inverters that can efficiently manage power conversion and support new energy technologies. With forecasts placing the EV inverter market at a staggering $29.26 trillion by 2034, understanding the forces driving this growth is essential for investors, manufacturers, policymakers, and consumers alike.

Overview of the EV Inverter Market

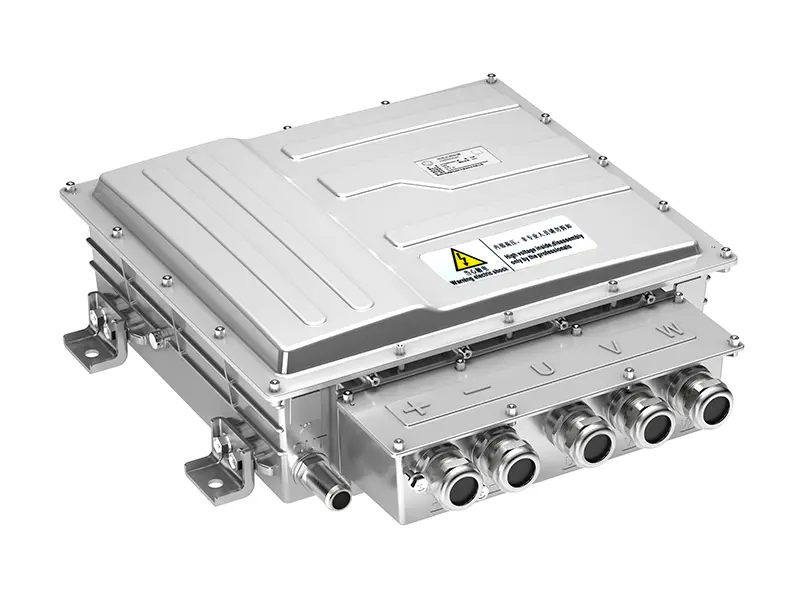

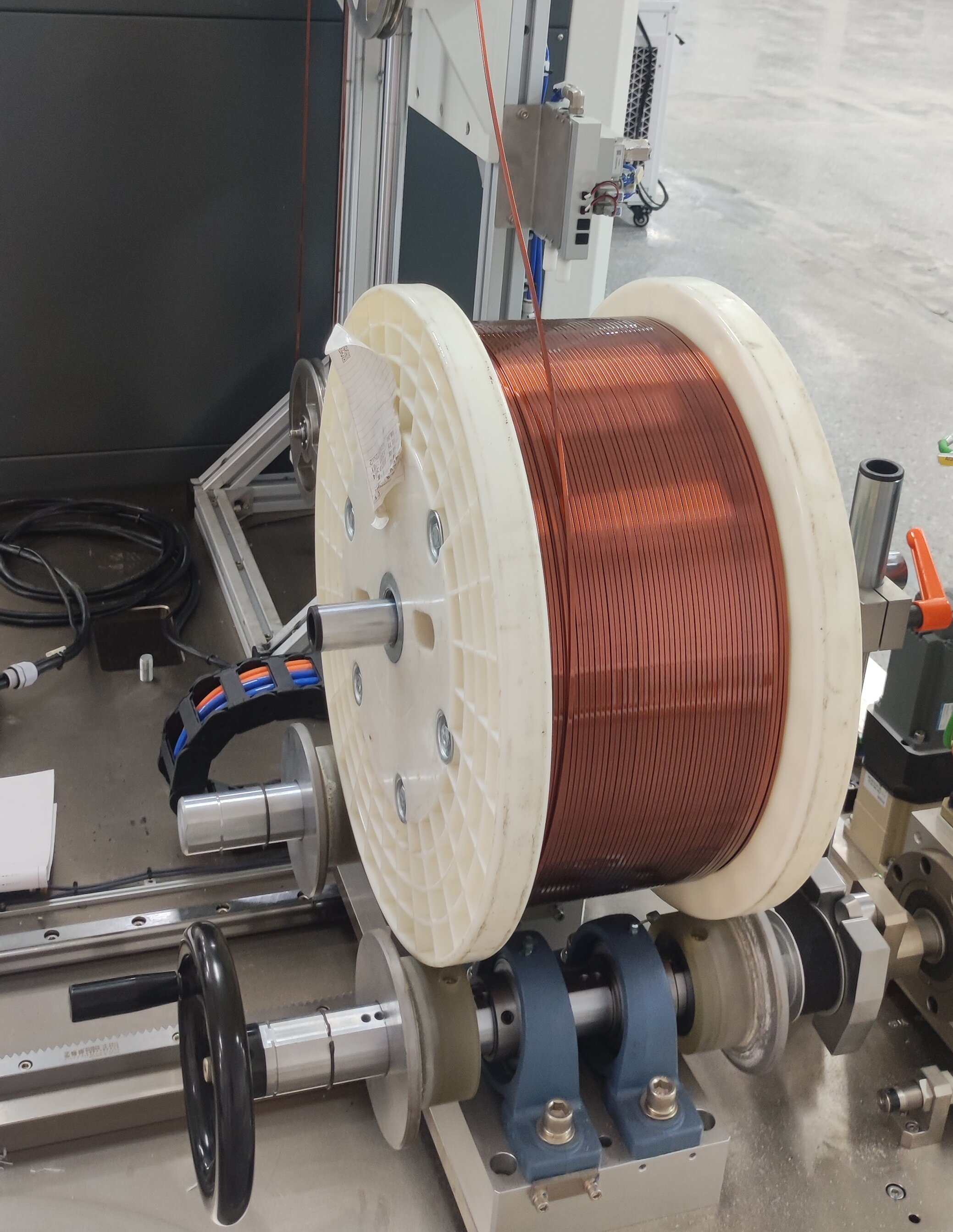

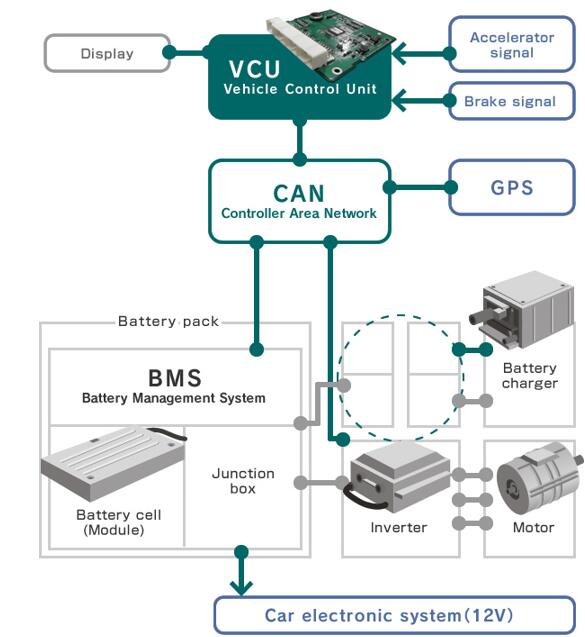

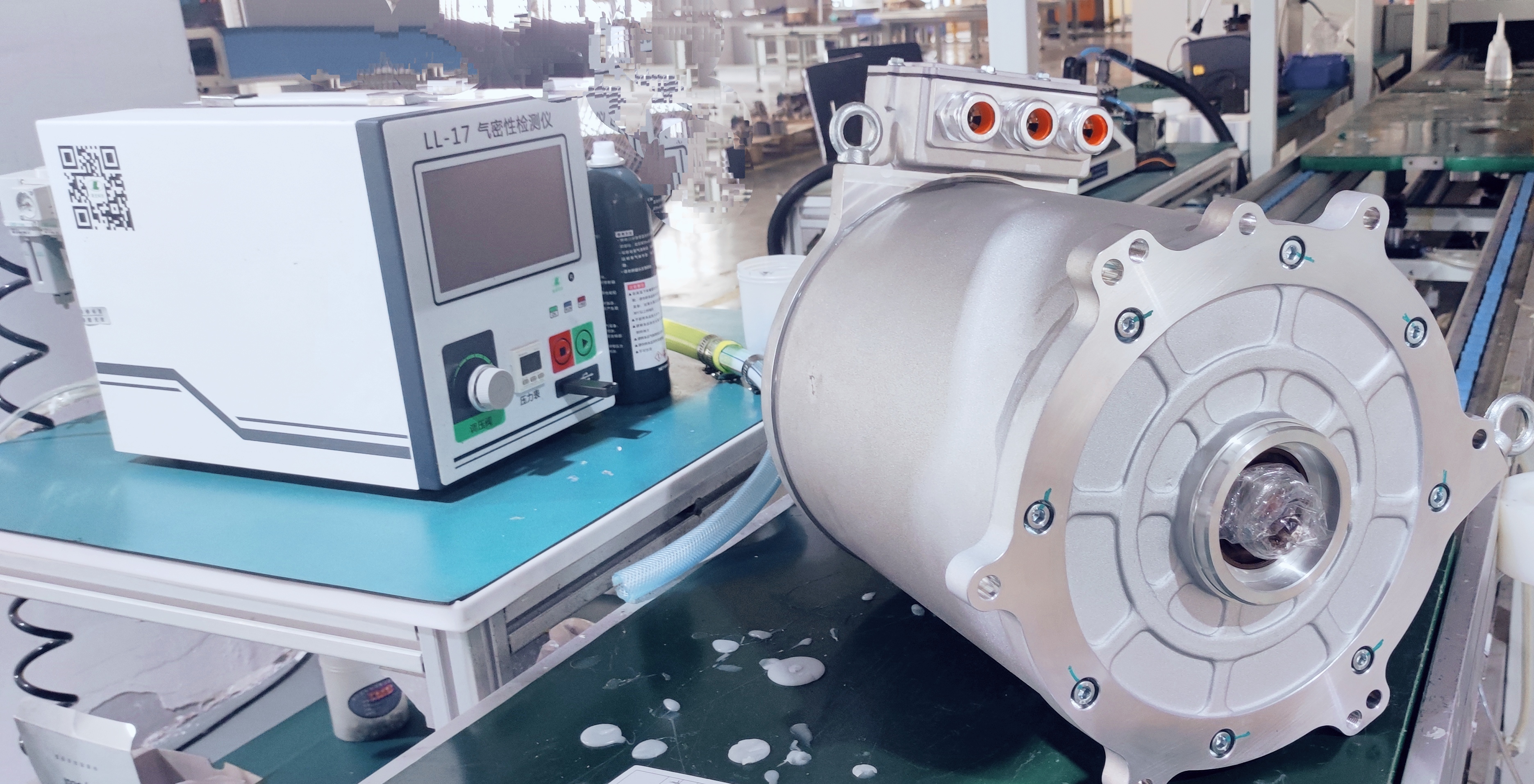

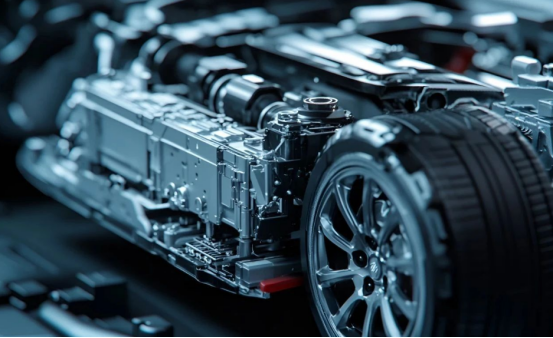

Electric vehicle inverters are electronic devices that play a vital role in the EV powertrain. These components convert direct current (DC) from the vehicle's battery into alternating current (AC) used by the electric motor. The rapid electrification of transportation has pushed the inverter market from a niche sector to a multi-trillion-dollar industry.

