Analysis of Development Trends in the Industrial Motor Industry Against the Backdrop of Global Carbon Neutrality Acceleration and the Fourth Industrial Revolution

Driven by the dual forces of accelerating global carbon neutrality and the deepening Fourth Industrial Revolution, the industrial motor industry stands at a historic turning point. As core fundamental equipment supporting industrial production and energy conversion, the industry is undergoing profound transformations in energy efficiency improvement, intelligent integration, and green transition. Based on the latest industry data, policy dynamics, and technological breakthroughs, this article systematically deconstructs the full picture of the industrial motor industry's development in 2025, revealing the three intertwined trends of high efficiency, intelligence, and greening, providing forward-looking strategic reference for industry decision-makers, investors, and innovators.

I. Deep Adjustment of the Global Industrial Landscape and the Consolidation of China's Leading Position

The global industrial motor industry landscape is undergoing structural reshaping. China, leveraging its complete industrial chain, sustained policy support, and technological iteration capabilities, has established a global leadership position. Data from the International Energy Agency (IEA) for 2025 shows that China's global market share of industrial motors reached 42.7%, an increase of approximately 9 percentage points compared to 2020; its market scale exceeded 53 trillion RMB, ranking first globally for eight consecutive years. Behind this achievement lies the synergistic advancement of the "Dual Carbon" goals and the Industry 4.0 strategy: the "Made in China 2025" strategy is entering its final stage, driving the penetration rate of high-efficiency motors to 68%, a 27-percentage-point increase from 2020; the "14th Five-Year Plan" motor energy efficiency improvement plan was completed ahead of schedule, leading to annual electricity savings in the industrial sector exceeding 210 billion kWh, equivalent to reducing carbon dioxide emissions by approximately 170 million tons.

The policy system continues to empower industrial upgrading. In 2025, investment from China's Manufacturing Transformation and Upgrade Fund into the motor industry increased by 35% year-on-year, focusing on cutting-edge areas such as permanent magnet motors, intelligent control systems, and superconducting technology. At the local level, characteristic industrial clusters have formed: Jiangsu Province implemented the "Motor Industry Strong Chain Plan," cultivating enterprise clusters, with output accounting for 22% of the national total in 2025; Guangdong Province, leveraging the innovation resources of the Guangdong-Hong Kong-Macao Greater Bay Area, built a full industrial chain from R&D design, core component manufacturing to system integration, with product export growth reaching 28%, of which intelligent motors targeting the high-end market accounted for over 40%.

The global market exhibits a trend of "Eastern dominance, multipolar growth." In 2025, China's exports of motors to countries along the "Belt and Road" initiative exceeded 98 million units, accounting for 54% of total exports, establishing brand influence especially in Southeast Asia, the Middle East, and other regions. Southeast Asia, due to manufacturing relocation and accelerated local industrialization, saw a 42% year-on-year increase in motor imports, becoming the fastest-growing region globally. Meanwhile, driven by upgrades in energy efficiency regulations, the dependence of European and North American markets on China's high-efficiency motors further increased.

