News

How E-Axles Drive Technological Upgrades in Electric Heavy-Duty Trucks? Penetration Rate Expected to Exceed 20% by 2026 | PUMBAA E-Axle Solutions In-Depth Analysis

As electric heavy-duty trucks move toward larger battery capacities and longer-haul applications, e-axles are becoming a core driving force due to their lightweight design, high efficiency, and space optimization advantages. This article combines market trends with PUMBAA’s e-axle product features to analyze how they contribute to TCO optimization and breakthroughs in electric long-distance logistics.

Electric Heavy-Duty Trucks Enter the "Battery Capacity Race," E-Axles Become the Key Solution

Electric Heavy-Duty Trucks Enter the "Battery Capacity Race," E-Axles Become the Key Solution

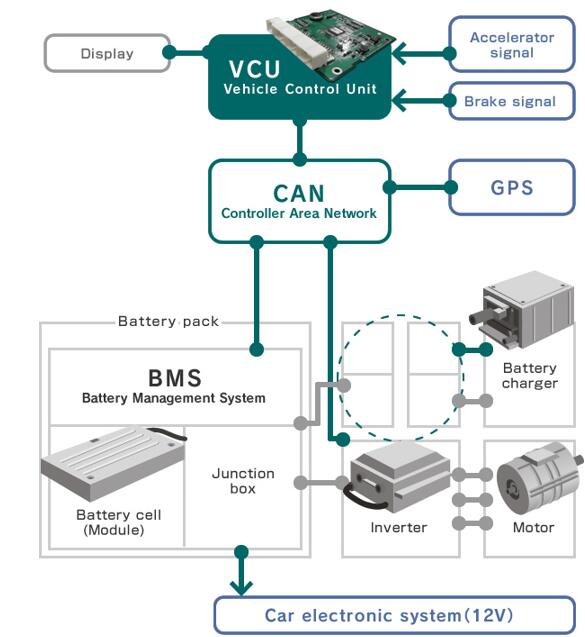

From 2024 to 2025, China’s electric heavy-duty truck market has undergone a structural shift: end-users are transitioning from "policy-driven" to "TCO (Total Cost of Ownership)-driven" demand, with transportation distances expanding from short-haul shuttle operations to medium- and long-haul trunk routes. To meet the need for extended range, 400 kWh batteries have become the standard configuration, while 600 kWh solutions are beginning to emerge. In this context, e-axles are evolving from an "optional technology" to a "must-have requirement" due to their high efficiency, lightweight design, and space optimization advantages. This article will provide an in-depth analysis of the market growth logic for e-axles, using industry data and technical case studies, and introduce leading manufacturer PUMBAA’s integrated e-axle solutions as an industry reference.

I: Three-Phase Evolution of Electric Heavy-Duty Trucks: E-Axles Shift from "Introduction" to "Standard"

Phase 1 (Before 2023): Technology Exploration Period

-

Technical Features: Central drive systems dominated, with configurations similar to traditional fuel-powered trucks, mostly using 282 kWh rear-mounted batteries + low-speed motors + traditional transmissions.

-

Scenario Limitations: Relied on policy subsidies, suitable only for short-haul scenarios like depot shuttles.

Phase 2 (2023–2025): Dual-Driven Development Period

-

Market Breakthrough: Penetration rate surged from 6% (2023) to 22% (first half of 2025), with TCO advantages becoming apparent.

-

Technological Diversification: Parallel development of retrofitted electric and all-new platforms, with e-axles completing market introduction and battery capacities upgraded to 400–500 kWh.

Phase 3 (Post-2026): Full Marketization

-

Core Driver: Expansion into long-haul trunk scenarios, where upfront vehicle costs are outweighed by lifecycle economics.

-

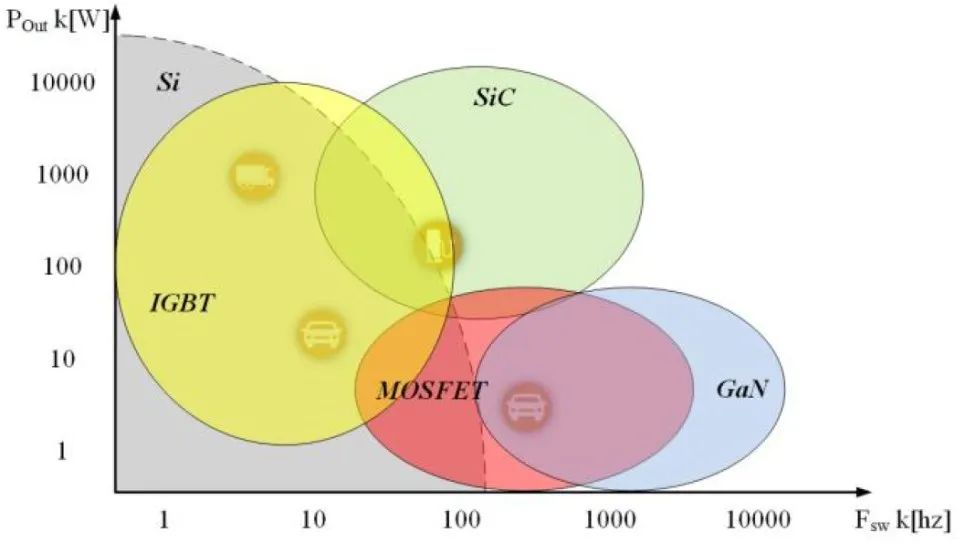

E-Axle Penetration Rate: Currently accounts for only 3% of heavy-duty commercial vehicles but is expected to exceed 20% by 2026 (industry consensus).

-

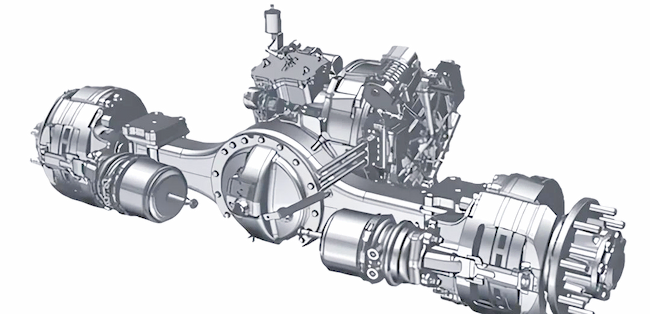

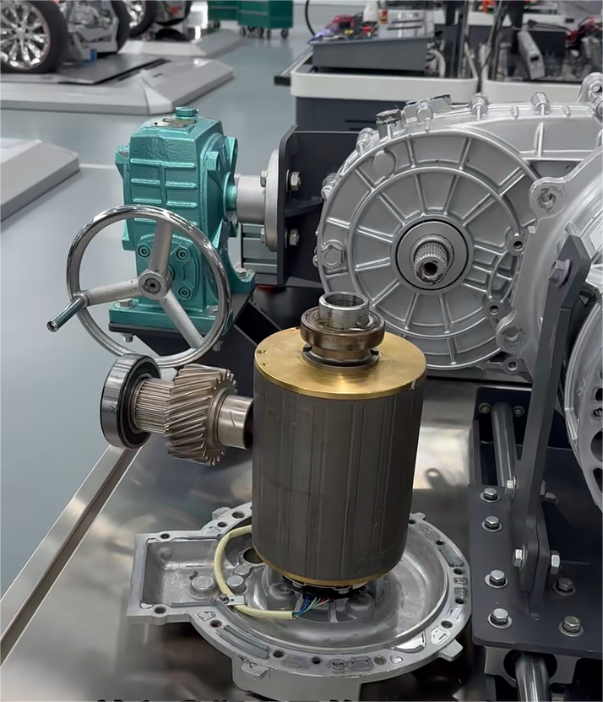

New Industry Dynamics: In addition to international giants like Bosch and ZF, Chinese brands such as PUMBAA have launched products like the PMEA40000Z Central E-Axle, optimized for scenarios such as sanitation trucks and heavy-duty trucks, compatible with 600 kWh chassis layouts.

ii: Three Core Advantages of E-Axles: Why They Are Essential for Long-Range Heavy-Duty Trucks