In 2024, the global EV inverter market is valued at $6.7 trillion, growing at an impressive compound annual growth rate (CAGR) of 15.7%. This growth is fueled by the proliferation of electric and hybrid vehicles, advances in power electronics, and a shift in consumer preferences toward greener transportation options.

The market is broadly segmented by inverter type (central, string, and micro), vehicle type (BEVs, PHEVs, HEVs), power ratings, and end-users including passenger cars and commercial vehicles. The integration of inverters into more complex electronic systems is also giving rise to demand for smarter and more compact units.

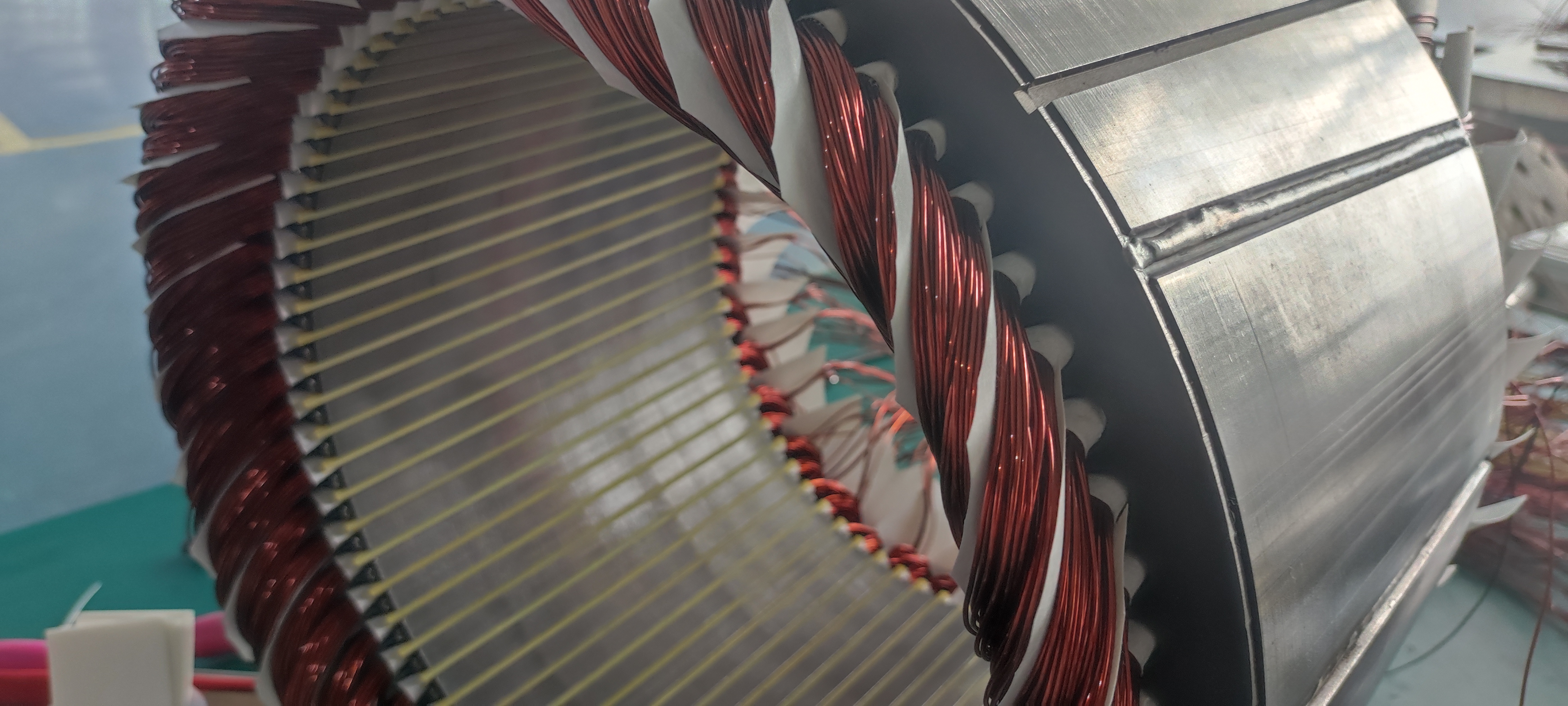

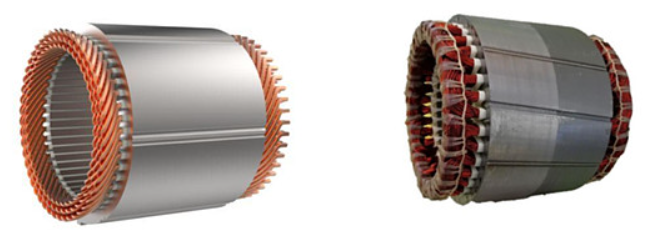

Role of Inverters in Electric Vehicles

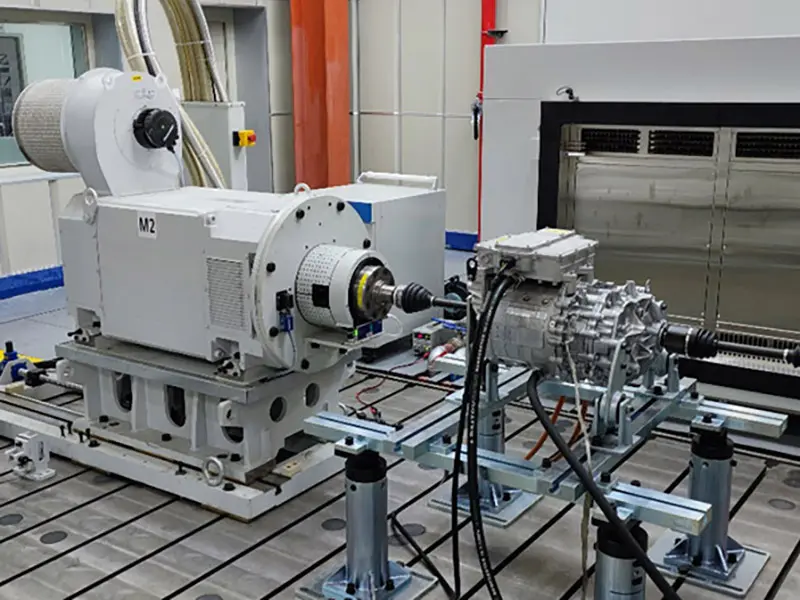

Inverters are essential for controlling the speed and torque of electric motors. They not only manage energy conversion but also influence driving dynamics and energy recovery. The key functions of EV inverters include:

- DC-to-AC Conversion: They convert stored DC energy from the battery into AC power required by the motor.