II. Multidimensional Segmentation and Market Restructuring Driven by Technological Innovation

(A) Product Structure Deeply Adjusts Towards High Efficiency and Intelligence

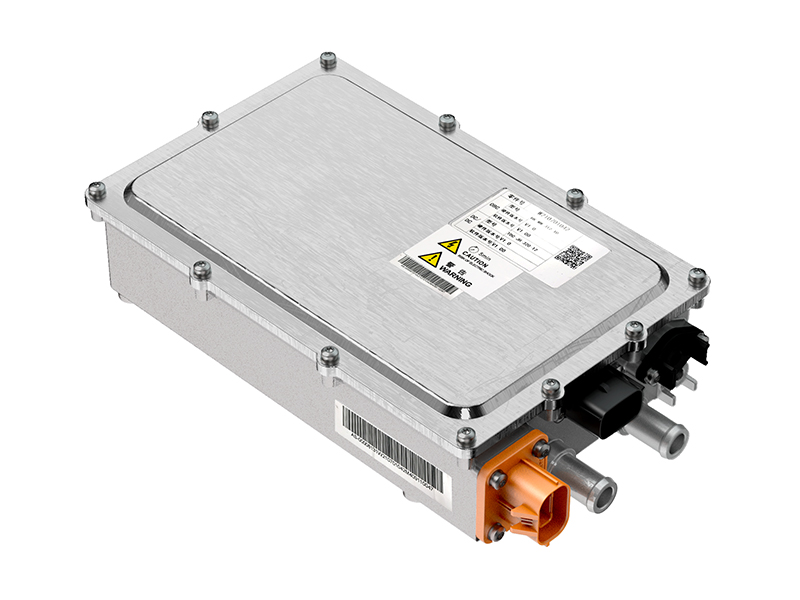

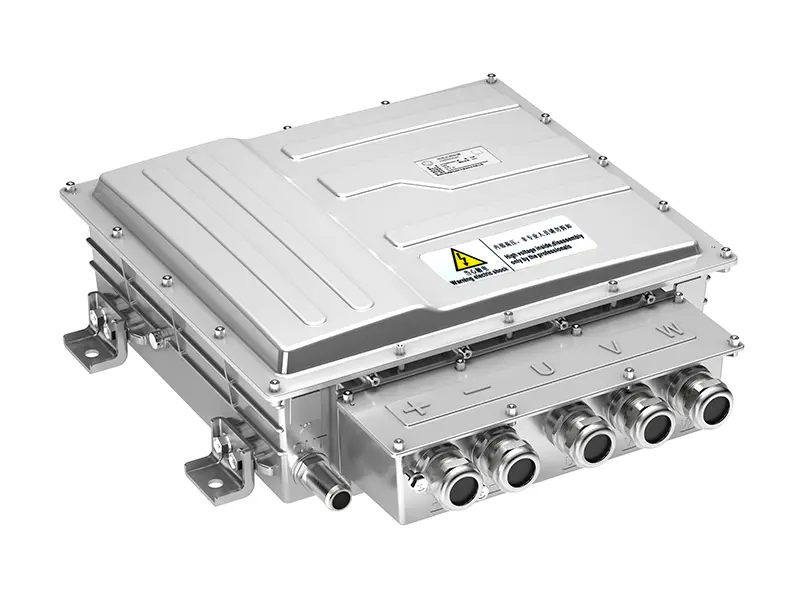

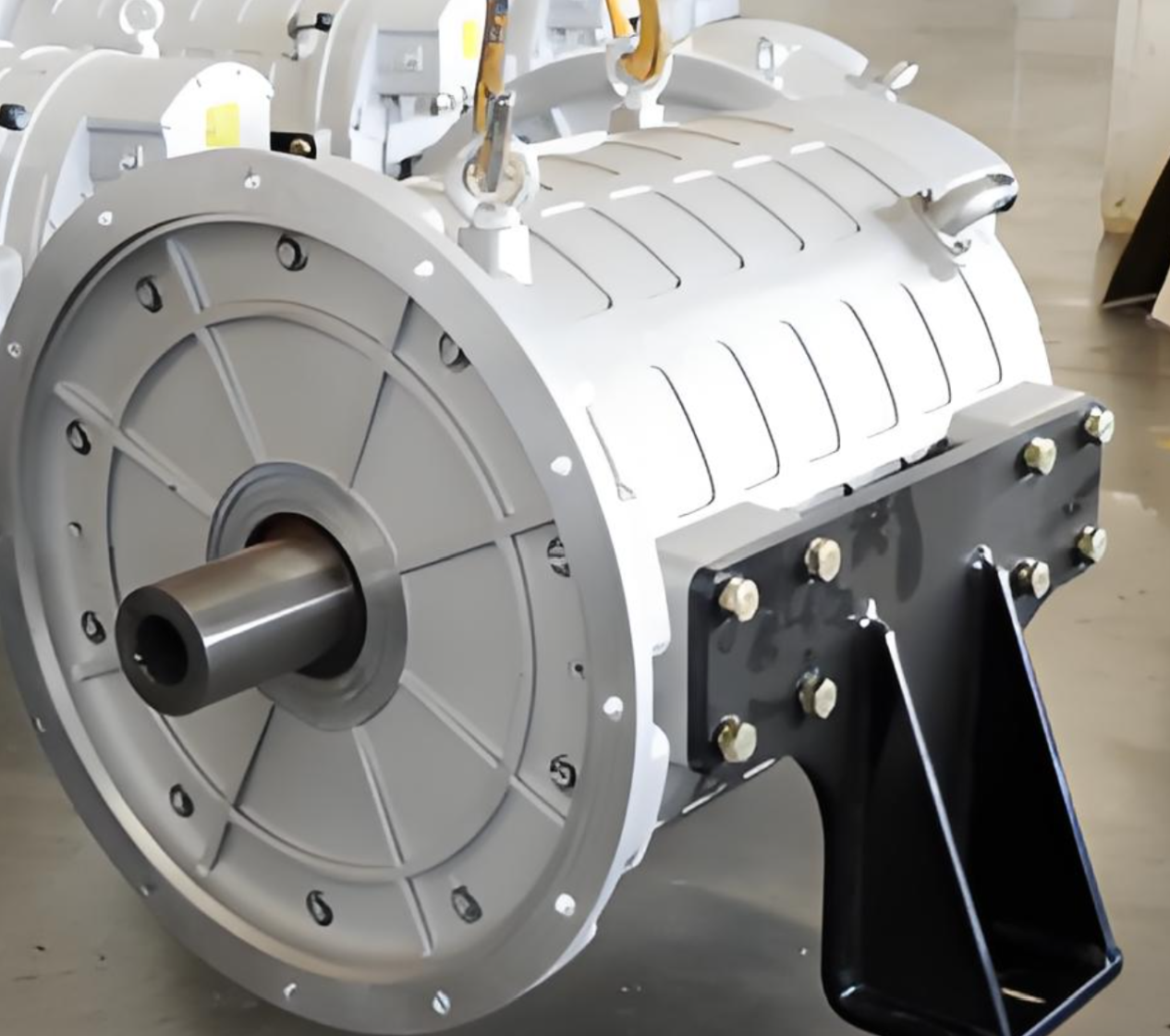

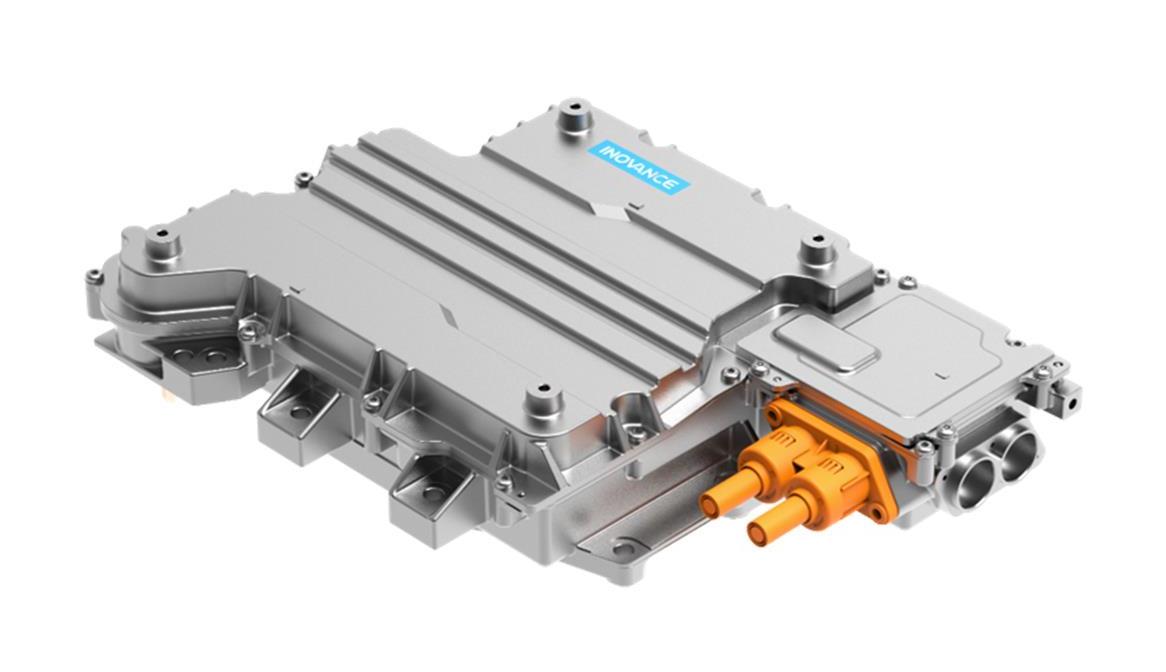

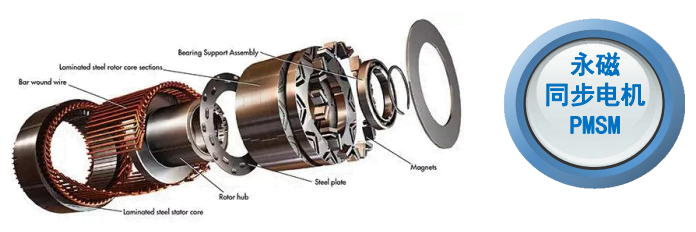

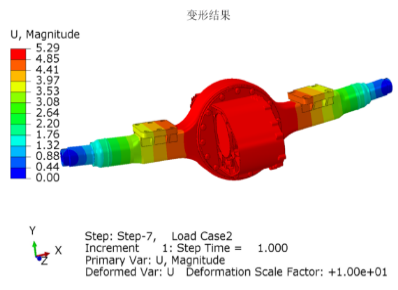