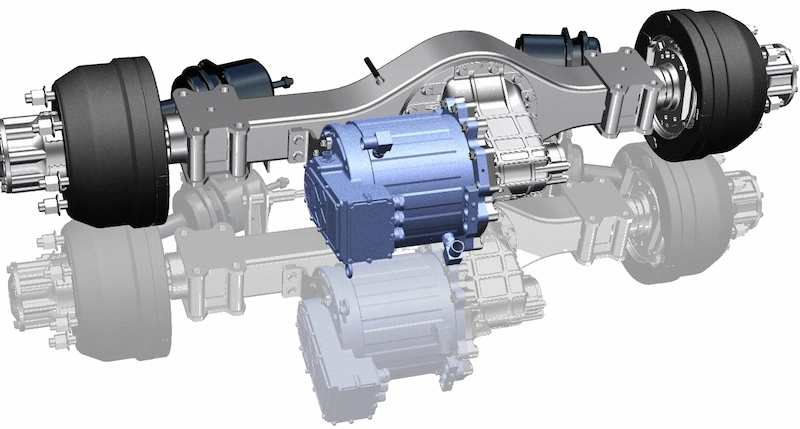

1. Space Reconfiguration: Overcoming Battery Layout Limitations

-

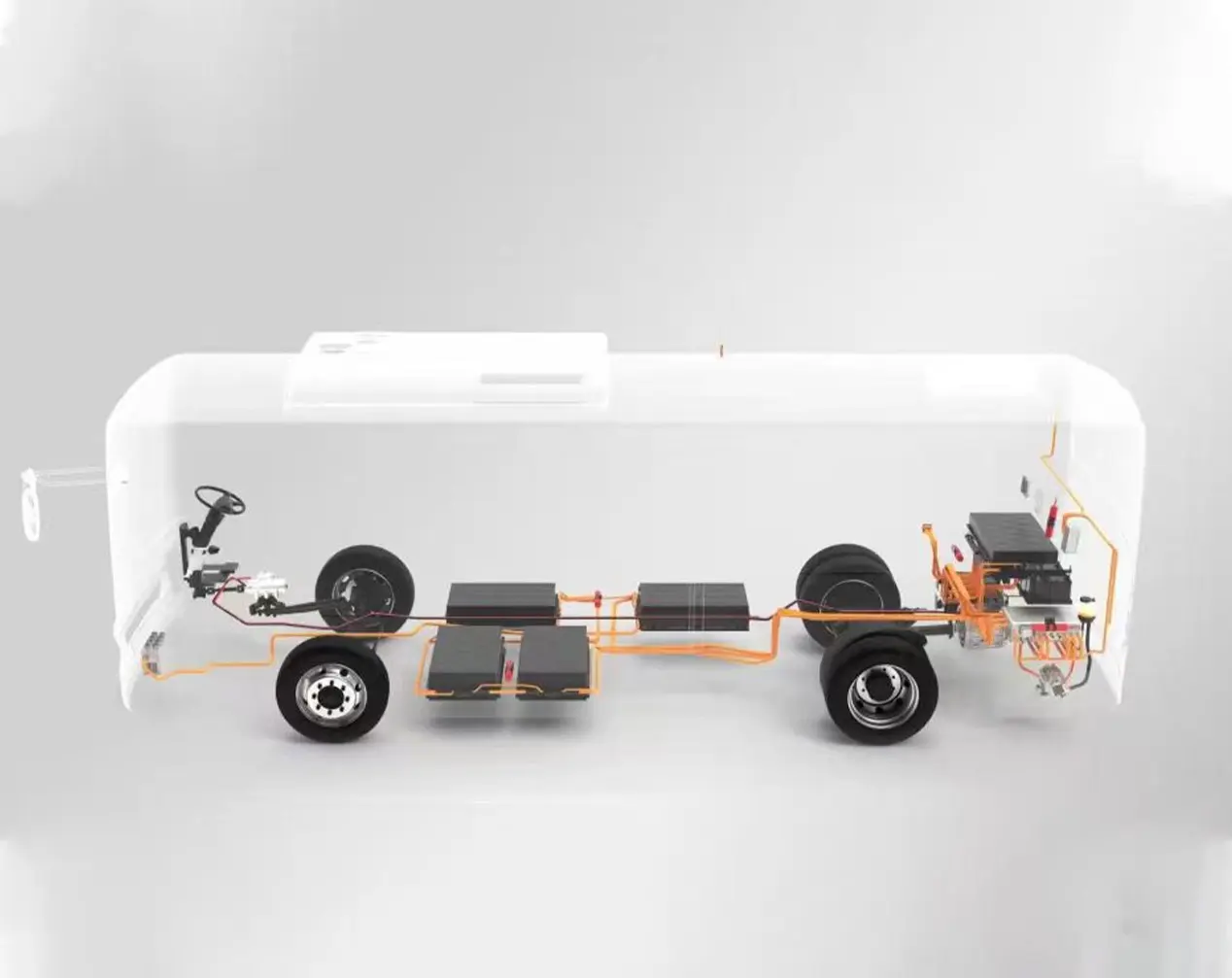

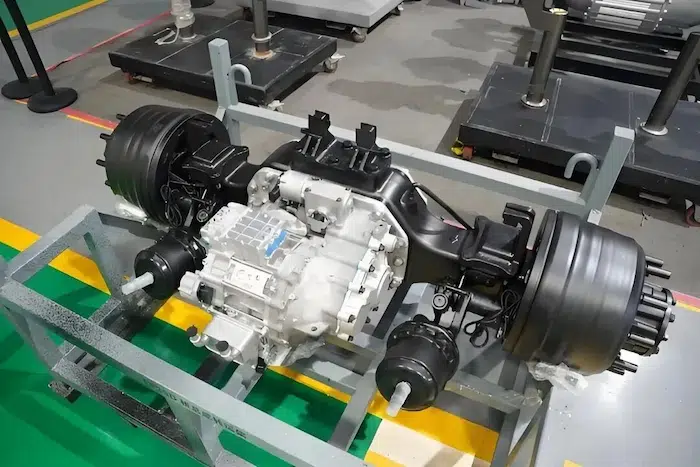

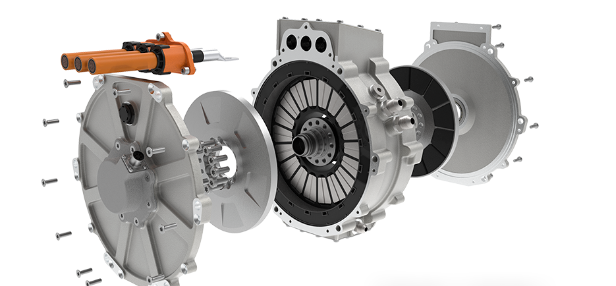

Traditional central drive systems occupy frame space, limiting battery capacity; e-axles free up the frame area, supporting bottom-swapping + large battery packs (e.g., PUMBAA’s PMEA45000Z integrated e-axle can accommodate bottom-mounted 800 kWh solutions).

-

Lower vehicle center of gravity improves high-speed stability while increasing cabin rearward displacement space in collisions, enhancing passive safety.