- Motor Control: By altering the frequency and amplitude of AC output, they regulate motor speed and torque.

- Regenerative Braking: Inverters enable reverse current flow during braking, converting kinetic energy back into electrical energy.

- Thermal Management: They help regulate temperature to prevent overheating and maintain efficiency.

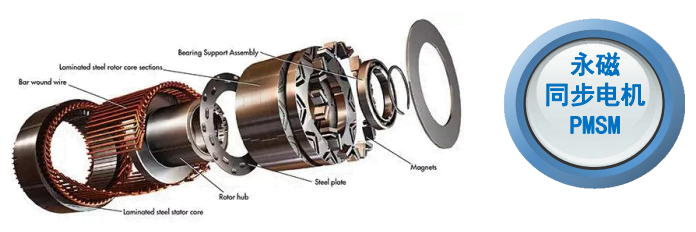

There are three primary inverter types used in EVs:

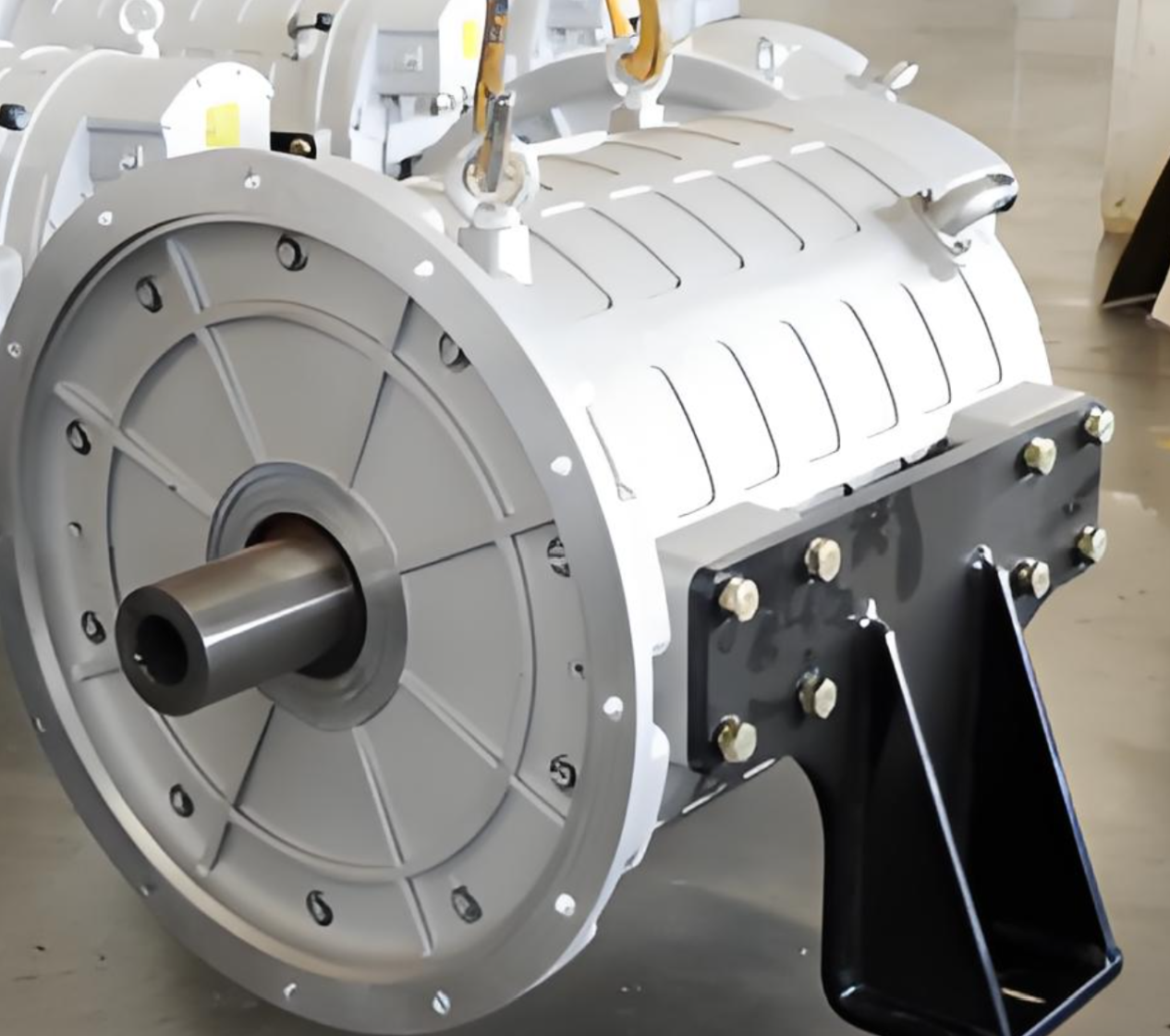

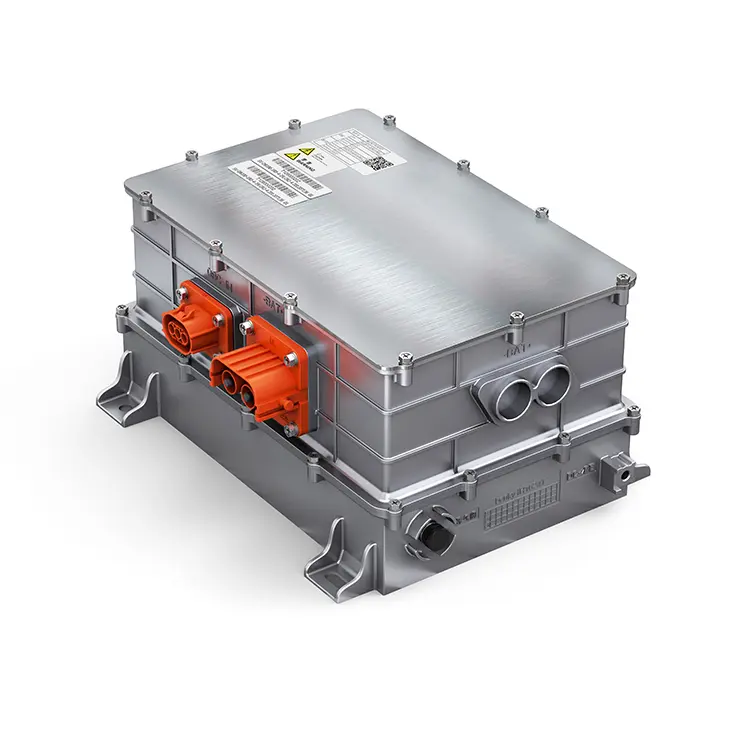

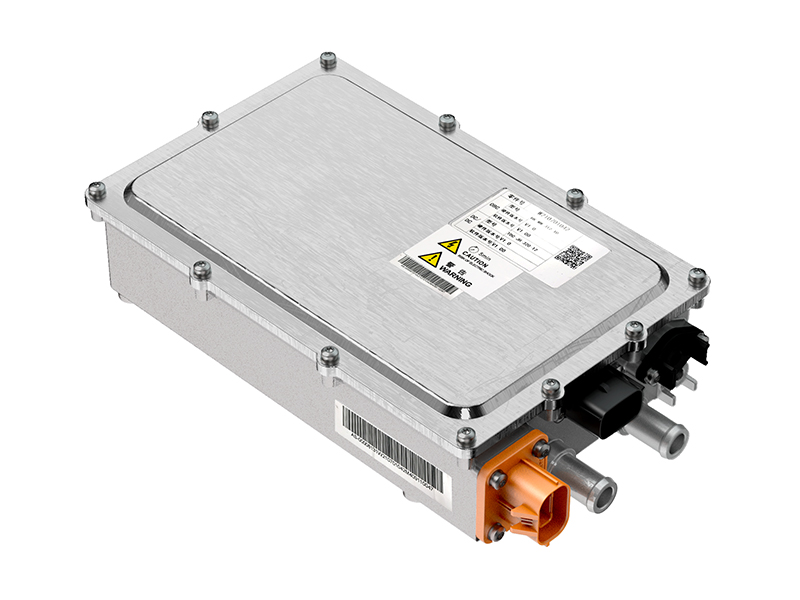

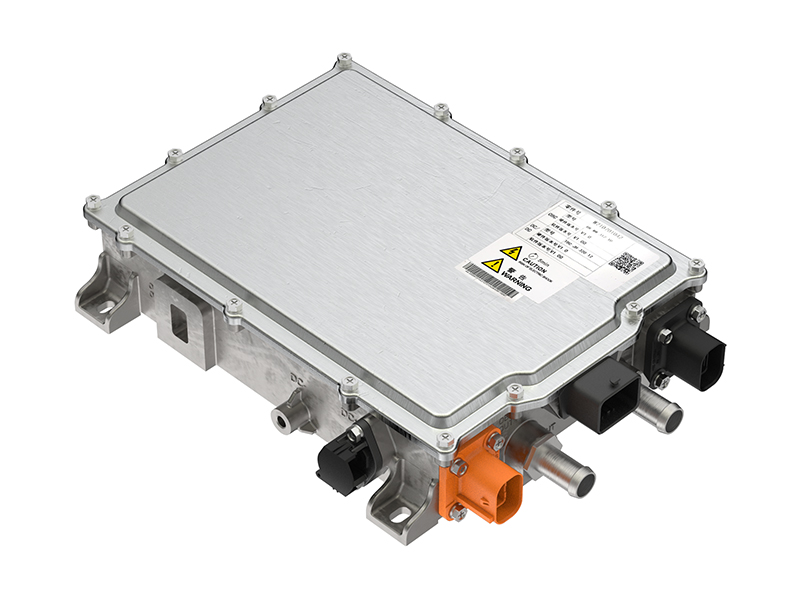

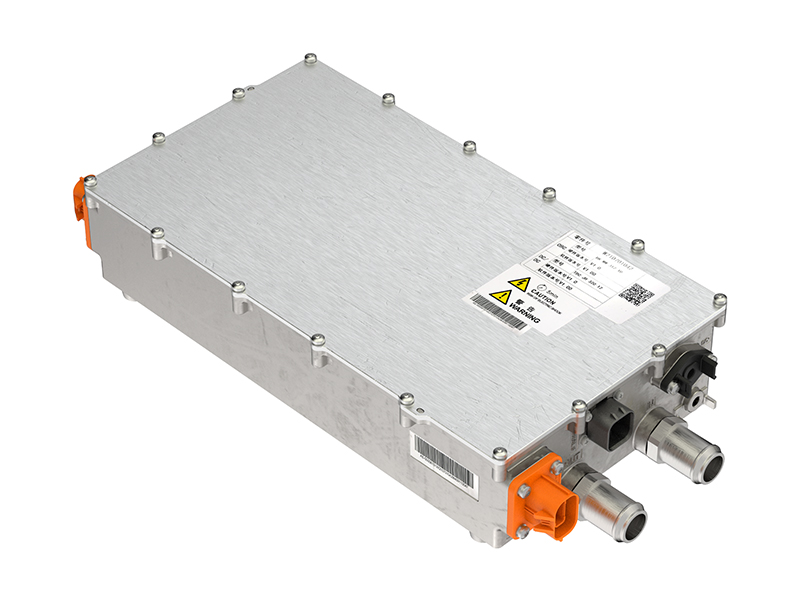

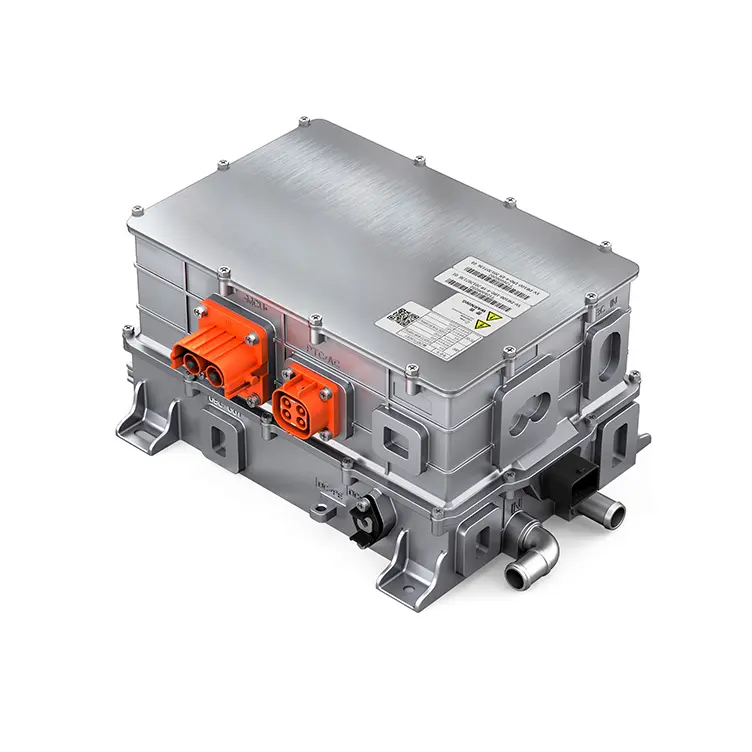

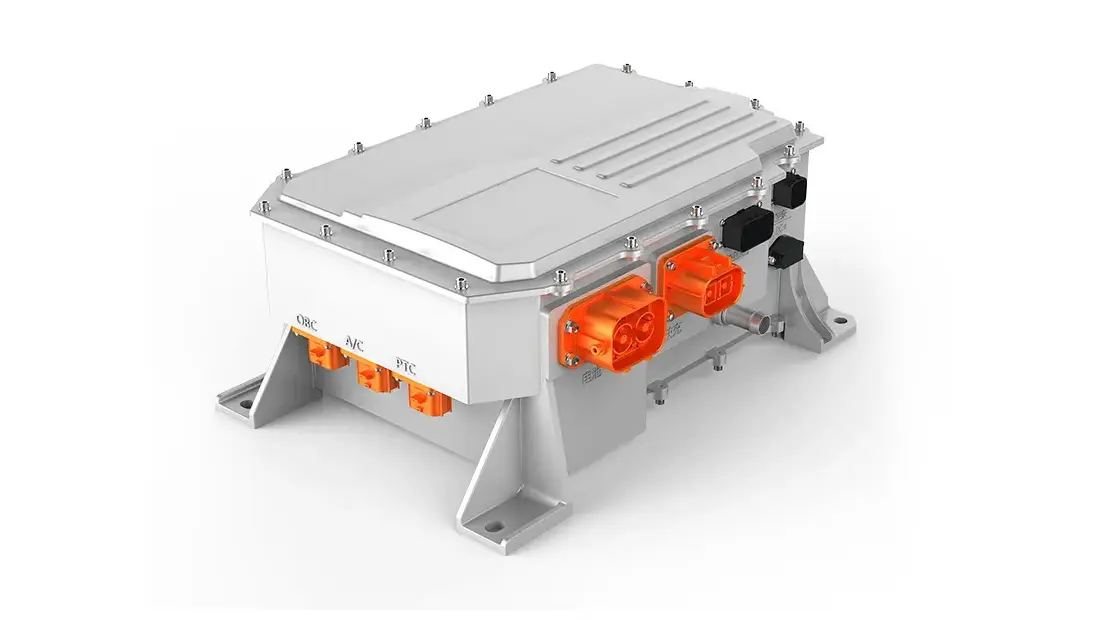

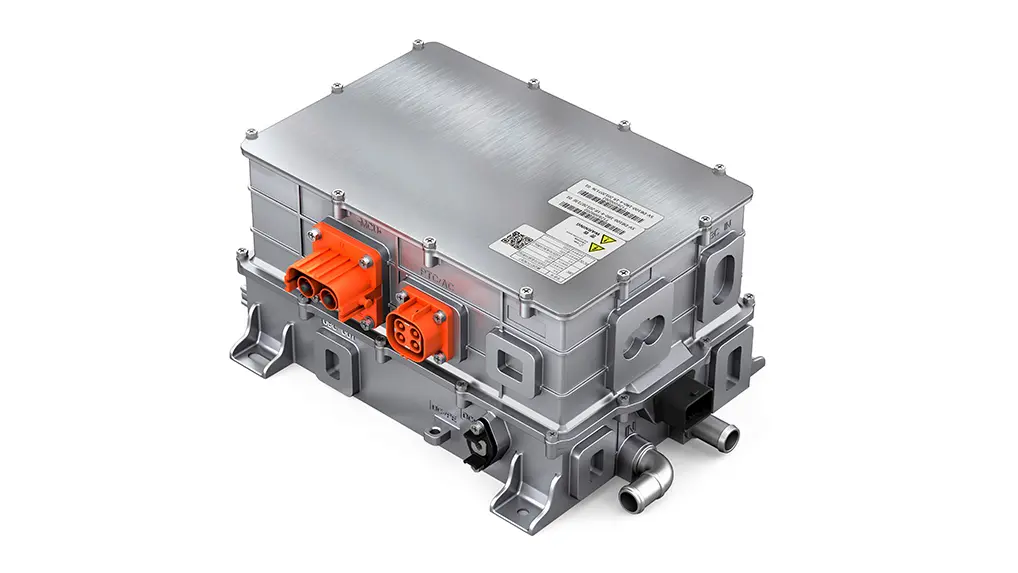

1.Traction Inverters – Drive the motor and directly influence the vehicle's propulsion.