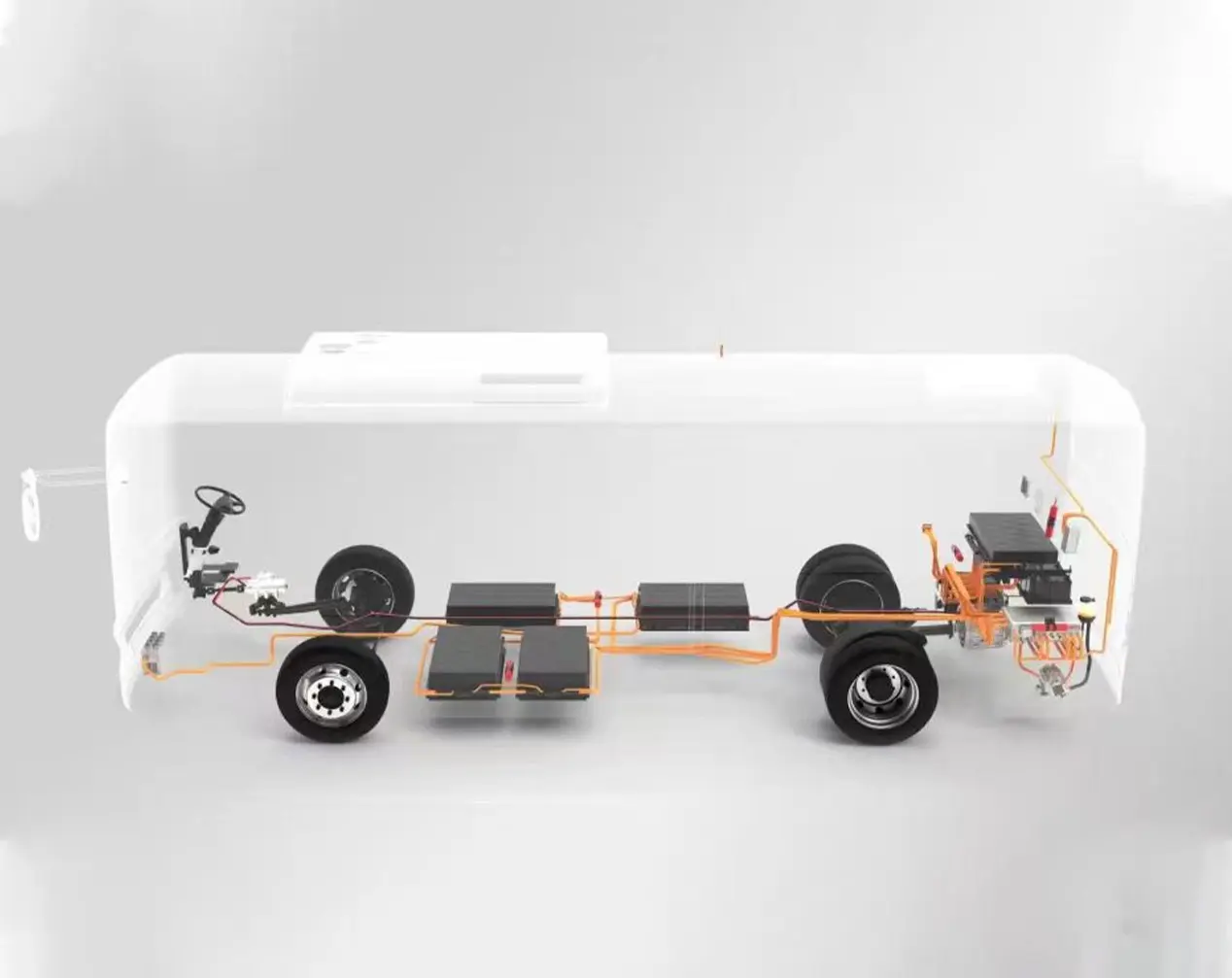

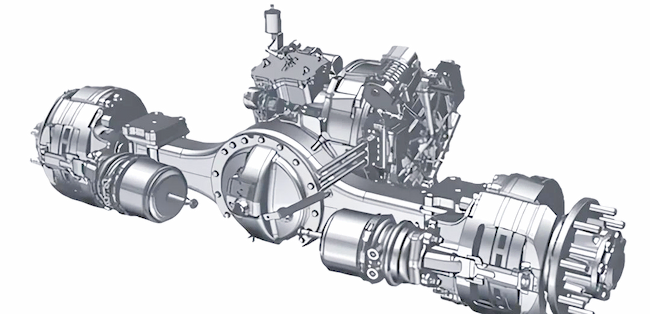

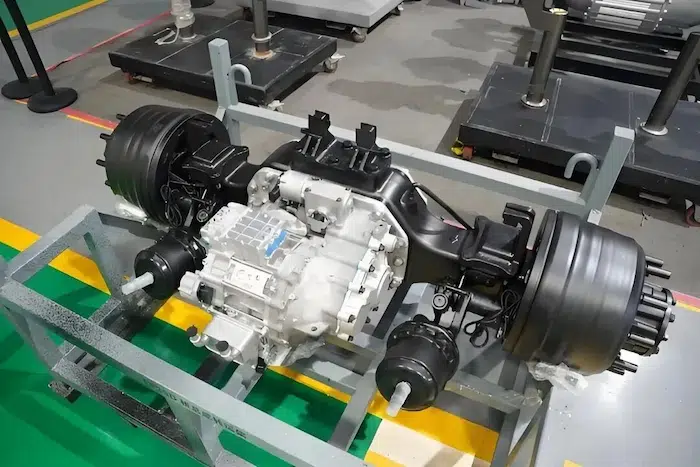

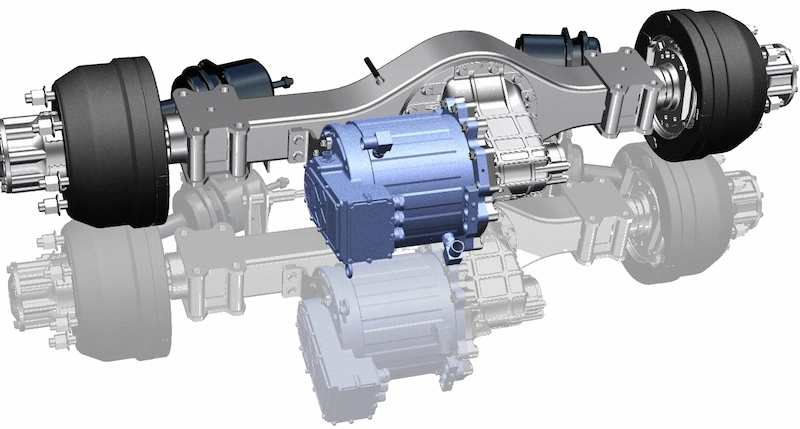

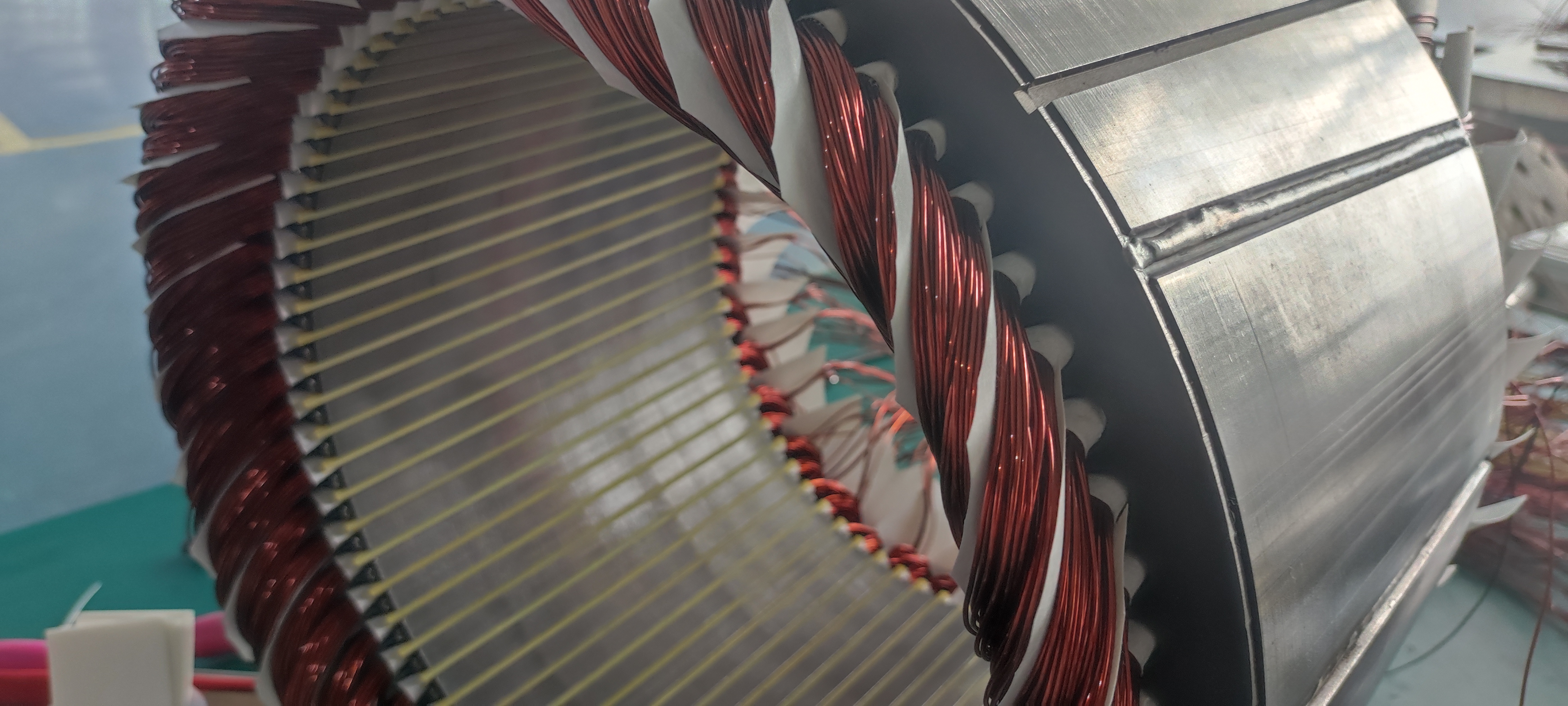

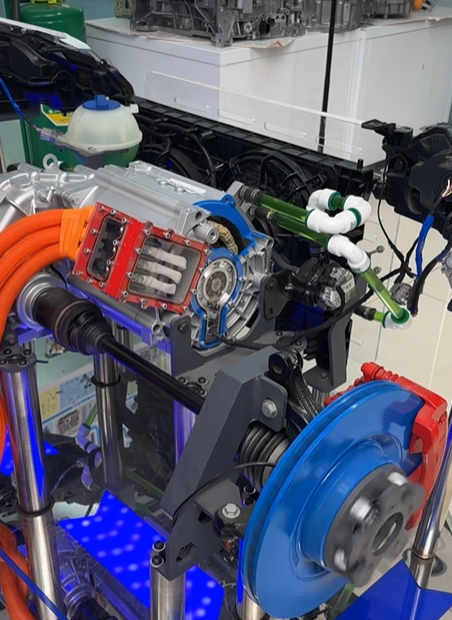

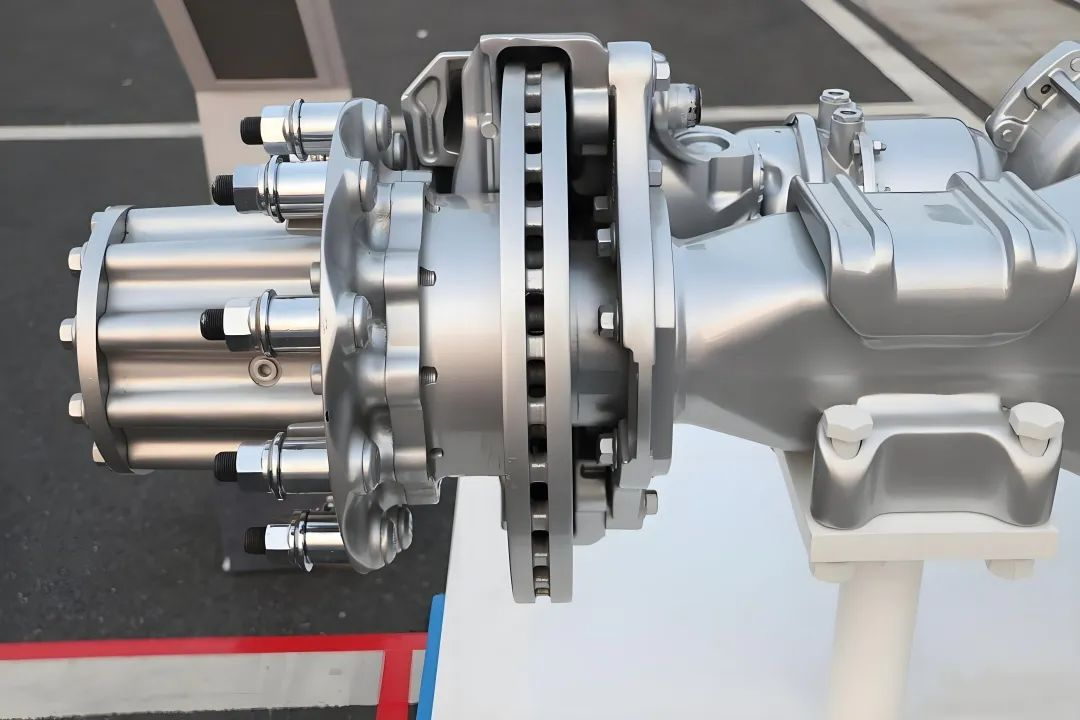

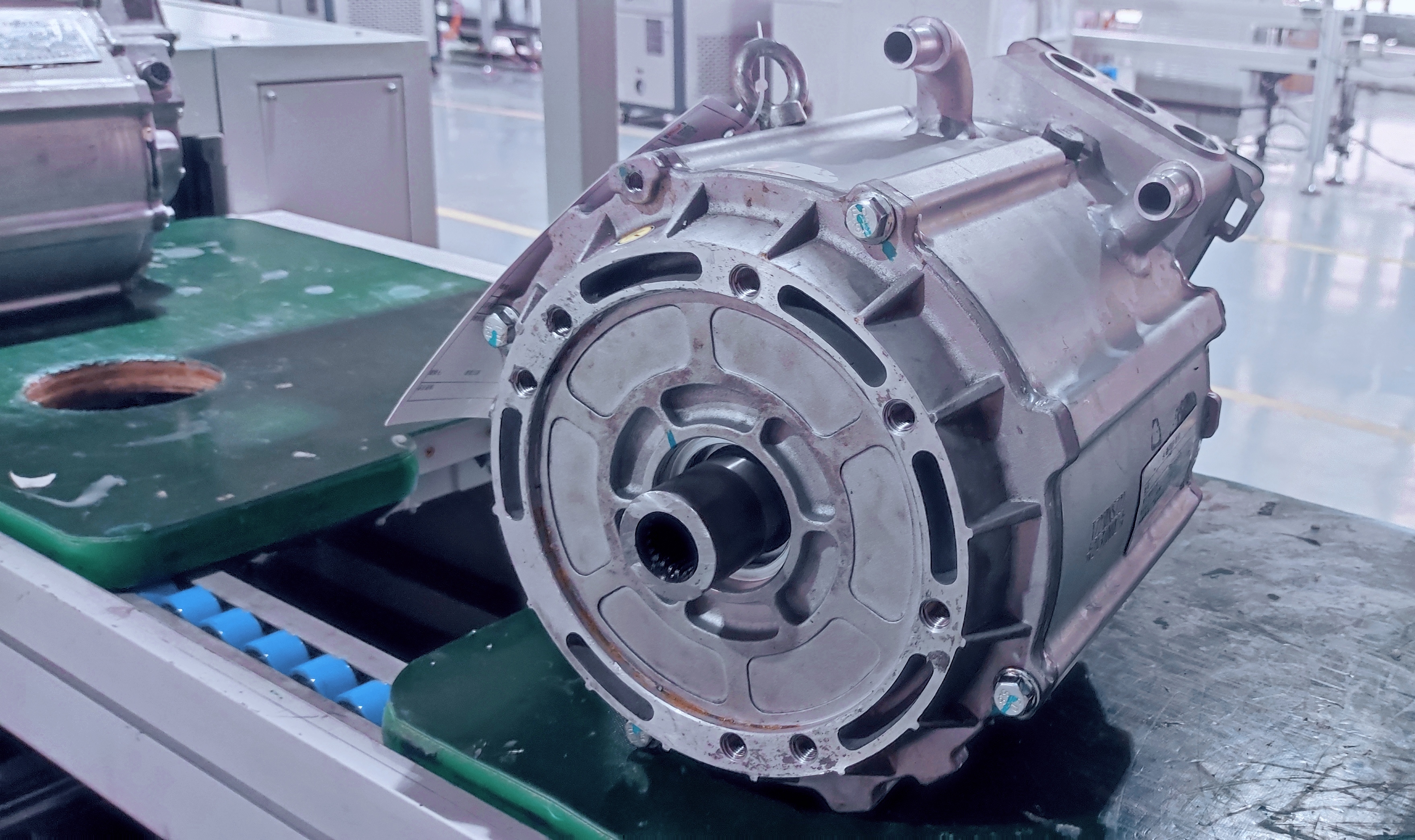

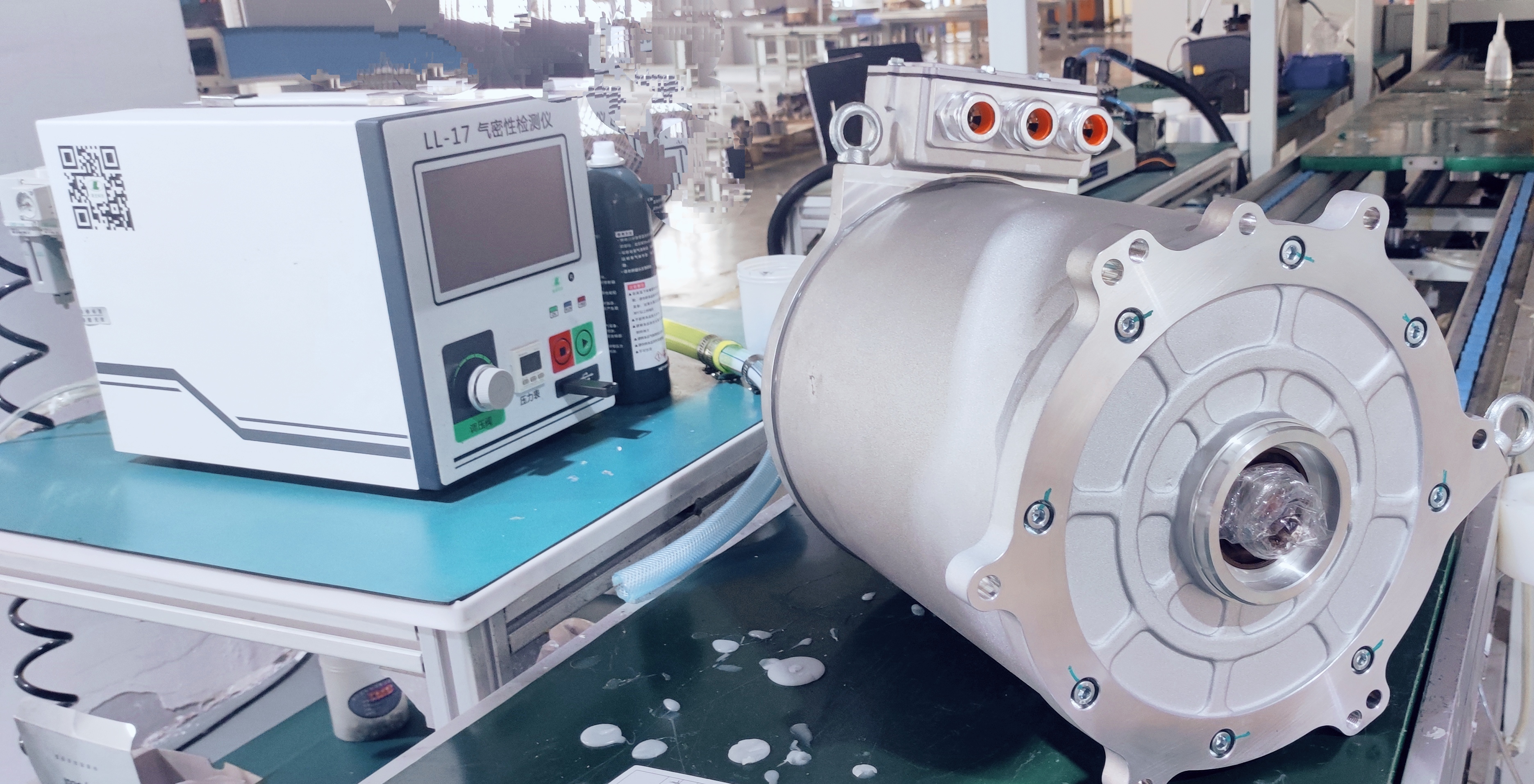

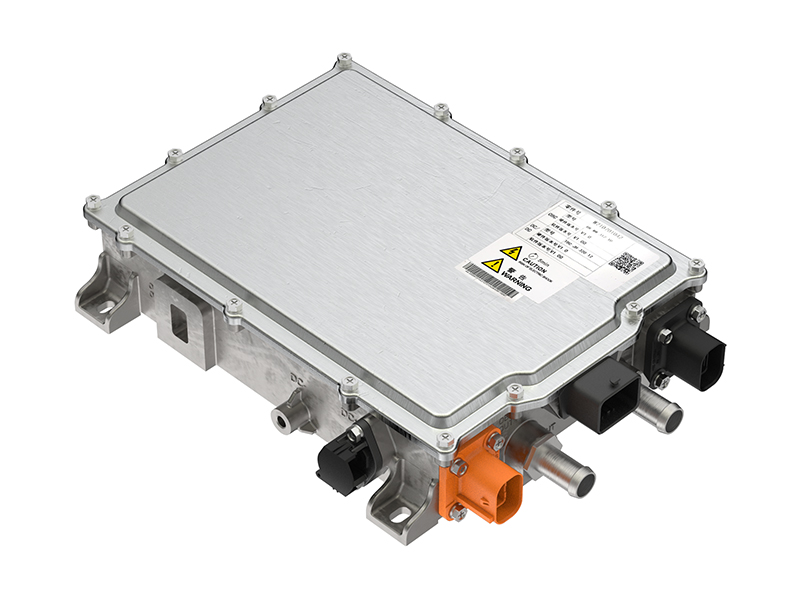