2. Lightweighting and Efficiency Improvements: Directly Reducing TCO

-

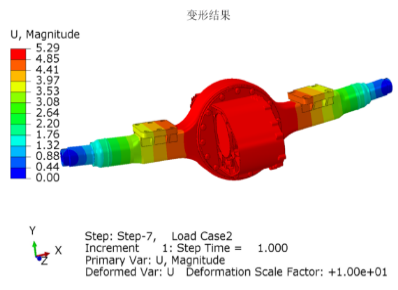

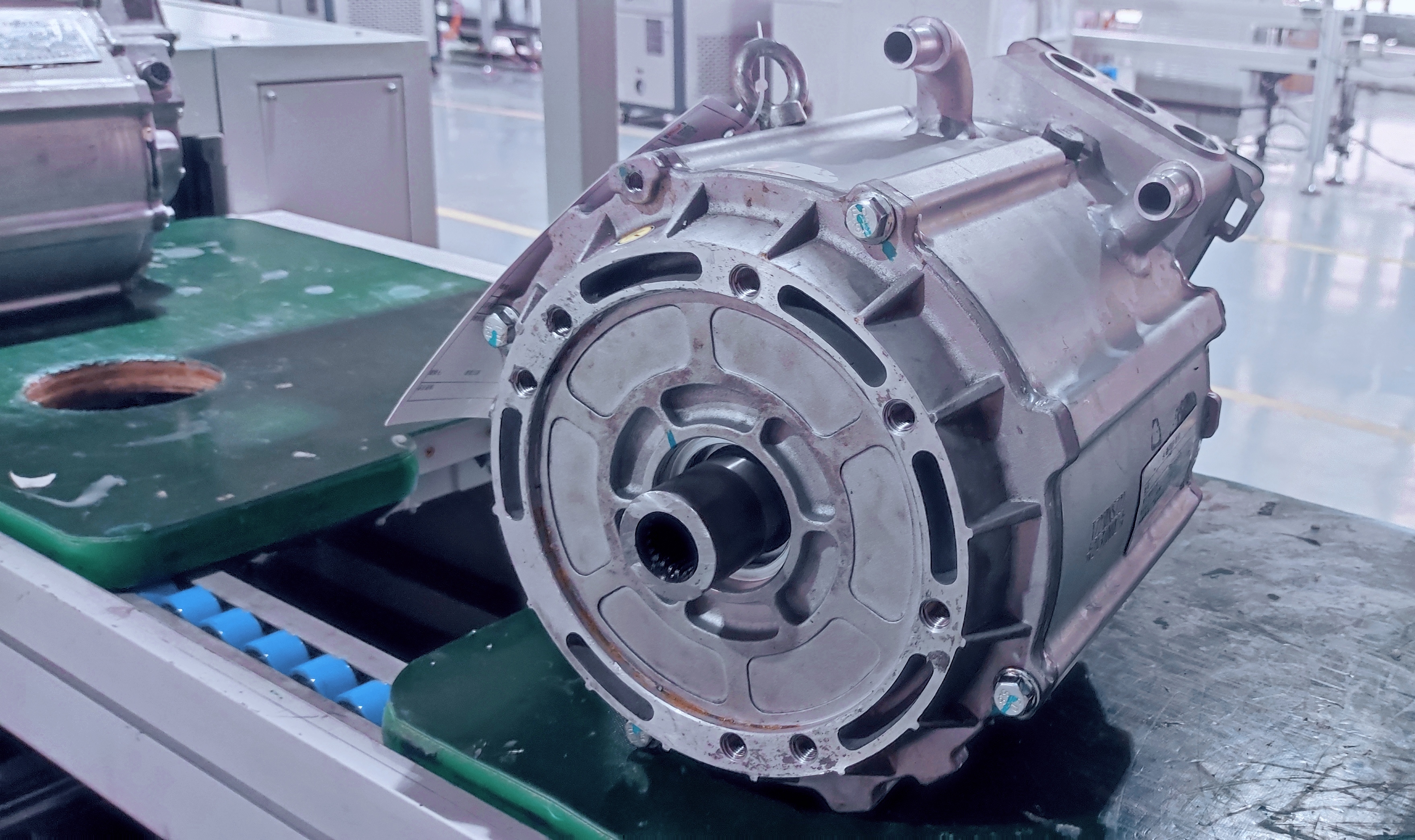

Lightweighting: Elimination of the transmission shaft and simplified gearbox reduce weight by 200–300 kg in PUMBAA’s e-axle series compared to traditional central drives, alleviating the "payload reduction" pain point in electric heavy-duty trucks.

-

Energy Consumption Optimization: Direct coupling of the motor and axle improves transmission efficiency by 10%–15%. For a truck operating 150,000 km annually, this translates to savings of approximately 3,500–5,000 per year in electricity costs.

3. Scenario Adaptability: From Mining to Trunk Routes

-

To address China’s complex operating conditions (mountainous heavy loads, highway light loads), companies like PUMBAA enhance adaptability through software strategy iterations (e.g., multi-mode torque distribution). For instance, their e-axle products support 6-phase motor redundancy design, ensuring reliability in high-stress scenarios.