2.DC-DC Converters – Step down high voltage to run accessories and onboard systems.

3.Onboard Chargers (OBC) – Convert grid AC to battery-friendly DC.

The efficiency and reliability of these systems significantly impact overall EV performance and battery life.

Market Forecast and Growth Drivers

Market Forecast:

- 2024: $6.7 trillion

- 2029: $13.9 trillion

- 2034: $29.26 trillion

Key Growth Drivers:

- Explosive EV Demand: Global electric vehicle sales topped 10 million units in 2023 and are projected to exceed 40 million units by 2030.

- Supportive Government Policies: Incentives, subsidies, and regulations in the U.S., China, and the EU encourage EV development and infrastructure.

- Technological Advancements: Developments in semiconductor materials, AI integration, and cooling systems increase inverter efficiency.

- OEM Strategies: Automotive manufacturers are increasingly designing inverters in-house to gain competitive advantages in performance and cost.

- Environmental Awareness: Global efforts to reduce greenhouse gas emissions are pushing consumers and businesses toward electrified transport options.

These factors collectively point to a thriving market with exponential opportunities across vehicle categories.

Impact of the Global EV Boom

The ongoing global EV boom is a direct result of environmental policies, cost reductions in batteries, increased urbanization, and lifestyle shifts. This boom has significant implications for the inverter market:

- Volume Growth: As more EVs roll off the production lines, the demand for inverters rises proportionally.

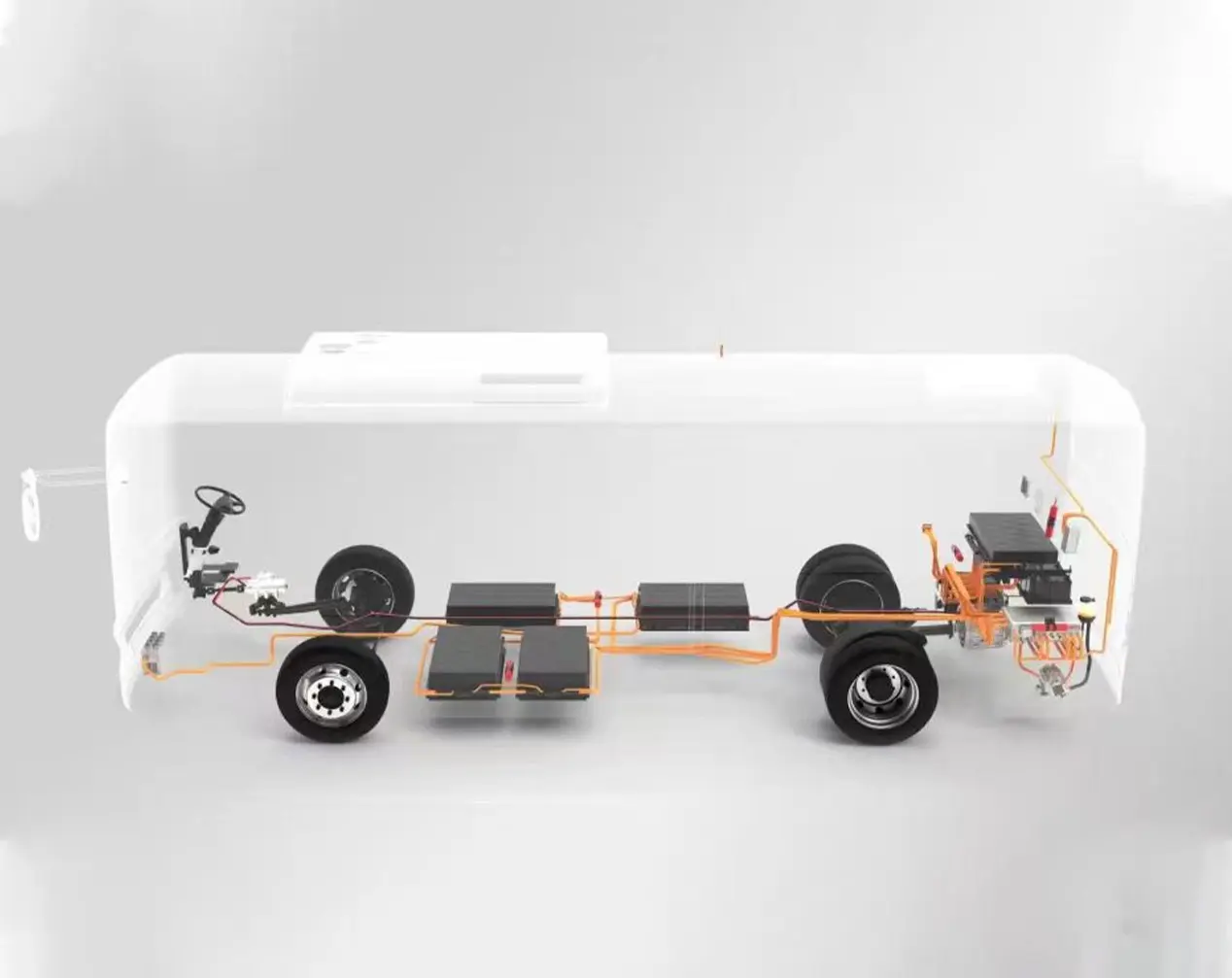

- Diverse Applications: From electric bikes to trucks and buses, each EV type requires tailored inverter solutions.

- Performance Focus: Consumers expect better range, acceleration, and charging speeds—all areas where inverters play a crucial role.

- Supply Chain Expansion: The boom is driving investments in inverter production facilities and material sourcing (e.g., for SiC and GaN).

- OEM Integration: Automakers like Tesla, Volkswagen, and BYD now incorporate custom-built inverters to enhance performance.

The EV boom is turning inverter manufacturers into key players in the sustainable mobility ecosystem.

Key Players and Competitive Landscape

The EV inverter market is intensely competitive and fragmented, with a mix of established electronics firms, automotive giants, and tech-savvy startups.

Leading Market Players:

- Continental AG – Integrated e-drive systems with high-performance inverter modules.

- Mitsubishi Electric – Offers cutting-edge SiC-based inverters with high thermal efficiency.

- Infineon Technologies – Supplies power semiconductors and modules central to inverter manufacturing.

- Tesla Inc. – Manufactures proprietary inverters optimized for its EV powertrains.

- BYD Auto – Designs and produces in-house inverters for scalability and performance.

- BorgWarner (Delphi Technologies) – Known for inverter systems with embedded software.

- DENSO Corporation – Major supplier of inverters to Japanese and global automakers.

Emerging Innovators:

- Rimac Automobili – Developing high-voltage inverters for hypercars.

- REE Automotive – Offers modular EV platforms with integrated inverters.

- Pumbaa – Supplies inverters for commercial electric cars.