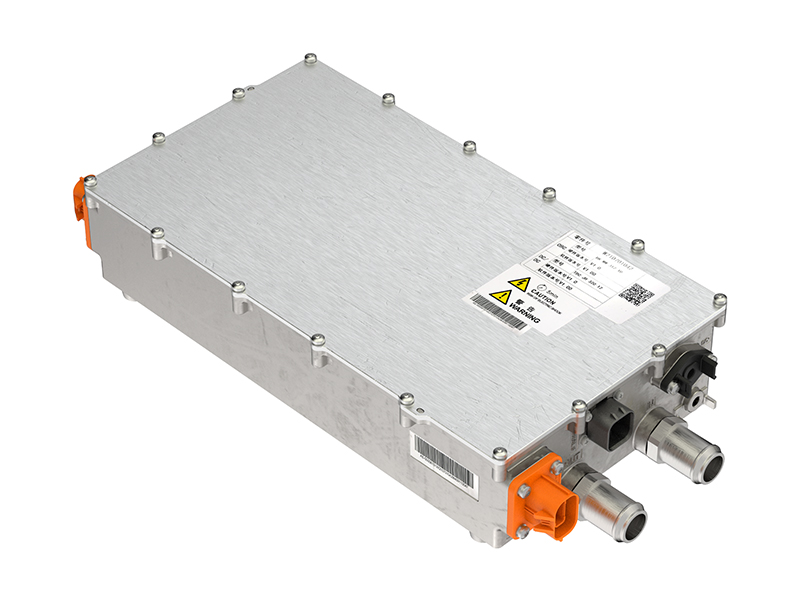

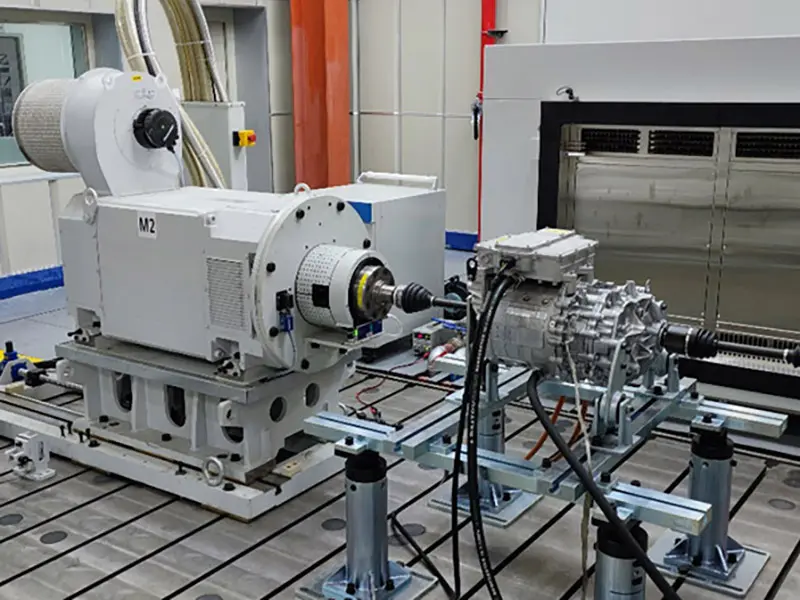

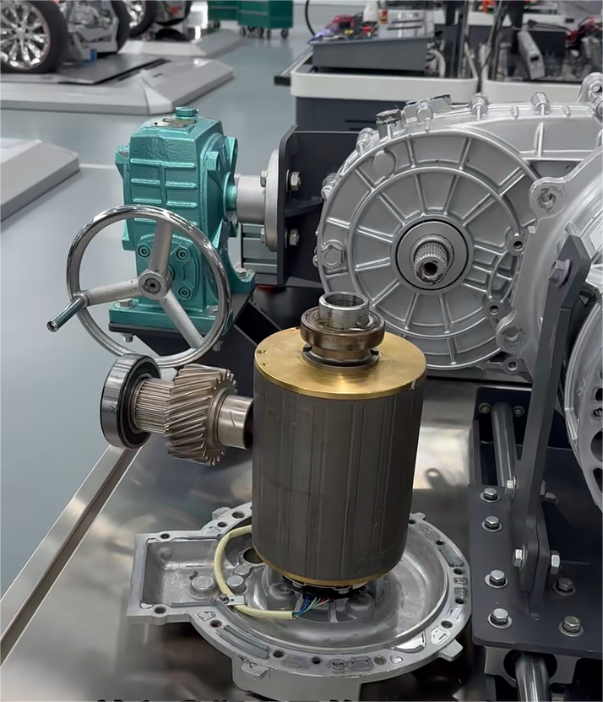

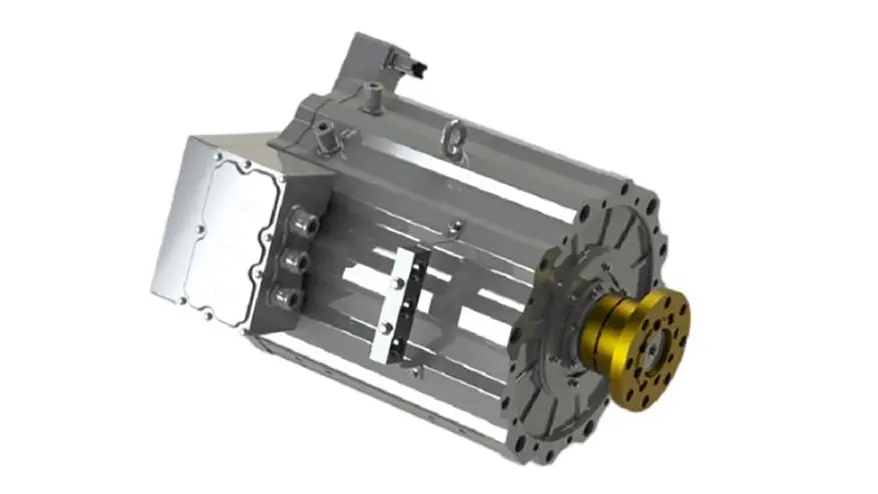

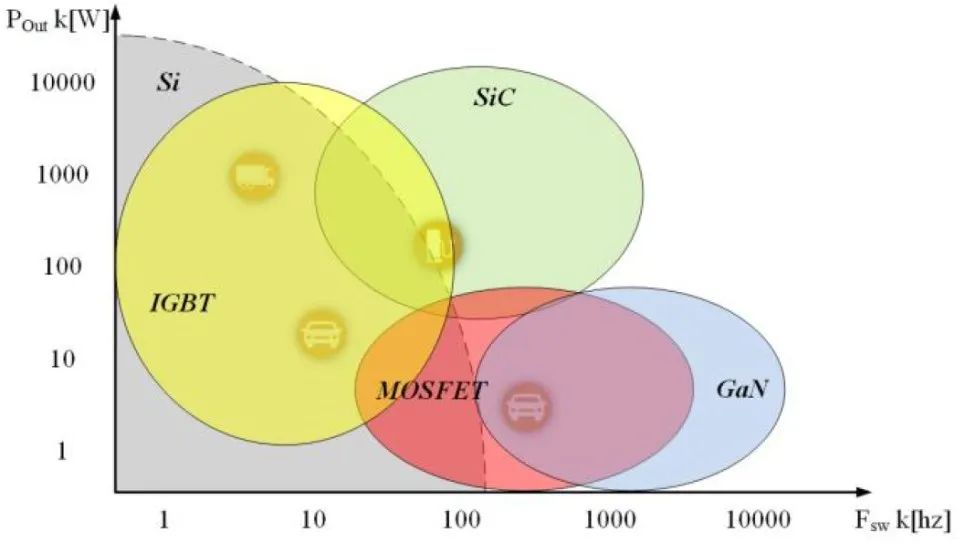

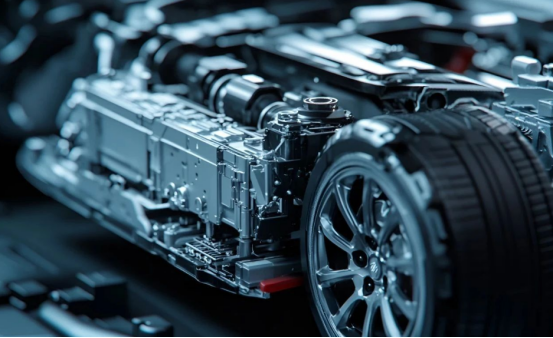

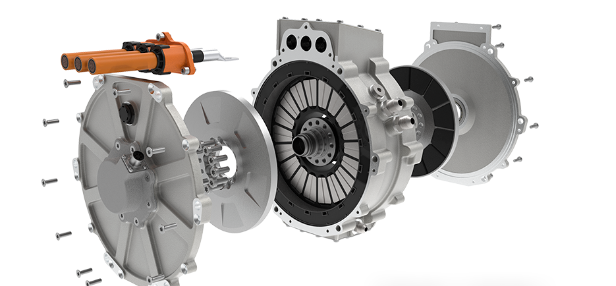

Permanent Magnet Synchronous Motors (PMSM), have entered a period of explosive large-scale application. In 2025, their penetration rate in the overall industrial motor market exceeded 40%, accounting for over 75% in high-end fields such as new energy vehicles, high-end CNC machine tools, and industrial robots. Taking rare earth permanent magnet materials as an example, the third-generation low-heavy rare earth NdFeB magnet developed by Zhongke Sanhuan enables a 12% improvement in motor efficiency even in high-temperature environments, driving the market size of new energy vehicle drive motors to 152 billion RMB. Servo motors, as core components for precision control, saw their market size exceed 38 billion RMB in 2025, with an application share of 63% in the field of industrial robots, and a compound annual growth rate maintained at a high level of 21%, resonating with the demand for intelligent manufacturing equipment.