iii: Challenges and Opportunities: The "Last Mile" for E-Axle Adoption

Initial Application Challenges

-

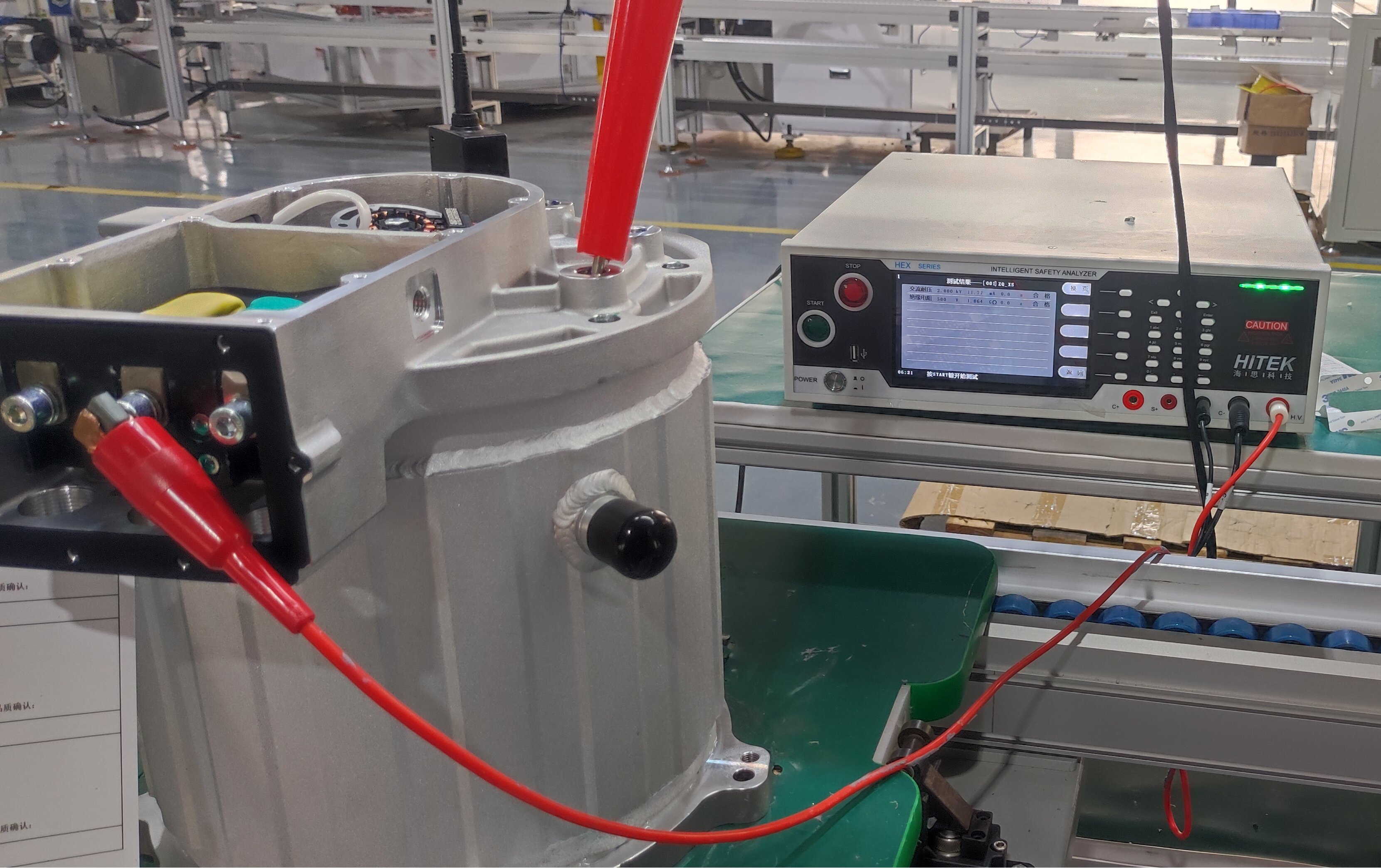

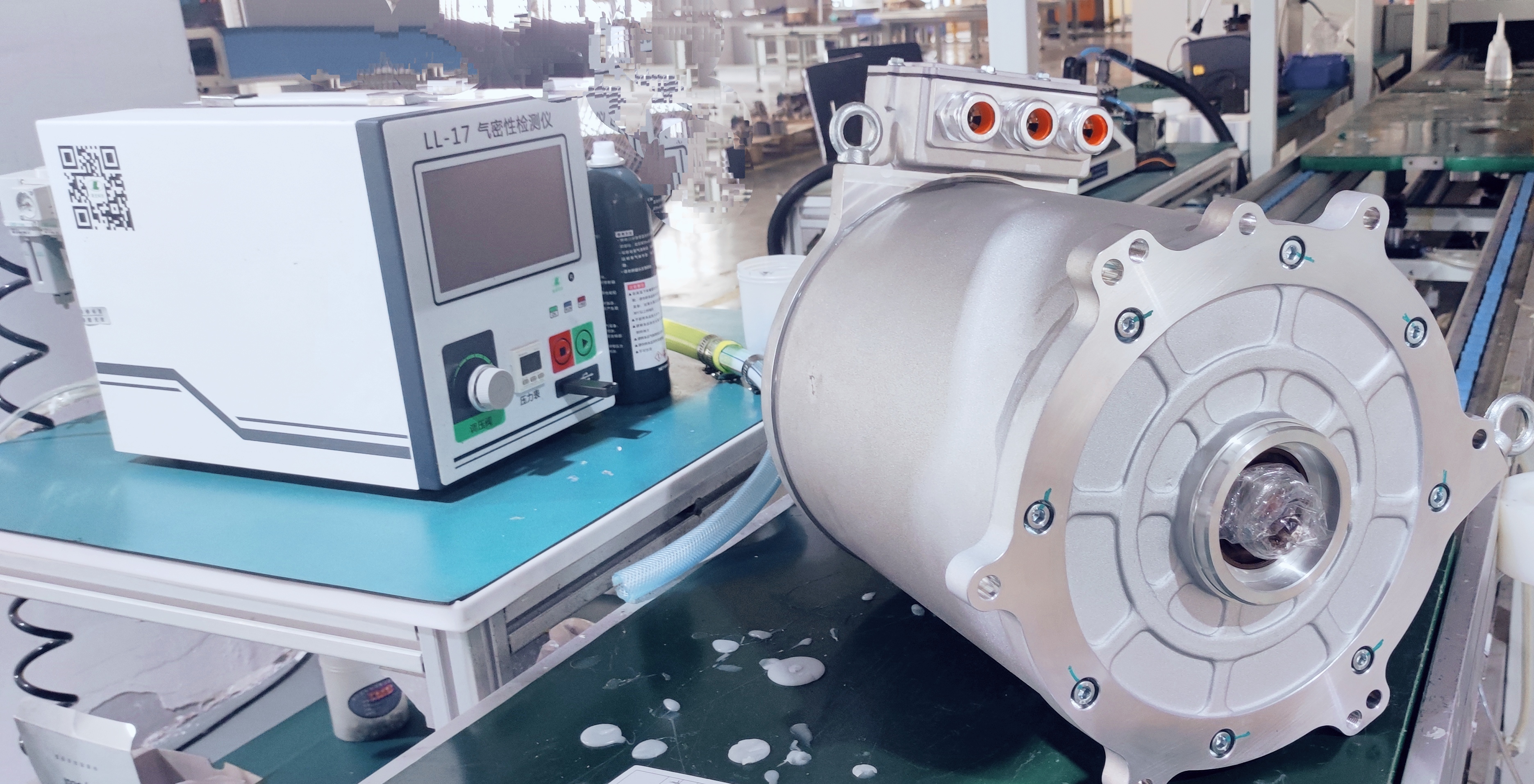

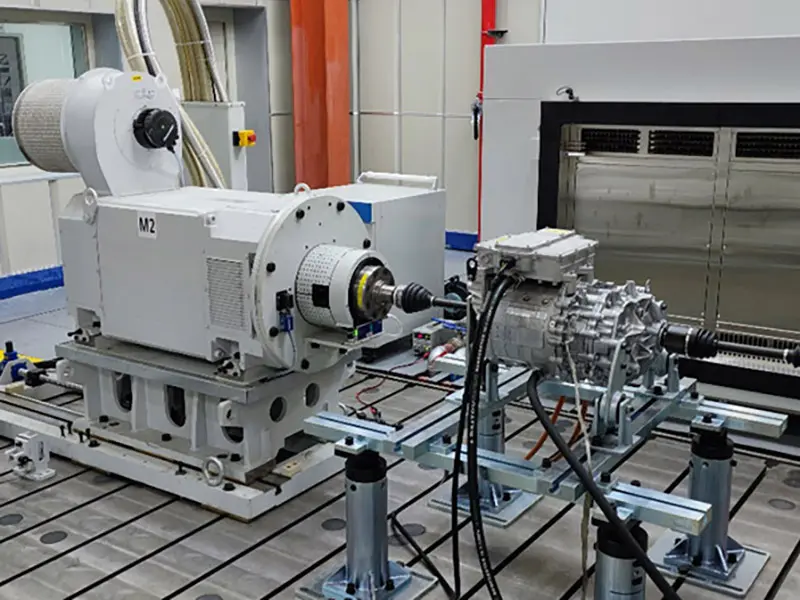

Reliability Validation: Complex conditions require high hardware and software durability, necessitating real-world testing data accumulation (e.g., PUMBAA’s validation cases in port machinery and electric buses).

-

Cost Concerns: Current purchase prices are higher than central drives, but the price difference can be recouped within 2–3 years for vehicles operating over 150,000 km annually.

Signals of Industry Acceleration

-

Industry Chain Collaboration: Truck manufacturers (FAW, Sinotruk) and component suppliers (PUMBAA, Bosch) are jointly developing customized e-axles, shortening iteration cycles.

-

Technology Extension: E-axle technology is compatible with hydrogen fuel cell heavy-duty trucks (e.g., PUMBAA’s e-axles support hybrid architectures for fuel cell vehicles), paving the way for diversified new energy solutions.

IIII: Case Study: How PUMBAA’s E-Axles Empower Electric Heavy-Duty Truck Upgrades