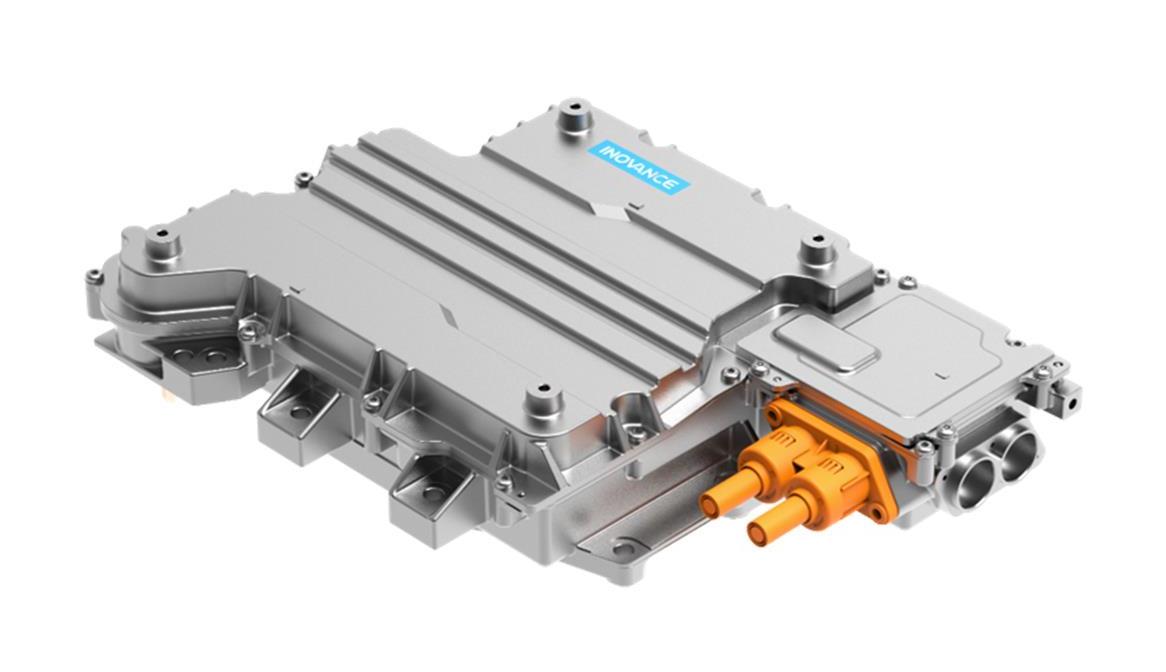

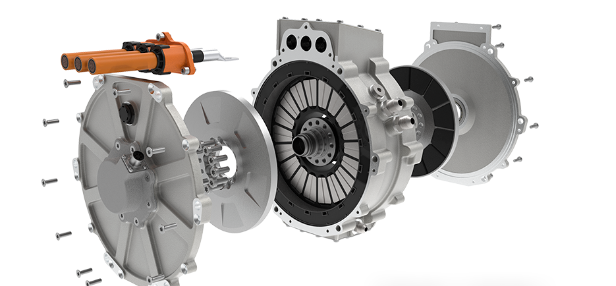

Competition is now focused on delivering compact, lightweight, thermally resilient, and AI-enhanced inverters.

Technological Advancements in EV Inverters

New technologies are revolutionizing inverter capabilities, efficiency, and form factors. Some of the most exciting developments include:

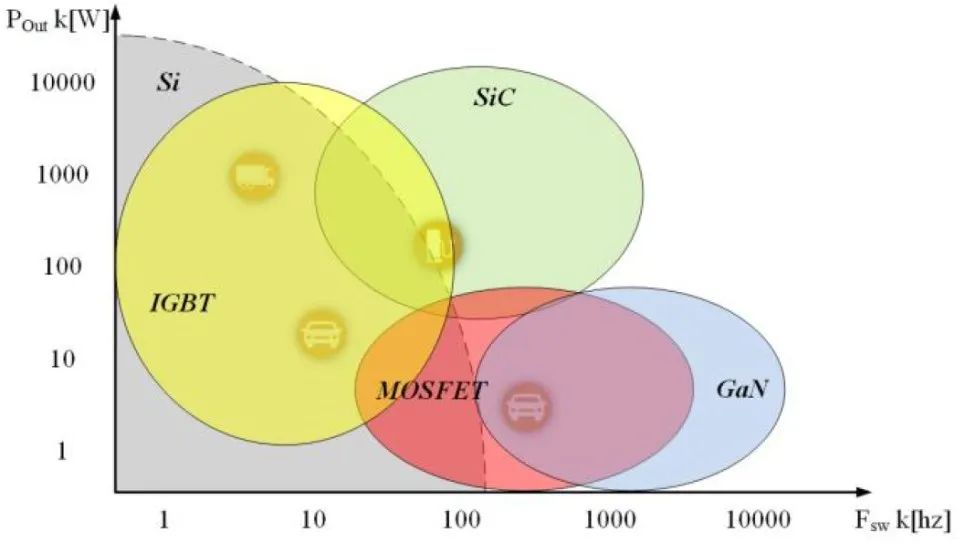

a. Wide Bandgap Semiconductors (WBG)

Silicon Carbide (SiC) and Gallium Nitride (GaN) devices outperform traditional silicon.

Offer higher switching frequencies and improved thermal performance.

Result in compact, lightweight, and more efficient inverters.

b. AI and Digital Control Systems

Inverter algorithms now include machine learning for dynamic optimization.

Predictive diagnostics reduce maintenance costs.

Adaptive power regulation improves energy usage.

c. Bidirectional Inverters

Enable Vehicle-to-Grid (V2G) and Vehicle-to-Home (V2H) features.

Allow EVs to function as power backup systems or energy contributors.

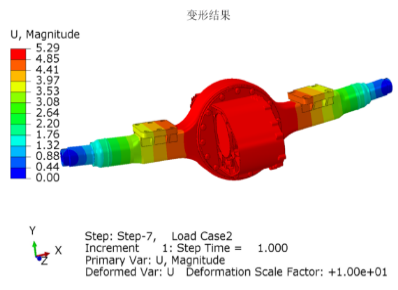

d. Advanced Cooling Systems

Introduction of liquid and two-phase cooling.

Crucial for maintaining thermal stability in compact inverters.