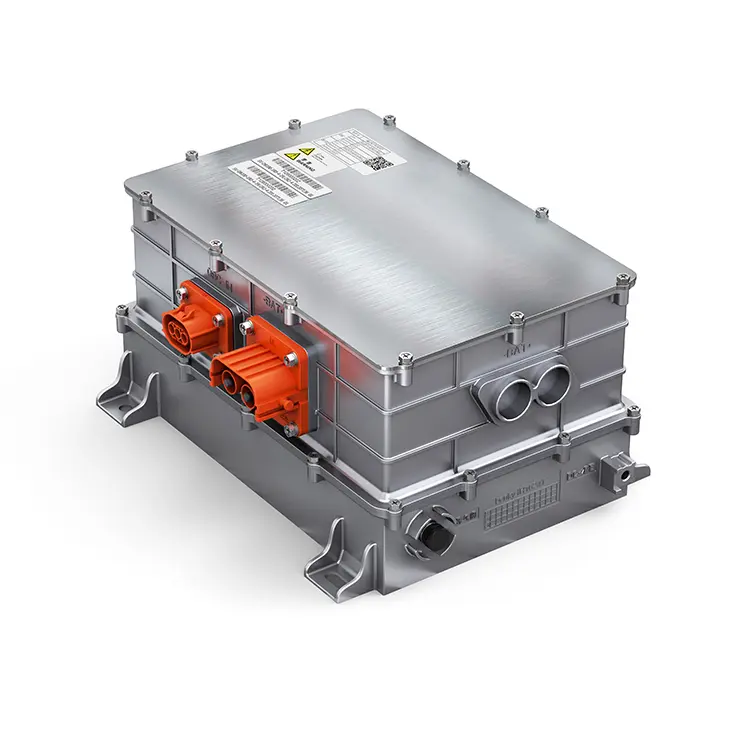

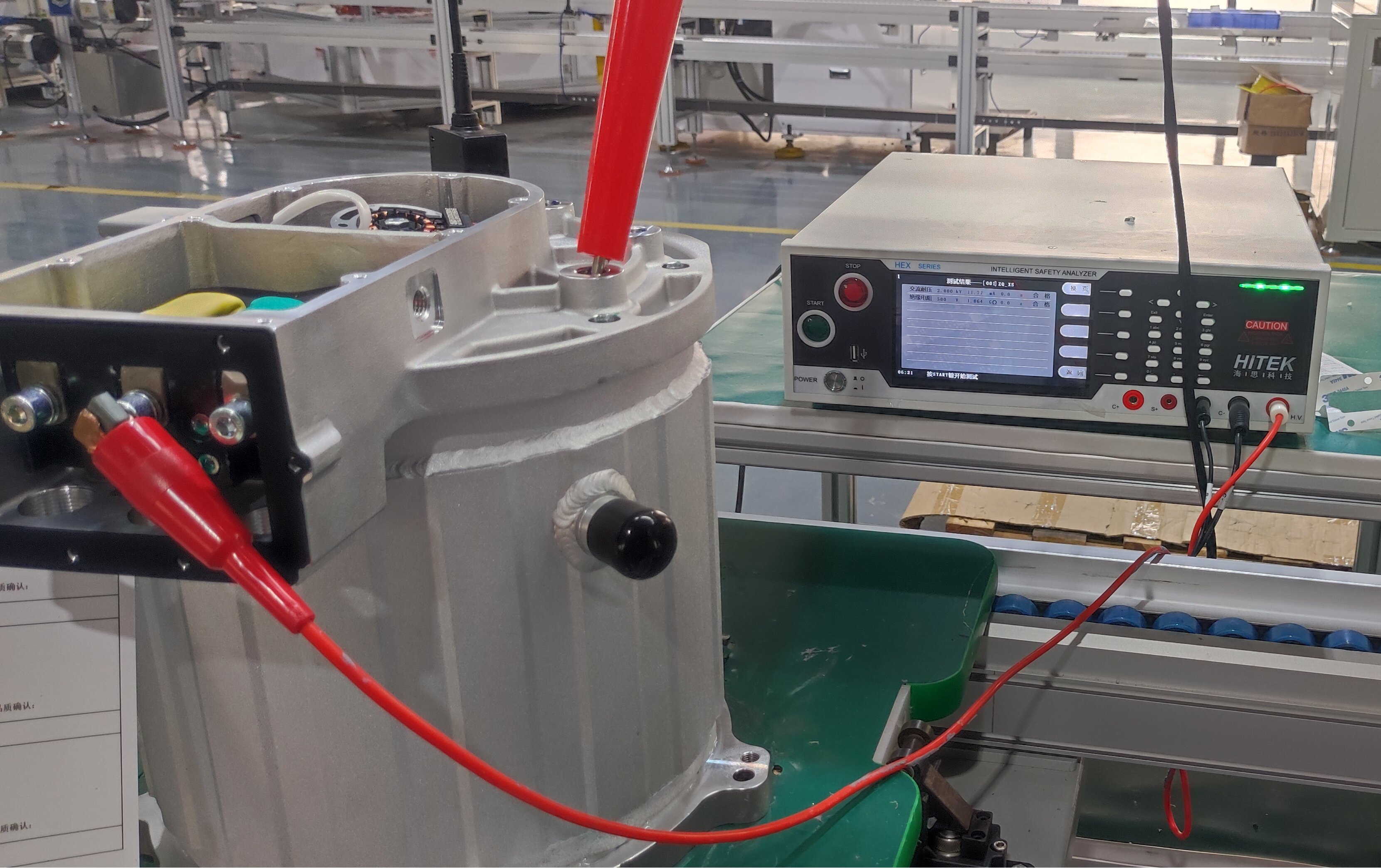

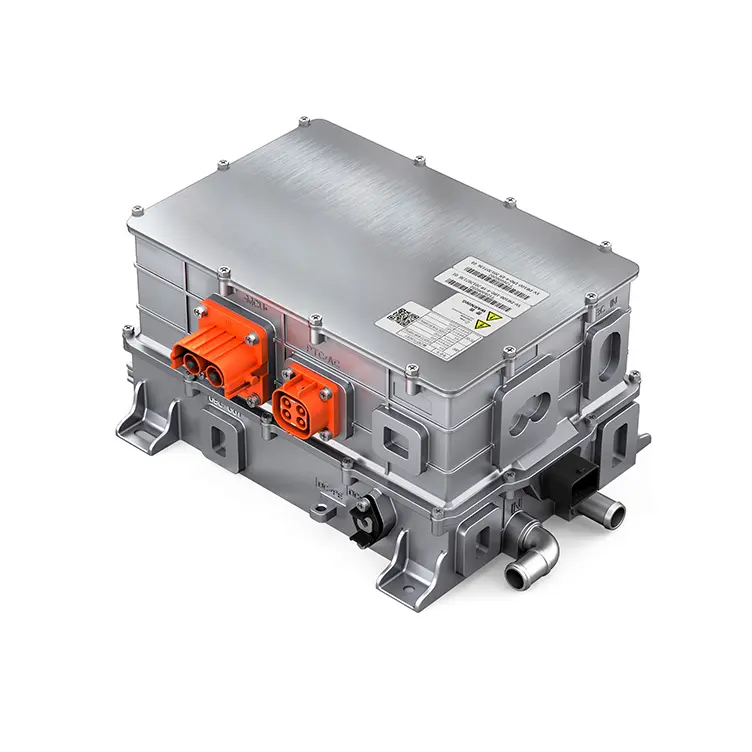

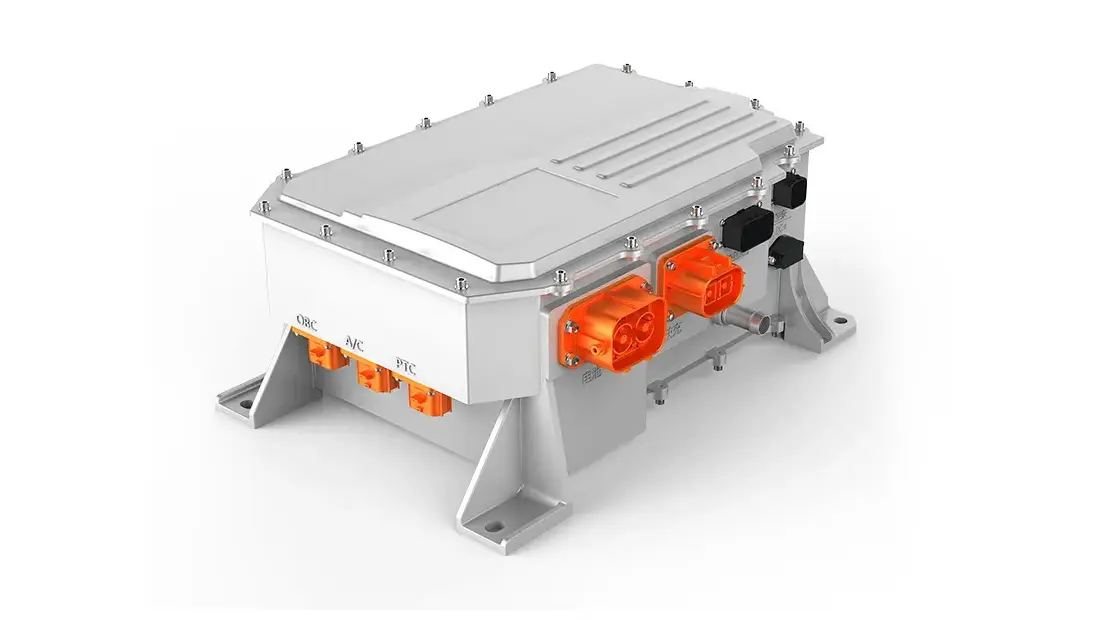

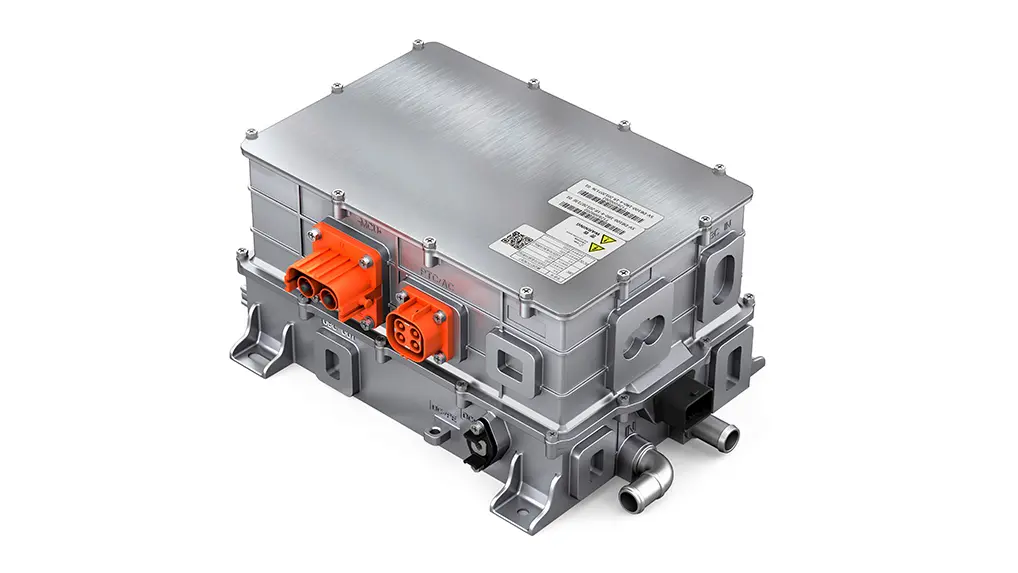

The intelligent transformation of traditional motors has opened up a trillion-RMB stock market. Intelligent motor systems integrating 5G communication, AI diagnosis, and predictive maintenance functions launched by companies such as Chint Electric and Delixi have reduced equipment failure rates by an average of 37% and operational maintenance costs by 29%. Data from the Ministry of Industry and Information Technology shows that in 2025, the penetration rate of intelligent motors in high-energy-consuming industries such as metallurgy, chemicals, and mining reached 58%, becoming a key lever for enterprise digital and energy-saving transformation.

(B) Regional Industrial Clusters Evolve Towards High-End and Synergization

The Yangtze River Delta region has formed the world's most influential intelligent manufacturing corridor,and built a complete ecosystem from R&D design, precision machining to system integration. Anhui Province, relying on the Hefei Comprehensive National Science Center, achieved a series of breakthroughs in frontier areas such as linear motors and magnetic levitation motors, with related product export value increasing by 45% year-on-year in 2025. Central and western regions achieved leapfrog development through models such as "R&D enclaves" and "industrial collaboration." For example, Sichuan Province introduced the CATL Motor Research Institute, driving the production capacity of new energy equipment motors to increase by 210% over three years, forming an industrial layout complementary to the Yangtze River Delta and Pearl River Delta regions.