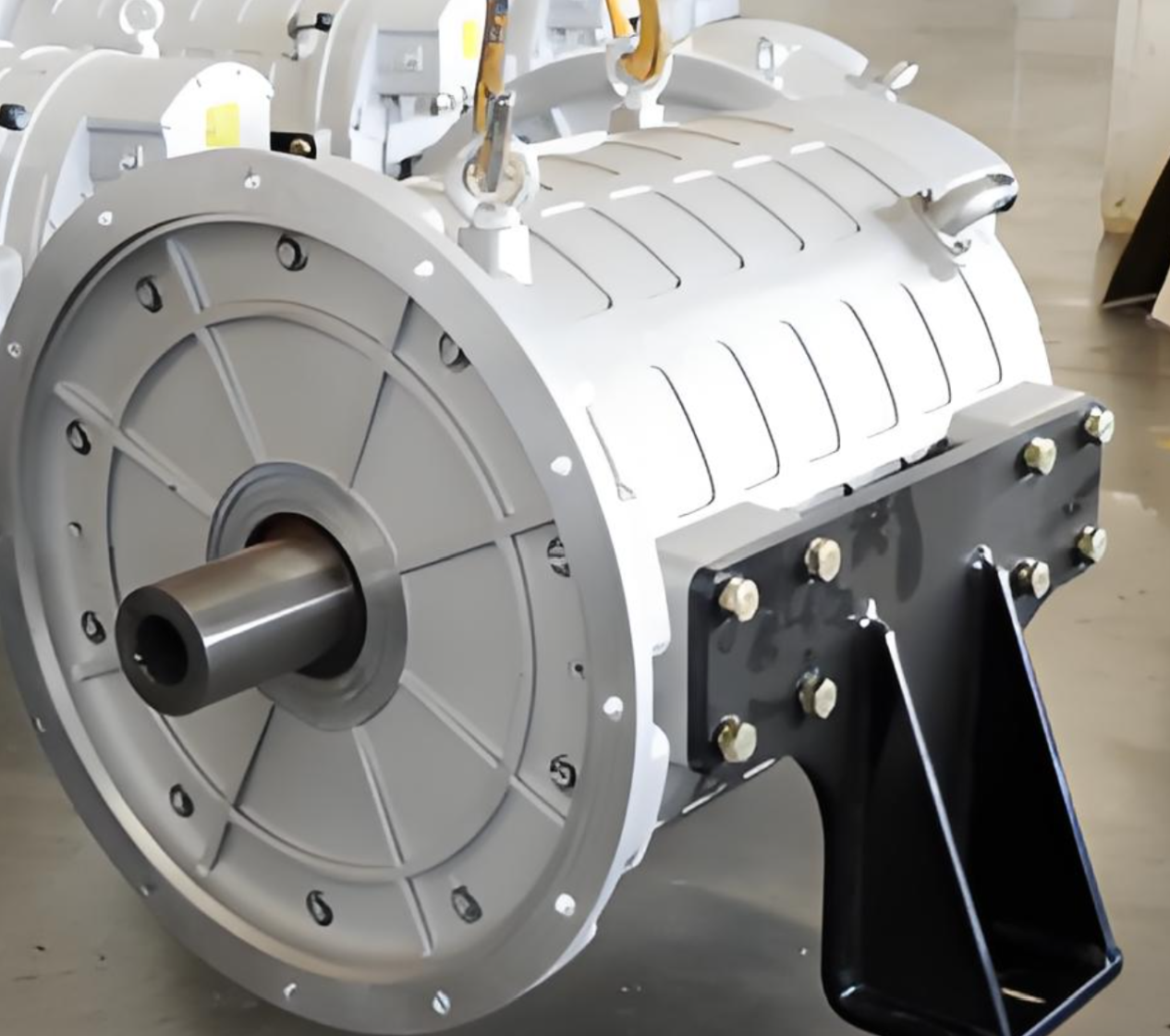

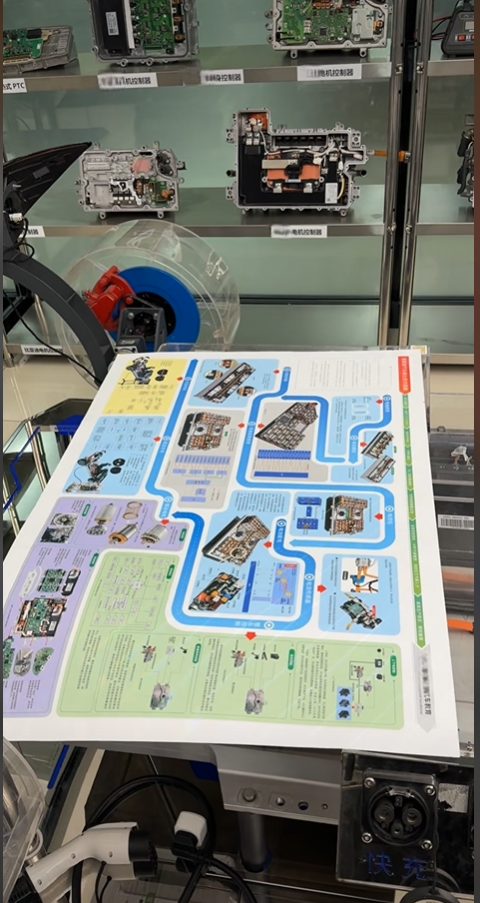

As a leading domestic supplier of electric drive systems, PUMBAA’s e-axle products cover scenarios from 4.5T–6.0T logistics vehicles to heavy-duty mining trucks:

-

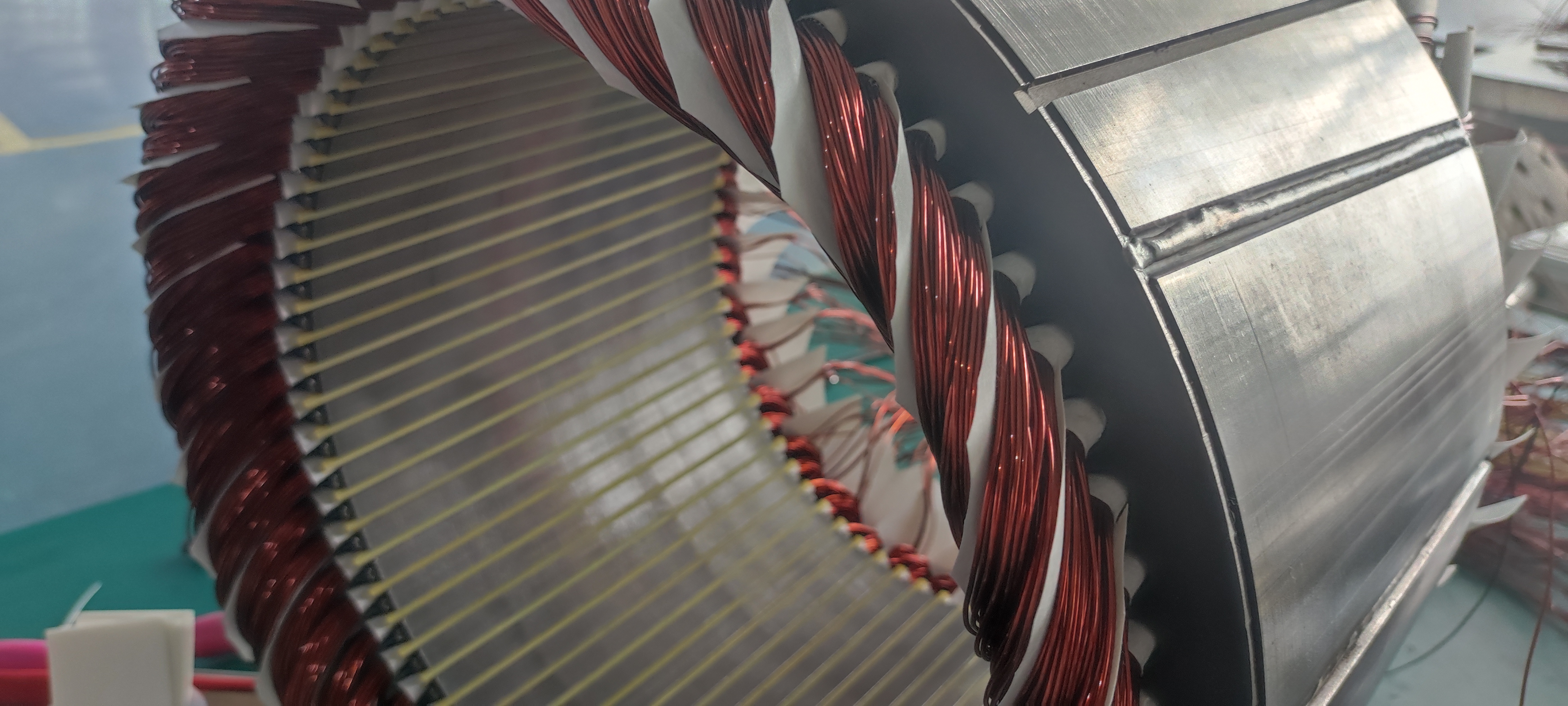

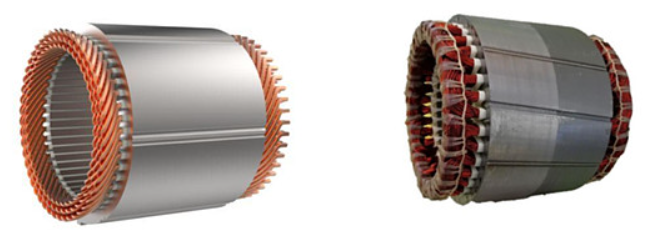

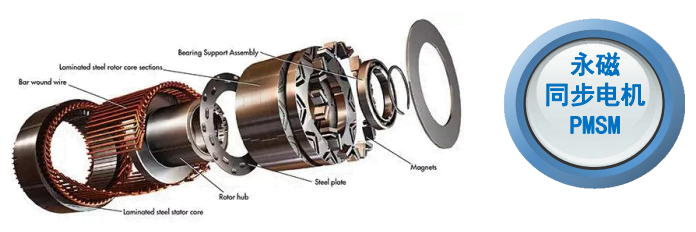

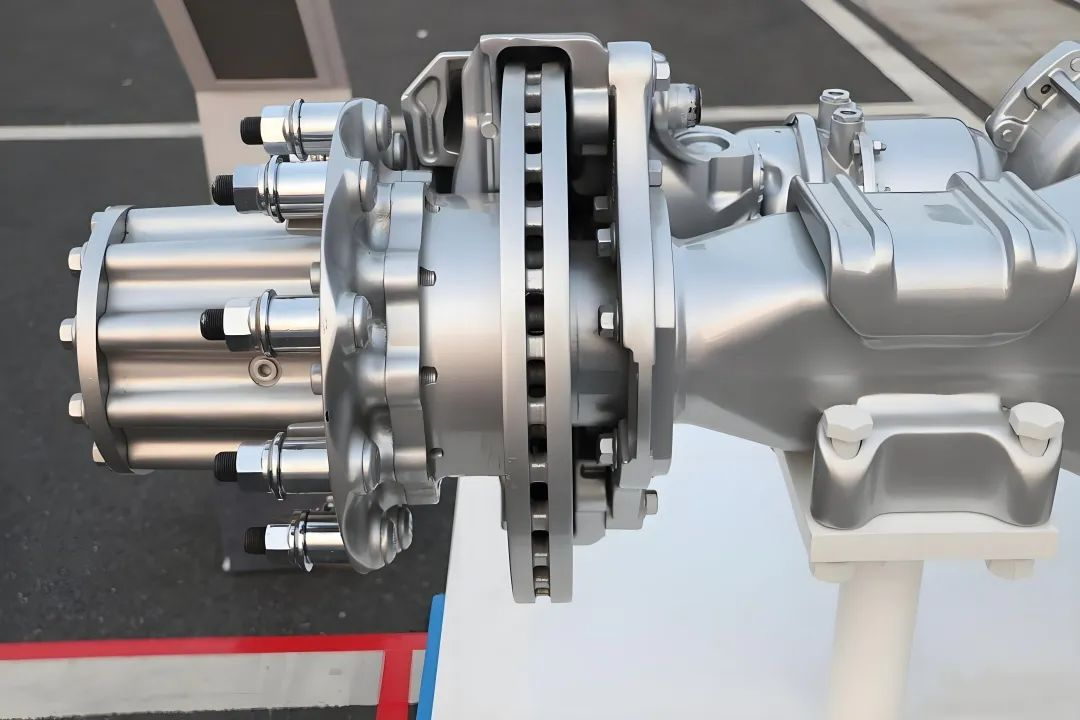

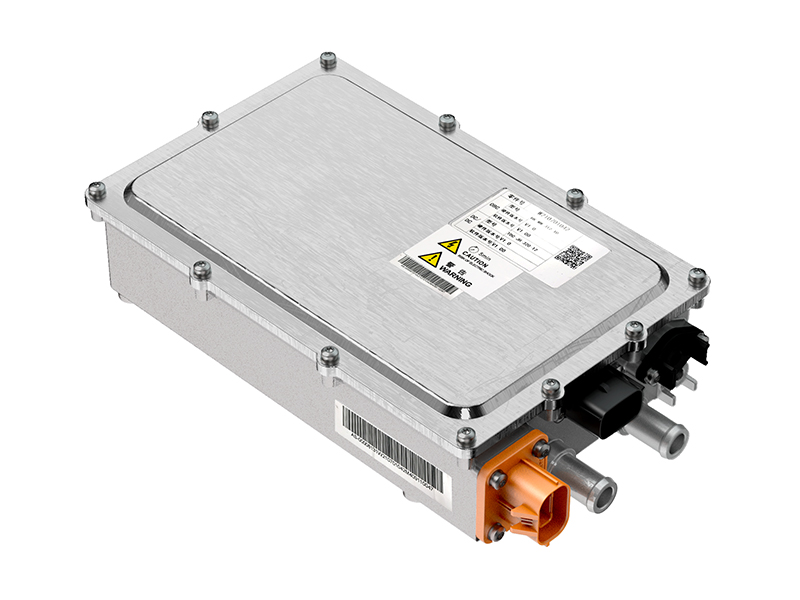

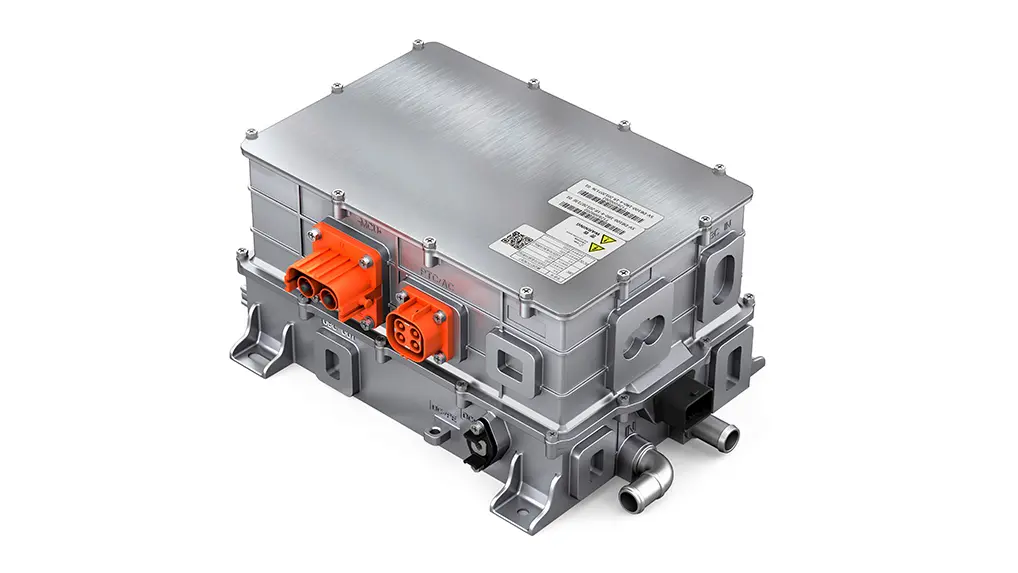

PMEA40000Z Central E-Axle: Designed for sanitation and sprinkler trucks, it uses a high-speed motor + 2-speed transmission, with peak efficiency reaching 96%, supporting heavy-load starts.