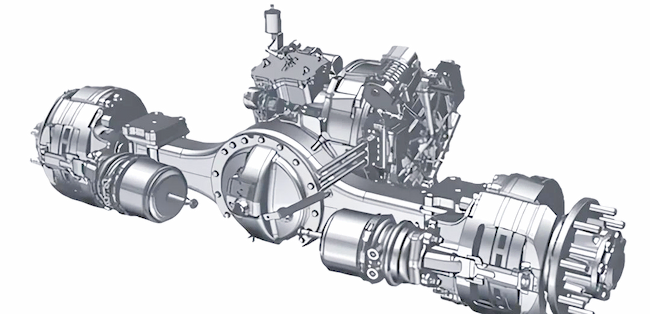

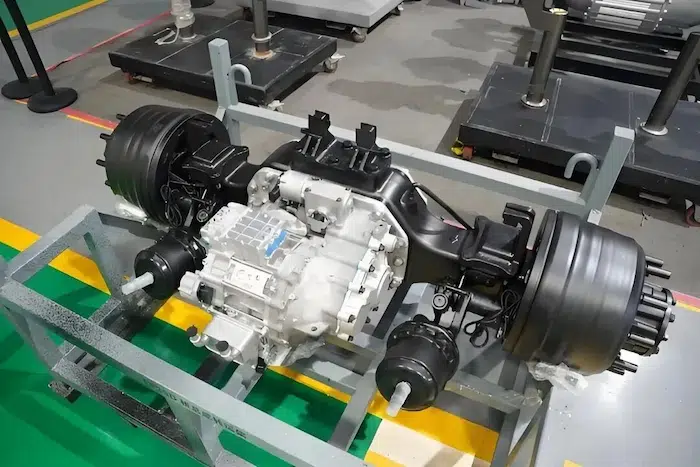

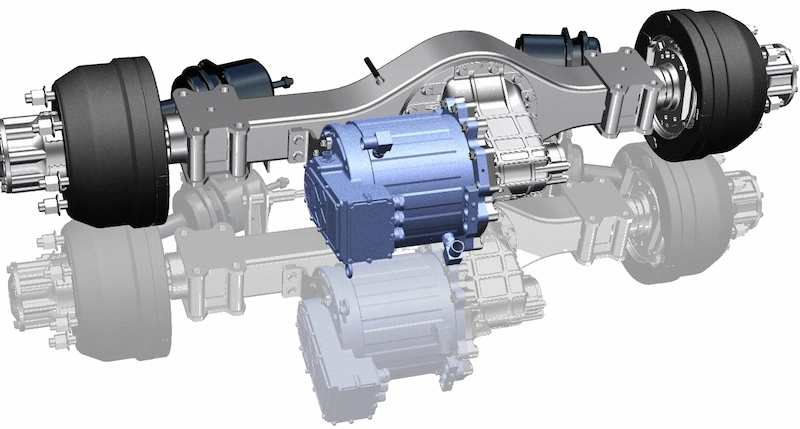

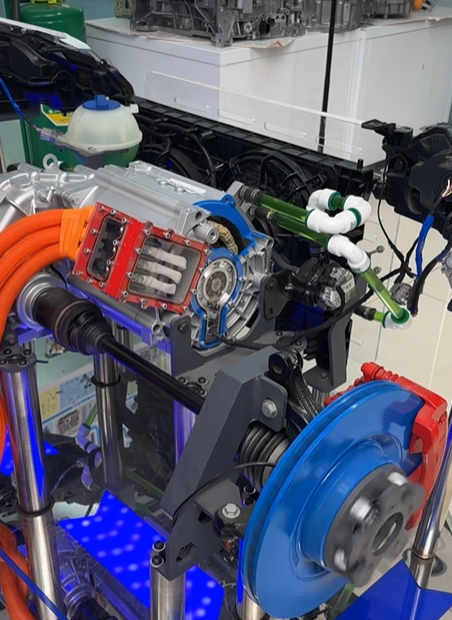

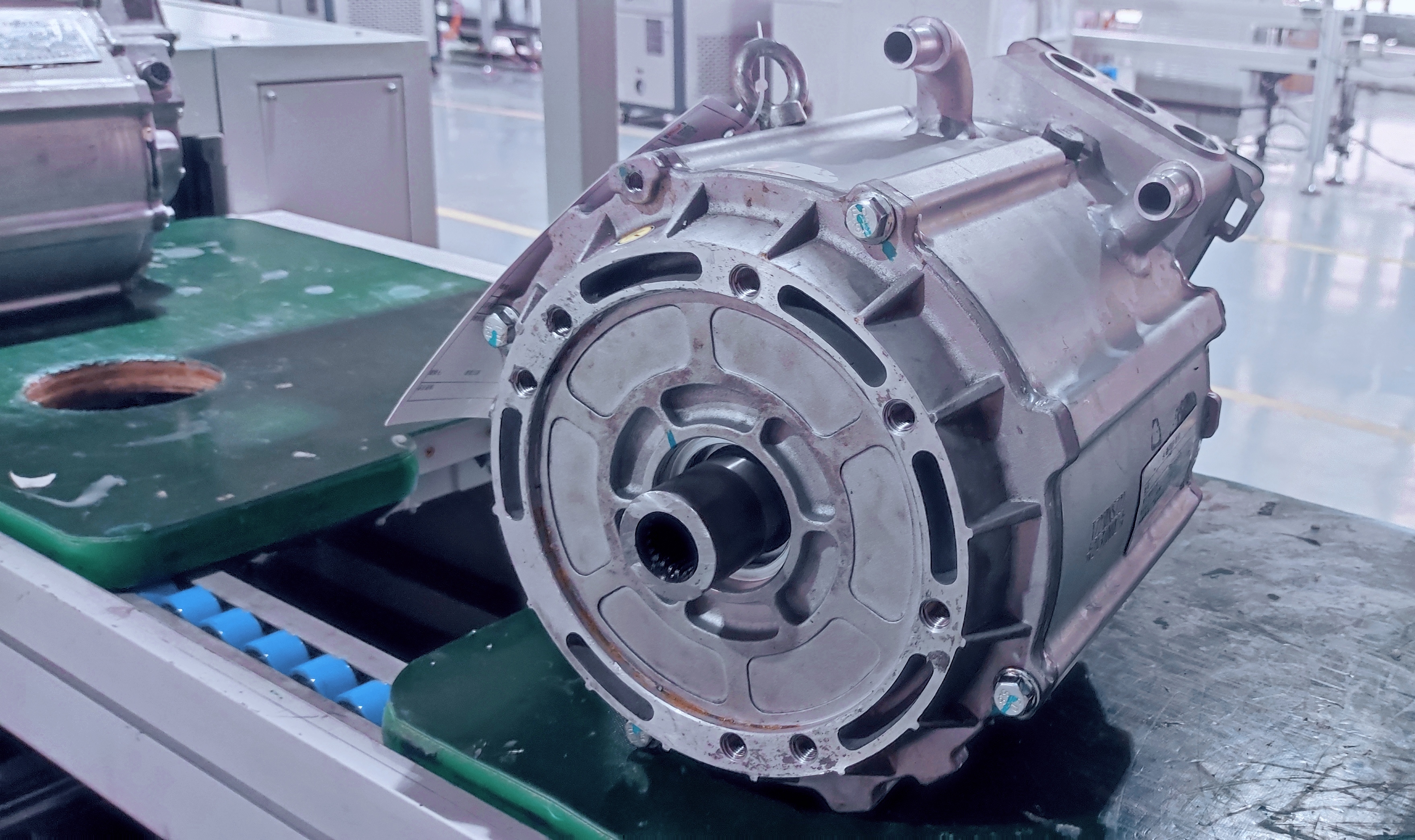

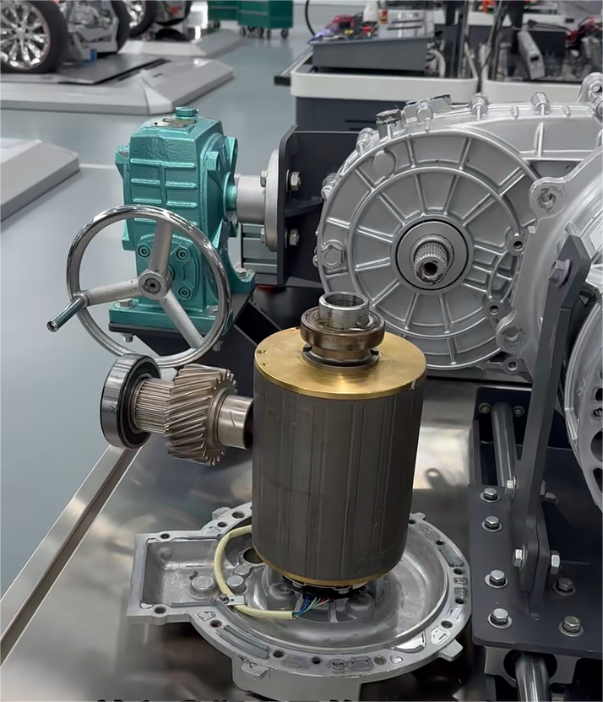

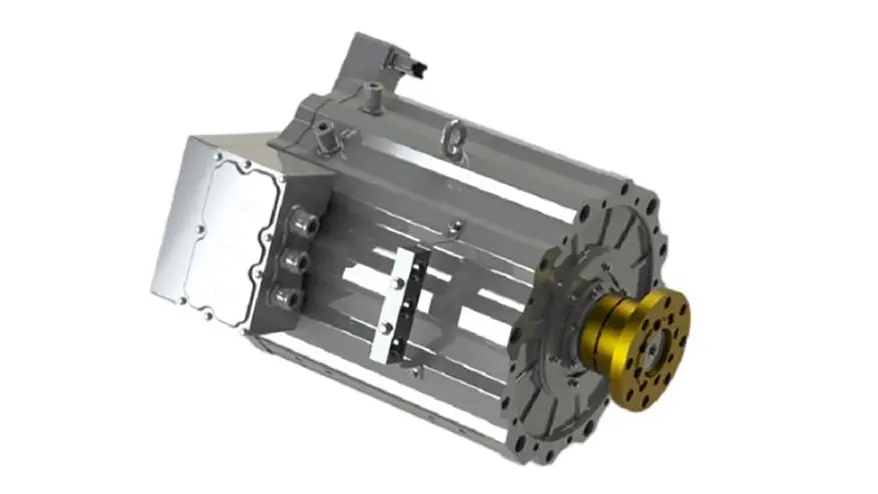

e. Integrated Drive Units

Combining motor, transmission, and inverter into a single unit.

Improves power density, reduces cost, and simplifies EV design.

These technologies are vital to scaling EV production while maintaining performance and safety.

Regional Market Breakdown

North America:

- Strong demand driven by U.S. EV leadership and federal incentives.

- Tesla, GM, and Ford lead domestic production.

- Market value projected to hit $6.5 trillion by 2034.

Europe:

- Policy-driven growth through Green Deal and Fit-for-55 package.

- Leading nations include Germany, Norway, and the Netherlands.

- European OEMs invest heavily in SiC/GaN technologies.

- Market projected at $8.2 trillion by 2034.

Asia-Pacific:

- Largest share globally, dominated by China.

- Chinese players like BYD and Geely manufacture inverters in-house.

- Strong government support and infrastructure buildup.

- Forecast to reach $11.7 trillion by 2034.

Rest of the World:

- Latin America, Africa, and the Middle East show rising interest.

- Infrastructure and policy development remain barriers.