III. Three-Dimensional Technological Revolution: Restructuring the Industry's Underlying Logic

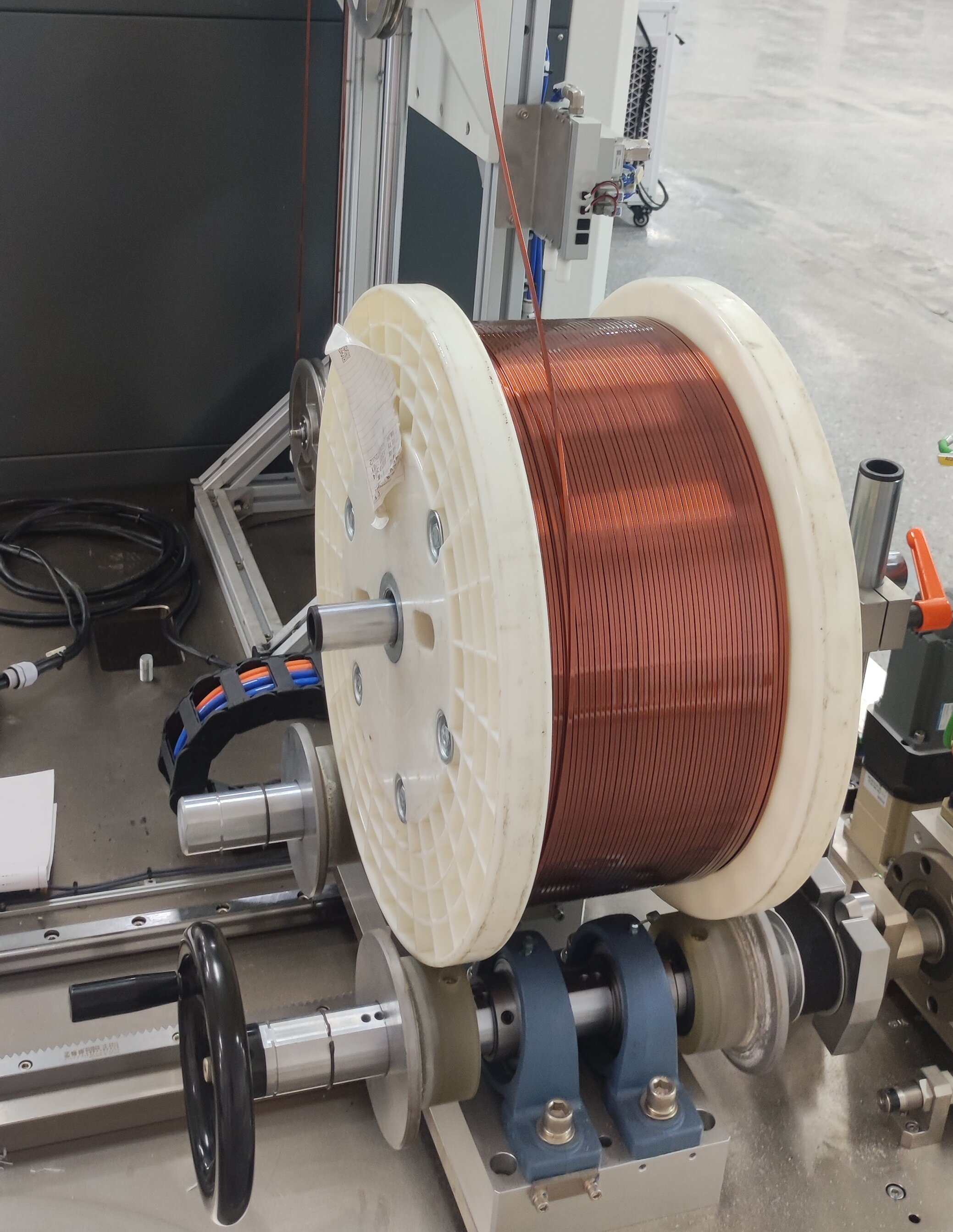

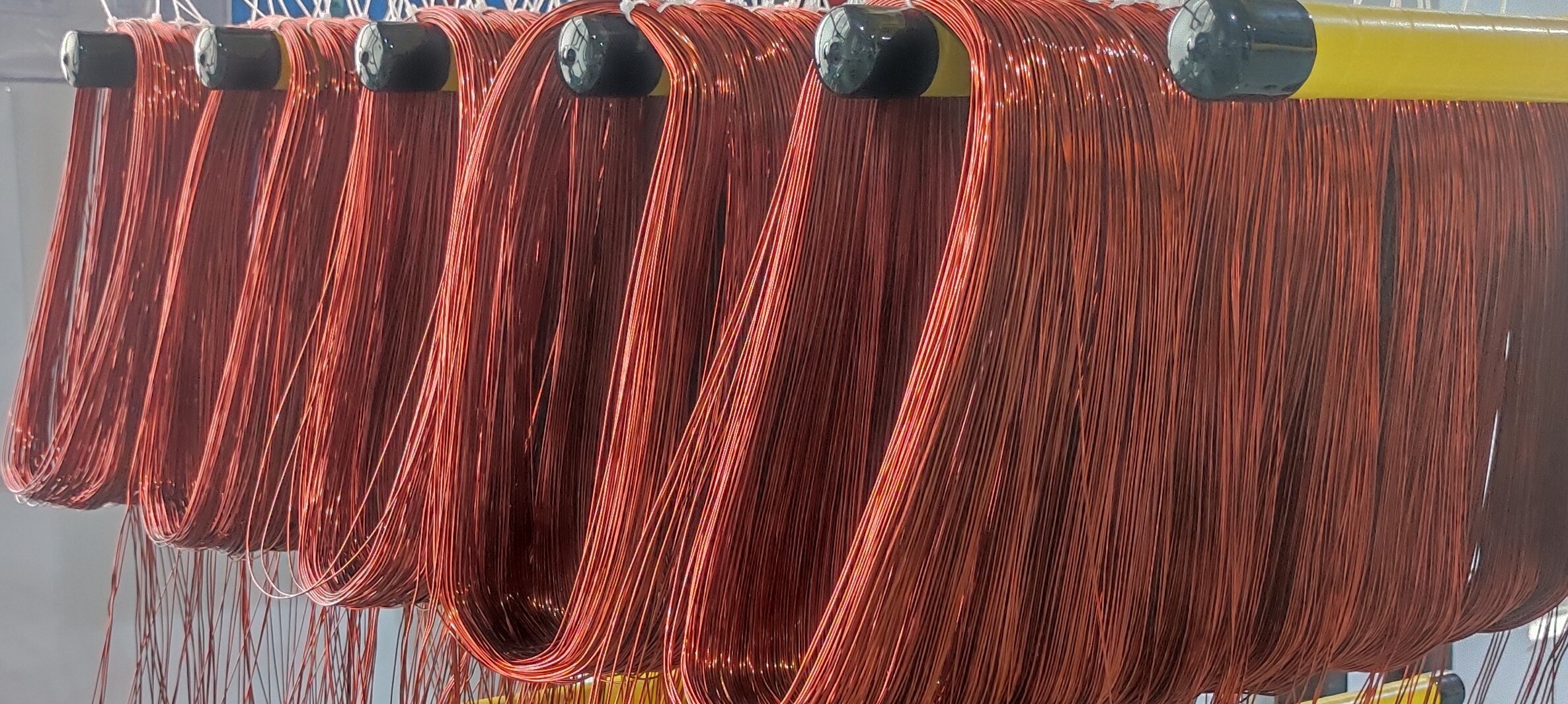

(A) Efficiency Revolution: New Materials and Technologies Break Physical Limits

Continuous innovation in rare earth permanent magnet materials is constantly expanding the efficiency boundaries of motors. The HRE series high-performance permanent magnet motor developed by JL MAG, adopting nanocrystalline alloy and non-uniform magnetic pole design, improves stability by 40% under high-temperature and high-load conditions. After being applied to Baosteel's hot rolling production line, it achieved a 12% reduction in energy consumption per ton of steel. Superconducting motor technology is moving from the laboratory to commercial application. A 10MW high-temperature superconducting motor developed by a Shanghai institution is 60% smaller in volume and 50% lighter in weight compared to traditional motors of the same power, and is soon to be applied in offshore wind power and large ship propulsion systems, marking a new stage in motor technology.

The circular economy model injects green genes into the industry. The established closed-loop system of "waste motor recycling - material regeneration - high-end remanufacturing" has achieved a comprehensive recovery rate of rare earth elements exceeding 97%, reduced the cost per ton of recycled materials by 38%, and reduced carbon emissions by approximately 75%. According to a report by the Bureau of International Recycling (BIR), China's motor recycling market scale will reach 28 billion RMB in 2025, creating environmental benefits equivalent to planting 960 million trees. Resource recycling and utilization have become a key pillar for the sustainable development of the industry.

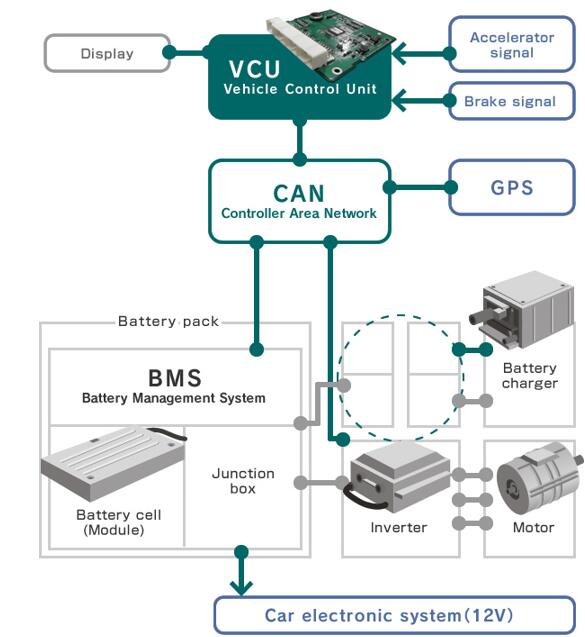

(B) Intelligent Revolution: Digital Twins and Industrial Internet Reshape the Value Chain

Industrial Internet platforms are transforming motors from independent devices into networked intelligent nodes. Through digital twin technology, enterprises can simulate and optimize the operating status of motors in real-time in a virtual environment, significantly improving operational efficiency. The popularization of predictive maintenance systems has increased the accuracy of motor fault warnings to over 95%, effectively avoiding losses caused by unplanned downtime.

(C) System Revolution: Energy Internet and Servitization Expand Industry Boundaries

The Virtual Power Plant (VPP) model enables distributed motor clusters to participate in grid interaction. A motor cluster coordination and control system developed by the State Grid Electric Power Research Institute can aggregate 560,000 industrial motors across the country to participate in grid peak shaving and demand response. In 2025, auxiliary service revenue reached 1.8 billion RMB, creating additional income for enterprises while ensuring grid stability. The "Motor as a Service" (MaaS) model is emerging. The "pay-by-output" service provided by the Haier COSMOPlat for the injection molding industry reduced user equipment investment costs by 45% and energy expenditure by 32%, promoting a business model transition from product sales to value services.

IV. Future Challenges and Strategic Breakthrough Paths

Behind the industry's prosperity lurk three major challenges:

-

Intensified constraints on key resources: The supply-demand gap for strategic elements such as dysprosium and terbium is expected to reach 23% in 2025, highlighting supply chain security pressures.

-

Traditional SMEs face the pains of high technical barriers and long investment return cycles in digital transformation.

-

Fierce international competition in technical standards: Standard organizations like IEC and IEEE have become focal points for the争夺产业话语权.

The solution lies in implementing a "trinity" strategic upgrade:

-

Build a resource closed-loop system: Accelerate the layout of overseas rare earth resource supply chains while improving domestic recycling networks, aiming to meet over 30% of demand with recycled rare earths by 2030.

-

Deepen digital integration and innovation: Establish a dual-engine R&D platform combining "physical mechanism models + data-driven AI," and develop lightweight, modular digital transformation solutions suitable for SMEs.

-

Strengthen international standard layout: Encourage leading enterprises to take the lead in formulating international standards for motor energy efficiency, intelligent operation and maintenance, and carbon footprint accounting, enhancing China's participation in global rule-making.

V. Conclusion

Standing at the industrial of 2025, technological innovation in industrial motors is evolving at a pace exceeding Moore's Law. The deep integration of efficiency improvement, intelligent connectivity, and green recycling is not only reshaping the motor itself but also restructuring the operational logic of the entire industrial system. Future competition will no longer be about single products, but a comprehensive contest of technology ecosystems, business models, and sustainable development capabilities. Enterprises that can integrate permanent magnet materials science, edge computing architectures, and circular economy models will occupy the commanding heights in the trillion-RMB market.

2025 is destined to be a watershed year for the industrial motor industry—it is not only a year of choice for technological pathways but also a critical node for redefining the global industrial ecosystem. Only enterprises that persist in open innovation, deepen integrated applications, and fulfill green commitments can lead this profound transformation, driving global industry towards a more efficient, intelligent, and sustainable future at an accelerated pace.