-

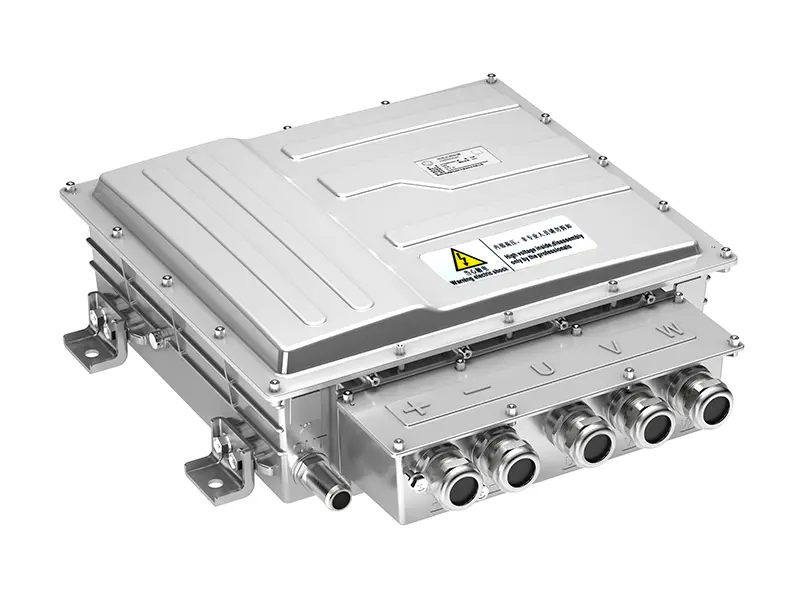

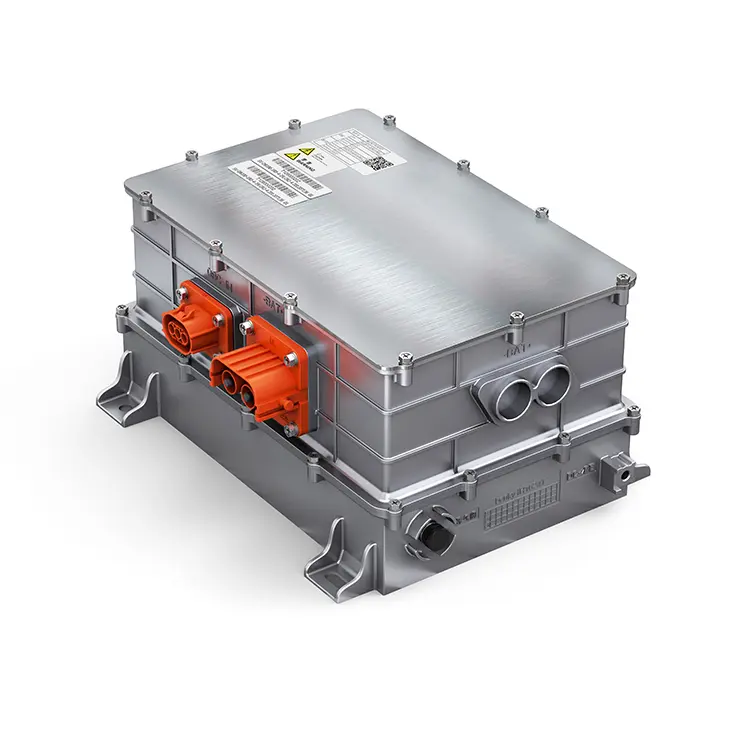

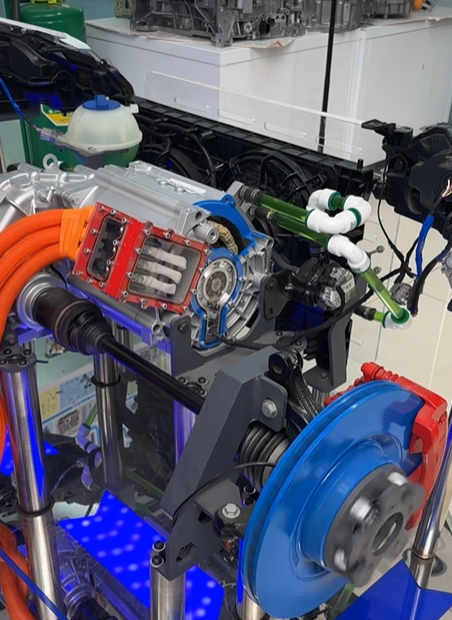

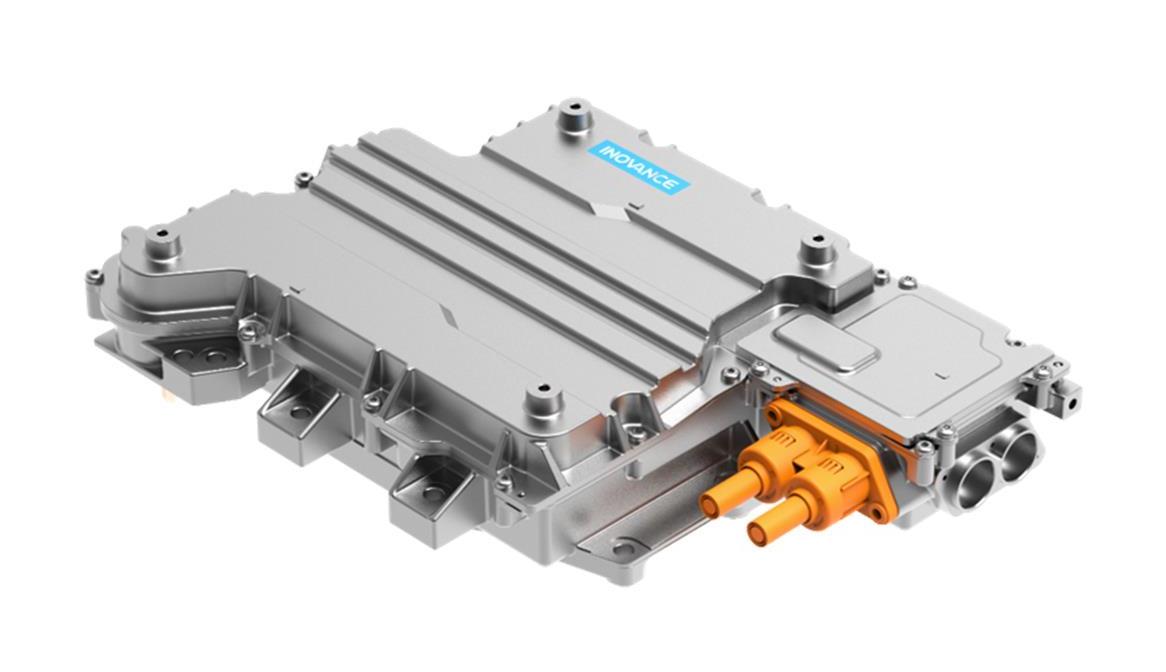

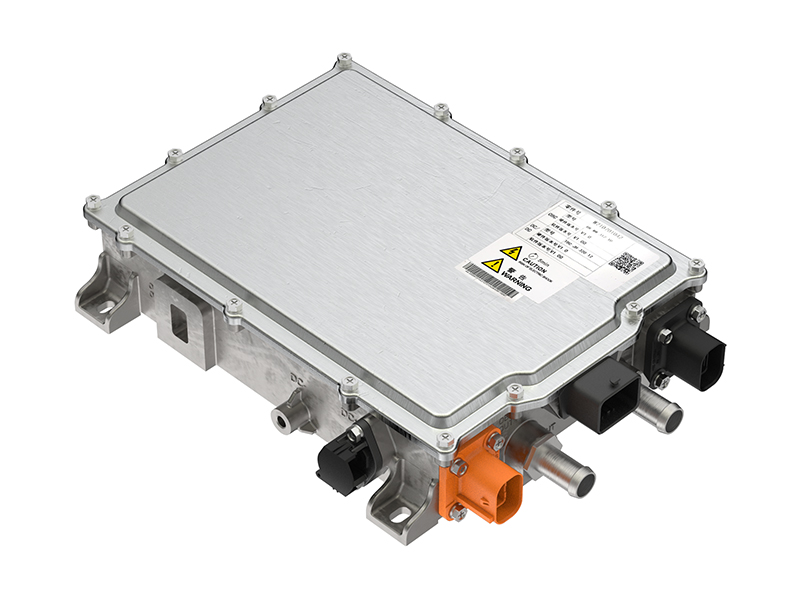

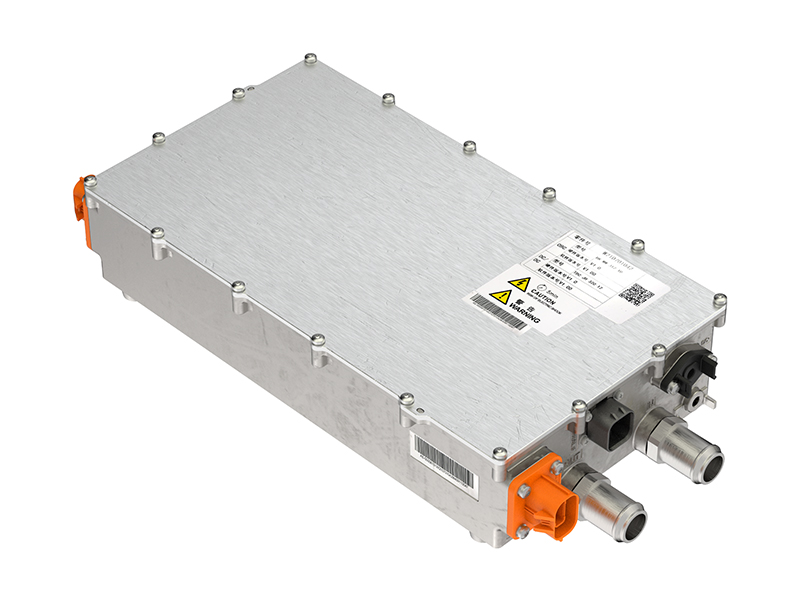

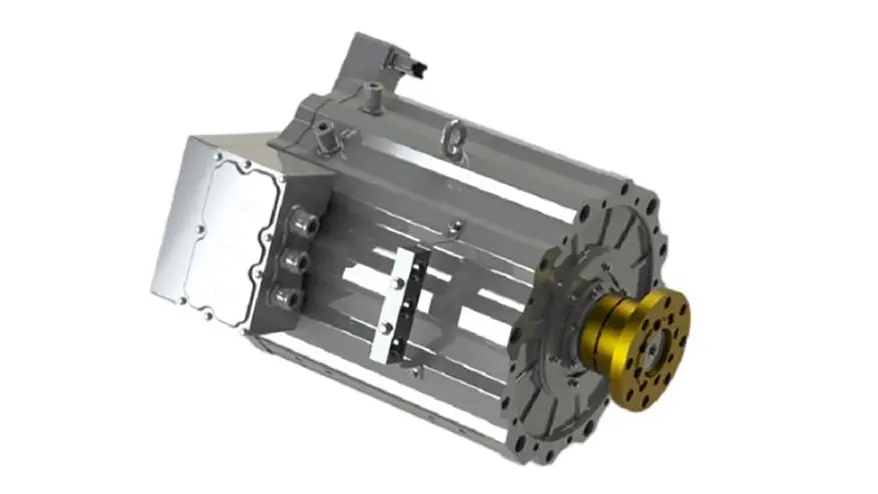

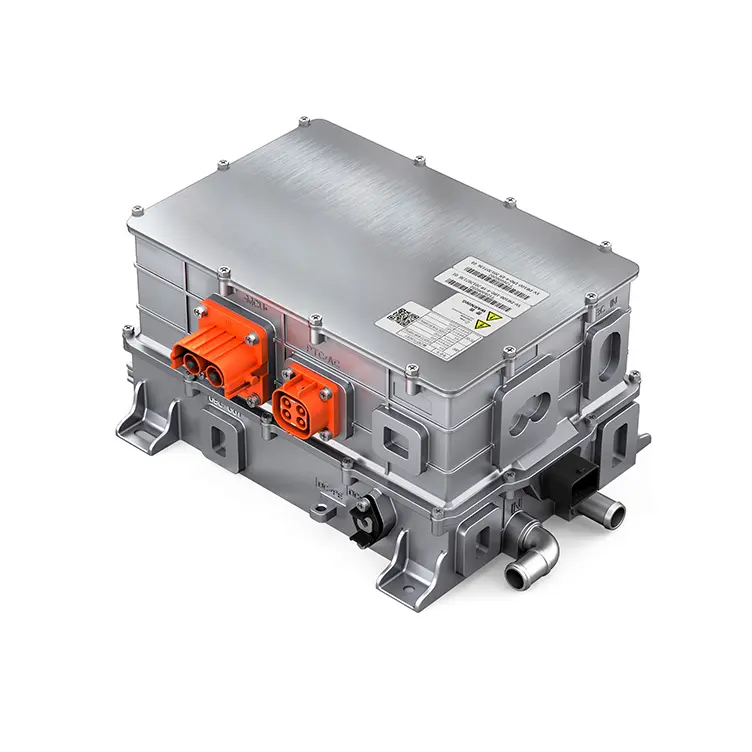

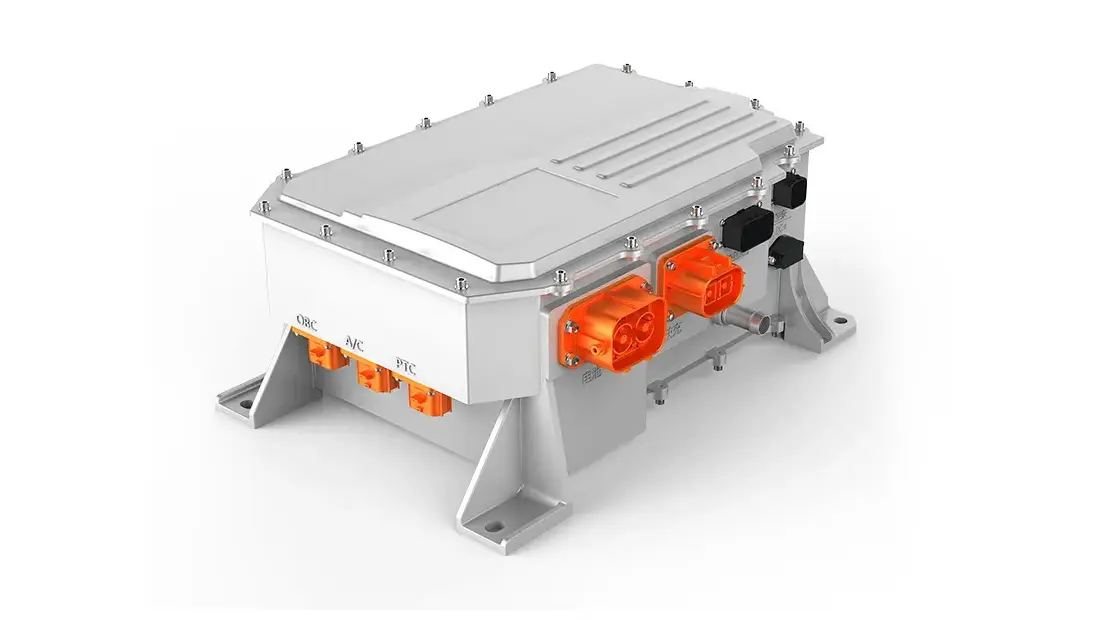

PMEA45000Z Integrated E-Axle: Targeted at heavy-duty trucks, it adopts a three-in-one design integrating the motor, controller, and axle, delivering 286 kW peak power for long-haul logistics.

-

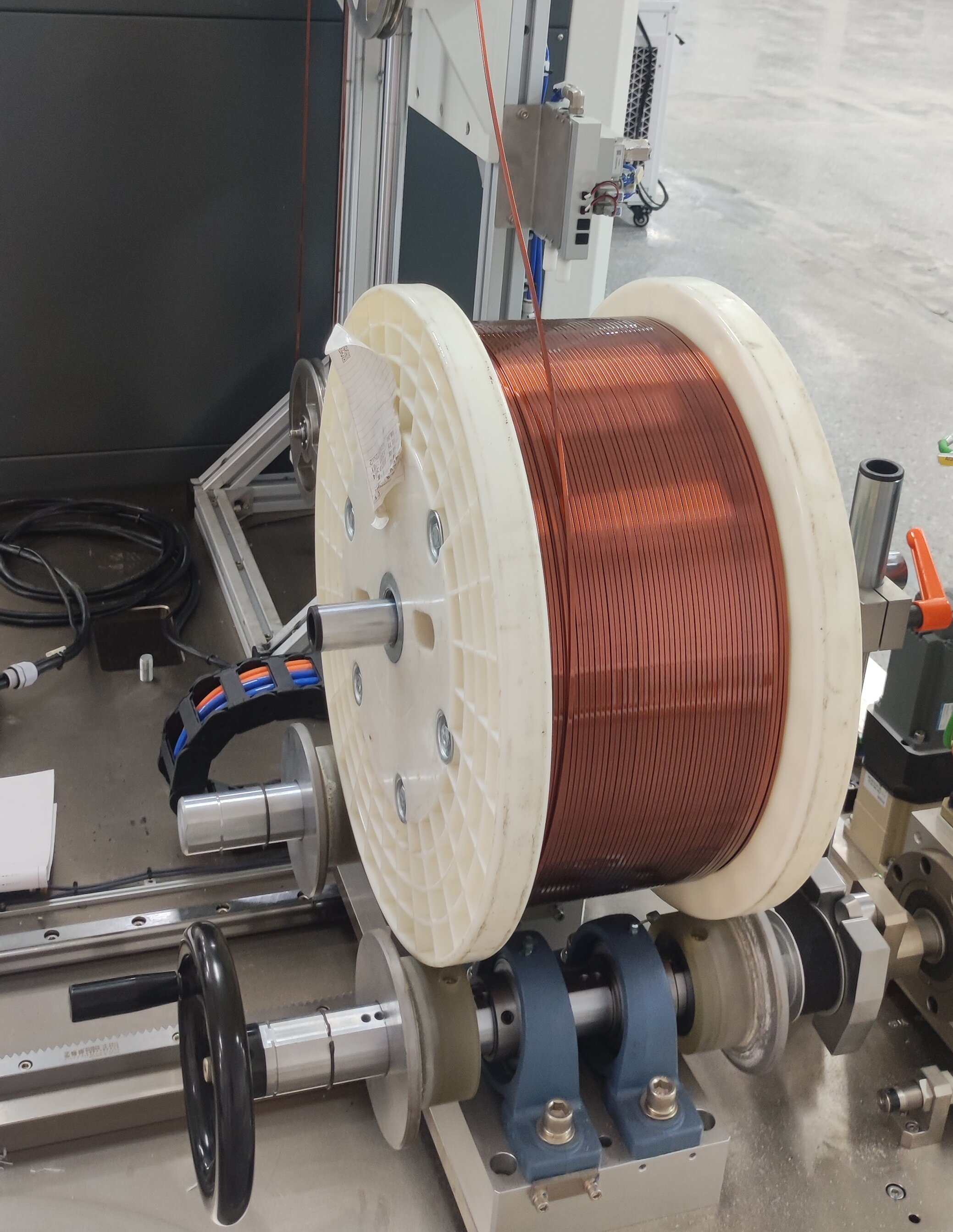

Technical Highlights: The full product series uses SVPWM modulation technology and a dual cooling system to ensure sustained high-power output in high-temperature environments.

Conclusion: E-Axles Will Reshape the Competitive Landscape of Electric Heavy-Duty Trucks

As the marketization phase approaches in 2026, e-axles are no longer a "backup option" but a core component determining vehicle energy consumption, range, and TCO. Their development trajectory can be compared to the adoption path of heavy-duty truck AMT transmissions—evolving from skepticism to standard in just five years. For truck manufacturers and users, early adoption of high-performance e-axle solutions (such as PUMBAA’s integrated platform) will provide a competitive edge in the long-range electric heavy-duty truck market.