- Long-term growth potential as technology becomes more affordable.

Challenges and Market Restraints

Despite its potential, the EV inverter market faces several challenges:

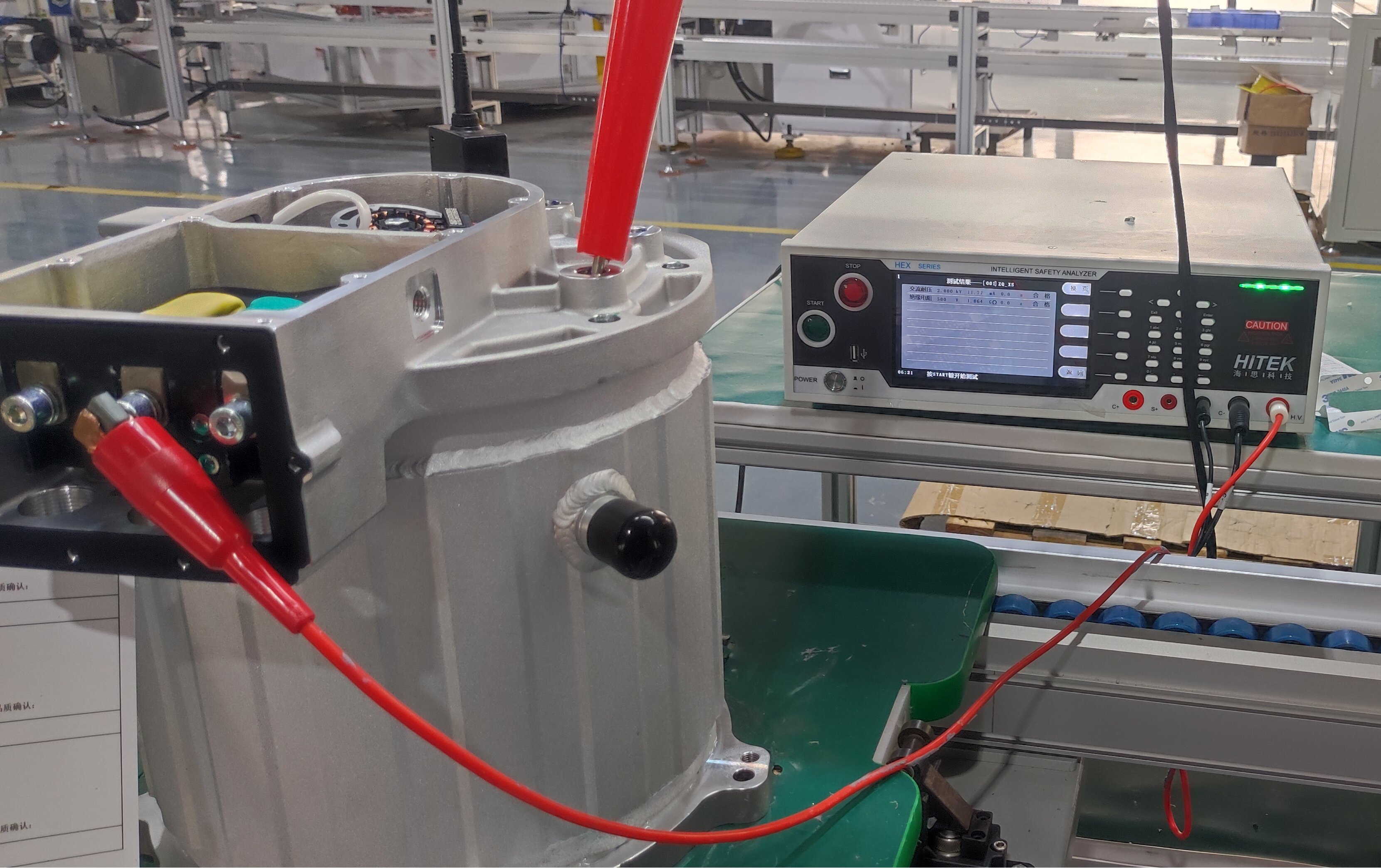

a. High Initial Costs

Advanced inverters use expensive materials and require precise manufacturing.

Cost barriers remain for low-cost EV segments.

b. Semiconductor Shortages

Global chip shortages disrupt production and delay shipments.

Over-reliance on a few suppliers adds to vulnerability.

c. Thermal Management Constraints

High-efficiency inverters generate substantial heat.

Cooling systems must evolve to prevent performance degradation.

d. Standardization Issues

Varying standards across regions and manufacturers hinder compatibility.

Lack of uniform testing protocols delays product certification.

e. Recycling and Sustainability

Inverter components are complex and hard to recycle.

Sustainable end-of-life strategies are still in early stages.

Addressing these challenges will be critical to maintaining the market's upward trajectory.

Future Outlook

Looking ahead, the EV inverter market is set to evolve with broader EV adoption, smarter systems, and deeper integration. Key future trends include:

- Integration with Solid-State Batteries: Inverters will adapt to high-voltage, ultra-fast charging environments.

- Blockchain in V2G Systems: Enabling secure, traceable energy exchanges.

- Subscription-Based Inverter Services: Offering leasing and updates through OTA platforms.

- Modular Platforms: Allow manufacturers to scale inverter designs across models and applications.

- Smart Inverters with Edge Computing: Enabling real-time analytics and autonomous decision-making.

These innovations promise a robust and intelligent inverter landscape capable of supporting next-gen mobility.

Conclusion

The electric vehicle inverter market is poised to become a $29.26 trillion powerhouse by 2034, riding the wave of the global EV boom. Inverters are no longer just conversion tools—they are integral to vehicle intelligence, performance, and sustainability.

As automakers, electronics companies, and startups compete to deliver better, faster, and more efficient inverter solutions, the industry is undergoing a revolution of its own. The intersection of power electronics, AI, energy storage, and vehicle connectivity makes this market one of the most exciting frontiers in modern technology.

Whether you’re an investor, manufacturer, or EV enthusiast, the EV inverter market offers unmatched potential in the transition to a clean energy future.

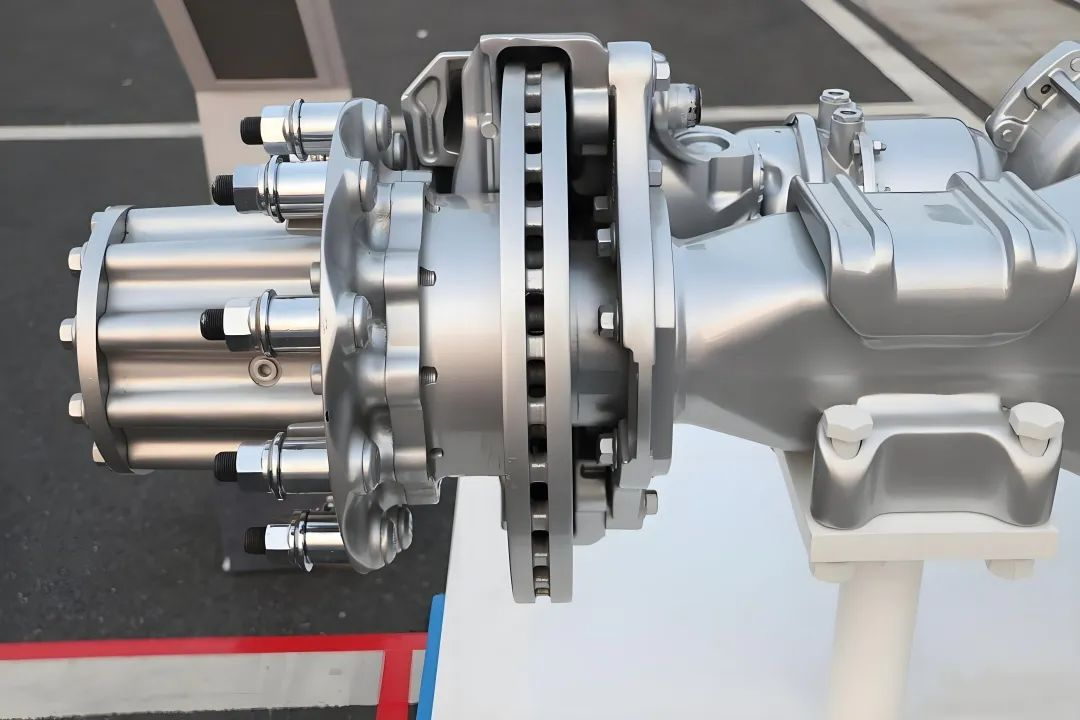

Read More: Overview of the Electric Drive Axle System for Heavy-Duty Trucks